PPT - WIPO

advertisement

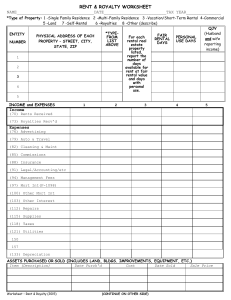

Structure of Financial Terms in a License OPTEON PTY LTD Philip Mendes Level 3, 380 Queen St Director Brisbane QLD, Australia Ph + 61 7 3211 9033 Fax + 61 7 3211 9025 philip@opteon.com.au Benchmarking financial terms . Benchmarking Financial Terms In licenses Structure Amounts What types of financial terms Royalties Milestone Payments 1. Royalty on sales by a licensee X% of sales price Gross sales price; or Net sales price Most common type of royalty provision Royalty is remuneration for quantity of use Greater the quantity of use, the greater the royalty The more sales, the greater the royalty But more to a license than a royalty on sales Clever ways for licensors to increase their remuneration Clever ways for licensees to reduce their royalty overhead 2. Royalty upon sub-license income received by licensee . Licensee grants sub-license Sub-licensee will pay to Licensee Royalties on the sublicensee’s own sales Milestone payments, etc All that income is sub-license income Licensee pays a royalty of Y% to Licensor on all that income Licensor Licensee Sub-Licensee 3. Royalty upon Last Licensee’s Sales Royalty on sale price for which . the last licensee sells product Royalty rate remains fixed, e.g. 2% of sale price of last sale – that is all licensor will receive Licensor might be better off receiving Y% of Sub-license income – might be greater than this 2% - as Licensee will sublicense after value adding and will secure a substantially higher royalty Licensor Licensee Sub-Licensee Buyer 4. Ramped Up Royalties As a product is more successful, and costs reduce, royalty increases Licensor forgoes royalties in early stages, in return for higher royalties later Infrequently seen Cumulative Gross Sales in up to 100m 100m to 250m 250m to 500 over 500m US$m 4.0% 5.0% 6.0% 7.0% 5. Royalty on sales in countries where patent granted Expressed as: “Valid Patent Claim” Sales in country where but for license product would infringe a granted patent That is, you only receive a royalty where sales are made in countries where the sale of a product is protected by a granted patent Traps: No royalties on sales made while patent pending (e.g., delays in examination, opposition proceedings etc) No royalties on sales in countries where patent is not sought, nor granted – ie, if patent in US only, you only get royalties on sales in US 6. Royalty on sales in countries where no patent is granted This royalty often resisted by licensee – “why should I pay a royalty for sales in countries where there is no patent and I have no power to prevent competitors ? Royalty might still fairly be payable: Patent is likely to be taken out in 20 – 25 countries and that may represent 90% - 95% of the world market – so why shouldn’t royalty be paid on sales in remaining countries ? Licensee will select the countries where patent will be sought Result pay full / part royalty, reducing by 50% if a competing product enters the marketplace, if it would have infringed the patent 7. Royalty stacking Can arise in two ways 1. Product to be sold needs license in of complementary technology, e.g., a delivery system another active ingredient a complementary product where both sold together e.g., a vaccine cocktail Sale price of product sold reflects complementary technology as well 2. Freedom to operate – license in patent that is infringed Cannot reduce royalty by whole amount of royalty paid to another person Alternative: in each case, reduce royalty by X% of royalty paid out, up to max of y% reduction on any royalty payment Stack for freedom to operate z% Stack for delivery system y% Royalty x% 8. Royalty Splitting – know how Split royalties so that they are referable to different parts of the IP that is licensed Instead of seeking a royalty of 5%: Royalty of 3% for use of patent Royalty of 2% for use of know how Purpose: If patent is invalidated, license on foot, with a royalty getting a royalty in countries where there are no patents 9. Reach Through Royalties Are royalties Not on a Product derived from your IP Instead, on a product derived from someone else’s IP, but which your IP validated Examples: License of a Mouse Model Mouse Model validates a drug target Therapeutic drug developed that acts on that target Software program – royalties on reagents Catalyst that reduces manufacturing costs 