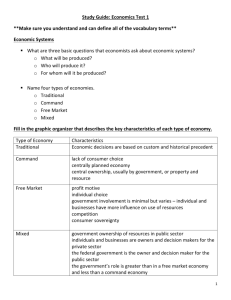

Economic Decision Makers

Economic Decision Makers

ECO 2013

Chapter 3

Households

Play a starring role in a market economy

Determines what gets produced

Supplies labor, capital, natural resources and entrepreneurial ability

Maximize utility

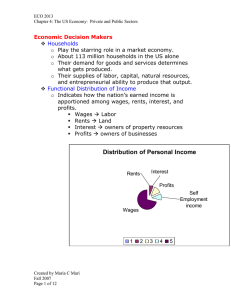

Functional Distribution of Income

Indicates how the nation’s earned income is apportioned among

Wages labor

Rents land

Interest owners of property resources

Profit owners of businesses

Functional Distribution of Income

Distribution of Personal Income

Rents

Interest

Profits

Self

Employment income

Wages

1 2 3 4 5

Personal Distribution of Income

How the nation’s money income is divided among individual households.

Top 20% earn over 50% of the income

Households

Income spent

Personal taxes – 12%

Personal savings – 0%

Personal consumption – 88%

Households

Three categories of spending:

Durable goods

Goods expected to last three or more years

Households

Nondurable goods

Goods such as food and gasoline

Household

Services

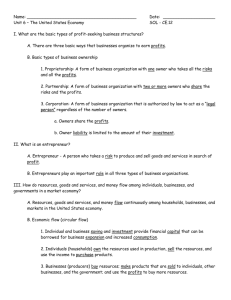

Businesses

Constitute the second major part of the private sector

Is a business organization that owns and operates plants.

Types of Firms

Sole proprietorships

A firm with a single owner who has the right to all profits and who bears unlimited liability for the firm’s debts.

Partnerships

A firm with multiple owners who share the firm’s profits and who bears unlimited liability for the firm’s debts.

Corporations

A legal entity owned by stockholders whose liability is limited to the value of their stock.

Distinct and separate from the individual stockholders who own it.

Government

Extensive role of the public sector

Levels of Government

Federal

State

Local

Role of Government

Providing legal structure

Promoting competition

Regulating monopolies

Redistributing income

Transfer payments

Market invention

Taxation

Reallocating resources

Market failure

Role of Government

Externalities

A cost or benefit that falls on a third party and is therefore ignored by the two parties to the market transaction

Externalities

An externality occurs when some of the costs or the benefits of a good are passed to or spill over to someone other than the immediate buyer or seller.

Negative externality

Production or consumption costs inflicted on a third party without compensation

Environmental pollution

Positive externalities

Benefits

education

Role of government

Public good

A good that once produced is available for all to consume regardless of who pays

National defense

Government structure

Federal

National security

Economic stability

Market competition

State

Public higher education

Prisons

Transportation

Local

Education

protection

Size of Government

Government spending has increased over the years

Government is the green in the chart

1930 – 10% of economy

2004 – 36% of economy

Government Purchase and Transfers

Government purchases

Exhaustive

Directly absorb resources and are part of the domestic output

Transfer payments

Non-exhaustive

Federal Expenditures

Pension and income security

35%

National defense

20%

Health

21%

Interest on debt

7%

Sources of Government Revenue

Taxes

Bulk of government revenues at all levels

Tax principles

Ability to pay principle

Benefits received tax principle

Tax incidence

Distribution of tax burden among taxpayers

Proportional tax

Progressive

Regressive

Marginal tax rate

Types of taxes

Personal income tax

Tax on earnings of individuals

Progressive tax

All but six states have it

Single taxpayer

But not over--

If taxable income is over--

$0

$7,150

$29,050

$70,350

$146,750

$319,100

$7,150

$29,050

$70,350

$146,750

$319,100 no limit

The tax is:

10% of the amount over $0

$715.00 plus 15% of the amount over 7,150

$4,000.00 plus 25% of the amount over 29,050

$14,325.00 plus 28% of the amount over 70,350

$35,717.00 plus 33% of the amount over 146,750

$92,592.50 plus 35% of the amount over 319,100

Types of Taxes

Corporate income tax

Tax on earnings of corporations

Progressive tax

Federal and state

If taxable income (line 30, Form 1120, or line 26, Form 1120-A) on page

1 is:

Over

—

$0

But not over

—

$50,000

Tax is:

15%

Of the amount over —

$0

50,000 75,000 $ 7,500 + 25% 50,000

75,000

100,000

335,000

10,000,000

15,000,000

18,333,333

100,000

335,000

10,000,000

15,000,000

18,333,333

- - - - -

13,750 + 34%

22,250 + 39%

113,900 + 34%

3,400,000 +

35%

5,150,000 +

38%

35%

75,000

100,000

335,000

10,000,000

15,000,000

0

Types of taxes

Sales tax

Tax on purchases of goods and services

Some services excluded

Some goods excluded

Flat rate

State and local government

Types of taxes

Property taxes

Tax on the value of real property

Tax on the value of tangible property

Flat rate

Local governments

Excise taxes

Tax on consumption of specific goods

Alcohol, tobacco, and gasoline

Sin taxes

All levels of government

Level of Government

Federal

Services Provided

National defense

Transfer payments

Transfers to states

Taxes Imposed

Personal income tax

Corporate income tax

Excise taxes

State Public transportation

Welfare

Higher education

Personal income tax

Corporate income tax

Excise taxes

Sales taxes

Local Police and fire protection

Primary and Secondary education

Excise taxes

Property taxes