Financial leverage - A Cup of Chocolate

advertisement

Chapter 14 - Raising Capital

in the Financial Markets

Chapter 15 – Analysis and

Impact of Leverage

IIS

1

Tujuan Pembelajaran 1

Mahasiswa Mampu untuk:

Memahami sumber dana internal dan eksternal

Memahami bauran pembiayaan yang cenderung

digunakan perusahaan

Menjelaskan mengapa pasar keuangan timbul

Menjelaskan komponen sistem pasar keuangan

Memahami peran bankir investasi dalam perolehan

modal

Membedakan antara penawaran terbatas dan penawaran

umum

IIS

2

Pokok Bahasan 1

Sumber dana internal dan eksternal

Bauran sekuritas perusahaan yang dijual di

pasar modal

Mengapa pasar keuangan muncul

Pembiayaan perusahaan

Komponen sistem pasar keuangan

Bankir investasi

Penawaran terbatas dan Penawaran umum

IIS

3

Tujuan Pembelajaran 2

Mahasiswa mampu untuk:

Memahami perbedaan antara risiko keuangan dan

risiko bisnis

Menggunakan teknik analisis titik impas untuk berbagai

jenis analisis

Membedakan konsep keuangan dari leverage operasi,

leverage keuangan, dan leverage gabungan

Menghitung degree of operating leverage, financial

leverage, dan combined leverage

IIS

4

Pokok Bahasan 2

Risiko bisnis dan keuangan

Analisis titik impas

Operating leverage

Financial leverage

Kombinasi operating leverage dan financial

leverage

IIS

5

Q: What are SECURITIES?

A: Financial Assets that

Investors purchase hoping to

earn a high rate of return.

IIS

6

Types of Securities

Treasury Bills and Treasury Bonds

Municipal Bonds

Corporate Bonds

Preferred Stocks

Common Stocks

Which of these are RISKY?

Which promise HIGH RETURNS?

Is there a relationship between RISK

and RETURN?

IIS

7

Corporate Financing

Sources

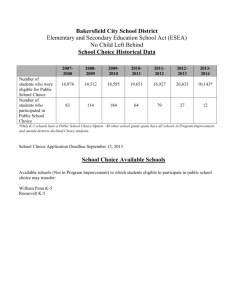

From 1999 through 2001, capital has been

raised through the following sources:

Corporate Bonds and Notes 76.9%

Equities

23.1%

IIS

8

Movement of Savings

Direct Transfer of Funds

cash

firm

saver

IIS

securities

9

Movement of Savings

Indirect Transfer using Investment Banker

funds

funds

saver

investment

banker

securities

IIS

firm

securities

10

Movement of Savings

Indirect Transfer using a Financial Intermediary

funds

saver

funds

financial

intermediary

intermediary

securities

IIS

firm

firm

securities

11

Financial Market Components

Public Offering

Firm issues securities, which are

made available to both individual

and institutional investors.

Private Placement

Securities are offered and sold to a

limited number of investors.

IIS

12

Financial Market Components

Primary Market

Market in which new issues of a

security are sold to initial buyers.

Secondary Market

Market in which previously issued

securities are traded.

IIS

13

Financial Market Components

Money Market

Market for short-term debt

instruments (maturity periods of

one year or less).

Capital Market

Market for long-term securities

(maturity greater than one year).

IIS

14

Financial Market Components

Organized Exchanges

Buyers and sellers meet in one central

location to conduct trades.

Over-the-Counter (OTC)

IIS

Securities dealers operate at many

different locations across the country.

Connected by Nasdaq system (National

Association of Securities Dealers

Automated Quotation system).

15

Investment Banking

How do investment bankers help

firms issue securities?

Underwriting the issue.

Distributing the issue.

Advising the firm.

IIS

16

Distribution Methods

IIS

Negotiated Purchase

Issuing firm selects an investment

banker to underwrite the issue.

The firm and the investment banker

negotiate the terms of the offer.

Competitive Bid

Several investment bankers bid for the

right to underwrite the firm’s issue.

The firm selects the banker offering

the highest price.

17

Distribution Methods

Best Efforts

Issue is not underwritten.

Investment bank attempts to sell the

issue for a commission.

Privileged Subscription

Investment banker helps market the

new issue to a select group of investors.

Usually targeted to current

stockholders, employees, or customers.

IIS

18

Distribution Methods

Direct Sale

Issuing firm sells the securities directly

to the investing public.

No investment banker is involved.

IIS

19

Stock Issue Example:

Our firm needs to raise approximately

$100 million for expansion. Our stock

price is $20. We Select Merrill Lynch to

underwrite the issue for a 2%

underwriting spread.

What type of issue is this?

It’s a negotiated purchase.