10. Suspending royalties Suspend royalties while revocation proceedings are on foot against a patent Licensee will be concerned that it may be unnecessarily paying royalties if the patent is revoked Licensor will be concerned to receive royalties if patent stands up A middle ground is that royalties are Paid to a trustee Returned to licensee if revocation proceedings successful Paid to licensor if revocation proceedings unsuccessful 11. “Most favoured” royalty Most favoured clause is very common in the case of a non exclusive license Agree on royalty of 10% If licensor later grants a license in the same country to a competing licensee for a lower royalty, that lower royalty will apply in lieu of the 10% royalty Sought by non exclusive licensee to enable it to be better able to compete 12. Royalties on damages Does Licensor get a royalty of X% on damages ? Assume: Cost of Good: $60 Profit Margin: $40 Retail price: $100.00 Royalty: 5% Damages for lost profits: therefore are: $40.00 Should licensor get: 5% of $40.00 ($2); or 5% of $100.00 ($5) ? 13. Lump Sum License Fees Once Only License Fee License fee payable by installments Signing Fee To offset past patent expenses, expenses of doing the deal (travel, legals etc) some part of R & D costs, 14. Minimum Annual Royalty Alternative to performance obligations Performance obligations are obligations that a licensee must meet to continue to be licensed Avoids shelving (non use) of IP Licensor gets no financial return and wants to be able to license someone else Avoids inadequate performance (e.g., no commercialisation in a major market, such as US) Licensor gets inadequate financial return and wants to be able to license someone else 14. Minimum Annual Royalty Examples of performance obligations Pre market entry milestones to be achieved: (a) If following completion of research, more research is needed to bring products to a market ready state, the completion of that research (b) Completion of animal studies (c) Completion of collection of data for lodging IND in USA (d) filing IND in USA (e) Commencement of Phase 1 Clinical Studies (f) Commencement of Phase 2 Clinical Studies (g) Commencement of Phase 3 Clinical Studies (h) Filing of PLA in USA (i) Approval of PLA. in USA (j) First sale anywhere in the world Failure leads to termination 14. Minimum Annual Royalty Examples of performance obligations Sell X quantity of product worldwide by 01.01.05 Or, sell the following quantities (revenues) in the following Territories in the following Periods: Territory USA Europe Period 2003 2004 each year thereafter 2003 2004 each year thereafter Units of Product 1m 1.5m 2m 1.5m 2m 2.5m Failure leads to termination All motivated by Licensor seeking to maximise commercialisation and therefore revenue 14. Minimum Annual Royalty Alternative to performance obligations A Pharma / multinational will not accept performance obligations of these type A large biotech company will not be able to secure those types of performance obligations from a pharma, and so will also not accept them from a licensor Alternative is Minimum Annual Royalties A minimum amount of royalties to be paid Licensee must pay the higher of Actual royalties, or Minimum annual stipulated amount Ramp up the amount year by year If Licensee elects not to pay, termination 15. Minimum Annual Payments Similar concept to Minimum Annual Royalties But refers to all payments payable under the license For example, credit Milestone payments against the minimum payment amount May credit other things Research monies paid Consultancy fees paid 16. Milestone Payments Payments made at identifiable points along the development / regulatory pathway No 1 2 3 Milestone Phase I trials commence Phase II trials commence Phase III trials commence Amount US$ 2000000 5000000 10000000 Pay royalties on what Definition of “Gross Sale Price” Gross / Net – only labels - definition that is important Pay on invoice price Deduct taxes, duties, VAT, GST etc on sale Deduct returns Deduct packaging, freight and insurance Only if separately invoiced Or lump sum deduction, maximum of 3-5% Sales to Related companies – transfer pricing Licenses to Related Companies (with consent) Royalty Rate Methodologies Arriving at the right royalty rate Most reliable method to arrive at a royalty rate Benchmarking combined with DCF Second least reliable method Rules of thumb Least