Your score : /5

advertisement

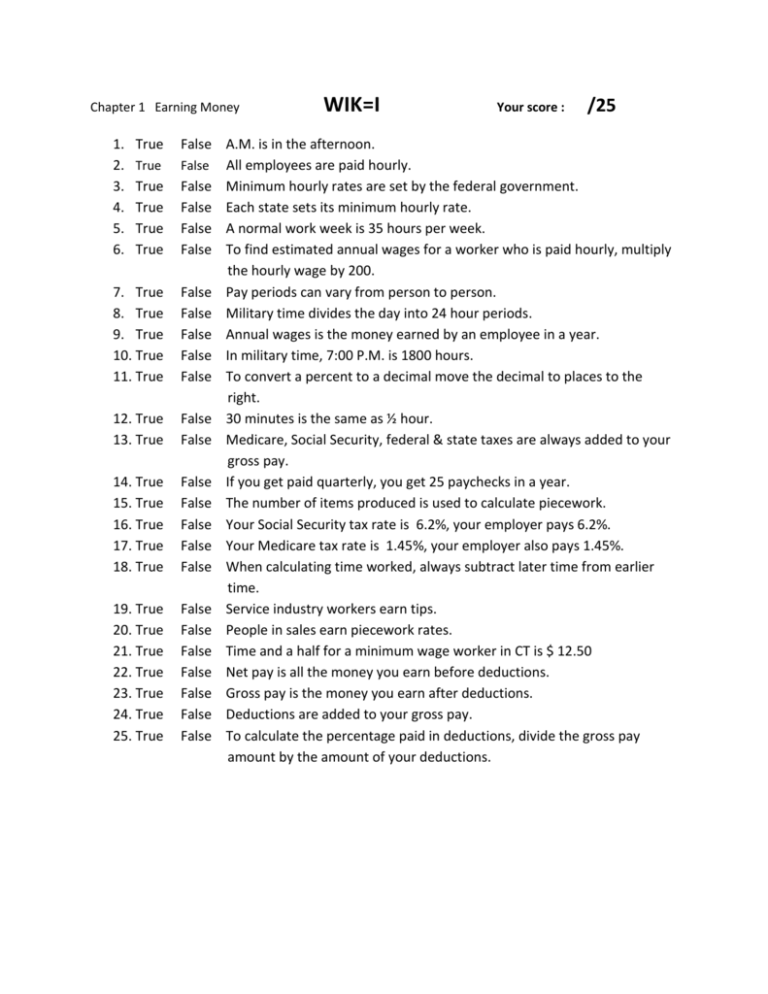

Chapter 1 Earning Money 1. 2. 3. 4. 5. 6. True True True True True True 7. True 8. True 9. True 10. True 11. True 12. True 13. True 14. True 15. True 16. True 17. True 18. True 19. True 20. True 21. True 22. True 23. True 24. True 25. True WIK=I Your score : /25 False A.M. is in the afternoon. False All employees are paid hourly. False Minimum hourly rates are set by the federal government. False Each state sets its minimum hourly rate. False A normal work week is 35 hours per week. False To find estimated annual wages for a worker who is paid hourly, multiply the hourly wage by 200. False Pay periods can vary from person to person. False Military time divides the day into 24 hour periods. False Annual wages is the money earned by an employee in a year. False In military time, 7:00 P.M. is 1800 hours. False To convert a percent to a decimal move the decimal to places to the right. False 30 minutes is the same as ½ hour. False Medicare, Social Security, federal & state taxes are always added to your gross pay. False If you get paid quarterly, you get 25 paychecks in a year. False The number of items produced is used to calculate piecework. False Your Social Security tax rate is 6.2%, your employer pays 6.2%. False Your Medicare tax rate is 1.45%, your employer also pays 1.45%. False When calculating time worked, always subtract later time from earlier time. False Service industry workers earn tips. False People in sales earn piecework rates. False Time and a half for a minimum wage worker in CT is $ 12.50 False Net pay is all the money you earn before deductions. False Gross pay is the money you earn after deductions. False Deductions are added to your gross pay. False To calculate the percentage paid in deductions, divide the gross pay amount by the amount of your deductions. Matching Your score : /10 _____ Hourly rate 52 pay periods per year _____ gratitude your Medicare tax rate _____ YTD 24 pay periods per year _____ Rate of commission your Social Security tax rate _____ piece rate a required amount _____ quota year to date _____ 1.45% tax rate amount earned for each hour worked _____ 6.2% tax rate amount paid for each item that passes inspection _____ weekly another word for tip _____ semimonthly % used with sales to calculate your earnings Word problems: Your score : Hourly rate $8.50 Show Your Work 1 2 3 4 5 6 1. 2. 3. 4. 5. /15 Calculate your pay if you worked 20 hours:________________ Calculate your pay if you worked 40 hours:________________ Calculate your double time rate:_________ Calculate your time and a half rate:_________ Calculate your pay if you worked 52 hours (10 hours on Saturday & 2 hours on Sunday): ________________ ___________________ _____________________ ________________ Regular wages Saturday wages Sunday wages 6. Estimate your annual wages: ________________________ Total Wages Time Worked Arrival 7:00AM Lunch 11:30-12:15 -____________________ Arrival 8:15AM - ___________________ Lunch 12:05-12:45 -____________________ Departure 4:30 Total Hours Worked + ___________________ Departure 5:15 - ___________________ Total Hours Worked + ___________________ Your score : /16 Jay works 3 days a week (6:00 AM to 6:00 PM) at Bradley International Airport as a baggage handler. He earns $9.15 an hour. He averages $105 in tips per day, calculate his weekly earnings. Hours worked__________ Earnings___________ Tips_____________ Total ___________ Round the following to the nearest : cent $9.993 $0.898 $55.076 $159.996 dollar Liz works at Timex putting watch bands on watches. She earns $.58 for each watch that passes inspection. Find her wages for the last 2 weeks using the information provided. Week of 10/15-10/19 Mon 189 Tues 192 Wed 187 Thurs 201 Fri 203 10/22-10/26 201 195 203 202 197 Total Wages Your score : /5 Find the commission and total salary for Mr. Smith using the information provided. base salary $250.00 sales $36,875.00 Rate of commission Commission Total (salary +commission) 4.5% Find the commission and total salary for Ms. Sullivan using the information provided. base salary $200.00 sales $42,055.00 Rate of commission Commission Total (salary +commission) 3% Sally just started working as an agent for Century 21. She sold her first house for $249,900. The contract she signed with the sellers, stipulated a 5% commission to be split equally between the broker representing the buyer and the broker representing the seller. Calculate the total commission:_________________ Your score : /28 Your net pay is also known as your __________________________________________; it is always ____________ than your gross pay Pete’s gross pay is $795/week. He pays $243.52 in deductions. What is his net pay?________________ What percentage of his income is deducted?_______________________ Tara’s deductions add up to $201.67 a week. If her net pay is $625 a week, what is her gross pay? ___________________ What percentage of her income is deducted?_______________________ Ruth earns $8.25/hour. She works 40 hours/week. $78.27 is deducted each week. What’s her net pay? ___________________ What percentage of her income is deducted?_______________________ Andre’s gross pay is $950. He pays $171 in taxes and health insurance. What is his net pay ? __________ What percentage of his income is deducted? _______________________ Barbara’s deductions total $38.25. Her gross pay is $425. What is her net pay ? __________ What percentage of her income is deducted? ______________________ Calculate the net pay & deductions for the following: Gross pay Social Security tax (4.2%) Medicare tax (1.45%) State tax (2%) Federal tax (22%) Medical/ Dental (18%) Net Pay Joy $1,376.29 Jack $1,704.05 Joy’s total deductions : ______________What percentage of Joy’s income is deducted? _____________ Jack’s total deductions : ______________What percentage of Jackson’s income is deducted? _________