IIS

20

Stock Issue Example:

Our firm needs to raise approximately

$100 million for expansion. Our stock

price is $20. We Select Merrill Lynch to

underwrite the issue for a 2%

underwriting spread.

How many shares will be sold?

$100,000,000 / $20 = 5 million new

shares of common stock.

IIS

21

Stock Issue Example:

Our firm needs to raise approximately

$100 million for expansion. Our stock

price is $20. We Select Merrill Lynch to

underwrite the issue for a 2%

underwriting spread.

IIS

What are the flotation costs?

Underwriting spread: 2% of $100

million = $2 million.

Issuing costs: printing and engraving

costs; legal, accounting, and trustee fees.

22

Stock Issue Example:

Our firm needs to raise approximately

$100 million for expansion. Our stock

price is $20. We Select Merrill Lynch to

underwrite the issue for a 2%

underwriting spread.

IIS

What are the risks?

The investment bank accepts the risk of

being able to sell the new stock issue for

$20 per share. If the stock price falls, the

investment bank could lose money.

23

Regulations:

The Primary Market

The Securities Act of 1933

Firms register with the Securities

Exchange Commission (SEC).

SEC has 20 days to review.

SEC may ask for more information.

The firm cannot solicit buyers during

the review period but can advertise.

IIS

24

Regulations:

The Secondary Market

The Securities Exchange Act of 1934

Established the SEC.

Exchanges must register with SEC.

Company information must be

available to the public.

Insider trading is regulated.

IIS

25

Regulations:

Recent Developments

Securities Acts Amendments of 1975

Created National Market System.

Eliminated fixed brokerage

commissions.

SEC Rule 415

Allows Shelf Registration

IIS

26

Chapter 15 – Analysis and

Impact of Leverage

Operating Leverage

Financial Leverage

IIS

27

What is Leverage?

IIS

28

What is Leverage?

IIS

29

Two concepts that enhance

our understanding of risk...

1) Operating Leverage - affects a

firm’s business risk.

2) Financial Leverage - affects a

firm’s financial risk.

IIS

30

Business Risk

The variability or uncertainty of a

firm’s operating income (EBIT).

IIS

31

Business Risk

The variability or uncertainty of a

firm’s operating income (EBIT).

EBIT

IIS

FIRM

EPS

Stockholders

32

Business Risk

Affected by:

Sales volume variability

Competition

Product diversification

Operating leverage

Growth prospects

Size

IIS

33

Operating Leverage

The use of fixed operating costs as

opposed to variable operating

costs.

A firm with relatively high fixed

operating costs will experience

more variable operating income if

sales change.

IIS

34

EBIT

Operating

Leverage

IIS

35

Financial Risk

The variability or uncertainty of

a firm’s earnings per share (EPS)

and the increased probability of

insolvency that arises when a

firm uses financial leverage.

IIS

36

Financial Risk

The variability or uncertainty of

a firm’s earnings per share (EPS)

and the increased probability of

insolvency that arises when a

firm uses financial leverage.

EBIT

IIS

FIRM

EPS

Stockholders

37

Financial Leverage

The use of fixed-cost sources of

financing (debt, preferred stock)

rather than variable-cost sources

(common stock).

IIS

38

EPS

Financial

Leverage

IIS

39

Breakeven Analysis

Illustrates the effects of operating

leverage.

Useful for forecasting the

profitability of a firm, division, or

product line.

Useful for analyzing the impact of

changes in fixed costs, variable

costs, and sales price.

IIS

40

Total Revenue

$

Quantity

IIS

41

Costs

Suppose the firm has both fixed

operating costs (administrative

salaries, insurance, rent, property

tax) and variable operating costs

(materials, labor, energy,

packaging, sales commissions).

IIS

42

Total Revenue

Total Cost

$

+

} EBIT

FC {

Q1

IIS

Quantity

43

Total Revenue

Total Cost

$

+

} EBIT

FC {

Break-even

point

IIS

Q1

Quantity

44

Operating Leverage

What happens if the firm

increases its fixed operating

costs and reduces (or

eliminates) its variable costs?

IIS

45

Total Revenue

$

+

{

FC

Total Cost

= Fixed

-

Break-even

point

IIS

}

EBIT

Q1

Quantity

46

With high operating leverage,

an increase in sales

produces a relatively larger

increase in operating

income.

IIS

47

Total Revenue

$

+

{

FC

IIS

}

EBIT

Total Cost

= Fixed

Breakeven

point

Q1

Quantity

48

Total

Revenue

Trade-off:

the firm has

a higher breakeven

EBIT

point. If sales

are not

+

high enough, the firm

will not meet

its fixed

Total

Cost

expenses!

= Fixed

$

{

FC

IIS

}

Breakeven

point

Q1

Quantity

49

Breakeven Calculations

Breakeven point (units of output)

QB =

F

P-V

QB = breakeven level of Q.

