CHAPTER 5: BANKING

advertisement

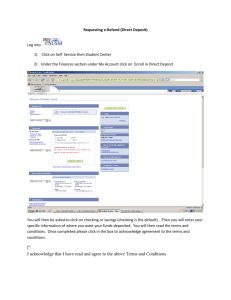

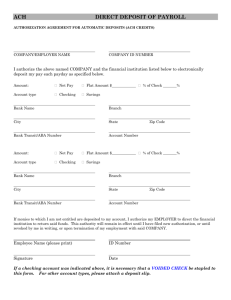

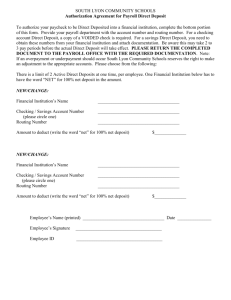

Direct deposit Automated teller machine (ATM) Debit card Point of sale transaction Commercial bank Savings and loan association (S&L) Credit union Consider pros and cons of different methods of payment (cash, debit, credit) Remember your long term goals and avoid debt (easy with credit cards) Sources of cash—FAST! Use your savings and make withdrawal Get a loan/borrow money BOTH CAN DELAY YOUR OTHER FINANCIAL GOALS SAVINGS SAFE STORAGE OF FUNDS FOR FUTURE USE TIME DEPOSIT—IF YOU LEAVE IN FOR A LONG TIME PAYMENT SERVICES TRANSFERRING MONEY FROM ACCOUNTS CHECKING ACCOUNT IS MOST COMMON PMT SVC DEMAND DEPOSIT—MONEY YOU DEPOSIT INTO CHK BORROWING CREDIT CARD CASH LOAN MORTGAGE / CAR LOAN DIRECT DEPOSIT AUTOMATIC DEPOSIT OF PAYCHECK INTO ACCOUNT RECEIVE STUB INSTEAD OF ACTUAL CHECK SAVES TIME AND EFFORT AUTOMATIC PAYMENTS PAY BILLS ONLINE BANK TAKES MONEY FROM ACCOUNT YOU CHOOSE ATMS (AUTOMATED TELLER MACHINE) A COMPUTER TERMINAL THAT ALLOWS WITHDRAWLS OF CASH FROM AN ACCOUNT CAN ALSO MAKE DEPOSITS, TRANSFERS. LOCATED ALL OVER (BANKS, MALLS, STADIUMS) YOU MUST APPLY FOR A CARD TO USE CALLED A DEBIT CARD —CARD THAT ALLOWS YOU TO MAKE PURCHASES OR WITHDRAWLS FROM CHECKING (VISA/MASTERCARD LOGO) MUST HAVE A PIN (PERSONAL IDENTIFICATION #) SOME BANKS MAY CHARGE A FEE IF USE ANOTHER IF LOST, NOTIFY BANK IMMEDIATELY PLASTIC POINT OF SALE TRANSACTIONS DEBIT CARD TRANSACTIONS AT STORES OR RESTAURANT STORE VALUE CARDS PAYMENTS PREPAID CARDS (SUBWAYS, PHONE CARDS, GIFTCARDS) ELECTRONIC CASH IN THE WORKS FOR ELECTRIC MONEY, COINS, CHECKS SHOULD I PUT MONEY IN A SAVINGS OR KEEP IN CASH? WHAT IF IT LOOSES VALUE? WHAT IF NO ATM NEAR HOME? HIGH FEES? IS IT WORTH OPENING A CHECKING ACCOUNT IF I HAVE TO KEEP AT LEAST $500 IN THERE? FDIC ( FEDERAL DEPOSIT INSURANCE CO) MAKES SURE EACH ACCOUNT IN A BANK DOES NOT LOSE ITS MONEY INSURES DEPOSITS UP TO $100,000 ALL BANKS MUST PARTICIPATE IN FDIC PROGRAM DEPOSIT COMMERCIAL BANKS INSTITUTIONS GOAL IS TO MAKE MONEY (FOR-PROFIT) OFFERS CHECKING, SAVINGS, LENDING SERVE INDIVIDUALS AND BUSINESSES NEED A LISCENSE TO OPERATE SAVINGS AND LOAN ASSOCIATIONS (S&L) SPECIALIZES IN SAVINGS ACCTS AND MORTAGE LOANS OFFER OTHER SERVICES (CHECKING, INVESTMENTS) MUTUAL SAVINGS BANK SPECIALIZE IN SAVINGS ACCTS AND MORTGAGE LOANS PERSONAL AND AUTO LOANS AS WELL INTEREST MAY BE LOWER PAYS HIGHER INTEREST ON SAVINGS ACCOUNTS CREDIT UNIONS NON-PROFIT FINANCIAL INSTITUTION OWNED BY MEMBERS AND WORK FOR THEIR BENEFIT MOST OFFER FULL RANGE OF SERVICES (CHEKING, SAVINGS, LOANS, CREDIT CARDS, INVESTMENTS) FEES AND INTEREST MIGHT BE LOWER NON-DEPOSIT LIFE INSURANCE COMPANIES MAKE HIGH-INTEREST LOANS TO CONSUMERS AND SMALL BUSINESSES THAT HAVE BAD CREDIT MORTGAGE COMPANIES PROVIDE FINANCIAL SECURITY FOR DEPENDANTS FINANCE COMPANIES INSTITUTIONS SPECIALIZE IN LOANS FOR HOMES INVESTMENT COMPANIES BUYS STOCKS, BONDS AND OTHER TYPES MANAGES THESE INVESTMENTS CALLED MUTUAL FUNDS WHERE CAN YOU GET BEST INTEREST RATE? WHERE CAN YOU GET FREE CHECKING? IS THE BANK FDIC INSURED? ARE THERE CONVIENIENT LOCATIONS? ARE THERE ONLINE BANKING SERVICES? 