Connecting Income Statements to Balance Sheets Balance sheets

advertisement

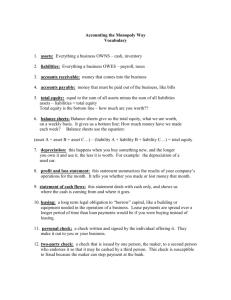

Making Informed Judgments Part 7 Income Measures Navigating Accounting, G. Peter & Carolyn R. Wilson, © NavAcc LLC, 1991-2009. Modified by [Your Name]. 1 Menu Income definition Connecting income statements to balance sheets Intel Evolution of balance sheet Dissecting changes in owners’ equity Connecting owners’ equity changes to income statement Navigating statement of owners’ equity Exercises Perez 1 Perez 2 True- False Income measurement Closing thoughts 2 Income Definition Things You Need to Know Income measures performance during a reporting period (such as a month or year). Income is the increase in owners’ equity during the period, excluding the effects of transactions with owners, accounting policy changes, and restatements. You have an income statement, and measurement aside, your income during a period is based on the increase in your owners’ equity during the period, excluding gifts. Thus, income is based on the increase in your net worth or equivalently, your net assets (assets – liabilities). Return to menu 3 Income Definition Questions Measurement aside, what events or circumstances will likely have the biggest impact on a representative student’s income for the reporting period that starts today and ends with this course? What events and circumstances will likely have the biggest impact on the student’s assets, without having an offsetting affect on his or her liabilities? What events and circumstances will likely have the biggest impact on the student’s liabilities, without having an offsetting affect on his or her assets? What actions can the student take to increase his or her income over this period? Return to menu 4 Income Definition Take Aways Income is the increase in owners’ equity during a reporting period, excluding the effects of transactions with owners, accounting policy changes, and restatements. The definition of income depends on the definition of owners’ equity, which depends on the definitions of assets and liabilities. Income statements and balance sheets are connected. Return to menu 5 Income Definition Take Aways Measurement aside, the best way students can generate income is to increase the financial value of their human capital (earnings power) by studying and learning as much as possible. Students’ income is mostly captured by the increase in earnings power during the period plus compensation earned from part-time jobs less operating costs associated with housing, food, entertainment, tuition, telecommunications, and transportation. Return to menu 6 Connecting Income Statements to Balance Sheets Evolution of Intel’s Balance Sheet Return to menu 7 Connecting Income Statements to Balance Sheets Things You Need to Know INTEL CORPORATION CONSOLIDATED BALANCE SHEETS December 27, 2008 and December 29, 2007 2008 (In Millions--Except Par Value) Assets Current assets: Cash and cash equivalents $ Short-term investments Trading assets Accounts receivable, net of allow ance for doubtful accounts of $17 ($27 in 2007) Inventories Deferred tax assets Other current assets Total current assets Property, plant and equipment, net Marketable equity securities Other long-term investments Goodwill Other long-term assets Total assets $ Liabilities and stockholders' equity Current liabilities: Short-term debt $ Accounts payable Accrued compensation and benefits Accrued advertising Deferred income on shipments to distributors Other accrued liabilities Total current liabilities Long-term income taxes payable Deferred tax liabilities Long-term debt Other long-term liabilities Commitments and contingencies (Notes 18 and 24) Stockholders' equity: Preferred stock, $0.001 par value, 50 shares authorized; none issued Common stock, $0.001 par value, 10,000 shares authorized; 5,562 issued and outstanding (5,818 in 2007) and capital in excess of par value Accumulated other comprehensive income (loss) Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $ 2007 3,350 5,331 3,162 1,712 3,744 1,390 1,182 19,871 17,544 352 2,924 3,932 6,092 50,715 $ 102 2,390 2,015 807 463 