F = total anticipated fixed costs.

P = sales price per unit.

V = variable cost per unit.

IIS

50

Breakeven Calculations

Breakeven point (sales dollars)

S* =

F

VC

1S

S* = breakeven level of sales.

F = total anticipated fixed costs.

S = total sales.

VC = total variable costs.

IIS

51

Analytical Income Statement

IIS

sales

variable costs

fixed costs

operating income

interest

EBT

taxes

net income

52

Degree of Operating

Leverage (DOL)

Operating leverage: by using fixed

operating costs, a small change in

sales revenue is magnified into a

larger change in operating income.

This “multiplier effect” is called

the degree of operating leverage.

IIS

53

Degree of Operating Leverage

from Sales Level (S)

DOLs =

=

IIS

% change in EBIT

% change in sales

change in EBIT

EBIT

change in sales

sales

54

Degree of Operating Leverage

from Sales Level (S)

If we have the data, we can use this formula:

Sales - Variable Costs

DOLs =

EBIT

=

IIS

Q(P - V)

Q(P - V) - F

55

What does this tell us?

If DOL = 2, then a 1% increase in

sales will result in a 2% increase in

operating income (EBIT).

Sales

IIS

EBIT

EPS

Stockholders

56

Degree of Financial

Leverage (DFL)

Financial leverage: by using fixed

cost financing, a small change in

operating income is magnified into

a larger change in earnings per

share.

This “multiplier effect” is called

the degree of financial leverage.

IIS

57

Degree of Financial Leverage

% change in EPS

% change in EBIT

DFL =

=

IIS

change in EPS

EPS

change in EBIT

EBIT

58

Degree of Financial Leverage

If we have the data, we can use this

formula:

EBIT

DFL =

EBIT - I

IIS

59

What does this tell us?

If DFL = 3, then a 1% increase in

operating income will result in a 3%

increase in earnings per share.

Sales

IIS

EBIT

EPS

Stockholders

60

Degree of Combined

Leverage (DCL)

Combined leverage: by using operating

leverage and financial leverage, a small

change in sales is magnified into a larger

change in earnings per share.

This “multiplier effect” is called the

degree of combined leverage.

IIS

61

Degree of Combined Leverage

DCL = DOL x DFL

% change in EPS

=

% change in Sales

=

IIS

change in EPS

EPS

change in Sales

Sales

62

Degree of Combined Leverage

If we have the data, we can use this

formula:

DCL =

=

IIS

Sales - Variable Costs

EBIT - I

Q(P - V)

Q(P - V) - F - I

63

What does this tell us?

If DCL = 4, then a 1% increase in

sales will result in a 4% increase in

earnings per share.

IIS

64

What does this tell us?

If DCL = 4, then a 1% increase in

sales will result in a 4% increase in

earnings per share.

Sales

IIS

EBIT

EPS

Stockholders

65

In-class Project:

Based on the following information on

Levered Company, answer these

questions:

1) If sales increase by 10%, what should

happen to operating income?

2) If operating income increases by 10%,

what should happen to EPS?

3) If sales increase by 10%, what should be

the effect on EPS?

IIS

66

Levered Company

Sales (100,000 units)

Variable Costs

Fixed Costs

Interest paid

Tax rate

Common shares outstanding

IIS

$1,400,000

$800,000

$250,000

$125,000

34%

100,000

67

Levered Company

Sales

Operating

Income

Operating

leverage

IIS

EPS

Financial

leverage

68

Degree of Operating Leverage

from Sales Level (S)

Sales - Variable Costs

DOLs =

EBIT

=

1,400,000 - 800,000

350,000

= 1.714

IIS

69

Levered Company

17.14%

10%

Sales

Operating

Income

EPS

Operating

leverage

IIS

70

Degree of Financial Leverage

EBIT

DFL =

EBIT - I

=

350,000

225,000

= 1.556

IIS

71

Levered Company

15.56%

10%

Sales

Operating

Income

EPS

Financial

leverage

IIS

72

Degree of Combined Leverage

DCL =

=

Sales - Variable Costs

EBIT - I

1,400,000 - 800,000

225,000

= 2.667

IIS

73

Levered Company

26.67%

10%

Sales

Operating

Income

Operating

leverage

IIS

EPS

Financial

leverage

74

Levered Company

10% increase in sales

IIS

Sales (110,000 units)

Variable Costs

Fixed Costs

EBIT

Interest

EBT

Taxes (34%)

Net Income

EPS

1,540,000

(880,000)

(250,000)

410,000 ( +17.14%)

(125,000)

285,000

(96,900)

188,100

$1.881 ( +26.67%)75

Penutup

Tugas

IIS

76