Discussion of \What Determines Annuity Demand at Retirement"

advertisement

Discussion of

\What Determines Annuity Demand at Retirement"

by Guiseppe Cappelletti, Giovanni Guazzarotti & Pietro Tommasino

Dirk Krueger

University of Pennsylvania, CEPR, and NBER

ECB Conference

June 1, 2010

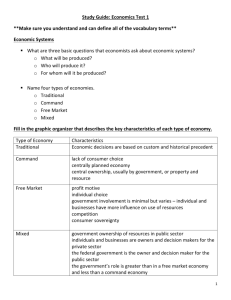

Background

This paper studies empirically the determinants of demand for annuities at retirement.

Theory:

{ Yaari (1965): If price of annuity is actuarially fair, in absence borrowing constraints and bequest motives risk averse households facing longevity risk should fully annuitize their wealth.

{ Brown, Davido and Diamond (2005) generalize this result.

Data:

{ Very few households annuitize private wealth: 70+ in US AHEAD

data: 8% own private annuities

{ Those that do are far from annuitizing it fully: SCF 2004 for 6585 old households: annuitized income (incl. DB pension, soc.

sec)/total income 50%:

Well known lack of annuitization puzzle.

If ever there were a prediction of economic theory that was

blatantly violated by the empirical evidence, it is that of full annuitization.

[Je Brown, NBER Reporter 2004]

Potential Reasons (Poterba 2008)

Demand Side

{ Precautionary demand for liquid wealth

{ Bequest motives

{ Access to public or informal private longevity risk insurance

Supply Side: Prices not actuarially fair (adverse selection, limited competition).

This paper

Uses SHIW data to study annuity demand, for various given prices.

Hypothetical questions posed to households about preferences over

two income streams, starting at age 65, until age of death T

A1

A2W

yi = 1000

y65:1 = W + 500

yi = 500

for i = 65:1; : : : ; T

for i = 65:2; : : : ; T

Question: how many households j state preference A1

A2W for

annuity of 500 over lump sum W; and what Xj correlate with this?

Main Results

Overall stated preferences

A1

A260000

80%

A1

A280000

68%

A1

A2100000

40%

Correlation of annuity demand with observables

Xj

Corr

Probit

Sex

0

0

Mar.

0

0

Kids

0

0

Health

+

+

Age

+

+

-

yd

+

+

Ed.

+

+

a

+

0

Lit.

+

+

-

Comments (I)

Given data on actual purchases of annuities, stated demand seems

large. Should we buy stocks of companies that o er annuities?

De ne

(W; r; T ) = W

PJ

500

j=65 (1+r)j

65 :

Companies should sell if

(W; r; T ) > 0: Risk-neutral, sel sh, non-liquidity constrained households should buy if (W; r; T ) < 0:

Istituto Nazionale di Statistica: in 2009, life expectancy in Italy at age

65 was 83.2 years (males) and 86.7 (females)

x 10

Profits of Issuer, W=100000

4

Zero Line

r=1%

r=4%

r=7%

8

6

Profits

4

2

0

-2

-4

-6

70

75

80

Lifetime Horizon

85

90

95

x 10

Profits of Issuer, W=80000

4

Zero Line

r=1%

r=4%

r=7%

6

4

Profits

2

0

-2

-4

-6

-8

70

75

80

Lifetime Horizon

85

90

95

x 10

Profits of Issuer, W=60000

4

5

Zero Line

r=1%

r=4%

r=7%

Profits

0

-5

-10

70

75

80

Lifetime Horizon

85

90

95

Comments (I)

In terms of pure present discounted values, annuities look good for

W = 60; 000 and 80; 000 (and not so bad for females and males with

higher than average life expectancy).

Perhaps not surprising that a large share of households would want to

buy (especially with risk aversion).

Given the results, why are actual choices so di erent? What is W in

the data?

Comments (II)

SHIW has signi cant panel dimension. Contains additional information

about households to help predict annuity demand.

Examples: might be able to construct measures of permanent income,

income risk, health risk (etc.) that one cannot measure in pure crosssection.

Might help to construct household level empirical proxies for a) precautionary demand for liquid wealth, b) bequest motives c) access to

informal private longevity risk insurance.

Table 1

Response rates in the Survey of Household Income and Wealth

Year

Contacted

Responses

Refusals

Absent units

Ineligible

Gross

Net

response rate response rate

families

units

1989

22,344

8,274

9,427

3,855

788

37.0

38.4

1991

25,210

8,188

6,962

9,481

579

32.5

33.2

1993

15,759

8,089

3,152

2,761

1,756

51.3

57.8

1995

15,606

8,135

3,653

2,510

1,308

52.1

56.9

1998

16,268

7,147

6,441

2,680

1,400

43.9

48.1

2000

20,882

8,001

10,461

2,420

802

38.3

39.8

2002

23,356

8,011

14,179

1,166

476

34.3

35.0

2004

22,018

8,012

12,991

1,015

549

36.4

37.3

2006

18,510

7,768

6,603

4,139

304

42.0

42.7

Note: Ineligible units include the families of persons unknown, dead or emigrated. The gross response rate is the

ratio of responses to contacted families. The net response rate is the ratio of responses to contacted families net

of ineligible units.

Table A1

Panel households of the SHIW, 1987-2006

Year of first interview

1987

1989

1991

1993

1995

1998

2000

2002

2004

2006

Cross-sectional sample size

Percentage of total sample

1987

8027

1989

1206

7068

1991

350

1837

6001

8027

8274

14.6

8188

26.7

22

Year of survey

1993 1995 1998 2000

173

126

85

61

877

701

459

343

2420 1752 1169

832

4619 1066

583

399

4490

373

245

4478 1993

4128

8089

42.9

8135

44.8

7147

37.3

8001

48.4

2002

44

263

613

270

177

1224

1014

4406

2004

33

197

464

199

117

845

667

1082

4408

8011

45.0

8012

45.0

2006

30

159

393

157

101

636

475

672

1334

3811

7768

50.9