Chapter Two

advertisement

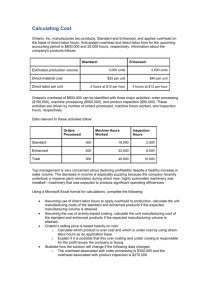

Chapter Two Manufacturing Costs and Job-Order Costing Systems What Does it Cost to Make Something? In Accounting 284, all inventory was purchased from another entity In Accounting 285, we will learn how to cost a product that is manufactured All cost associated with the production process are called product costs and go through inventory accounts Product and Period Costs Product costs are Direct material Direct labor Manufacturing Overhead Indirect material Indirect labor Utilities Depreciation Any other manufacturing cost Period Costs are Selling cost Administrative cost Product Costs and Period Costs Product Cost Period Cost Balance Sheet Income Statement Inventory Accounts Cost of Goods Sold Selling General and Administrative Expense Three Inventory Accounts Material inventory includes the cost of materials purchased but not yet put into production Work in Process (WIP) includes the cost of material, labor and manufacturing overhead of goods started but not yet completed Finished goods included the cost of good completed but not yet sold Cost Flows Through Inventory Raw material Direct labor Overhead Work in Process Finished Goods Cost of Goods Sold Flow Through Accounts Material WIP Beginning Material Beginning WIP Finished Goods Beginning Finished goods + Purchases +Direct Material + Cost of goods used + Direct manufactured Labor + MOH = Material Available =Total cost to =Goods available account for for sale - Ending Material - Ending WIP - Ending Finished Goods = Cost of material = Cost of goods =Cost of goods used manufactured sold Job-order versus Process Costing Job-order costing keeps track of the cost of materials and labor used on each job and then applies manufacturing overhead to each job. Process costing keeps track of total costs and divides by output for a period to get an average unit cost. Job Order versus Process Costing Use Job order costing for non-repetitive, high cost unique orders Use Process costing for large numbers of homogeneous products Which would home builder, tomato cannery, and automobile manufacturer use? Job Order Costing Keep payroll records according to jobs to know direct labor cost of each job Use material requisitions for all materials to know the direct material cost for each job Put all overhead (including indirect materials and indirect labor) into the overhead account and “apply” it to jobs Actual versus Normal Overhead The big problem in job order costing is relating overhead to production To solve this, overhead is applied to production on the basis of some activity driver Actual costing waits until the end of the period and then determines the actual overhead and the actual level of the driver. Normal costing estimates the level of the driver and overhead in advance and then applies it throughout the period. Problems with Actual Costing If done on shorter than an annual period - say monthly - overhead rates can vary greatly from month to month. If done annually, must wait until end of year to determine costs of all units during the year No estimates are available for bidding, which is how job order costers normally obtain jobs. Normal Costing Use a predetermined overhead rate so that products can be costed as the period goes along, not at the end Rate is developed by using the cost formula for overhead, estimating activity and developing a rate This is called NORMAL COSTING Developing Overhead Rate 1) 2) 3) 4) Determine overhead application basis Estimate activity level Estimate overhead costs at that level Divide estimated costs by activity to get rate Rate Example 1) 2) 3) 4) Activity driver is direct labor hours Estimated activity level is 25,000 hours Estimated costs at 25,000 hours is $250,000 Rate is 250,000/25,000 = $10/DLHr Applying Overhead 1) 2) 3) Multiply actual activity by predetermined overhead rate - this is applied overhead Compare to the actual overhead - if the applied is greater overhead is overapplied, if it is less it is under applied. Being overapplied is favorable. The amount of under or overapplied overhead is assigned to cost of goods sold or prorated between inventories Applied Overhead Example 1) 2) 3) Assume that actual hours worked were 26,000 and actual overhead was $257,000 Applied overhead would be 26,000 * $10 or $260,000 Overhead would be overapplied by $3,000 Why might this be the case? Causes of Under/overapplied Assume that overhead was $150,000 + $4/direct labor hours so that at a volume of 25,000 hours overhead was estimated to be $250,000 (150,000+(4*25,0000)) The rate of $10 consists of $6 fixed and $4 variable. When we work 26,000 hours, its like more people coming to the party in that we keep applying the overhead even though we shouldn’t still be incurring it. More analysis Overhead was overapplied by $3,000 (Actual overhead was $257,000 and applied was $260,000) Overhead for 26,000 hours should have been 150,000 + (4)(26,000) = 254,000 Thus we spent $3,000 more than we should have, but made up for it by working 1,000 extra hours and applying $6,000 in fixed overhead that we should not have incurred You Try it Driver is DL hours Overhead is expected to be $200,000 + $6/DLHr Expected hours are 40,000 Actual hours are 42,000 Actual overhead is $455,000 What are the: the overhead application rate, the amount of under/overapplied overhead, the amount of overhead expected for the volume achieved, the deviation from expected overhead the impact of missing the volume Overhead Application Rate The rate is: $200,000 +(6)(40,000) = $11/hour 40,000 Under/overapplied overhead Actual hours x predetermined rate 42,000 x $11 = $462,000 Actual overhead is $455,000 Overhead is overapplied by $7,000 The amount of overhead expected for the volume achieved The budget formula for overhead was OH = $200,000 + $6/DLHr Actual hours were 42,000 Budget for volume achieved was 200,000 + (42,000)(6) = $452,000 The deviation from expected overhead The overhead for the actual volume that we worked was $455,000 and the budget for that volume was $452,000 Thus, we spent $3,000 more than we should have The impact of missing the volume The expected volume was 40,000 and the actual volume was 42,000 direct labor hours The extra 2,000 hours times the $5/DLHr fixed overhead ($200,000/40,000) gives us $10,000 in extra applied overhead The overhead was $7,000 overapplied even though we spent $3,000 more than we should have because we worked more that enough extra hours to cover it Costing Individual Job Assume Job ANZ used $5,000 worth of material, 150 labor hours at $15/hour; what is the cost of this job? Direct material $5,000 Direct labor $2,250 Overhead (150*$10) $1,500 Total Cost $8,750 Just In Time Production Goal is to minimize inventories to allow quicker response to customer needs Requires more frequent smaller delivers tied to when the input is needed in production Allows simpler accounting procedures as there are fewer inventories Total Quality Management Continuous improvement Do it right the first time Listen to the needs of customers Empowering employees to make good products or provide good service