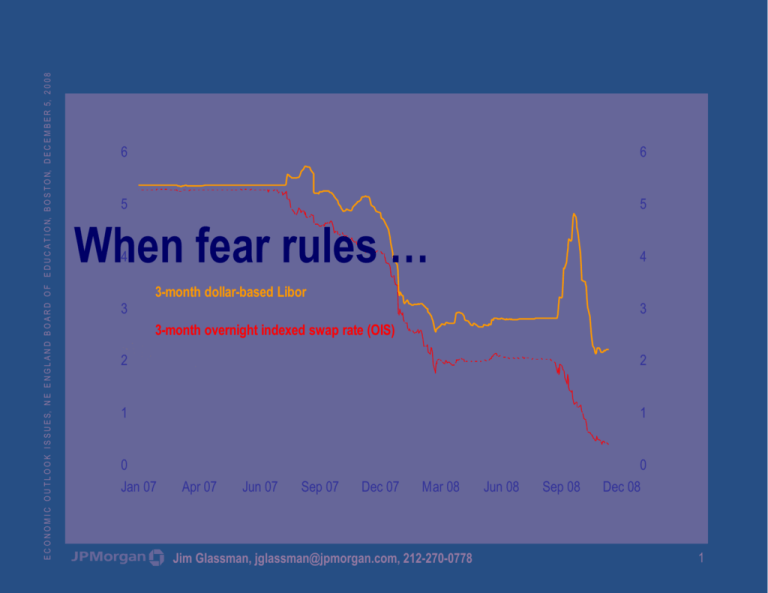

E C O N O M I C O U T L O O K I S S U E S, N E E N G L A N D B O A R D O F E D U C A T I O N, B O S T O N, D E C E M B E R 5, 2 0 0 8

6

6

5

5

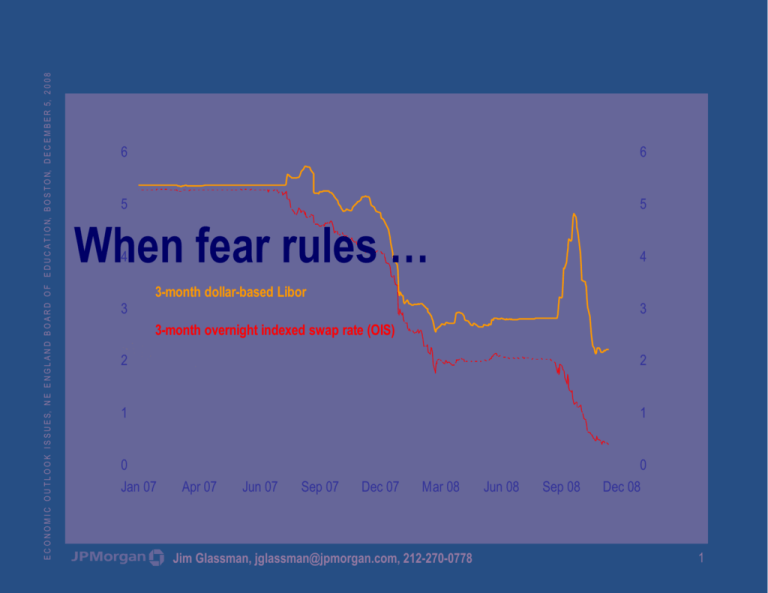

When fear rules …

4

4

3-month dollar-based Libor

3

3

3-month overnight indexed swap rate (OIS)

2

2

1

1

0

0

Jan 07

Apr 07

Jun 07

Sep 07

Dec 07

Mar 08

Jim Glassman, jglassman@jpmorgan.com, 212-270-0778

Jun 08

Sep 08

Dec 08

1

E C O N O M I C O U T L O O K I S S U E S, N E E N G L A N D B O A R D O F E D U C A T I O N, B O S T O N, D E C E M B E R 5, 2 0 0 8

In defense of policy activism …

Jim Glassman, jglassman@jpmorgan.com, 212-270-0778

2

E C O N O M I C O U T L O O K I S S U E S, N E E N G L A N D B O A R D O F E D U C A T I O N, B O S T O N, D E C E M B E R 5, 2 0 0 8

