Course Syllabus

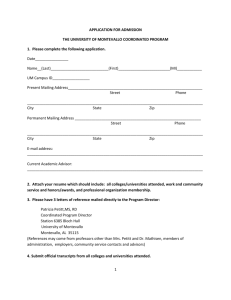

advertisement

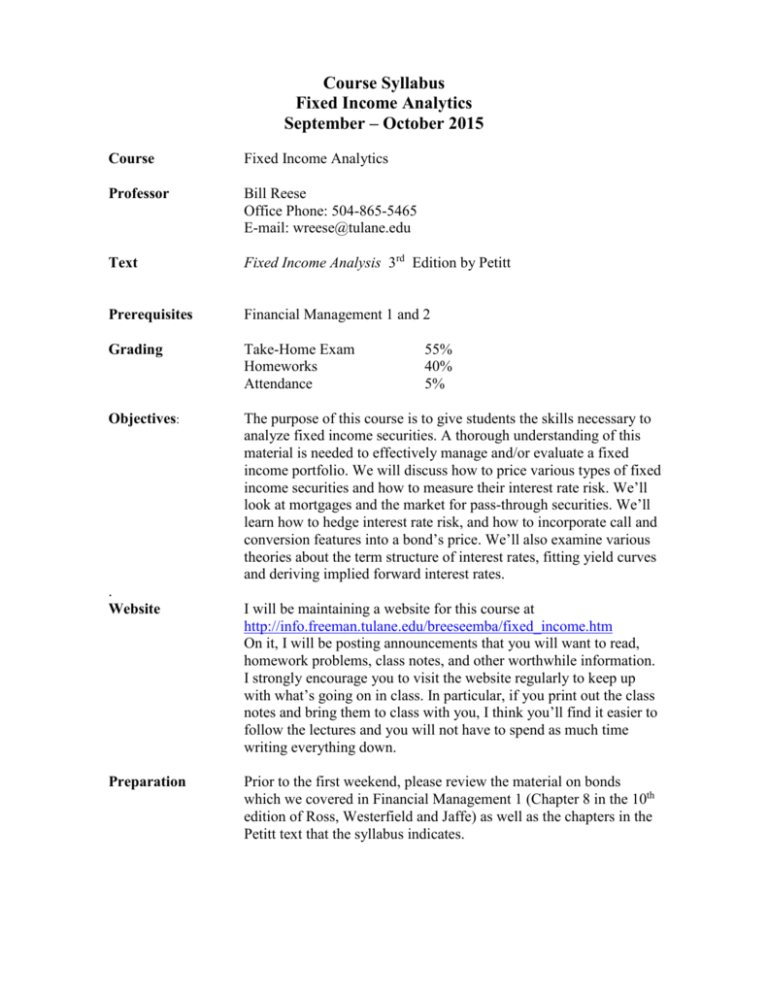

Course Syllabus Fixed Income Analytics September – October 2015 Course Fixed Income Analytics Professor Bill Reese Office Phone: 504-865-5465 E-mail: wreese@tulane.edu Text Fixed Income Analysis 3rd Edition by Petitt Prerequisites Financial Management 1 and 2 Grading Take-Home Exam Homeworks Attendance Objectives: The purpose of this course is to give students the skills necessary to analyze fixed income securities. A thorough understanding of this material is needed to effectively manage and/or evaluate a fixed income portfolio. We will discuss how to price various types of fixed income securities and how to measure their interest rate risk. We’ll look at mortgages and the market for pass-through securities. We’ll learn how to hedge interest rate risk, and how to incorporate call and conversion features into a bond’s price. We’ll also examine various theories about the term structure of interest rates, fitting yield curves and deriving implied forward interest rates. . Website Preparation 55% 40% 5% I will be maintaining a website for this course at http://info.freeman.tulane.edu/breeseemba/fixed_income.htm On it, I will be posting announcements that you will want to read, homework problems, class notes, and other worthwhile information. I strongly encourage you to visit the website regularly to keep up with what’s going on in class. In particular, if you print out the class notes and bring them to class with you, I think you’ll find it easier to follow the lectures and you will not have to spend as much time writing everything down. Prior to the first weekend, please review the material on bonds which we covered in Financial Management 1 (Chapter 8 in the 10th edition of Ross, Westerfield and Jaffe) as well as the chapters in the Petitt text that the syllabus indicates. Tentative Course Schedule Date Material Readings First Friday Review of Bond Basics RWJ chapter 8 Petitt 1 First Saturday Invoice Prices, T-Bill Quotes, Bond Prices and Yields in Excel, TIPS, FRNs, Strips, Repos, Treasury Issue Process Petitt 2, 3 Second Friday Implied Forward Rates, Yield Curve Analysis, Bootstrapping, Par-Bond Yield Curve Petitt 10 Second Saturday Factors Affecting Interest Rate Risk, Duration, Modified Duration, Convexity, PVBP Petitt 4, 5 Third Friday Yield Volatility, Hedging Duration Risk, Interest Rate Futures, Interest Rate Futures Options Petitt 11, 12 Third Saturday Interest Rate Swaps, Interest Rate Caps, Floors, and Collars Fourth Friday Callable Bonds Petitt 8, 9 Fourth Saturday Mortgage Backed Bonds, Convertible Bonds Petitt 7