Dynamic Efficiency

advertisement

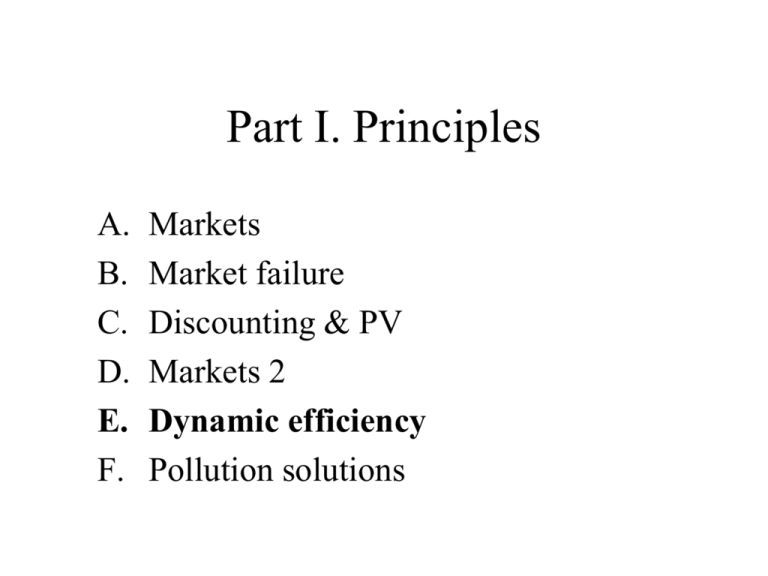

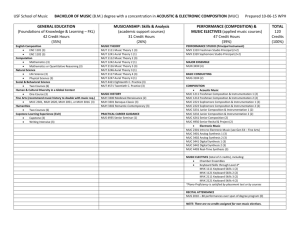

Part I. Principles A. B. C. D. E. F. Markets Market failure Discounting & PV Markets 2 Dynamic efficiency Pollution solutions E. Dynamic efficiency (End of chapter 2 & Appendix 2B) Dynamic Efficiency • A static analysis is only concerned with 1 time period. • If the optimal allocation of resources in 1 period depends on the optimizing decisions of the past or future periods, then a dynamic analysis must be employed. Dynamic Efficiency • Static example – a farmer has 100 acres of cropland and decides to plant one type of crop this year and a different crop next year, in response to changes in market forces. • Dynamic example – a farmer has 100 acres of forest. A choice to cut trees this year and plant corn means that in the next time period cannot decide to have trees again. Dynamic Efficiency & Exhaustible Resources • Since decisions made today can influence the quality and stock of resources far into the future, dynamic considerations important in the study of environmental and resource economics. • E.g., the decision of how much oil to take out the ground today effects our ability to take oil out of the ground in the future. • This will be based on how much people will be WTP for oil in the future. Dynamic Efficiency & Exhaustible Resources • Efficiency requires that you continue to sell oil today until MC = MB. • The way in which the future is represented in this decision is to incorporate an opportunity cost (also called user cost or scarcity rent) into the decision making process. • The discount/interest rate becomes important also. Intertemporal efficiency • The individual oil owner has two choices for producing income in the future: – Sell oil today and invest money and earn interest income. – Hold on to oil, sell in the future. • Intertemporal efficiency requires that the producer make a choice that will maximize the sum of the PV of the earnings potentially received in each period. Sell today? Or… • If current price perceived as low relative to future price – producers want to sell in future. • Present production withheld – drives up today’s price – and at same time – expected future price falls as realize too much oil being held for future use • Combination of rising present price + falling future price makes selling today more attractive. Sell tomorrow? • Now assume that oil producers believe that the future price will be too low, and they will be better off selling oil now. • Sales of oil now mean less oil available in the future (this will cause future oil prices to rise). • Sales of oil now will also depress current price of oil. • Combination of higher future prices and lower present prices will make holding oil for sale in the future more attractive. Sale today = sale tomorrow • As long as 1 option (selling in the present versus selling in the future) appears to be a more attractive option than the other, prices will adjust. • The process of price adjustment will continue until owners of oil are indifferent between the options of selling in the present and selling in the future. Opportunity cost • Since the present price is dependent on the future price, and the future price is dependent on the present price, there is an opportunity cost for using a barrel of oil at any particular point in time. • This opportunity cost is associated with NOT having the barrel of oil available in another time period. Price equation • The price of oil, at any particular time can be represented by the following equation: Pt = MUCt + MECt • Where – MUC refers to Marginal User Cost, and – MEC refers to Marginal Extraction Cost MUC and