step by step fafsa completion 2013-2014

advertisement

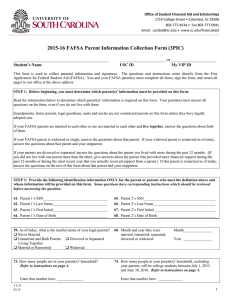

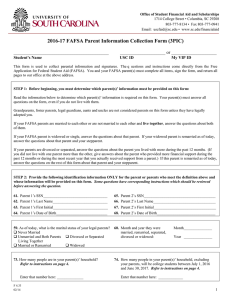

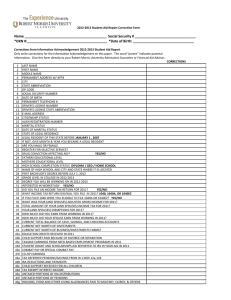

Jamie Petersen Cheryl Warmann Oakton Community College January 9, 2013 enrollmentcenter@oakton.edu Demographic Information Student’s name and address Student’s SSN and date of birth Student’s driver’s license information Student’s email address (preferably not the high school assigned email address) Citizenship Status U.S. Citizen Eligible Noncitizen Permanent U.S. Resident with Permanent Resident Card Conditional Permanent Resident Arrival-Departure Record I-94 List Alien ID Number Student needs a SSN; parents do not Student’s Marital Status Single Married/Remarried Separated Divorced/Widowed State of Legal Residence Illinois Enter date of legal residency if moved to IL after January 1, 2008 Selective Service If child is male and NOT registered, select “Register me” If there is a question about registration, it is okay to check “Register me” Drug Convictions & Student Aid No, I have never received federal student aid Parent(s) Education Select highest educational level completed High School High School Completion Status High School Name High School City and State College Information Grade level Most likely “never attended college and 1st year undergraduate” Degree or certificate Most likely “1st bachelor’s degree” or “associate degree” School codes Can enter up to 10 colleges Search capability Dependency Status Not usually Not born before 1990 Not married Not in graduate school Not in service on active duty Not a veteran Dependency Status Not usually Providing more than 50% of support of a child Providing more than 50% of support for other dependents Dependency Status Not usually An orphan, ward of the court, foster care (after age 13) Emancipated by the court Assigned a legal guardian by the court Determined to be an unaccompanied youth & homeless after July 1, 2012, by High school Director of HUD funded shelter Director of youth center or transitional living program Who is a Parent? Married or remarried Biological Parent or Step-Parent Divorced or Separated, Single, Widowed Parent that student lived with more in last 12 months Month & Year of change in marital status Email address to learn FAFSA processed Identifiers Social Security Number If parent is remarried; also include step-parent Last Name and First Initial On social security card Date of Birth Dislocated Worker Yes if: Receiving unemployment benefits due to being laid off and is unlikely to return to the same type of work; or Laid off or received a lay-off notice; or Was self employed but is now unemployed due to economic conditions or natural disaster; or Is a ‘displaced homemaker’ Previously a ‘stay at home’ mom or dad, no longer supported by spouse, does not have secure employment State of Legal Residence Illinois Enter date of legal residency if parent moved to IL after January 1, 2008. Use date for parent who has lived in the state the longest Tax Type Have already completed Will file Not filing 1040 (used if you itemize) 1040A, 1040EZ Foreign Tax Return Puerto Rico Tax Return IRS Data Retrieval Process Available February 1, 2013 Available during initial application and correction process Question prompts will be asked to determine eligibility to use the Data Retrieval System If no, request will be made for an IRS Tax Transcript IRS Tax Transcripts Online request www.irs.gov “Order a tax return or account transcript” Telephone request 1-800-908-9946 Paper request IRS Form 4506T-EZ http://www.irs.gov/pub/irs-pdf/f4506tez.pdf **Must know address used on tax return! Adjusted Gross Income 2012 Federal Income Tax Form 1040 — Line 37 1040A — Line 21 1040EZ — Line 4 Earnings from Work W-2 statements or Federal 1040 – Add lines 7, 12, 18 and Box 14 or IRS Schedule K-1 or Federal 1040A – Line 7 or Federal 1040EZ – Line 1 If you did not work – Enter Zero Income Tax Federal 1040 – Line 55 or Federal 1040A – Line 35 or Federal 1040EZ – Line 10 Not the amount withheld Federal Benefits 2011 or 2012 Checkmark Supplemental Security Income (disability related) Supplemental Nutrition Assistance Program (SNAP) – commonly known as food stamps Free or Reduced Price School Lunch Temporary Assistance for Needy Families (TANF) Special Supplemental Nutrition Program for Women, Infants, and Children (WIC) Not “medical card” Additional Financial Info Educational Credits (Next year may have Hope Scholarship Credit) Child Support Paid Taxable earnings from limited Financial Aid (Next year student may have federal work study) Taxable grants or scholarships Combat Pay or Special Combat Pay Cooperative education earnings Additional Financial Info Child Support Paid Statement signed by applicant, spouse, or parent who paid child support certifying: Amount of child support paid Name of person to whom child support paid; and Name of children for who child support paid. If institution believes information is inaccurate, other acceptable documentation: Copy of separation or divorce decree listing amount Statement from individual receiving payment showing amount Copies of child support checks or money order receipts Untaxed Income Tax-Deferred Savings (eg: 401K & 403B) W-2 Box 12a-12d (Codes D, E, F, G, H and S) Child Support Received IRA Deductions/SEP, SIMPLE, Keogh, etc Tax Exempt Interest (eg: Municipal Bonds) Untaxed IRA Distributions/Pensions Exclude Rollovers Untaxed Income Military, Clergy, etc Housing, food, other living allowances Noneducational Veterans Benefits Disability, Death Pension Other untaxed Workmen’s Compensation; First-time homebuyer tax credit Gifts (eg: someone paying bills) Cash, Savings, Checking As of the day FAFSA completed Investments (Net Worth) Real Estate Second home Rental property Trust Funds Unified Gift & Transfers to Minor Accounts Money Market Funds Mutual Funds Certificates of Deposit Investments Stocks/Stock Options Bonds Other Securities Coverdell Savings Accounts 529 College Savings Plans Accounts reported as parental investment Include sibling’s account 529 Prepaid Tuition Plan (refund value) Business/Farms (Net Worth) Investment Farms (not family farm) Business 100 or more full-time employees Family controls less than 50% Student Finances Follow same definition as parent section Assets Cash, Savings, Checking-as of today Investments-Unified Gift to Minors/Trust Funds Dependent earnings under $6,130 are “protected” Family Members in Household Student Parent(s) Parents’ other dependent children Other people if Live with Parents and Receive 50% or more support from Parents and Will continue to receive 50% or more support from Parents in 2013-2014 College Students Student Include others if they will attend at least half-time in 2013-2014 Do not include parent(s) Contribution from Assets Student Max of $200 per $1,000 of savings/investment Parent age 45 (single parent) Assets over $10,600 $120 for every $1,000 Parent age 45 (two parents) Assets over $36,200 $120 for every $1,000 PINs, Colleges, and Deadlines Create PINs (electronic signatures) Student and Parent When online—keep going until you have a confirmation number Check College Websites for Deadlines IL Monetary Award Program Formula and Calculators www.ifap.ed.gov Search EFC Formula Guide www.fafsa4caster.ed.gov www.collegeillinois.org College Calculators EFC Calculator Additional Help Federal Phone Number 1-800-4-FED-AID Oakton Community College By appointment Mon-Fri; Feb. 4-15; 9am – 4pm 847-635-1708 or enrollmentcenter@oakton.edu Collegeillinois.org for other sessions