Name ___________________________________________ Social Security # ________________________________

advertisement

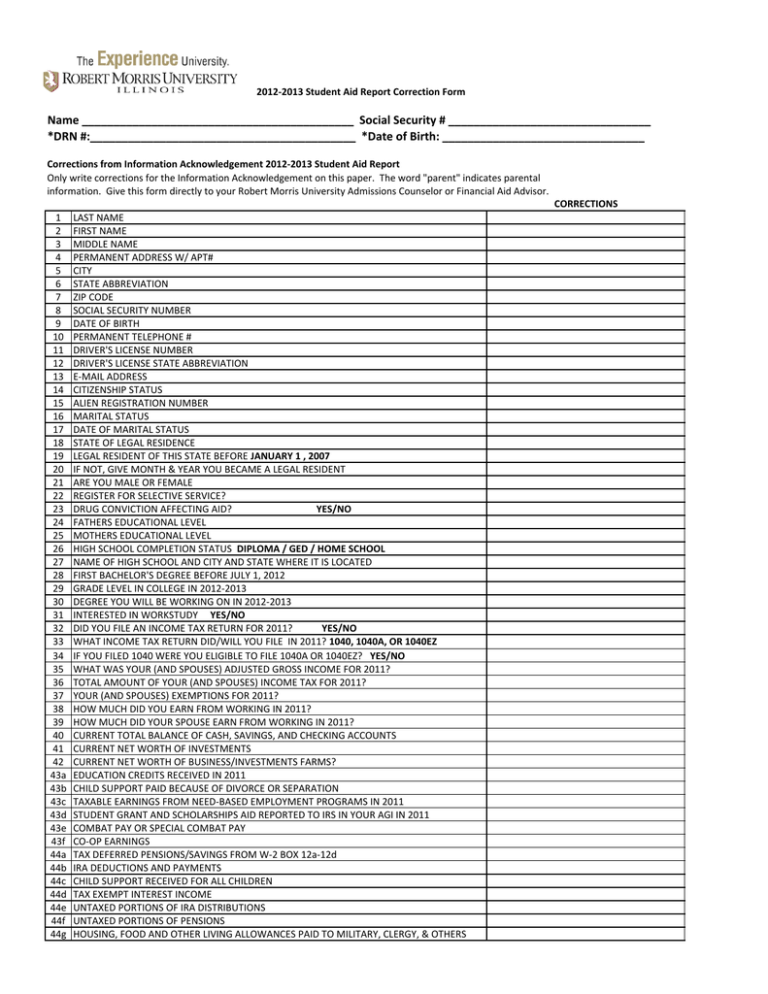

2012-2013 Student Aid Report Correction Form Name ___________________________________________ Social Security # ________________________________ *DRN #:__________________________________________ *Date of Birth: ________________________________ Corrections from Information Acknowledgement 2012-2013 Student Aid Report Only write corrections for the Information Acknowledgement on this paper. The word "parent" indicates parental information. Give this form directly to your Robert Morris University Admissions Counselor or Financial Aid Advisor. CORRECTIONS 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43a 43b 43c 43d 43e 43f 44a 44b 44c 44d 44e 44f 44g LAST NAME FIRST NAME MIDDLE NAME PERMANENT ADDRESS W/ APT# CITY STATE ABBREVIATION ZIP CODE SOCIAL SECURITY NUMBER DATE OF BIRTH PERMANENT TELEPHONE # DRIVER'S LICENSE NUMBER DRIVER'S LICENSE STATE ABBREVIATION E-MAIL ADDRESS CITIZENSHIP STATUS ALIEN REGISTRATION NUMBER MARITAL STATUS DATE OF MARITAL STATUS STATE OF LEGAL RESIDENCE LEGAL RESIDENT OF THIS STATE BEFORE JANUARY 1 , 2007 IF NOT, GIVE MONTH & YEAR YOU BECAME A LEGAL RESIDENT ARE YOU MALE OR FEMALE REGISTER FOR SELECTIVE SERVICE? DRUG CONVICTION AFFECTING AID? YES/NO FATHERS EDUCATIONAL LEVEL MOTHERS EDUCATIONAL LEVEL HIGH SCHOOL COMPLETION STATUS DIPLOMA / GED / HOME SCHOOL NAME OF HIGH SCHOOL AND CITY AND STATE WHERE IT IS LOCATED FIRST BACHELOR'S DEGREE BEFORE JULY 1, 2012 GRADE LEVEL IN COLLEGE IN 2012-2013 DEGREE YOU WILL BE WORKING ON IN 2012-2013 INTERESTED IN WORKSTUDY YES/NO DID YOU FILE AN INCOME TAX RETURN FOR 2011? YES/NO WHAT INCOME TAX RETURN DID/WILL YOU FILE IN 2011? 1040, 1040A, OR 1040EZ IF YOU FILED 1040 WERE YOU ELIGIBLE TO FILE 1040A OR 1040EZ? YES/NO WHAT WAS YOUR (AND SPOUSES) ADJUSTED GROSS INCOME FOR 2011? TOTAL AMOUNT OF YOUR (AND SPOUSES) INCOME TAX FOR 2011? YOUR (AND SPOUSES) EXEMPTIONS FOR 2011? HOW MUCH DID YOU EARN FROM WORKING IN 2011? HOW MUCH DID YOUR SPOUSE EARN FROM WORKING IN 2011? CURRENT TOTAL BALANCE OF CASH, SAVINGS, AND CHECKING ACCOUNTS CURRENT NET WORTH OF INVESTMENTS CURRENT NET WORTH OF BUSINESS/INVESTMENTS FARMS? EDUCATION CREDITS