5.1 ASSESSMENT 1-3, 5 REGULAR SAVINGS ACCOUNTS (PASSBOOK) REQUIRE NO MINIMUM BALANCE WITHDRAWL AS MUCH AS YOU NEED LOW INTEREST—DOESN’T MAKE MUCH RECEIVE A LEDGER TO KEEP TRACK OF ACTIVITY CREDIT UNIONS MAY BE CALLED SHARE ACCOUTS CERTIFICATES OF DEPOSIT (CDS) MONEY IS PUT IN AN ACCOUNT FOR A PERIOD OF TIME TO EARN A SPECIFIC RATE OF RETURN TERM: AMOUNT OF TIME YOU LEAVE IT IN MATURITY DATE: DATE MONEY IS AVAILABLE TO YOU LOW-RISK, HIGHER INTEREST THAN SAVINGS LEAVE MONEY IN FOR 1 MONTH-5+ YEARS WILL PAY A PENALTY FOR TAKING OUT EARLY MINIMUM DEPOSIT REQUIRED SHOP RATES (CAN GET FROM ANYWHERE) CHOOSE MATURITY DATE WISELY NEVER LET A BANK “ROLL OVER” A CD CONSIDER WHEN YOU NEED THE MONEY MIGHT WANT TO CREATE SEVERAL ACCOUNTS CALLED A CD PORTFOLIO MONEY MARKET ACCOUNTS SAVINGS ACCOUNT THAT REQUIRES A MINIMUM BALANCE AND EARNS INTEREST THAT CHANGES EVERY MONTH DEPENDS ON MARKET RATES/ECONOMY YOU PAY A PENALTY IF IT DROPS BELOW $1000 LIMITED NUMBER OF CHECKS SAVINGS BONDS YOU PURCHASE FROM GOVERNMENT FOR HALF OF FACE VALUE (WHAT PERSON GETS AT MATURITY) PAY $250, HAS FACE VALUE OF $500 GOVERNMENT LIMITS PURCHASES TO $15000 BUY AT BANKS MATURITY DATE DEPENDS ON WHEN PURCHASED PENALTY IF CASHED EARLY YOU PAY TAXES ON SAVINGS BONDS WHEN CASHED RATE HOW MUCH YOU ARE EARNING/MAKING ON DEPOSITS PERCENTAGE INCREASE IN THE AMOUNT FROM EARNED INTEREST Ex: WHEN EMMA PUT $75 BABYSITTING MONEY INTO REGULAR SAVINGS ACCOUNT, SHE EARNED $3 INTEREST. WHAT WAS HER RATE OF RETURN? OF RETURN INTEREST AMOUNT/DEPOSITED AMOUNT (CHANGE TO PERCENT) 3/75=.04 = 4% ROR PRACTICE PROBLEMS LIQUIDITY: HOW EASY TO CHANGE INTO CASH (HOW EASY TO WITHDRAWL CASH FROM ACCOUNT) What does ATM stand for? If a bank is FDIC insured, what does that mean? Name 1 difference between a Credit Union and a Commercial Bank What is a CD? What is a Bond? Find the Rate of Return if you deposit $350 into an account and you earn $18.75 interest If your ROR is 15.5% on a $1200 deposit, how much interest did you earn? REGULAR NO MIN BALANCE (OR PAY A FEE) ACTIVITY ACCOUNTS BANK CHARGES A FEE FOR EVERY CHECK YOU WRITE AND YOU ALSO PAY MONTHLY FEE NEVER A MINIMUM BALANCE REQUIRED GOOD IF UNABLE TO KEEP MINIMUM BALANCE INTEREST CHECKING ACCOUNTS EARNING CHECKING COMBO OF SAVINGS AND CHECKING PAY INTEREST IF MAINTAIN A MINIMUM BALANCE RESTRICTIONS? FEES/CHARGES? INTEREST? SPECIAL SERVICES? OVERDRAFT PROTECTION AN AUTOMATIC LOAN TO YOUR ACCOUNT IF IT DROPS BELOW ZERO. YOU WILL PAY INTEREST BUT NO FEES OPENING AN ACCOUNT WRITING CHECKS CHECK REGISTERS STOP-PAYMENT ORDER REQUEST SENT IN FOR BANK NOT TO CASH CHECK FEE $10-$20 MAKING ENDORSING A CHECK: SIGNATURE OF WHO IT IS WRITTEN TO BLANK ENDORSEMENT: CHECK HOLDER SIGNS BACK RESTRICTIVE ENDORSEMENT: REQUIRES CHECKHOLDER SIGNATURE AND INSTRUCTIONS “FOR DEPOSIT ONLY” SPECIAL ENDORSEMENT: TRANSFER CHECK TO SOMEONE ELSE DEPOSITS “PAY TO ORDER OF” WRITTEN ON BACK DO NOT ENDORSE UNTIL READY TO CASH/DEPOSIT IT SIGN THE BACK SIGN EXACTLY HOW WRITTEN ON FRONT USE A PEN BANK DEPOSITS CHECKS WRITTEN WITHDRAWALS DEBIT CARD CHARGES INTEREST EARNED BANK WILL SEND A STATEMENT EACH MONTH RECONCILIATION REPORT THAT SHOWS DIFFERENCE BETWEEN STATEMENT AND YOUR CHECKBOOK BALANCE 5.2 ASSESSMENT 1-3 CHAPTER 5 REVIEW & ACTIVITIES 1-6 BANKING QUIZ 1-8 ADDITIONAL CHECKING CLASS CHECKING PACKET SIMULATION