2,041 7,818 736 46 1,886 1,141 $ $ 7,307 5,490 2,566 2,576 3,370 1,186 1,390 23,885 16,918 987 4,398 3,916 5,547 55,651 142 2,361 2,417 749 625 2,277 8,571 785 411 1,980 1,142 - - 12,944 (393) 26,537 39,088 50,715 11,653 261 30,848 42,762 55,651 $ Intel's 2008 Form 10-K, page 57. www.sec.gov See accompanying notes in the 10-K. Return to menu 8 Connecting Income Statements to Balance Sheets Things You Need to Know Return to menu 9 Connecting Income Statements to Balance Sheets Things You Need to Know Return to menu 10 Connecting Income Statements to Balance Sheets Dissecting Changes in Intel’s Owners’ Equity Return to menu 11 Connecting Income Statements to Balance Sheets Things You Need to Know Return to menu 12 Connecting Income Statements to Balance Sheets Things You Need to Know Return to menu 13 Connecting Income Statements to Balance Sheets Things You Need to Know Return to menu 14 Connecting Income Statements to Balance Sheets Things You Need to Know INTEL CORPORATION CONSOLIDATED BALANCE SHEETS December 27, 2008 and December 29, 2007 2008 (In Millions--Except Par Value) Assets Current assets: Cash and cash equivalents $ Short-term investments Trading assets Accounts receivable, net of allow ance for doubtful accounts of $17 ($27 in 2007) Inventories Deferred tax assets Other current assets Total current assets Property, plant and equipment, net Marketable equity securities Other long-term investments Goodwill Other long-term assets Total assets $ Liabilities and stockholders' equity Current liabilities: Short-term debt $ Accounts payable Accrued compensation and benefits Accrued advertising Deferred income on shipments to distributors Other accrued liabilities Total current liabilities Long-term income taxes payable Deferred tax liabilities Long-term debt Other long-term liabilities Commitments and contingencies (Notes 18 and 24) Stockholders' equity: Preferred stock, $0.001 par value, 50 shares authorized; none issued Common stock, $0.001 par value, 10,000 shares authorized; 5,562 issued and outstanding (5,818 in 2007) and capital in excess of par value Accumulated other comprehensive income (loss) Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $ 2007 3,350 5,331 3,162 1,712 3,744 1,390 1,182 19,871 17,544 352 2,924 3,932 6,092 50,715 $ 102 2,390 2,015 807 463 2,041 7,818 736 46 1,886 1,141 $ $ 7,307 5,490 2,566 2,576 3,370 1,186 1,390 23,885 16,918 987 4,398 3,916 5,547 55,651 142 2,361 2,417 749 625 2,277 8,571 785 411 1,980 1,142 - - 12,944 (393) 26,537 39,088 50,715 11,653 261 30,848 42,762 55,651 $ Intel's 2008 Form 10-K, page 57. www.sec.gov See accompanying notes in the 10-K. Return to menu 15 Connecting Income Statements to Balance Sheets Things You Need to Know Return to menu 16 Connecting Income Statements to Balance Sheets Things You Need to Know Return to menu 17 Connecting Income Statements to Balance Sheets Connecting Intel’s Owners’ Equity Changes to the Income Statement Return to menu 18 Connecting Income Statements to Balance Sheets Things You Need to Know INTEL CORPORATION CONSOLIDATED STATEMENTS OF INCOME Three Years Ended December 27, 2008 (In Millions--Except Per Share Amounts) Net revenue Cost of sales Gross margin Research and development Marketing, general and administrative Restructuring and asset impairment charges Operating expenses Operating income Gains (losses) on equity method investments, net Gains (losses) on other equity investments, net Interest and other, net Income before taxes Provision for taxes Net income Basic earnings per common share Diluted earnings per common share Weighted average shares outstanding Basic Diluted 2008 37,586 16,742 20,844 5,722 5,458 710 11,890 8,954 (1,380) (376) 488 7,686 2,394 $ 5,292 $ $0.93 $0.92 $5,663.00 $5,748.00 Intel's 2008 Form 10-K, page 56. www.sec.gov See accompanying notes in the 10-K. Return to menu 19 Connecting Income Statements to Balance Sheets Navigating Intel’s Statement of Owners’ Equity Return to menu 20 Connecting Income Statements to Balance Sheets Things You Need to Know INTEL CORPORATION CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY Three Years Ended December 27, 2008 (In