RECEIVED IN 2011 CHILD SUPPORT PAID BECAUSE OF DIVORCE OR SEPARATION TAXABLE EARNINGS FROM NEED-BASED EMPLOYMENT PROGRAMS IN 2011 STUDENT GRANT AND SCHOLARSHIPS AID REPORTED TO IRS IN YOUR AGI IN 2011 COMBAT PAY OR SPECIAL COMBAT PAY CO-OP EARNINGS TAX DEFERRED PENSIONS/SAVINGS FROM W-2 BOX 12a-12d IRA DEDUCTIONS AND PAYMENTS CHILD SUPPORT RECEIVED FOR ALL CHILDREN TAX EXEMPT INTEREST INCOME UNTAXED PORTIONS OF IRA DISTRIBUTIONS UNTAXED PORTIONS OF PENSIONS HOUSING, FOOD AND OTHER LIVING ALLOWANCES PAID TO MILITARY, CLERGY, & OTHERS 44h 44i 44j 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91a 91b 91c 91d 91e 91f 92a 92b 92c 92d 92e 92f 92g 92h 92i 93 94 95 VETERENS NONEDUCATION BENEFITS OTHER UNTAXED INCOME (WORK COMP, DISABILITY,home buyer credit) MONEY RECEIVED OR PAID ON YOUR BEHALF WERE YOU BORN BEFORE JAN 1, 1989 ARE YOU MARRIED? ENROLLED IN MASTERS OR DOCTORATE IN 2012-2013 CURRENTLY SERVING ON ACTIVE DUTY IN THE U.S. ARMED FORCES? ARE YOU A U.S. VETEREN OF THE U.S ARMED FORCES? DO YOU HAVE CHILDREN YOU SUPPORT? DEPENDENTS OTHER THAN CHILDREN/SPOUSE? SINCE AGE 13, ARE BOTH PARENTS DECEASED, IN FOSTER CARE OR WARD OF COURT? ARE YOU OR WERE YOU AN EMANCIPATED MINOR? ARE YOU OR WERE YOU IN LEGAL GUARDIANSHIP? DID A HIGH SCHOOL LIASON DETERMINE YOU WERE HOMELESS AS OF 7/1/2011 DETERMINED TO BE HOMELES BY HOUSING AND URBAN DEVELOPMENT AS OF 7/1/2011 AT RISK OF BEING HOMELESS PARENTS MARITAL STATUS MARRIED, DIVORCED/SEPARATED,WIDOWED OR SINGLE MONTH AND YEAR PARENTS WERE MARRIED, SEPARATED/DIVORCED OR WIDOWED FATHER'S/STEPFATHER'S SOCIAL SECURITY NUMBER FATHER'S/STEPFATHER'S LAST NAME FATHER'S/STEPFATHER'S FIRST INITIAL FATHER'S/STEPFATHER'S DATE OF BIRTH MOTHER'S/STEPMOTHER'S SOCIAL SECURITY NUMBER MOTHER'S/STEPMOTHER'S LAST NAME MOTHER'S/STEPMOTHER'S FIRST INITIAL MOTHER'S/STEPMOTHER'S DATE OF BIRTH PARENTS EMAIL ADDRESS PARENTS STATE OF LEGAL RESIDENCE LEGAL RESIDENT OF THIS STATE BEFORE JANUARY 1 , 2007 IF NO, GIVE MONTH AND YEAR BECAME LEGAL RESIDENT HOW MANY PEOPLE ARE IN YOUR PARENT'S HOUSEHOLD? HOW MANY WILL BE COLLEGE STUDENTS DURING 7/1/2012 AND 6/30/2013 RECEIVED SUPPLEMENTAL SECURITY INCOME YES/NO RECEIVED FOOD STAMPS YES/NO RECEIVED FREE OR REDUCED LUNCH YES/NO RECEIVED TANF BENEFITS YES/NO RECEIVED WIC BENEFITS YES/NO HAVE PARENTS COMPLETED 2011 TAX FORMS? YES/NO WHAT INCOME TAX RETURN DID/WILL YOUR PARENT FILE IN 2011? 