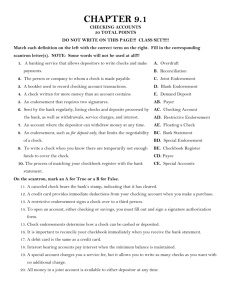

Power Point

advertisement

Chapter 7 Banking Services Banks Help You Move Your Money 7.1 How Banks Work Bell Ringer-1 • Why do we have banks? –What do banks do? –Who uses and benefits from banks? –Why not just keep your money in your mattress/shoe box? Banks Purpose Earn Profit • Banks are a private business • They earn money by selling financial services • Income comes from interest they charge when they lend money • Money they lend mostly comes from deposits made by consumers and businesses How It Works… • Banks pay depositors interest on accounts they have… – The interest rates that depositors receive are lower than what banks will charge borrowers – The difference between the rates is the banks profit How It Works… • Example: – You deposit $100 into your bank account • - Bank pays you 2% interest on your account ($2) – The bank lends $100 to a business and charges them 6% interest ($6) – The bank will earn $4 Other Sources of Income • • • • • Credit card fees Checking account fees Financial planning fees Overdraft fees ATM fees Inflation • Sustained increase in the average level of prices – Example: • You save for a year for a TV that cost $800… when you go to buy that same TV a year later you notice it is now $850. • The price of the TV may have increased due to the general state of inflation in the economy. Security • Banks provide security – If money is stolen or a bank is robbed, a bank has insurance to cover the loss – If you keep your money in a shoe box in your closet and someone either... steals your money, you lose it, or mishap occurs, your money is gone. Federal Deposit Insurance Corporation (FDIC) • An organization created by the federal government that insures deposits in most banks up to a maximum of $250,000 • If a bank fails and is not able to pay its depositors, the FDIC will pay instead • There is no chance of losing money that you deposit up to the maximum in an FDIC insured bank • Your Bank Has Failed • Bank Run Money and Financial Transactions • Bartering – Trading goods and services without using money – Example… Your parents will let you use their car on Saturday if you babysit your sister on Friday night… • Currency – Paper money and coins used for financial transactions • Check – An order to a bank to pay a specified sum to the person or business named on the check– Money and Financial Transactions • Payee – Person the check is made out to… “Pay to the order of…” Advantages of using a check • Safety – If check gets lost or stolen, no one else can legally cash it – If someone does cash it illegally, you are not responsible, the money will not come out of your account… the bank or business that cashed the check will take the loss • Convenience – Making large purchases – Safer to send through mail than cash • Records your transactions – Bank statement- a written record of all your transactions Parts of a Check Chapter 7.2 Use Your Checking Account Bell Ringer-2 • What does is mean when a bank is member FDIC? • Up to what amount are your deposits insured? Checking Account • A bank account that allows depositors to write checks to make payments • Banks offer different features and aspects of various types of checking accounts, but they all work the same way! • Joint account- when 2 or more people have access to the same bank account – Mother and Son – Husband and Wife Opening a check account • Complete application • Sign a signature card • Provide valid identification • Make an initial deposit Deposit Slips • Used to deposit cash and checks into your bank account • First thing you need to do after opening your account • Deposit slips are often found at the back of your checkbook, if you run out, you can always get more at the bank when you go to deposit your money Opening a Checking Account • Safest and easiest ways to manage your money • Allows you to write checks for bills and pay them by mail • Allows you to avoid carrying a large amounts of cash • Statement is given to you each month to summarize your spending Writing A Check • 1. Date- Write in the date • 2. Pay to the order of- who is the check going to? (person or company) • 3. Amount- numerical amount written in small box • 4. Amount- written out in words • 5. Memo- what is the check for? • 6. From- Your signature Check Register • Booklet used to record your transactions including deposits! Check Register • Record Fees – For writing a certain amount of checks • Record interest – Credit you receive • Calculate New Balance – Account Balance- total amount in the account at a specific date – Make sure to always record new balance when you write checks or use your debit card! • Record Check Number – This helps you know what each check was written for – Also helps you know if you have forgotten to record a check Check Writing/Check Register • Go to Page 3 in your packet. • Read the 3 transactions listed – Write the checks for the bills listed – Record the transactions in your check register! Account Balance • The total amount in your bank account at a specific date Overdrawing • Writing a check for more than you have in your account. • This will result in “Insufficient Funds” – You may be charged $35 or more (depending