Market economies cycle …

US real GDP (percent change from four quarters earlier)

25

25

20

20

15

15

10

10

5

5

0

0

-5

-5

-10

-10

-15

-15

-20

Average historical growth = 3.75% annually

-20

1852 1862 1872 1882 1892 1902 1912 1922 1932 1942 1952 1962 1972 1982 1992 2002

Source: NBER recession bars; US Department of Commerce; various academic sources

Jim Glassman, jglassman@jpmorgan.com, 212-270-0778

3

E C O N O M I C O U T L O O K I S S U E S, N E E N G L A N D B O A R D O F E D U C A T I O N, B O S T O N, D E C E M B E R 5, 2 0 0 8

… when demand falters, yes … when supply shifts, no

US real GDP (chained 2000 dollars)

13,000

13,000

12,000

12,000

11,000

11,000

10,000

10,000

9,000

9,000

8,000

8,000

Potential real GDP (maximum

sustainable output)

7,000

7,000

6,000

6,000

5,000

5,000

4,000

4,000

3,000

3,000

Actual real GDP

2,000

2,000

60

65

70

75

80

85

90

95

00

05

Source: US Department of Commerce

Jim Glassman, jglassman@jpmorgan.com, 212-270-0778

4

E C O N O M I C O U T L O O K I S S U E S, N E E N G L A N D B O A R D O F E D U C A T I O N, B O S T O N, D E C E M B E R 5, 2 0 0 8

Three hurdles, two cleared …

(1) Inflated housing values

(2) Oil’s convulsion

(3) Irrational fears

Jim Glassman, jglassman@jpmorgan.com, 212-270-0778

5

E C O N O M I C O U T L O O K I S S U E S, N E E N G L A N D B O A R D O F E D U C A T I O N, B O S T O N, D E C E M B E R 5, 2 0 0 8

A view about 2009 … nothing wrong that isn’t fixed

US real GDP (percent change from four quarters earlier)

10

10

9

9

8

8

7

7

6

6

5

5

4

4

3

3

2

2

1

1

0

0

-1

-1

-2

-2

-3

-3

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

Source: JPMorgan Chase & Co.

Jim Glassman, jglassman@jpmorgan.com, 212-270-0778

6

E C O N O M I C O U T L O O K I S S U E S, N E E N G L A N D B O A R D O F E D U C A T I O N, B O S T O N, D E C E M B E R 5, 2 0 0 8

(1) Ground Zero … inflated valuations are history

Nominal income per household and house prices (ratio to 1970 Q1 level)

10

9

8

Existing house prices (Case-Shiller national index)

FHFA (previously Ofheo) purchase only index

Gross nominal income per household

2001 Q2

7

10

9

8

7

6

6

5

5

4

4

3

3

2

2

1

1

0

0

70 72 74 76 78 80 82 84 86 88 90 92 94 96 98 00 02 04 06 08 10 12 14

Sources: Standard & Poor’s; US Department of Commerce

Jim Glassman, jglassman@jpmorgan.com, 212-270-0778

7

E C O N O M I C O U T L O O K I S S U E S, N E E N G L A N D B O A R D O F E D U C A T I O N, B O S T O N, D E C E M B E R 5, 2 0 0 8

(2) Oil’s speculative (?) convulsion …

Global oil demand (millions of barrels daily)

90

86

82

78

74

70

66

62

58

54

50

46

42

38

34

30

Petroleum, WTI (dollars per barrel)

Global petroleum demand (left)

Petroleum price (right)

140

120

100

80

60

40

20

0

1947 1952 1957 1962 1967 1972 1977 1982 1987 1992 1997 2002 2007

Source: American Petroleum Institute

Jim Glassman, jglassman@jpmorgan.com, 212-270-0778

8

E C O N O M I C O U T L O O K I S S U E S, N E E N G L A N D B O A R D O F E D U C A T I O N, B O S T O N, D E C E M B E R 5, 2 0 0 8

… was a headwind, now a tailwind …

Contribution to real GDP growth (contribution to percent change from four quarters earlier)

1.5

1.5

Oil price assumption

1.0

1.0

2008 Q4 = $50 per barrel

2009 Q4 = $55 per barrel

0.5 2010 Q4 = $60 per barrel

0.5

0.0

0.0

-0.5

-0.5

-1.0

-1.0

2008 Q4

-1.5

2002

-1.5

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

Sources: US Department of Commerce; JPMorgan Chase &Co.