reliable method Statistics and averages 25% Rule Rule of thumb Rule of Thumb As with all Rules of Thumb – need to use with caution May be a starting point only – with justifiable departures Sam Davis, “Patent Licensing”, Patent Law Institute 1958, see Goldscheilder & Marshall, “The Art of Licensing from a Consultant’s Point of View”, Les Nouvelles No 6, 1971 Licensor should receive 25% of the pre tax profits, and the licensee should receive 75% of the pre tax profits. Principle is that a royalty should be 25% of an expected profit margin. Rule used not just to value IP for licensing purposes, but used to assist in determining damages in infringement proceedings. Rule formulated having regard to a study of numerous worldwide licenses negotiated over many years. 25% Rule Operation Relies on knowing the margin for an industry If a margin is generally known or accepted, the 25% can work as a rule of thumb Anticipated Sale Price 400 Anticipated Sale Price 400 Margin 10% 40 Margin 15% 60 25% Rule 10 25% Rule 15 Royalty % 400 10 Royalty % 2.5 Margin / Profits subject to interpretation 400 15 3.75 25% Rule Discounting for early stage Assumes that the IP is market ready Development costs are therefore not taken into account Should licensee pay same royalty rate if IP is market ready / still requiring $100m of development / regulatory costs ? Anticipated Sale Price 800 Margin 20% 25% Rule Royalty 160 40 Discount for early stage 50% 60% 70% 80% 800 40 5 2.5 2 1.5 1 25% Rule How reliable is it ? A starting point, A guide Not an inflexible rule Royalty Source database table – and new study of applicability of 25% Rule “Use of the 25% Rule in Valuing IP Les Nouvelles December 2002 p 123 25% Rule A starting point Once you have a starting point What factors may suggest that the royalty should: Decrease IP not market ready Further R&D Regulatory and compliance matters A highly competitive market High plant production costs High marketing costs Extraordinary capital expenditure that has to be incurred Volatile Margin Increase A robust patent position Access to ongoing know how and trade secrets R&D Program by licensor and prospect of improvements Marketing networks and leads Marketing assistance Proven track record 25% Rule Don’t make that the royalty rate Don’t make the royalty rate 25% of pre tax profits The concept of profit is too easily capable of manipulation Onerous to keep separate accounting records in relation to different products of a business 25% is a rule of thumb, an approach Ascertain the margin Model the revenues and costs Arrive at an amount that represents 25% of margin Apply that as a percentage Adjust upwards or downwards as the circumstances justify Royalties responsive to development costs / risk The more development costs a The more development costs a licensor has incurred, the greater licensee will incur, the lower the return it seeks, the higher the royalty it is prepared to pay royalty it requires Put another Way: The more risk a licensor has taken, the greater the return it seeks Put another Way: The more risk that a licensee takes, the lower the royalty it is prepared to pay Royalties responsive to development costs / risk Research organisation licensors typically get a low royalty rate: compared to the licensee, they take comparatively little risk, and pay comparatively little of the development cost Research organisations may typically pay $500K to $1-2m in research Pharma / multinational licensee will typically pay $25 m to $300 in Further research costs Development costs Regulatory costs Average financial terms in University Biotech Deals Average financial term s in University Biotech Deals in US$ 1980 to 2003 Type of financial term : 1980-1986 Up front fee $20,085 (n=21) Royalties on sales 4% (n=25) Royalties on sub license income 37.4% (n=9) Source: Nature Biotechnology June 2003 p 620 1987 - 1990 $40,655 (n=35) 5.1% (n=43) 34.3% (n=17) 1991 - 1994 $48,649 (n=53) 4.2% (n=62) 28.4% (n=27) 1995- 2003 $87942 (n=24) 3.9% (n=24) 28.4% (n=14) Pathway to Market - Value Discovery Lead Pre-Clinical Phase I V A L U E PATHWAY TO MARKET Phase II Phase III Registration Pathway to Market - Risk Discovery Lead Pre-Clinical Phase I V R A I L S U K E PATHWAY TO MARKET Phase II Phase III Registration Royalties on Therapeutic Drugs . THERAPEUTIC DRUG Technology is at the following stage: Royalty % Milestone payments in US $ 