Millions--Except Per Share Amounts) Balance as of December 31, 2005 Components of comprehensive income, net of tax: Net income Other comprehensive income Total comprehensive income Adjustment for initially applying SFAS No. 158, net of tax 1 Proceeds from sales of shares through employee equity incentive plans, net excess tax benefit, and other Share-based compensation Repurchase and retirement of common stock Cash dividends declared ($0.40 per share) Common Stock and Capital in Excess of Par Value Number of Shares Amount 5,919 $ 6,245 INTEL CORPORATION CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY Accumulated Other Comprehensive Income (Loss) $ 127 Retained Earnings $ 29,810 $ Total 36,182 Three Years Ended December 27, 2008 - - 26 5,044 - - - (210) - 5,044 26 5,070 (210) - (3,550) (2,320) 1,248 1,375 (4,593) (2,320) (57) 28,984 36,752 73 (226) - 1,248 1,375 (1,043) - Balance as of December 30, 2006 Cumulative-effect adjustments, net of tax 1: Adoption of EITF 06-02 Adoption of FIN 48 Components of comprehensive income, net of tax: Net income Other comprehensive income Total comprehensive income Proceeds from sales of shares through employee equity incentive plans, net excess tax benefit, and other Share-based compensation Repurchase and retirement of common stock Cash dividends declared ($0.45 per share) 5,766 7,825 - - - - - 318 Balance as of December 29, 2007 Components of comprehensive income, net of tax: Net income Other comprehensive income Total comprehensive income Proceeds from sales of shares through employee equity incentive plans, net excess tax benefit, and other Share-based compensation Repurchase and retirement of common stock Cash dividends declared ($0.5475 per share) 5,818 - Balance as of December 27, 2008 5,562 165 (113) - (181) 181 (181) 181 6,976 - 6,976 318 7,294 - (2,494) (2,618) 3,170 952 (2,788) (2,618) 11,653 261 30,848 42,762 - (654) 5,292 - 3,170 952 (294) - (In Millions--Except Per Share Amounts) Balance as of December 29, 2007 Components of comprehensive income, net of tax: Net income Other comprehensive income Total comprehensive income Proceeds from sales of shares through employee equity incentive plans, net excess tax benefit, and other Share-based compensation Repurchase and retirement of common stock Cash dividends declared ($0.5475 per share) Balance as of December 27, 2008 1 1 72 (328) - 1,132 851 (692) $ 12,944 $ (393) 5,292 (654) 4,638 (6,503) (3,100) $ 26,537 Common Stock and Capital in Excess of Par Value Number of Shares Amount 5,818 11,653 - - 72 (328) 5,562 Accumulated Other Comprehensive Income (Loss) 261 (654) 1,132 851 (692) $ 12,944 Retained Earnings 30,848 $ (393) $ Total 42,762 5,292 - 5,292 (654) 4,638 (6,503) (3,100) 1,132 851 (7,195) (3,100) 26,537 $ 39,088 For further discussion of the adjustments recorded at the beginning of fiscal years 2006 and 2007, see "Accounting Changes" in "Note 2: Accounting Policies." Intel's 2008 Form 10-K, page 59. www.sec.gov See accompanying notes in the 10-K. 1,132 851 (7,195) (3,100) $ 39,088 For further discussion of the adjustments recorded at the beginning of fiscal years 2006 and 2007, see "Accounting Changes" in "Note 2: Accounting Policies." Intel's 2008 Form 10-K, page 59. www.sec.gov See accompanying notes in the 10-K. Return to menu 21 Connecting Income Statements to Balance Sheets Things You Need to Know INTEL CORPORATION CONSOLIDATED BALANCE SHEETS INTEL CORPORATION CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY December 27, 2008 and December 29, 2007 2008 (In Millions--Except Par Value) Assets Current assets: Cash and cash equivalents $ Short-term investments Trading assets Accounts receivable, net of allow ance for doubtful accounts of $17 ($27 in 2007) Inventories Deferred tax assets Other current assets Total current assets Property, plant and equipment, net Marketable equity securities Other long-term investments Goodwill Other long-term assets Total assets $ Liabilities and stockholders' equity Current liabilities: Short-term debt $ Accounts payable Accrued compensation and benefits Accrued advertising Deferred income on shipments to distributors Other accrued liabilities