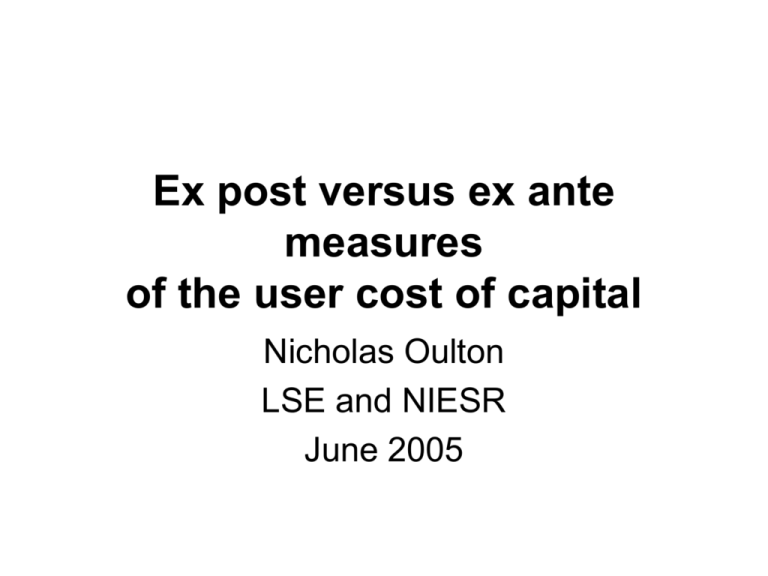

Ex post versus ex ante measures of the user cost of capital

advertisement

Ex post versus ex ante measures of the user cost of capital Nicholas Oulton LSE and NIESR June 2005 Roadmap • Issues: ex post or ex ante? • Theory: model of temporary equilibrium leads to hybrid method • How much difference does method make in practice? Illustration using UK industry data Two measures required for each industry : 1. Growth of capital services : Kˆ t 2. Contributi on of capital : Capital share times Kˆ t National accounting identity : GOSt i 1 qit K it m GOS : Gross operating surplus qit : User cost (Rental price) of ith type of capital K it : Capital services from ith capital stock Real user cost (rental price) of ith asset type : qit Tit rt i (1 it ) it ( pi ,t 1 / pYt ) it ( pit pi ,t 1 ) / pi ,t 1 Issues • For growth accounting, we want to measure actual (ex post) marginal products • The ex post measure automatically satisfies the national income identity BUT … • Firms make investment decisions based on the required (not the ex post) rate of return and anticipated (not actual) prices • In practice, the ex post measure may produce negative rental prices True versus common ex post measures • The “true” ex post measure is the right one for growth accounting • The estimated (“common”) ex post measure imposes the same rate of return on all assets. This is right only if expectations all turn out to be correct MODEL • Firms must look ahead one period. • Investments must be expected to pay the required rate of return. • Future asset prices, output price and level of demand not known with certainty. • Asset stocks must be chosen in advance, other inputs (eg labour) can be freely varied later MAIN RESULT If production function is CES, then ratio of expected marginal product to actual marginal product is the same for all assets. NB: (expected) marginal product = (expected) user cost HYBRID METHOD • Use ex ante user costs to construct index of capital services • To calculate contribution of capital, multiply index of capital services by ex post share of GOS in value of output How much difference does method make? Bank of England Industry Dataset: 31 industries in the market sector (exclude public sector) 7 assets: Non-ICT ICT Buildings Computers Plant & machinery Software Vehicles Communications Intangibles Depreciation: geometric (similar rates to BEA) Computer and software prices: US, adjusted for exchange rate changes Methods 1. Ex post (common): solve for rate of return; actual GOS 2. Ex ante (perfect foresight): required rate of return is average actual rate in market sector; actual prices; predicted GOS 3. Ex ante (AR): required rate of return is average actual rate in market sector; prices forecast by ARMA model; predicted GOS 4. Hybrid: as ex ante (AR), but actual GOS Capital services in the market sector, 1970 = 1.0 log scale 5 4 3 2 1 1970 1975 Ex post 1980 1985 Ex ante, p.f. 1990 Ex ante, AR 1995 2000 Hybrid CONCLUSIONS • Hybrid and ex post (common) methods produce similar results • Hybrid method eliminates negative rental prices (1.7% of rental prices were negative for ex post) • Hybrid method satisfies national income accounting identity • Hybrid methods uses exactly the same data as is required for ex post (common) method