Economics of non-renewable resources

Economics of abiotic resources

Non-renewables

• Fossil Fuels

• Minerals

• Land

The Hubbert curve-discovery

The Hubbert curve-production

The Hubbert curve (cont.)

• Production requires discovery

•

Peak discovery year was 1969

•

Operating at net deficit since 1980s

– Depends to some extent on how you measure reserves

Price trends of oil

Why aren’t oil prices increasing?

• Scarcity effect and information effect

• Traditional theory

• A dose of reality

Scarcity effect vs. information effect

•

Discovery is followed by production

•

Production increases scarcity

•

Discovery provides information, increases known reserves

•

Information can counterbalance use=depletion for a time

Marginal extraction costs

• Easiest to extract deposits extracted first , therefore should become increasingly expensive to extract. Why then do resources get cheaper?

– Are easiest to extract deposits discovered first?

– What has happened to the size of discoveries over time?

• Technology can reduce costs

• Energy costs of extraction increase, more limiting than financial costs.

•

What does this tell us about

Exhaustibility?

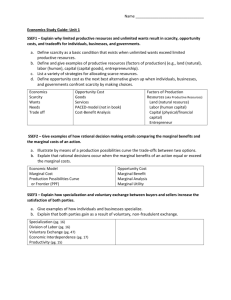

Efficient extractionStatic efficiency

•

Maximize profits in current time period

•

Increasing marginal extraction cost

What about scarcity?

Marginal extraction cost increases over time

Efficient extraction

Dynamic efficiency

• What happens when the resource starts to run out?

• Does it make sense to produce for zero profit in this time period?

•

Profit maximizing extraction in this time period while accounting for profits in future time periods

•

Maximization of Net Present Value

Intertemporal valuation and discounting

• What is discounting?

– Compounded interest in reverse.

– What would you rather have, $1000 now or $1000 in five years? Why?

– How economists value future benefits now

• Discount rate

– Many justifications for discounting, therefore many possible rates

• Discount factor: (1/(1+r)) t

Example yea r inco me DF w/

10% DR value of inco me

6

7

8

9

10

2

3

0

1

4

5

$100

$100

$100

$100

$100

$100

$100

$100

$100

$100

$100

1.00

$100.00

0.91

$90.91

0.83

$82.64

0.75

$75.13

0.68

$68.30

0.62

$62.09

0.56

$56.45

0.51

$51.32

0.47

$46.65

0.42

$42.41

0.39

$38.55

10% growth in

I

$38.55

$42.41

$46.65

$51.32

$56.45

$62.09

$68.30

$75.13

$82.64

$90.91

$100.00

How is discounting used?

Cost-Benefit Analysis: NPV=(B t

-C t

)/(1+r) t

Justifications for discounting

• opportunity cost

– Returns on investments

• Time preference for consumption

– Impatience

– Eat drink and be merry, for tomorrow we die

– Consumer sovereignty

– Theoretically equivalent to opportunity cost

User cost

• If oil supplies are finite, then if we extract and use oil now, that reduces the amount left to extract and sell in the future.

• Assumptions:

– Use = depletion = growing scarcity

– price reflects scarcity

– Prices are increasing over time

• If we extract the resource now, we lose the opportunity to extract it in the future, at which time it will have a higher price. The value of this lost opportunity for future profits is User Cost. It is a real cost of production.

• User Cost= opportunity cost of producing now instead of in the future

Marginal user cost

• Marginal User Cost = opportunity cost of producing one more barrel

• The more we extract now, the lower the price is in the current period (greater current supply=lower current price)

• The more we extract now, the less we have next year, and the higher next year’s price will be

(lower future supply= higher future price)

• This means that each additional unit of production has a higher user cost than than the previous unit, so MUC is increasing with total production.

MUC and production by firm

The individual producer takes prices as fixed, and produces until marginal benefit (price) = marginal private cost

Other definitions (meanings) of

Marginal user cost

• Marginal user cost = user cost from additional unit

• User cost is value of resource in the ground

– Resource has value because it is scarce. Remember diamond water paradox

• User cost is unearned economic profit

– No one created resource in ground, therefore profit unearned

• User cost = royalty (how much resource owner can charge producer)

How fast should MUC increase?

• $$ in future worth less than $$ in present

• NCE: In profit maximizing equilibrium,

MUC increases at same rate as discount rate

P t

= MEC t

+ MUC

0

(1+r) t

•Treat resource as an investment

•If MUC increases slower than interest rate in bank (discount rate), then extract resource now and invest profit in the bank

•If MUC increases faster than interest rate in bank, then leave the resource in the ground as a more profitable investment

Can we measure marginal user cost?

• Theoretically, MUC = price - extraction cost

• For this to be true, each individual producer would have to know how much of the resource exists.

• Price is intersection of supply and demand, but we do not know the supply.

Price in future determined by Supply and Demand: What is future demand?

• Substitutes reduce demand

– Technological progress

– Scarcity --> price increase --> innovation

– Backstop resource/technology.

– Justification for discounting

• Complements increase demand

– Are technology and natural resources substitutes or complements?

• Increasing size of economy or number of people increase demand

Why do Prices fail to increase in

Spite of Increasing Scarcity?

• Producers are ignorant of in ground supply

• Price determined by above-ground scarcity

• Money in the bank grows, resource prices do not

• If prices do not grow, there is no reason for producer to leave resource in ground.

• Producer should produce until increasing marginal extraction cost = price (i.e. static optimization)

Scarcity effect vs.

Information effect

• Scarcity effect: as we use up the resource, we have less

– Drives price up

• Information effect: the more we explore and extract, the more we learn

– We can find more

– It becomes cheaper to extract

– Drives price down

• As scarcity effect comes to dominate information effect, producer will reduce production, price will rise, and producer will reduce production even more.

Marginal External Costs

• Negative externalities

– Extraction

– Waste disposal

• Socially efficient price should include marginal external cost

Non-renewables and sustainability

• Binding constraints: source or sink?

•

Impact of non-renewable extraction and use

• Can non-renewables increase optimal scale?

•

Is the current population level dependent on non-renewables?

•

Solutions?

•

Invest MUC (rent) from non-renewables into renewable substitutes (and technology).

Discount rates revisited

• Opportunity cost

– Why does money in the bank grow?

• economic growth

– Ignoring environmental cost

– Treating natural resources as free good

– Discounting goods and services which can’t be invested

• Time preference for consumption

– Interpersonal comparisons

Ethical question of how much we have the right to consume

• Rights of future generations

• Technology and the ethics of resource depletion

• WHAT IS AN ALTERNATIVE?- maybe making sure that our use of exhaustible resources doesn’t leave future generations worse off, and not leaving future generations dependent on resources in imminent danger of exhaustion.

Land

• Supply curve for land

• Who creates the value in land?

• How can society capture the value it creates?