Total current liabilities Long-term income taxes payable Deferred tax liabilities Long-term debt Other long-term liabilities Commitments and contingencies (Notes 18 and 24) Stockholders' equity: Preferred stock, $0.001 par value, 50 shares authorized; none issued Common stock, $0.001 par value, 10,000 shares authorized; 5,562 issued and outstanding (5,818 in 2007) and capital in excess of par value Accumulated other comprehensive income (loss) Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $ 2007 3,350 5,331 3,162 1,712 3,744 1,390 1,182 19,871 17,544 352 2,924 3,932 6,092 50,715 $ 102 2,390 2,015 807 463 2,041 7,818 736 46 1,886 1,141 $ $ 7,307 5,490 2,566 2,576 3,370 1,186 1,390 23,885 16,918 987 4,398 3,916 5,547 55,651 142 2,361 2,417 749 625 2,277 8,571 785 411 1,980 1,142 - - 12,944 (393) 26,537 39,088 50,715 11,653 261 30,848 42,762 55,651 $ Three Years Ended December 27, 2008 (In Millions--Except Per Share Amounts) Balance as of December 29, 2007 Components of comprehensive income, net of tax: Net income Other comprehensive income Total comprehensive income Proceeds from sales of shares through employee equity incentive plans, net excess tax benefit, and other Share-based compensation Repurchase and retirement of common stock Cash dividends declared ($0.5475 per share) Balance as of December 27, 2008 1 Common Stock and Capital in Excess of Par Value Number of Shares Amount 5,818 11,653 - - 72 (328) 5,562 Accumulated Other Comprehensive Income (Loss) 261 (654) 1,132 851 (692) $ 12,944 Retained Earnings 30,848 $ (393) $ Total 42,762 5,292 - 5,292 (654) 4,638 (6,503) (3,100) 1,132 851 (7,195) (3,100) 26,537 $ 39,088 For further discussion of the adjustments recorded at the beginning of fiscal years 2006 and 2007, see "Accounting Changes" in "Note 2: Accounting Policies." Intel's 2008 Form 10-K, page 59. www.sec.gov See accompanying notes in the 10-K. Intel's 2008 Form 10-K, page 57. www.sec.gov See accompanying notes in the 10-K. Return to menu 22 Connecting Income Statements to Balance Sheets Things You Need to Know INTEL CORPORATION CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY Three Years Ended December 27, 2008 (In Millions--Except Per Share Amounts) Balance as of December 29, 2007 Components of comprehensive income, net of tax: Net income Other comprehensive income Total comprehensive income Proceeds from sales of shares through employee equity incentive plans, net excess tax benefit, and other Share-based compensation Repurchase and retirement of common stock Cash dividends declared ($0.5475 per share) Balance as of December 27, 2008 1 Common Stock and Capital in Excess of Par Value Number of Shares Amount 5,818 11,653 - - 72 (328) 5,562 Accumulated Other Comprehensive Income (Loss) 261 (654) 1,132 851 (692) $ 12,944 Retained Earnings 30,848 $ (393) $ Total 42,762 5,292 - 5,292 (654) 4,638 (6,503) (3,100) 1,132 851 (7,195) (3,100) 26,537 $ 39,088 For further discussion of the adjustments recorded at the beginning of fiscal years 2006 and 2007, see "Accounting Changes" in "Note 2: Accounting Policies." Intel's 2008 Form 10-K, page 59. www.sec.gov See accompanying notes in the 10-K. Return to menu 23 Connecting Income Statements to Balance Sheets Exercises Perez 1 Return to menu 24 Question 25 Return to menu Connecting Income Statements to Balance Sheets Perez 1(a) Solution 26 Return to menu Connecting Income Statements to Balance Sheets Perez 1(a) Question 27 Return to menu Connecting Income Statements to Balance Sheets Perez 1(b) Solution 28 Return to menu Connecting Income Statements to Balance Sheets Perez 1(b) Question 29 Return to menu Connecting Income Statements to Balance Sheets Perez 1(c) Solution 30 Return to menu Connecting Income Statements to Balance Sheets Perez 1(c) Connecting Income Statements to Balance Sheets Exercises Perez 2 Return to menu 31 Question 32 Return to menu Connecting Income Statements to Balance Sheets Perez 2(a) Solution 33 Return to menu Connecting Income Statements to Balance Sheets Perez 2(a) Question 34 Return to menu Connecting Income Statements to Balance Sheets Perez 2(b) Solution 35 Return to menu Connecting Income Statements to Balance Sheets Perez 2(b) Question 36 Return to menu Connecting Income Statements to Balance Sheets Perez 2(c) Solution 37 Return to menu Connecting Income Statements to Balance Sheets Perez 2(c) Connecting Income Statements to Balance Sheets Exercises True-False Return to menu 38 Connecting Income Statements to Balance Sheets Questions 1. True or False: Net income for a reporting period is the increase in owners’ equity during the period, excluding the effects of transactions with owners, changes in accounting policies, and restatements. 