Group Activity: Chapter 1 - Dean of Students Office

advertisement

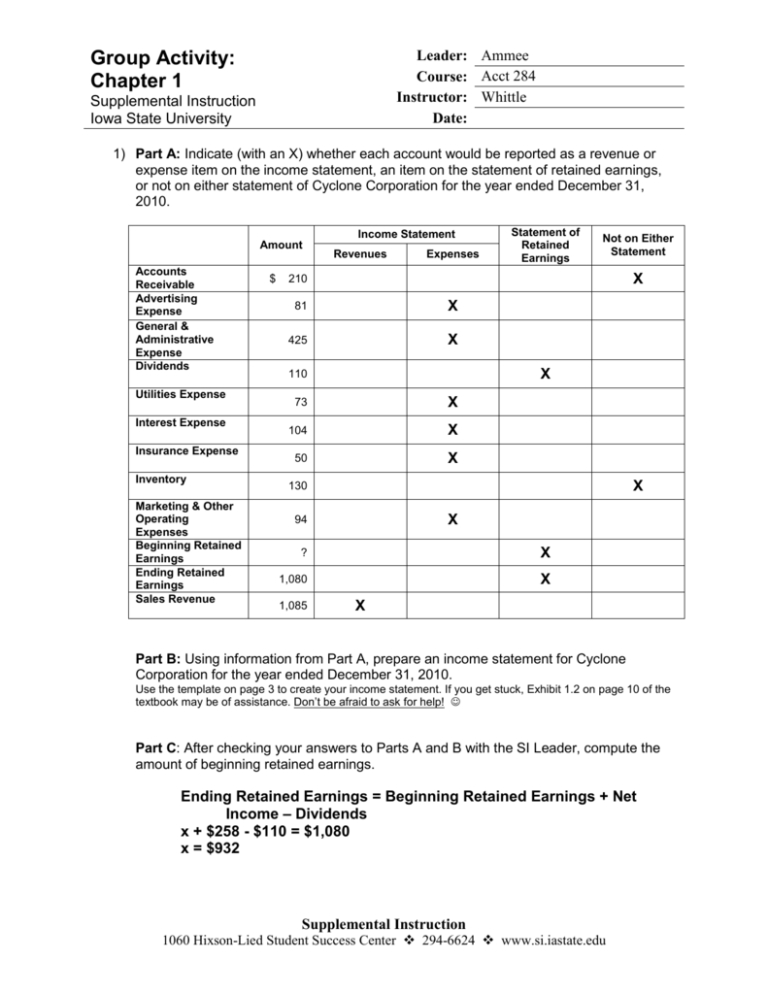

Leader: Ammee Course: Acct 284 Instructor: Whittle Date: Group Activity: Chapter 1 Supplemental Instruction Iowa State University 1) Part A: Indicate (with an X) whether each account would be reported as a revenue or expense item on the income statement, an item on the statement of retained earnings, or not on either statement of Cyclone Corporation for the year ended December 31, 2010. Income Statement Amount Accounts Receivable Advertising Expense General & Administrative Expense Dividends Utilities Expense Interest Expense Insurance Expense Inventory Marketing & Other Operating Expenses Beginning Retained Earnings Ending Retained Earnings Sales Revenue $ Revenues Expenses Statement of Retained Earnings Not on Either Statement X 210 81 X 425 X X 110 73 X 104 X 50 X X 130 X 94 ? X 1,080 X 1,085 X Part B: Using information from Part A, prepare an income statement for Cyclone Corporation for the year ended December 31, 2010. Use the template on page 3 to create your income statement. If you get stuck, Exhibit 1.2 on page 10 of the textbook may be of assistance. Don’t be afraid to ask for help! Part C: After checking your answers to Parts A and B with the SI Leader, compute the amount of beginning retained earnings. Ending Retained Earnings = Beginning Retained Earnings + Net Income – Dividends x + $258 - $110 = $1,080 x = $932 Supplemental Instruction 1060 Hixson-Lied Student Success Center 294-6624 www.si.iastate.edu If your group doesn’t finish these two problems during the session, they make great self-study! Solutions will be posted online at www.si.iastate.edu. 2) This summer’s flood destroyed some accounting records at Campanile Creations, Inc., so Cy, the company’s manager, is trying to piece together some of the historical information. On December 31, 2010, the company had retained earnings of $140,000. The company paid $15,000 in dividends during the year, and reported net earnings of $60,000. How much was retained earnings on January 1, 2010? Ending Retained Earnings = Beginning Retained Earnings + Net Income – Dividends $140,000 = x + $60,000 – $15,000 x = $95,000 3) You are the manager of ISU Dining’s catering segment, and you are working on the segment’s income statement for the month of December. The following transactions occurred during the month: Dec. 7 Dec. 10 Dec. 22 Dec. 26 Delivered $4,000 of food to the College of Business for an accounting conference. Cash was received by the delivery person. Received a check for $500 from a customer who had bagels and coffee delivered on November 29 for a staff meeting. Delivered sub sandwiches to a student organization meeting. The campus organization accounting office will verify the expense and send a check for $150 by January 15th. Received a $300 cash deposit from a couple wanting catering service for a wedding that will occur on April 5th. How much revenue should ISU Dining’s catering segment report for the month of December? $4,000 + $150 = $4,150 Use this template to complete Exercise 1, Part B. Cyclone Corporation Income Statement For the year ended December 31, 2010 Revenues Sales Revenue Total Revenues Expenses General & Admin. Expense Interest Expense Marketing & Other Expense Advertising Expense Utilities Expense Insurance Expense Total Expenses Net Income $ $ 1,085 1,085 425 104 94 81 73 50 827 258