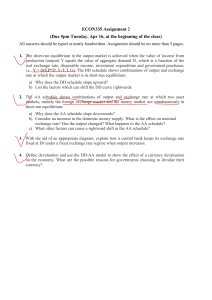

PROBLEM SET #4 1) Explain how does an increase in the real

advertisement

PROBLEM SET #4 1) Explain how does an increase in the real exchange rate affect exports and imports? 2) True, False Explain: Monetary expansion causes the current account balance to increase in the short run. 3) Find the real exchange rate for the following case: Assume that the representative basket of European goods costs 100 euros and the representative U.S. basket costs $125, and the dollar/euro exchange rate is $0.75 per euro, then the price of the European basket in terms of U.S. basket is: . 4) Give 4 examples of situations that would cause the DD-curve to shift to the left. 5) Imagine that the economy is at a point on the DD-AA schedule that is above both AA and DD and where both the output and asset markets are out of equilibrium. Explain what will happen next? 6) Using a figure show that under full employment, a temporary fiscal expansion would increase output (over-employment) but cannot increase output in the long run. 7) True, False or Uncertain: Explain i) In an open economy DD-AA model, a permanent increase in domestic government purchases leads to an increase in domestic equilibrium interest rate and output, and results into a depreciation of domestic currency against foreign currency in the short run. [Diagram required] ii) Both the temporary and permanent expansionary fiscal policy improves the current account balance. [Diagrams required] iii) If the economy, which is under a flexible exchange rate system, starts at long-run equilibrium, a permanent tax cut will cause its currency to appreciate but will have no effect on output in the short-run. [Diagram required] ANALYTICAL QUESTIONS: 8. Consider the model of output and exchange rate determination (the AA-DD model) we have studied in class. Suppose the economy begins at its long-run level with output at its fullemployment level. Compare and contrast the short-run effects of the following temporary policies by the home government: listed below on home output, the home current account, and the nominal exchange rate. Use AA-DD-XX diagrams to support your answers. (i) an increase in home money supply (ii) a decrease in home government taxes