Investment Appraisal Methods - Secondary Social Science Wikispace

advertisement

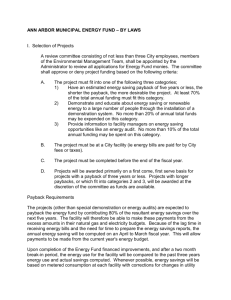

Investment Appraisal Methods L3 Business Studies Investment Buying the equipment needed to make or sell a product/service. IS Buying productive assets IS NOT Buying shares, saving in the bank or buying gold Investment Appraisal Deciding on the best investment choice from a possible range. involves CHOI CE What truck? Investment Appraisal Learning Objectives 3 methods: Payback Period Accounting Rate of Return Net Present Value Investment is? Discuss with your partner and make your choice. Write it in your notes. A B C D Putting money in an ASB account Buying GOLD bars and storing them Buying productive assets Investing in XERO shares Investment is? A B C D Putting money in an ASB account Buying GOLD bars and storing them Buying productive assets Investing in XERO shares DECISIONS, DECISIONS! Glass company wants to grow and needs a new delivery vehicle. It has decided on 3 possible options HOW DOES IT MAKE A FINAL DECISION? OPTION 1 OPTION 2 OPTION 3 Investment Appraisal 3 methods: Payback Period Accounting Rate of Return Net Present Value Payback period How long will it take to pay back the initial investment from NET CASH FLOWS OPTION 1: $45000 initial investment OPTION 2 $36000 initial investment OPTION 3 $60000 initial investment Payback period NET CASH FLOWS are … Income received from asset minus costs of running asset YOU WILL be given the NET CASH FLOW for each investment option in the exam. Payback period $14000 $14000 $14000 $14000 $14000 0 OPTION 1: 1 2 3 4 Years (NET Cash Flow) $45000 If the annual flows are all the same … Initial Investment Annual Net Cash Flows = PAYBACK PERIOD Give it a go yourself 5 Payback period $14000 $14000 $14000 $14000 $14000 0 OPTION 1: $45000 1 2 3 4 Years (NET Cash Flow) 5 Payback period $10000 $9000 $9000 $12000 $12000 0 OPTION 2: 1 2 3 4 Years (NET Cash Flow) $36000 If the annual flows are different … Year Net Cash Flow Total 1 $,000 2 $,000 $,000 3 $,000 $,000 4 $,000 $,000 Add each year until you have covered your investment Give it a go yourself 5 Payback period $10000 $9000 $9000 $12000 $12000 0 OPTION 2: $36000 1 2 3 4 Years (NET Cash Flow) 5 Payback period $18000 $22000 $26000 $26000 $30000 0 OPTION 3: 1 2 3 4 5 Years (NET Cash Flow) $60000 PAYBACK a little harder to find? YOUR TURN A B C D 3yrs 2 mths 2yrs 6 mths 3yrs 8mths 2yrs 10mths Payback period $18000 $22000 $26000 $26000 $30000 0 OPTION 3: 1 2 3 4 5 Years (NET Cash Flow) $60000 PAYBACK a little harder to find? YOUR TURN A B C D 3yrs 2 mths 2yrs 6 mths 3yrs 8mths 2yrs 10mths Payback period $18000 $22000 $26000 $26000 $30000 0 OPTION 3: 1 3 4 5 Years (NET Cash Flow) $60000 Year 2 Net Cash Flow Total 1 $18,000 2 $22,000 $40,000 3 $26,000 $66,000 Need $60,00 Add each year until you have covered your investment Sometime in Yr2. Need extra 20,000 out of 26000 in Yr 3. 20,000/26,000= 0.769. 0.769 x 12mths = 9.23 or 10 months approx. PAYBACK = 2 years and 10 months Payback period WHICH PROJECT? OPTION 1: 3yrs 3mths OPTION 2 3yrs 8mths OPTION 3 2yrs 10mths Payback period What are the Criteria? OPTION 1: 3yrs 3mths OPTION 2 3yrs 8m OPTION 3 2yrs 10m Accept if: 1. Fastest PAYBACK – OPTION 3 OR 2. Meets criteria eg. PAYBACK < 3 yrs – OPTION 3 Payback Period is? A B C D A method for paying off debts An approach to help decide on the best investment The best form of investment appraisal How long it takes you to pay for equipment Payback Period is? A B C D A method for paying off debts An approach to help decide on the best investment The best form of investment appraisal How long it takes you to pay for equipment Payback period WEAKNESSES This method ignores: 1. The total return on the investment project (i.e. the earnings after payback). 