Jim Glassman, jglassman@jpmorgan.com, 212-270-0778

9

E C O N O M I C O U T L O O K I S S U E S, N E E N G L A N D B O A R D O F E D U C A T I O N, B O S T O N, D E C E M B E R 5, 2 0 0 8

… that reached/reaches all corners of Planet Earth

Real GDP in selected regions (percent change from four quarters earlier)

10

9

10

Emerging economies in Asia, Eastern Europe and Latin America (orange)

9

8

8

7

7

6

6

US (blue-gray)

EU-11 (black)

Japan (red)

5

4

5

4

3

3

2

2

1

1

0

0

-1

-1

-2

-2

-3

-3

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

Source: JPMorgan Chase & Co.

Jim Glassman, jglassman@jpmorgan.com, 212-270-0778

10

E C O N O M I C O U T L O O K I S S U E S, N E E N G L A N D B O A R D O F E D U C A T I O N, B O S T O N, D E C E M B E R 5, 2 0 0 8

(3) Fear … irrational, if you ask me

Market value of all publicly traded stocks (Wilshire 5000 index)

18,000

18,000

16,000

16,000

14,000

14,000

12,000

12,000

10,000

10,000

8,000

8,000

6,000

6,000

4,000

4,000

2,000

2,000

0

0

90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09

Source: Dow Jones

Jim Glassman, jglassman@jpmorgan.com, 212-270-0778

11

E C O N O M I C O U T L O O K I S S U E S, N E E N G L A N D B O A R D O F E D U C A T I O N, B O S T O N, D E C E M B E R 5, 2 0 0 8

Two red herrings/myths …

(1) The housing ATM story

(2) Household debt

Jim Glassman, jglassman@jpmorgan.com, 212-270-0778

12

E C O N O M I C O U T L O O K I S S U E S, N E E N G L A N D B O A R D O F E D U C A T I O N, B O S T O N, D E C E M B E R 5, 2 0 0 8

What the 2000s taught us about consumers

Real consumer spending and income (annual percent change over period shown)

5

4

4.1

3.6

3.7

3.5

4

3

consumption (orange)

income(indigo)

3.2

3.2

2.9

2.8

3

2.6

2.2

1.9

1.7

2

2

1

1

0

1980-84

1985-89

1990-94

1995-99

2000-04

2005-08

Source: US Department of Commerce

Jim Glassman, jglassman@jpmorgan.com, 212-270-0778

13

E C O N O M I C O U T L O O K I S S U E S, N E E N G L A N D B O A R D O F E D U C A T I O N, B O S T O N, D E C E M B E R 5, 2 0 0 8

Debt … if you bought in the 80s/90s, you know the story

Mortgage rates (percent)

20

Household debt (ratio to income)

1.4

30-year mortgage commitment rate (left)

1.3

18

16

1.2

1.1

14

1.0

0.9

12

Ratio of mortgage debt

to disposable personal

income (right)

10

0.8

0.7

0.6

8

0.5

6

0.4

4

0.3

2

0.2

Ratio of non-mortgage debt to disposable personal income (right)

0.1

0

1960

0.0

1965

1970

1975

1980

1985

1990

1995

2000

2005

2010

Source: Federal Reserve Board

Jim Glassman, jglassman@jpmorgan.com, 212-270-0778

14

E C O N O M I C O U T L O O K I S S U E S, N E E N G L A N D B O A R D O F E D U C A T I O N, B O S T O N, D E C E M B E R 5, 2 0 0 8

