2012-06-19.ccmin

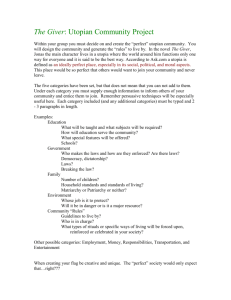

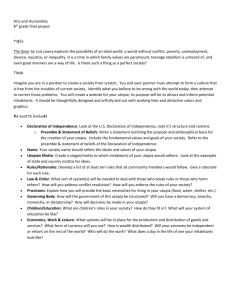

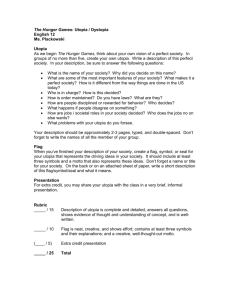

advertisement