2. The timing of the return (slow cash flows to start could result in rejecting profitable projects) . Investment Appraisal 3 methods: Payback Period Accounting Rate of Return Net Present Value Average Rate of Return aka Accounting Rate of Return Total Return considered. Expressed as a % OPTION 1: $45000 initial investment OPTION 2 $36000 initial investment OPTION 3 $60000 initial investment Average Rate of Return $14000 $14000Rate $14000 $14000 aka Accounting of Return $14000 0 OPTION 1: 1 2 $45000 3 4 5 Years (NET Cash Flow) Total net cash flows = Total inflows minus initial investment Expected life of asset = Useful life of asset Total Net Cash Flows from Asset Expected Life of Asset Average Annual Net Cash Flows Initial Investment = Average Annual NCF = Accounting Rate of Return Average Rate of Return aka Accounting Rate of Return $14000 $14000 $14000 $14000 $14000 0 OPTION 1: $45000 1 2 3 4 Years (NET Cash Flow) Total NCF = 70000 – investment 45000 35000/5 = 7000 7000/45000 = 15.5% 5 Average Rate of Return aka Accounting of Return $10000 $9000 Rate $9000 $12000 $12000 0 OPTION 2: $36000 1 2 3 4 5 Years (NET Cash Flow) Total Cash inflows = 52000 Life = 5 yrs 52000 – 36000 = 16000/5 = 3200 3200/36000 = 8.9% Average Rate of Return aka Accounting of Return $18000 $22000 Rate $26000 $26000 $30000 0 OPTION 3: 1 2 3 4 5 Years (NET Cash Flow) $60000 YOUR TURN A B C D 12.6% 20.0% 20.7% 18.3% Average Rate of Return aka Accounting of Return $18000 $22000 Rate $26000 $26000 $30000 0 OPTION 3: 1 2 3 4 5 Years (NET Cash Flow) $60000 YOUR TURN A B C D 12.6% 20.0% 20.7% 18.3% Average Rate of Return aka Accounting of Return $18000 $22000 Rate $26000 $26000 $30000 0 OPTION 3: $60000 1 2 3 4 5 Years (NET Cash Flow) HOW? Total Cash Flows = 122000 Life = 5yrs 122000-60000= 62000/5 = 12400 12400/60000 = 20.7% Average Rate of Return aka Accounting Rate of Return WHICH PROJECT? OPTION 1: 15.5% OPTION 2: 8.9% OPTION 3: 20.7% Average Rate of Return aka Accounting Rate of Return What are the Criteria? OPTION 1: 15.5% OPTION 2: 8.9% OPTION 3: 20.7% Accept if: 1. Best ARR– OPTION 3 OR 2. Meets criteria eg. ARR > 16% – OPTION 3 Average Rate of Return aka Accounting Rate of Return A B C D An unsatisfactory interest rate An approach to help decide on the best investment The best form of investment appraisal aka Economic rate of return Average Rate of Return aka Accounting Rate of Return A B C D An unsatisfactory interest rate An approach to help decide on the best investment The best form of investment appraisal aka Economic rate of return Average Rate of Return aka Accounting Rate of Return WEAKNESSES Attaches no importance to the timing of the inflows of cash. A.R.R treats all money as of equal value, irrespective of when it is received. Hence, a project may be favoured even though it only produces a return over a long period of time. . Average Rate of Return aka Accounting Rate of Return More sophisticated methods take the timing and size of the cash inflows into account. A sum of