Two structural “challenges” …

(1) End of an era for consumers

(2) Financial deleveraging

Jim Glassman, jglassman@jpmorgan.com, 212-270-0778

15

E C O N O M I C O U T L O O K I S S U E S, N E E N G L A N D B O A R D O F E D U C A T I O N, B O S T O N, D E C E M B E R 5, 2 0 0 8

(1) End of an era for consumers/retailers

Consumer spending (percent of GDP)

0.75

0.75

0.70

0.70

0.65

0.65

0.60

0.60

0.55

0.55

47

52

57

62

67

72

77

82

87

92

97

02

07

Source: US Department of Commerce

Jim Glassman, jglassman@jpmorgan.com, 212-270-0778

16

E C O N O M I C O U T L O O K I S S U E S, N E E N G L A N D B O A R D O F E D U C A T I O N, B O S T O N, D E C E M B E R 5, 2 0 0 8

The Luckiest Generation … we hope …

Saving (% of income)

Net worth (ratio to income)

16

6.4

Ratio of net worth to income (right)

6.2

6.0

12

5.8

5.6

5.4

8

5.2

Saving rate, the line (left)

5.0

4

4.8

4.6

4.4

0

4.2

4.0

-4

1960

3.8

1965

1970

1975

1980

1985

1990

1995

2000

2005

2010

Sources: US Department of Commerce; Federal Reserve Board

Jim Glassman, jglassman@jpmorgan.com, 212-270-0778

17

E C O N O M I C O U T L O O K I S S U E S, N E E N G L A N D B O A R D O F E D U C A T I O N, B O S T O N, D E C E M B E R 5, 2 0 0 8

… about equities (the economy), not real estate

Saving (% of income)

Net worth (ratio to income)

20

6.5

Ratio of net worth to income (right)

6.0

Saving rate, the line (left)

5.5

16

5.0

4.5

12

4.0

3.5

8

3.0

2.5

4

2.0

1.5

0

1.0

Real estate net worth (right)

0.5

-4

1960

0.0

1965

1970

1975

1980

1985

1990

1995

2000

2005

2010

Sources: US Department of Commerce; Federal Reserve Board

Jim Glassman, jglassman@jpmorgan.com, 212-270-0778

18

E C O N O M I C O U T L O O K I S S U E S, N E E N G L A N D B O A R D O F E D U C A T I O N, B O S T O N, D E C E M B E R 5, 2 0 0 8

(2) Securitized finance … the end of shadow banking

Assets held at financial intermediaries (share of all assets held at financial intermediaries)

100

Life Insurance Companies

90

Pension Funds

80

70

Brokers and Dealers, Finance,

Mortgage, and Other Insurance

Companies, and Funding

Corporations

60

Money Market Mutual Funds

50

40

Mutual Funds, Closed-End Funds,

Exchange-Traded Funds, and REITs

30

Government-Sponsored Enterprises,

Federally Related Mortgage Pools,

and Issuers of Asset-Backed

Securities

20

10

Banks, Savings Institutions, and

Credit Unions

0

50

53

56

59

62

65

68

71

74

77

80

83

86

89

92

95

98

01

04

07

Source: Federal Reserve Board

Jim Glassman, jglassman@jpmorgan.com, 212-270-0778

19

E C O N O M I C O U T L O O K I S S U E S, N E E N G L A N D B O A R D O F E D U C A T I O N, B O S T O N, D E C E M B E R 5, 2 0 0 8

Inflation … R.I.P.

Jim Glassman, jglassman@jpmorgan.com, 212-270-0778

20

E C O N O M I C O U T L O O K I S S U E S, N E E N G L A N D B O A R D O F E D U C A T I O N, B O S T O N, D E C E M B E R 5, 2 0 0 8

Markets sign the articles of surrender

10-year inflation expectations (percent)

3.00

3.00

2.75

2.75

2.50

2.50

2.25

2.25

2.00

2.00

1.75

1.75

1.50

1.50

1.25

1.25

1.00

1.00

0.75

0.75

0.50

0.50

0.25

0.25

0.00

0.00

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

Sources: Bloomberg; Federal Reserve Board

Jim Glassman, jglassman@jpmorgan.com, 212-270-0778

21

E C O N O M I C O U T L O O K I S S U E S, N E E N G L A N D B O A R D O F E D U C A T I O N, B O S T O N, D E C E M B E R 5, 2 0 0 8