2. True or False: For revenue to be recognized, net assets must increase. 3. True or False: For expenses to be recognized, net assets must decrease. 4. True or False: The statement of owners’ equity explains how comprehensive income effects balance sheets. Return to menu 39 Connecting Income Statements to Balance Sheets Answers 1. True or False: Net income for a reporting period is the increase in owners’ equity during the period, excluding the effects of transactions with owners, changes in accounting policies, and restatements. This is the definition for comprehensive income. 2. True or False: For revenue to be recognized, net assets must increase. 3. True or False: For expenses to be recognized, net assets must decrease. 4. True or False: The statement of owners’ equity explains how comprehensive income effects balance sheets. Return to menu 40 Connecting Income Statements to Balance Sheets Take Aways Balance sheets, income, statements, and statements of owners’ equity are tightly connected. The statement of owners’ equity helps outsiders distinguish changes in owners’ equity associated with: Transactions with owners Distributions to shareholders: dividends or share repurchases Contributions from shareholders: stock issuances including stock based compensation Comprehensive income Net income Other comprehensive income Accounting policy changes and restatements Return to menu 41 Income Measurement Things You Need to Know At the end of this course, a thousand objective measurement experts will measure the income earned by a representative student for the period that starts today and ends with the course. The representative student’s income is expected to be similar to that earned by you and your classmates over this reporting period. The experts will interview your group to acquire information needed to complete this task. Return to menu 42 Income Measurement Questions What questions will the experts need to ask the representative student to measure this income? How reliable is this measure: to what extent would experts agree on the measurement? How does the reliability of income measures relate to the reliability of balance sheet measures? Return to menu 43 Income Measurement Take Aways To determine income measures for a period, you need to first determine the changes in asset and liability measures during the period. Thus, income measures depend on asset and liability measures. The dispersion of experts’ estimates of the value of income for a period depends on the entity’s assets and obligations and how changes in experts’ estimates over the period are dispersed. Return to menu 44 Closing Thoughts Balance sheets report the net effects of all entries recorded from the time the entity was founded until the reporting date. Balance sheets are useful: Help insiders and outsiders assess companies’ financial health at reporting dates, meaning their ability to: Meet obligations Support operations Weather economic downturns Finance growth Balance sheets are imperfect: Some assets and liabilities are not recognized. Others are measured with varying degrees of reliability. Return to menu 45 Closing Thoughts Income statements measure performance over reporting periods. Income statements are useful: Help insiders and outsiders assess past performance and predict future performance. Can significantly affect insiders’ compensation. Can significantly affect outsiders’ investment decisions. Income statements are imperfect: Some revenues, expenses, gains, and losses are not recognized. Others are measured with varying degrees of reliability. Return to menu 46