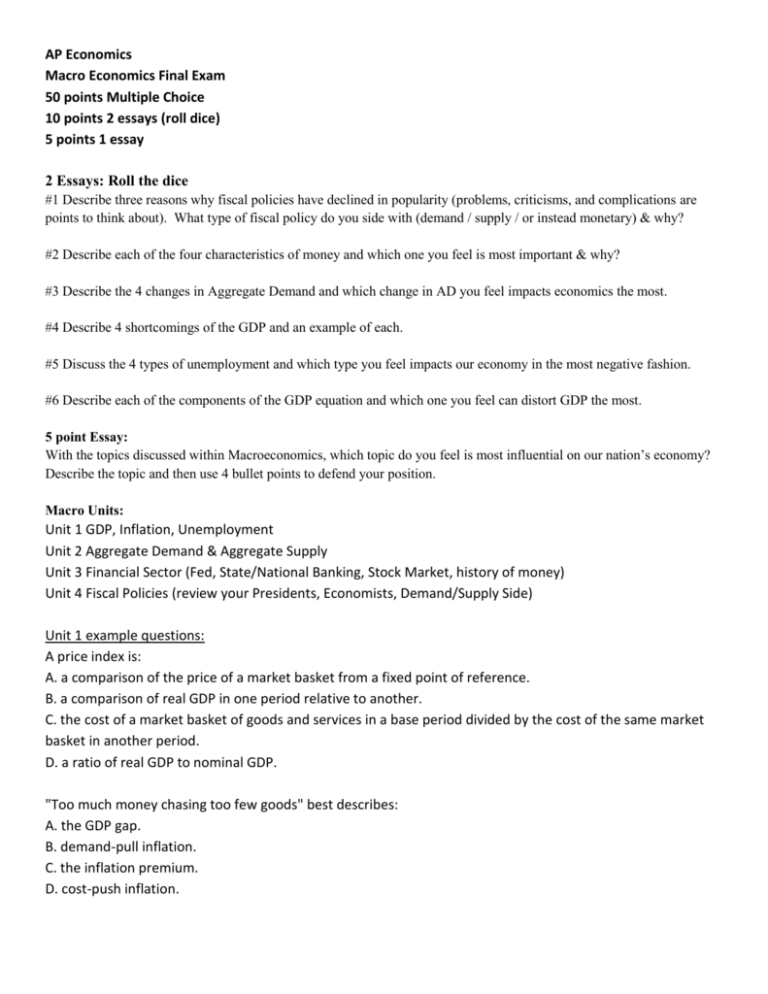

AP Economics Macro Economics Final Exam 50 points Multiple

advertisement

AP Economics Macro Economics Final Exam 50 points Multiple Choice 10 points 2 essays (roll dice) 5 points 1 essay 2 Essays: Roll the dice #1 Describe three reasons why fiscal policies have declined in popularity (problems, criticisms, and complications are points to think about). What type of fiscal policy do you side with (demand / supply / or instead monetary) & why? #2 Describe each of the four characteristics of money and which one you feel is most important & why? #3 Describe the 4 changes in Aggregate Demand and which change in AD you feel impacts economics the most. #4 Describe 4 shortcomings of the GDP and an example of each. #5 Discuss the 4 types of unemployment and which type you feel impacts our economy in the most negative fashion. #6 Describe each of the components of the GDP equation and which one you feel can distort GDP the most. 5 point Essay: With the topics discussed within Macroeconomics, which topic do you feel is most influential on our nation’s economy? Describe the topic and then use 4 bullet points to defend your position. Macro Units: Unit 1 GDP, Inflation, Unemployment Unit 2 Aggregate Demand & Aggregate Supply Unit 3 Financial Sector (Fed, State/National Banking, Stock Market, history of money) Unit 4 Fiscal Policies (review your Presidents, Economists, Demand/Supply Side) Unit 1 example questions: A price index is: A. a comparison of the price of a market basket from a fixed point of reference. B. a comparison of real GDP in one period relative to another. C. the cost of a market basket of goods and services in a base period divided by the cost of the same market basket in another period. D. a ratio of real GDP to nominal GDP. "Too much money chasing too few goods" best describes: A. the GDP gap. B. demand-pull inflation. C. the inflation premium. D. cost-push inflation. Unit 2 example questions: The downward slope of the aggregate demand curve is best explained by the: A. Interest rate, real-balances, and foreign purchases effects B. Rate of inflation and the natural rate of unemployment C. Policies to stabilize prices and reduce unemployment D. Household indebtedness, business taxes, and exchange rates Deflation is: A. a slow-down in the inflation rate B. a decrease in the general price level of goods and services C. a persistent increase in the general price level of goods and services in an economy over a period of time D. the number of goods or services that can be purchased with a unit of currency E. the income of individuals or nations after adjusting for inflation Unit 3 example questions: The primary goal of the Federal Reserve is to: A. oversee fiscal policies B. oversee the printing of money C. oversee the level of inflation D. vote on monetary policies for changes in the Constitution How many board of governors are there for the Fed? A. 7 B. 9 C. 12 D. 14 E. 17 Unit 4 examples questions: Discretionary fiscal policy refers to: A. any change in government spending or taxes that destabilizes the economy. B. the authority that the President has to change personal income tax rates. C. changes in taxes and government expenditures made by Congress to stabilize the economy. D. the changes in taxes and transfers that occur as GDP changes. Shows how the actual distribution of income differs from an equal distribution in order to display income inequalities? A. Phillips Curve B. Kerr Curve C. Lorenz Curve D. Roberts Curve