Inflation doesn’t do well when the economy chills

Unemployment rate (percent of the labor force)

12

12

10

10

8

8

6

6

4

4

2

2

0

0

60

65

70

75

80

85

90

95

00

05

10

Sources: NBER recession bars; US Department of Labor

Jim Glassman, jglassman@jpmorgan.com, 212-270-0778

22

E C O N O M I C O U T L O O K I S S U E S, N E E N G L A N D B O A R D O F E D U C A T I O N, B O S T O N, D E C E M B E R 5, 2 0 0 8

The Fed’s 30-year price stability battle … final days

10-year inflation expectations (percent)

12

12

10

The

10

FOMC's

forecast

for core

8

PCE chain

8

price

inflation

6

6

Chain PCE

price index

4

4

2

2

Core chain PCE price index

0

1960

0

1965

1970

1975

1980

1985

1990

1995

2000

2005

2010

Sources: Bloomberg; Federal Reserve Board

Jim Glassman, jglassman@jpmorgan.com, 212-270-0778

23

E C O N O M I C O U T L O O K I S S U E S, N E E N G L A N D B O A R D O F E D U C A T I O N, B O S T O N, D E C E M B E R 5, 2 0 0 8

… the stuff of opportunity

Jim Glassman, jglassman@jpmorgan.com, 212-270-0778

24

E C O N O M I C O U T L O O K I S S U E S, N E E N G L A N D B O A R D O F E D U C A T I O N, B O S T O N, D E C E M B E R 5, 2 0 0 8

Markets value the future at fire sale prices? I don’t think so

US real GDP (percent change from four quarters earlier)

26

18,000

24

16,000

22

Price-earnings ratio (left scale)

20

Wilshire 5000 (right scale)

18

14,000

12,000

10,000

16

8,000

14

6,000

12

10

4,000

8

2,000

6

0

1950 1955 1960 1965 1970 1975 1980 1985 1990 1995 2000 2005 2010

Sources: US Department of Commerce; Dow Jones

Jim Glassman, jglassman@jpmorgan.com, 212-270-0778

25

E C O N O M I C O U T L O O K I S S U E S, N E E N G L A N D B O A R D O F E D U C A T I O N, B O S T O N, D E C E M B E R 5, 2 0 0 8

The world is not flat …

circa 1980

Less than $5,000 per capita GDP

$5,000 - $10,000 per capita GDP

Over $10,000 per capita GDP

Jim Glassman, jglassman@jpmorgan.com, 212-270-0778

26

E C O N O M I C O U T L O O K I S S U E S, N E E N G L A N D B O A R D O F E D U C A T I O N, B O S T O N, D E C E M B E R 5, 2 0 0 8

… but others want to make it so …

circa 2005

Less than $5,000 GDP per person

$5,000 - $15,000 GDP per person

Over $15,000 GDP per person

Jim Glassman, jglassman@jpmorgan.com, 212-270-0778

27

E C O N O M I C O U T L O O K I S S U E S, N E E N G L A N D B O A R D O F E D U C A T I O N, B O S T O N, D E C E M B E R 5, 2 0 0 8

Appendix I. Threats to our way

Jim Glassman, jglassman@jpmorgan.com, 212-270-0778

28

E C O N O M I C O U T L O O K I S S U E S, N E E N G L A N D B O A R D O F E D U C A T I O N, B O S T O N, D E C E M B E R 5, 2 0 0 8

Anxiety about America’s living standard … it’s about us

Labor compensation trends (percentage of nominal GDP)

0.64

0.64

0.60

0.60

0.56

0.56

Compensation

0.52

0.52

0.48

0.48

0.44

Wages and salaries (including average hourly earnings)