money in one year's time is worth less than that same sum of money now (i.e. inflation will erode the real value of that sum of money over the year). This is where the notion of present value is used. . EXAM QUESTION EXAM QUESTION EXAM QUESTION EXAM QUESTION The new machinery will cost $730m Expected net cash flows per year; Year 1 194 Year 2 199 Year 3 207 Year 4 212 Year 5 217 EXAM The new machinery will QUESTION cost $730m Expected net cash flows per year; Year 1 194 Year 2 199 Year 3 207 Year 4 212 Year 5 217 Net Present Value An approach to investment appraisal that takes into account the time value of money Net Present Value Sophisticated Discounts Cash Flows Net Present Value The value of future cash flows are discounted back to present day values. A $dollar today is worth more than a $dollar received in the future. Net Present Value If I gave you $1 today you could invest it in the bank at current interest rates. The same $1 in a years time has not been able to earn that interest so has less value to me in todays terms. Net Present Value Present value of net cash inflows minus initial investment Information you need to calculate: Initial investment Annual cash flows A % discounting rate (k) Net Present Value Present value of net cash inflows minus initial investment Cash Flow 1 (1 + k) + Cash Flow + 2 2 (1 + k) Cash Flow 3 3 (1 + k) Cash Flow t + (1 + k)t = NET PRESENT VALUE Cash - Flow 0 Net Present Value Cash Flow 1 (1 + k) + Cash Flow + 2 2 (1 + k) Cash Flow 3 3 (1 + k) Cash Flow t + (1 + k)t Cash - Flow 0 Net Present Value Cash Flow 1 (1 + k) + Cash Flow + 2 2 (1 + k) $14000 Cash Flow 3 3 (1 + k) $14000 $14000 Cash Flow t + (1 + k)t $14000 Cash - Flow 0 $14000 0 OPTION 1: $45000 1 2 3 4 Years (NET Cash Flow) We will use a discount rate of 8% (.08). 5 Net Present Value Cash Flow 1 (1 + k) 14000 (1 + 0.08) + + Cash Flow + 2 2 (1 + k) 14000 (1 + 0.08)2 + Cash Flow 3 3 (1 + k) 14000 (1 + 0.08)3 + Cash Flow t + (1 + k)t 14000 (1 + 0.08) 4 + 14000 (1 + 0.08) 12962.96 + 12002.74 + 11113.65 + 10290.42 + 9528.16 - 45000 = $10897.93 5 Cash - Flow 0 - $45000 Net Present Value $10000 $9000 $9000 $12000 $12000 0 OPTION 2: $36000 1 2 3 4 Years (NET Cash Flow) 5 Net Present Value $18000 $22000 $26000 $26000 $30000 0 OPTION 3: 1 2 3 4 5 Years (NET Cash Flow) $60000 YOUR TURN – closest to A B C D $12600 $20000 $41000 $36000 Net Present Value $18000 $22000 $26000 $26000 $30000 0 OPTION 3: 1 2 3 4 5 Years (NET Cash Flow) $60000 YOUR TURN – closest to A B C D $12600 $20000 $41000 $36000 Net Present Value $18000 $22000 $26000 $26000 $30000 0 OPTION 3: $60000 1 2 3 4 Years (NET Cash Flow) 5 Net Present Value WHICH PROJECT? OPTION 1: $10898 OPTION 2: $8058 OPTION 3: $35696 Net Present Value DECISION CRITERIA? OPTION 1: $10898 OPTION 2: $8058 OPTION 3: $35696 REJECT if NPV is less than zero (reject none) Net Present Value DECISION CRITERIA? OPTION 1: $10898 OPTION 2: $8058 OPTION 3: $35696 ACCEPT if NPV is positive (accept all) Choose largest NPV (Accept Option 3) Investment Appraisal Learning Objectives 3 methods: Payback Period Accounting Rate of Return Net Present Value Investment Appraisal Learning Objectives 3 methods: Payback Period Accounting Rate of Return Net Present Value SIMPLES T SIMPLE SOPHISTICAT ED Investment Appraisal Learning Objectives Payback Period SIMPLES T Your 3 methods: Exam Accounting s Rate of Return SIMPLE Net Present Value SOPHISTICAT ED