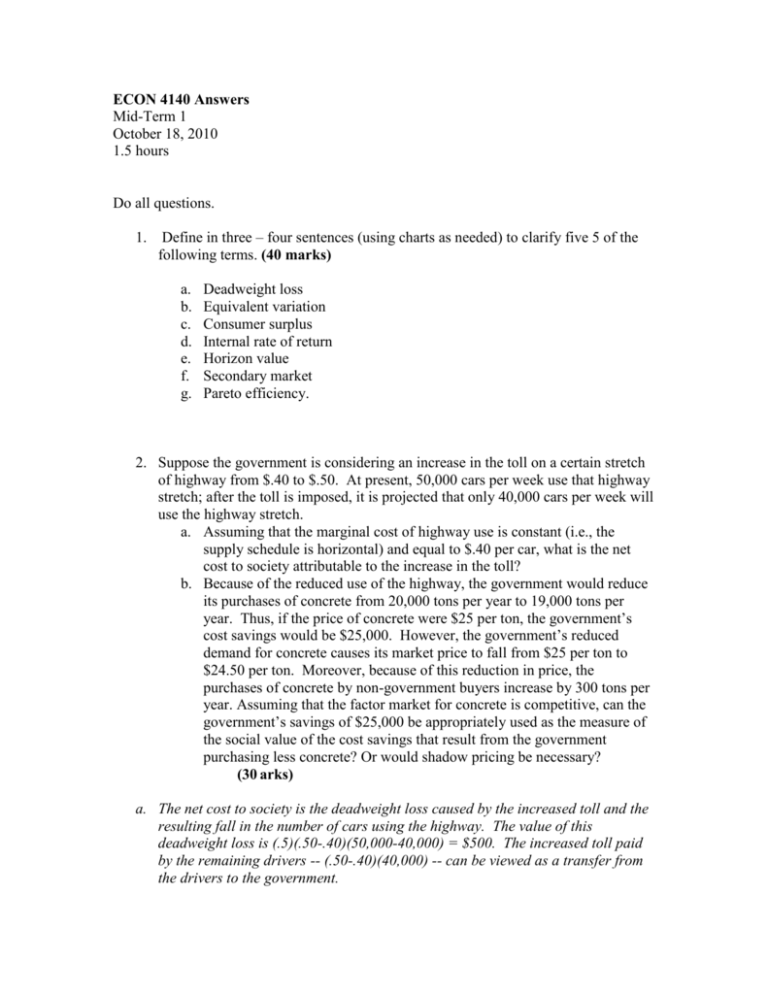

ECON 4140 Answers Mid-Term 1 October 18, 2010 1.5 hours Do all

advertisement

ECON 4140 Answers Mid-Term 1 October 18, 2010 1.5 hours Do all questions. 1. Define in three – four sentences (using charts as needed) to clarify five 5 of the following terms. (40 marks) a. b. c. d. e. f. g. Deadweight loss Equivalent variation Consumer surplus Internal rate of return Horizon value Secondary market Pareto efficiency. 2. Suppose the government is considering an increase in the toll on a certain stretch of highway from $.40 to $.50. At present, 50,000 cars per week use that highway stretch; after the toll is imposed, it is projected that only 40,000 cars per week will use the highway stretch. a. Assuming that the marginal cost of highway use is constant (i.e., the supply schedule is horizontal) and equal to $.40 per car, what is the net cost to society attributable to the increase in the toll? b. Because of the reduced use of the highway, the government would reduce its purchases of concrete from 20,000 tons per year to 19,000 tons per year. Thus, if the price of concrete were $25 per ton, the government’s cost savings would be $25,000. However, the government’s reduced demand for concrete causes its market price to fall from $25 per ton to $24.50 per ton. Moreover, because of this reduction in price, the purchases of concrete by non-government buyers increase by 300 tons per year. Assuming that the factor market for concrete is competitive, can the government’s savings of $25,000 be appropriately used as the measure of the social value of the cost savings that result from the government purchasing less concrete? Or would shadow pricing be necessary? (30 arks) a. The net cost to society is the deadweight loss caused by the increased toll and the resulting fall in the number of cars using the highway. The value of this deadweight loss is (.5)(.50-.40)(50,000-40,000) = $500. The increased toll paid by the remaining drivers -- (.50-.40)(40,000) -- can be viewed as a transfer from the drivers to the government. b. Part of the government's $25,000 savings from purchasing less concrete are offset by a reduction in surplus received by the producers of concrete. This loss can be computed as the triangular area above the supply curve and between the old and the new quantities purchased by the government. Consequently, the size of the annual loss to producers of concrete is (.5)($25-$24.50)(1,000) = $250. Thus, the social value of the savings that results from the government using less concrete is $25,000 - $250 = $24,750. It would appear, therefore, that the reduction in the government's budgetary expenditure provides a good approximation of the social value of the savings that results from the reduced purchases of concrete and that the use of shadow prices in this instance is not really necessary. Note that the government, as well as non-government buyers of concrete, also receive gains from the 50 cent reduction in the price of concrete. However, these gains are more than offset by reductions in the surplus of the producers of concrete. In estimating the effects of the 50 cent reduction in price, it is the difference between the loss of producer surplus and the gain in consumer surplus that must be measured. 3. The environmental protection agency of a county would like to preserve a piece of land as a wilderness area. The current owner has offered to lease the land to the county for 20 years in return for a lump-sum payment of $1.1 million, which would be paid at the beginning of the 20-year period. The agency has estimated that the land would generate $110,000 per year in benefits to hunters, bird watchers, and hikers. Assume that the lease price represents the social opportunity cost of the land and that the appropriate real discount rate is 4 percent. a. Assuming that the yearly benefits, which are measured in real dollars, accrue at the end of each of the 20 years, calculate the net benefits of leasing the land. b. Some analysts in the agency argue that the annual real benefits are likely to grow at a rate of 2 percent per year due to increasing population and county income. Recalculate the net benefits assuming that they are correct. (30 marks) a. The present value of the real yearly benefits is most easily calculated using the formula for the present value of an annuity presented in Appendix 6a: PV(benefits) = ($110,000)[1-(1+.04)-20]/(.04) = $1,494,935.90 NPV = $1, 494,935.90 - $1,100,000 = 394,935.87 b. In this case we use the formula for the present value of an annuity with a growth rate in benefits of 2 percent: First, calculate dg = (.04-.02)/(1+.02) = .0196 PV(benefits) = [($110,000)/(1+.02)][1-(1+dg)-20]/dg] [($110,000)/(1+.02)][1-(1+.0196)-20]/.0196] = NPV = $1,770,245-$1,100,000 = $660,245