0.40

0.44

0.40

69 71 73 75 77 79 81 83 85 87 89 91 93 95 97 99 01 03 05 07 09

Source: US Department of Commerce

Jim Glassman, jglassman@jpmorgan.com, 212-270-0778

29

E C O N O M I C O U T L O O K I S S U E S, N E E N G L A N D B O A R D O F E D U C A T I O N, B O S T O N, D E C E M B E R 5, 2 0 0 8

Analysts’ Compensation: The research analysts responsible for the preparation of this report receive compensation based upon various factors, including

the quality and accuracy of research, client feedback, competitive factors and overall firm revenues. The firm’s overall revenues include revenues from its

investment banking and fixed income business units. Principal Trading: JPMorgan and/or its affiliates normally make a market and trade as principal in the

securities discussed in this report.

Legal Entities: JPMorgan is the marketing name for JPMorgan Chase & Co. and its subsidiaries and affiliates worldwide. J.P. Morgan Securities Inc. is a

member of NYSE and SIPC. JPMorgan Chase Bank, N.A. is a member of FDIC and is authorized and regulated in the UK by the Financial Services Authority.

J.P. Morgan Futures Inc. is a member of the NFA. J.P. Morgan Securities Ltd. (JPMSL) is a member of the London Stock Exchange and is authorized and

regulated by the Financial Services Authority. J.P. Morgan Equities Limited is a member of the Johannesburg Securities Exchange and is regulated by the

FSB. J.P. Morgan Securities (Asia Pacific) Limited (CE number AAJ321) is regulated by the Hong Kong Monetary Authority. JPMorgan Chase Bank,

Singapore branch is regulated by the Monetary Authority of Singapore. J.P. Morgan Securities Asia Private Limited is regulated by the MAS and the Financial

Services Agency in Japan. J.P. Morgan Australia Limited (ABN 52 002 888 011/AFS License No: 238188) (JPMSAL) is a licensed securities dealer

General: Information has been obtained from sources believed to be reliable but JPMorgan does not warrant its completeness or accuracy except with

respect to any disclosures relative to JPMSI and/or its affiliates and the analyst’s involvement with the issuer. Opinions and estimates constitute our judgment

as at the date of this material and are subject to change without notice. Past performance is not indicative of future results. The investments and strategies

discussed here may not be suitable for all investors; if you have any doubts you should consult your investment advisor. The investments discussed may

fluctuate in price or value. Changes in rates of exchange may have an adverse effect on the value of investments. This material is not intended as an offer or

solicitation for the purchase or sale of any financial instrument. JPMorgan and/or its affiliates and employees may act as placement agent, advisor or lender

with respect to securities or issuers referenced in this report. Clients should contact analysts at and execute transactions through a JPMorgan entity in their

home jurisdiction unless governing law permits otherwise. This report should not be distributed to others or replicated in any form without prior consent of

JPMorgan. U.K. and European Economic Area (EEA): Investment research issued by JPMSL has been prepared in accordance with JPMSL’s Policies for

Managing Conflicts of Interest in Connection with Investment Research. This report has been issued in the U.K. only to persons of a kind described in Article

19 (5), 38, 47 and 49 of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2001 (all such persons being referred to as “relevant

persons”). This document must not be acted on or relied on by persons who are not relevant persons. Any investment or investment activity to which this

document relates is only available to relevant persons and will be engaged in only with relevant persons. In other EEA countries, the report has been issued to

persons regarded as professional investors (or equivalent) in their home jurisdiction. Australia: This material is issued and distributed by JPMSAL in Australia

to “wholesale clients” only. JPMSAL does not issue or distribute this material to “retail clients.” The recipient of this material must not distribute it to any third

party or outside Australia without the prior written consent of JPMSAL. For the purposes of this paragraph the terms “wholesale client” and “retail client” have

the meanings given to them in section 761G of the Corporations Act 2001. Korea: This report may have been edited or contributed to from time to time by

affiliates of J.P. Morgan Securities (Far East) Ltd, Seoul branch.

Copyright 2008 JPMorgan Chase & Co. All rights reserved. Additional information available upon request.

Jim Glassman, jglassman@jpmorgan.com, 212-270-0778

30