MEC • The most important thing to understand about this equation is that it is possible to predict the changes in the price of oil by predicting changes in the MEC and the MUC. • Especially MUC (opportunity cost) Gulf war & oil • August 1990 – Iraqi forces invade Kuwait – looked like they might control or destroy Saudi oil fields • Price of oil immediately rose 50% • Why? • MUC rose dramatically as the taking of Kuwait and threats to SA increased the opportunity cost of using oil at that point in time Gulf war & oil cont. • When US and the coalition began air attacks in 1991, became apparent Iraq could not damage Saudi oil fields or affect Persian Gulf exports in long run • People’s perceptions of the opportunity cost (MUC) of using a barrel of oil decreased, and price of oil decreased MUC and MEC • The existence of MUC means that price will always be different from MEC. Remember, MUC is a form of scarcity rent. • If no scarcity, MUC = 0 • If scarcity, MUC = PV of marginal net benefit in each time period • If MEC = 0 – Competitive firm MUC = price = MB – Monopoly MUC = MR = MB MUC • In order for an owner of oil to be indifferent as to the period in which he or she sells, the PV of the MUC must be the same in all periods. This means that MUC of an exhaustible resource will increase with the discount rate. Example: Dynamically efficient extraction of an exhaustible resource • • • • • 100 tons of coal 2 periods MEC = 0 Demand each period P = 500 – 0.5q How will 100 tons be allocated over 2 periods? 2 ways to analyze 1. Maximize PS: Owners of coal max PV income each period 2. Maximize Social Welfare (“benevolent social planner”): CS + PS Producer maximizes PV income each period • Revenue period 1 = (500 – 0.5 q1 ) q1 • Revenue period 2 = (500 – 0.5 q 2 ) q 2 • Since q1 + q 2 = 100 Revenue period 2 = [500 – 0.5(100 – q1)](100 – q1) • If discount rate is 5%, PV revenue period 2 is… Calculate PV FV PV t (1 r) PV period 2 [500 0.5(100 q1)](100 q1) 1.05 [476.2 0.4762(100 q1)](100 q1) How much oil should be used each period to max PS? PV = (500-0.5 q1) q1 + [476.2 0.4762(100 q1)](100 q1) To maximize PV, set dPV/d q1 = 0, solve for OR, use Microsoft Excel Solver! Solution: q1= 60.97, q 2= 39.02 p1= 469.5 p2= 480.5 q1 2 important points 1. Although MEC = 0, price in both periods is positive. The price is composed exclusively of user cost (the opportunity cost of NOT having the coal available in another period) 2. Price higher in 2nd period – reflects positive rate of time preference Previous analysis maxes PS only • What about social welfare maximization? • Social welfare max = CS + PS maximized • Social welfare max is where demand curves intersect, we consider both surpluses • Can also be solved using MS Excel Solver Graphical analysis of SW max 500 Demand 1 476.2 Demand 2 ←q2 73 26 q1→ Interpretation • Demand 1 is demand curve period 1 • Demand 2 is PV of demand period 2 • PV social welfare maximized where 2 curves intersect ( q1 = 73.17 and q 2 = 26.83) • To left of intersection, can ↑ PV by allocating more coal to period 1 since price WTP period 1 > PV price in period 2 • To right, ↑ PV by allocating more coal to period 2 Other Examples of Dynamic Problems • Stock pollutants that accumulate in the environment. – Today’s decision to generate a stock pollutant (radioactive waste, lead) has an effect on environmental quality far into the future. • Changes in land use patterns can change environmental resources that can never be restored. – Over-grazing of grasslands, clear-cutting of tropical forests

![[#OF-921] MUC Group ACLs are not updated when users join a group](http://s3.studylib.net/store/data/008619926_1-dc47889bb80d7c334b3d8444733236f8-300x300.png)