on your bank) each day your account is negative! Check Register •Go to page 5 in your packet. •Practice filling in your check register! Endorsement • Signing the back of a check – When you sign the back of a check, you are acknowledging you received the money or transferred your right to someone else. – DO NOT sign back until you get to the bank, otherwise someone else can deposit it! 3 Types Of Endorsements • Blank – Just your signature and Account number • Restrictive – “For Deposit Only” include your name and your account number. – This ensures it only gets deposited into your account! Endorsement in Full • Used to transfer a check to another person. • No one except the person whose name is stated on the endorsement can cash the check. • “Pay To The Order Of...” #123456789 • This type of check is called a Third Party Check. – Signing your check over to someone else Endorse A Check • Go to page 6 in your packet • Read the scenarios on the following slides and endorse each check accordingly. Check Endorsing Scenarios 1. You receive a check for $63 that you wish to give to Ethan. Endorse the check using a third party endorsement. 2. You receive a check for $933. Use a blank endorsement to deposit the check in your account #740696. 3. You receive a check for $395. Use a restrictive endorsement so it may only be deposited directly into your account. Check Endorsing Scenarios 4. You receive a check for $922 that you wish to give to Anna. Endorse the check using a third party endorsement. 5. You receive a check for $33. Use a blank endorsement to deposit the check into your account. 6. You received a check for $50. Use a restrictive endorsement so it may only be deposited directly into your account. Check-Clearing Process • When you deposit money, you cannot withdrawal the money unless you have enough in your account already to cover what you are taking out. – Example: • You have a current balance of $50 • You deposit a check for $100 • You cannot take more than $50 out until the check you just deposited has cleared. Checking Account Fees • IF a bank charges a fee for a checking account, there are 2 basic fees that can be charged... – Monthly Service Fee (flat fee) – Service Charge Fee Types of Checking Accounts and Fees... Account Feature Free Checking Green Checking Premier Checking Ultimate Checking Min. Balance to waive service charge None None $1,500 in account or $5,000 in bank $10,000 in account Service Charge Interest None None None Compounded daily, paid monthly $8 per month Compounded daily, paid monthly $10 per month Tiered at $25,000 Free Checks Other Features None -Free ATM Withdrawals -Free Bill Pay -Free Online Banking -Free Check Image Return -Annual Fee waived on approved VISA None -Electronic Statement -Free ATM Withdrawal -Free Online Banking -Free Bill Pay -Annual Fee waived on approved VISA Standard Style FREE CHECKING FEATURES PLUS: -Service charge waived for 55 and older -50% off small safe deposit box Any Style FREE CHECKING FEATURES PLUS: -.25% rate bump on CDS -Free Cashier’s checks -Free stop payments -Free small safe deposit box Chapter 7.3 Balance Your Checkbook Your Bank Statement • Received at the end of the month showing all transactions for the month • You should compare your checkbook register to your bank statement to make sure no mistakes have been made. • This is called reconciliation or balancing your account. Reconciliation • Checking bank statement with checkbook register to assure no mistakes have been made. PAYMENT OUTSTANDING No. • Check Summary – – – – – – 01/03 Deposit 01/08 Check 101 01/15 Check 103 01/15 Check 104 01/19 Check 105 01/28 Check 107 102 106 $717.20+ $35.24$40.00$41.80$120.24$314.12 108 TOTAL 24.00 33.93 450.00 507.93 ENDING BALANCE ON STATEMENT ADD DEPOSITS NOT SHOWN SUB-TOTAL SUBTRACT PAYMENTS OUTSTANDING BALANCE $ 160 692 853 507 80 37 17 93 345 24 Reconciliation • Look at your statement and start with the first transaction and compare it with your check register. • Continue this one transaction at a time. • After you have checked off everything listed in your statement, look for any entries in your check register that you did not check off. Routing Diagram Canceled Check • A check that has been paid • A check that has made its way through the banking system What is included in a Statement? • Account Balance • Any checks you have written • Any withdrawals you have made (ATM or debit card) • Any deposits you have made • Any fees that you have received Can’t reconcile? • The design of reconciliation forms varies from bank to bank • Often times a reconciliation form will be attached to the back of your statement • You should speak with a bank representative or manager if you have an issue with your bank account. Bank Reconciliation- Page 5 • Use the bank statement and check register to reconcile your bank account. • 1. Use the checkmark column on your checkbook register to check off transactions that are on your bank statement. • 2. On your reconciliation form, record checks that are on your checkbook register, but are NOT on your bank statement. • 3. Record any deposits you have made that are not on your bank statement. • 4. Determine the correct balance! Bell Ringer–3 • Name 