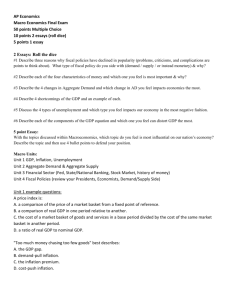

AP Economics Review: Chapters 7-11 + 16 Chapter 7 Define GDP

advertisement

AP Economics Review: Chapters 7-11 + 16 Chapter 7 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. Define GDP a. The value of all final goods/services produced within a country in one year What is the expenditures approach formula for calculating GDP a. C + I + G + X (net exports) Give an example of an intermediate good a. Sugar used for baking chips ahoy cookies Why are social security payments NOT counted in GDP? a. Because they are purely financial transactions – no production involved If I bought my textbooks for graduate school, which begins in 2011, today (2010) at the used bookstore, in which year would this purchase count towards GDP? a. Neither, secondhand sales not counted What is depreciation? a. Consumption of fixed capital What are three “statistical adjustments” that are included in the GDP formula for the Income approach? a. Indirect business taxes, depreciation, and net foreign factor income. What is net foreign factor income? a. The difference between income earned from foreign-owned resources in the U.S.A and income from U.S. owned resources supplied abroad. What is Disposable Income? a. Personal Income – Personal Taxes What’s the difference between Nominal and Real GDP? a. Nominal = face value of GDP b. Real = inflation – adjusted GDP How do you calculate a price index? a. (Price of market basket in specific year/ price of same basket in base year) X 100 b. Nominal GDP / Real GDP Chapter 8 1. What is the continuous order of any business cycle starting with peak? a. Peak, recession, trough, expansion 2. What are four types of unemployment? a. Structural, seasonal, frictional, cyclical 3. Give an example of frictional unemployment? a. In between jobs 4. Define “full-employment”. a. Frictional + structural unemployment b. Zero cyclical unemployment 5. What is the full employment rate also referred to? a. Natural rate of unemployment 6. How do you calculate the unemployment rate? 7. 8. 9. 10. a. (Unemployed / labor force) X 100 State Okun’s law. a. for every 1 percentage point which the actual unemployment rate exceeds the natural rate, a GDP gap of about 2 percent occurs illustrate a negative GDP gap a. potential GDP curve above actual GDP What causes demand-pull inflation? a. When excess demand for goods/services drives up prices of the limited output How is cost-push inflation caused? a. When rising resource prices force producers to increase the price of their final goods/services they are producing. Chapter 9 1. Describe Keynesian economics a. The economy may need occasional government intervention to stimulate growth 2. Describe classical economics a. The economy should be left to it’s own devices, no government intervention needed 3. How does Say’s law contribute to classic economic theory. a. If supply creates it’s own demand, then the economy will always be producing enough goods/services/income to constantly stimulate economic growth. 4. How do you calculate MPC and MPS? a. MPC = change in consumption / change in income b. MPS = change in saving/ change in income 5. At what point is equilibrium achieved according to the aggregate expenditures model? a. When Aggregate expenditures = Real domestic output (GDP) (DI) Chapter 10 1. Why does the multiplier effect exist? a. Because the economy has continuous flows of expenditures and income (Circular flow), any change in initial spending/income will have a compounded effect on total aggregate expenditures/GDP. 2. What are three ways you can calculate the multiplier? a. 1/MPS, 1/1-MPC, change in real GDP/change in spending 3. When describing a closed/private economy, what aggregate(s) is not included? a. Net exports and government Chapter 11 1. What is aggregate demand? a. “Total” demand. Collective demand of all amounts of real output 2. What is aggregate supply? a. “total” supply. Collective supply of all amounts of real output. 3. Explain the wealth effect. a. Higher price levels = decreased purchasing power = decreased AD. 4. What does the wealth account for? 5. 6. 7. 8. 9. 10. 11. 12. 13. a. Downward sloping AD curve Explain the interest-rate effect. a. Higher price levels = increased interest rates = decreased AD Explain foreign purchases effect a. Higher price levels= decreased net exports = decreased AD What are 2 determinants of Aggregate demand? a. Change in consumer spending i. Consumer wealth ii. Consumer expectations iii. Household indebtedness iv. taxes b. Change in investment spending i. Interest rates ii. Profit expectations iii. Business taxes iv. Technology v. Degree of excess capacity c. Change in government spending d. Change in net exports spending Identify the Keynesian range of an AS curve a. Horizontal range How do you measure productivity? a. Output/input How do you measure per-unit productivity cost? a. (Input X cost) / output Explain the ratchet effect. a. Prices/wages are flexible upwards and inflexible downwards. When AD decreases, output decreases, but price level remains the same. Explains why prices stay inflated during periods of economic recession. Illustrate the ratchet effect. a. See page 236 in textbook Why are economies experiencing a recession/depression in the horizontal range of the AS curve? a. Because resources are not fully employed. Production is occurring, but not at fullemployment levels…so there are unemployment issues Chapter 16 1. What’s the difference between short-run and long-run? a. Time for nominal wages to respond to changes in the price level. 2. Illustrate the extended AS-AD model in long-run equilibrium. a. See page 333 3. Illustrate an economy in a recession (long-run) a. LRAS to the right of AS/AD intersection 4. What generally happens as a result of inflationary gaps in terms of inflation? 5. 6. 7. 8. 9. a. Cost-push inflation occurs Illustrate a short-run Phillips curve. a. See page 337 What is stagflation? a. Periods of both increasing price level and unemployment Illustrate an increase in AD on the extended AD/AS model, then show the corresponding effect this would have on the short-run Phillips curve. a. AD shifts right, Phillips curve moves up and to the right What does the Laffer curve illustrate? a. Relationship between tax rates and revenues Explain how the Laffer curve illustrates increased tax revenues at decreased tax rates. a. Lower taxes increases incentives to work, thus increasing employment, therefore generating more total revenue.