1040, 1040A OR 1040EZ IF PARENTS FILED 1040, WERE THEY ELIGIBLE TO FILE 1040A OR 1040EZ? YES/NO AS OF TODAY IS EITHER PARENT A DISLOCATED WORKER? YES/NO PARENTS' ADJUSTED GROSS INCOME FOR 2011 PARENTS' INCOME TAX FOR 2011 PARENTS' EXEMPTIONS FOR 2011 HOW MUCH DID FATHER/STEPFATHER EARN FROM WORKING IN 2011? HOW MUCH DID MOTHER/STEPMOTHER EARN FROM WORKING IN 2011? PARENTS' CURRENT TOTAL OF CASH,SAVINGS, AND CHECKING PARENTS' NET WORTH OF INVESTMENTS PARENTS' NET WORTH OF BUSINESS OR INVESTMENT FARMS EDUCATION CREDITS RECEIVED IN 2011 CHILD SUPPORT PAID BECAUSE OF DIVORCE OR SEPARATION PARENTS TAXABLE EARNINGS FROM NEED-BASED EMPLOYMENT STUDENT GRANT AND SCHOLARSHIP AID REPORTED TO IRS IN 2011 AGI COMBAT PAY OR SPECIAL COMBAT PAY CO-OP EARNINGS TAX DEFERRED PENSIONS/SAVINGS FROM W-2 BOX 12a-12d IRA DEDUCTIONS AND PAYMENTS CHILD SUPPORT RECEIVED FOR ALL CHILDREN IN 2011 TAX EXEMPT INTEREST INCOME UNTAXED PORTIONS OF IRA DISTRIBUTIONS UNTAXED PORTIONS OF PENSIONS HOUSING, FOOD AND OTHER LIVING ALLOWANCES PAID TO MILITARY, CLERGY, & OTHERS VETERENS NONEDUCATION BENEFITS OTHER UNTAXED INCOME NOT REPORTED (WORK COMP, DISABILITY) HOW MANY PEOPLE ARE IN YOUR HOUSEHOLD? HOW MANY PEOPLE IN YOUR HOUSEHOLD WILL BE IN COLLEGE 7/1/2012-2013 RECEIVED SUPPLEMENTAL SECURITY INCOME YES/NO 96 97 98 99 100 101a 101b 101c 101d 101e 101f 101g 101h 102 103 RECEIVED FOOD STAMPS YES/NO RECEIVED FREE OR REDUCED LUNCH YES/NO RECEIVED TANF BENEFITS YES/NO RECEIVED WIC BENEFITS YES/NO AS OF TODAY ARE YOU (OR SPOUSE) A DISLOCATED WORKER? YES/NO NAME OF COLLEGE HOUSING PLANS NAME OF COLLEGE HOUSING PLANS NAME OF COLLEGE HOUSING PLANS NAME OF COLLEGE HOUSING PLANS DATE THIS FORM WAS COMPLETED STUDENT SIGNATURE PARENT SIGNATURE 104 PREPARER'S SOCIAL SECURITY NUMBER 105 EMPLOYER ID NUMBER 106 PREPARER'S SIGNATURE AND DATE You must read this Certification and sign below. PLEASE DO NOT PRINT. CERTIFICATION All of the information on this form is true and complete to the best of my knowledge. 1 STUDENT DATE 2 FATHER/ STEPFATHER DATE 3 MOTHER/ STEPMOTHER DATE Robert Morris University offers professional, career-focused education in a collegiate setting to diverse communities.