3 types of fees you can incur when having a checking account Chapter 7.4 Electronic Banking Electronic Funds Transfer (EFT) • To move money from one account to another by computer. (Including smartphone or tablet) • You DO NOT need checks or currency in order to do this. • EFTS are quicker and less expensive for banks to complete than paper transactions. Automated Teller Machine (ATM) • A computer terminal that you can use to make deposits, withdraw cash, transfer money between accounts, check your account balance, and pay some kinds of bills. • An ATM can come complete most transactions that a human teller can. • Most popular way to transfer money. Personal Identification Number (PIN) • A secret number that identifies you to the ATM as the owner of the account. • When you insert your card and enter your PIN on the ATM key pad, the machine identifies you as the card owner and authorizes you to make transactions. Direct Deposit • Having your payroll check directly deposited into your checking/saving account. • You will receive a pay-stub which does not have value and cannot be deposited. Debit Card • • • • Plastic card that resembles a credit card. Also know as a “Check Card.” Used in place of writing a check. When using a debit card, the funds automatically get withdrawn from your bank account. Automatic Withdrawal • An arrangement you can make with your bank to pay certain bills automatically from your bank account. • Often done online • Convenient way for you to make sure bills are paid on time each month. – Eliminates late fees Online Banking • Features – Keeps checkbook register – Pay bills - Automated – Transfer funds • Convenient – Any device can be used, just need internet • Security – Password protected – Use of different computers/devices Mobile Banking • https://www.bankofamerica.com/onlinebanking/mobile.go Chapter 7.5 Certified Check • Personal check that has been stamped and signed by a bank officer to guarantee your account has the funds to cover the check. Cashiers Check • A way to guarantee payment • A banks own check signed by the bank’s cashier • You pay the teller the amount you want the check written for and the bank uses their own check. • There is usually a $25 fee to use this type of check. • In what situations may you need to get a cashiers check? Money Order • A check that draws on the money of the bank or other financial business that doesn’t accept personal checks. • Similar to a cashiers check only there are 2 major differences: – 1. Many different companies sell money orders, not just banks... post office, a check-cashing business, Western Union, American Express, etc... – 2. Your name, not the bank’s name, appears on the money order. Traveler’s Check • Checks you pay for in advance, and if they are lost of stolen, the company you got them from will replace them for free. • Can be bought in many places: – Banks, American Express offices, travel agencies, offices at the American Automobile Association • Generally sold in amounts such as $20, $50, or $100 • Fee is usually 1% of the amount it is worth • How to cash them- sign bottom signature line in front of the person you want to pay. Usually an ID will be required. Why Travelers check... • Why travelers Check? – If you travel its not always a good idea to bring a lot of cash with you.. In case you lose your suitcase, misplace your money, etc... – Most local businesses wont accept a personal check, especially if your bank is from away from where you currently are visiting. – Traveler’s checks are a good option in this situation! Wire Transfer • An electronic communication that moves money from an account in one bank to an account in a different bank. • They happen instantly • On a smaller scale... This is what happens when you withdrawal money from an ATM. • Why a wire transfer? – Suppose a company orders thousands of monitors from a company and agrees to pay 28 million for them. This huge sum would earn substantial interest in a bank account each day. Companies don’t want to lose this interest so instead of writing a check and waiting a few days for it to go through, they will do a wire transfer to pay immediately. Safe Deposit Box • Boxes with individual locks that you can rent from a bank. • Located in a vault, where their contents are safe from fire, theft, and loss. • Renting a small safe deposit box can range from $30$50 per year. • A larger safe deposit box can cost more • If you need to access your safe deposit box you need to sign in, show your ID, and give your box key to a bank employee. Endorsing Assessment • 1. You have just entered the bank, and you are depositing your check from Grandma Sally. On the back of this check, write a blank endorsement to put this check in your account. Your account number is: #700456. • 2. You have received a check from Grandpa Frank, and you want to mail it to your bank. On the back of this check, write a restrictive endorsement so that you can mail this check to the bank and have it deposited to your account. Your account number is: #700456. Endorsing Assessment • 3. You receive a check for $50 that you wish to give to Rachel Adams. Endorse the check in full to Rachel Adams. Rachel Adams’ account number is #100123.