1.Identification of new chemical entity (new compound etc) 3-5 100K – 1m 2.Therapeutic indication based on structure 3-6 200K – 2m 3.In vitro data upon the chemical entity showing a positive therapeutic indication 4-7 300K – 4m 4.Animal studies upon a suitable animal model showing a positive therapeutic indication 5-10 500K – 5m 5.Toxicology studies indicating no adverse toxicological effects 6-12 500K – 8m 6.Commencement of Phase I trials 7.Commencement of Phase II trials 8.Commencement of Phase III trials 9.Product licensed by FDA 6-12 8-15 9-18 12-30 500K – 10m 1m – 25 m 2m – 100m 2 x previous milestones +/- < 20% Clinical Trials . Phase I: Phase II: Phase III: Clinical Trials Testing a new drug or treatment in a small group of people (20-80) for the first time to evaluate its safety, determine a safe dosage range, and identify side effects Drug or treatment is given to a larger group of people (100-300) to see if it is effective and to further evaluate its safety Drug or treatment is given to a larger group of people (1,000-3,000) to confirm its effectiveness, monitor side effects, compare it to commonly used treatments, and collect data Variables impacting upon royalty rates who pays development costs a research organization perceived to be inexperienced will get a comparatively lower rate a product with a small market will attract a small royalty rate (e.g. a rare disease) product with lots of competing products (e.g. headache tablet) likely to attract a small royalty rate product with a large market, and few competitors will attract a very high royalty rate Structure of Milestone Payments No Milestone Amount US$ 1. Phase 1 clinical trials commence anywhere in the world 1,500,000 2. Phase 2 clinical trials commence anywhere in the world 3,000,000 3. PLA approved, but only in respect to the first such approval anywhere in the world 8,000,000 Pre-clinical Milestone Payments Source: Health Advances LLC Analyses of selected Recap reported deals Royalty on Vaccines VACCINE Technology is at the following stage: Royalty % Milestone payments in US$ 1.Identification of antigen 2.Animal studies showing immune response 3.Animal studies showing immune response and protection 4.Toxicology studies indicating no adverse toxicological effects 5.Commencement of Phase I trials 6.Commencement of Phase II trials 7.Commencement of Phase III trials 8.Product licensed by FDA 3-5 4-7 5-8 100K – 2m 250K – 2.5m 500 – 3m 5-10 500 – 3.5m 7-10 7-12 8-15 10-20 750K – 5m 2m – 10m 5m – 15m 2 x all previous milestones +/up to 20% Royalty on Diagnostic product DIAGNOSTIC Technology is at the following stage: Royalty % range Milestone payments in US$ 1.Identification of punitive marker (protein, gene sequence etc) 4-8 for 3-5 years then declining to 15-35% of estimated profit in 5th year after product launch 10-25% of aggregate of total milestone payments 2.Correlation between disease state and marker in small study of 10-20 patients 6-12 for 3-5 years then declining to 25-60% of estimated profit in 5th year after product launch 20-30% of aggregate of total milestone payments on filing PLA with FDA Range of Total: 0-5m 3.Correlation between disease state and marker in large study of 100 patients 8-15 for 3-5 years then declining to 50-75% of estimated profit in 5th year after product launch 50-70% of aggregate of total milestone payments on PLA approval Range of Total: 0-5m Range of Total: 0-5m Royalty rate distribution Licenses by Industry: Probability of Ranges License In 0-2% 2-5% 5-10% Aerospace 50% 50% Automotive 52.50% 45% 2.50% Chemical 16.50% 58.10% 24.30% Computer 62.50% 31.30% 6.30% Electronics 50% 25% Energy 66% Food/Consumer 100% 10-15% 15-20% 0.80% 0.40% >25% 25% 33% General M FG. 45% 28.60% 12.10% Gov't/University 25% 25% 50% Telecommunication/Other 40% 37.30% 23.60% License Out 0-2% 2-5% 5-10% 10-15% 40% 55% 5% Aerospace 20-25% 14.30% Automotive 35% 45% 20% Chemical 18% 57.40% 23.90% 0.50% Computer 42.50% 57.50% 15-20% 20-25% Electronics 50% 15% 10% 25% Energy 50% 15% 10% 25% Food/Consumer 12.50% 62.50% 25% General M FG. 21.30% 51.50% 20.30% 2.60% 0.80% 0.80% Gov't/University 7.90% 38.90% 36.40% 16.20% 0.40% 0.60% Telecommunication/Other 11.20% 41.20% 28.70% 16.20% 0.90% 0.90% >25% 2.60% 0.90% Royalty Source data Royalty upon sub-license income received by licensee Sub-licensee will pay to Licensee Royalties on the sublicensee’s own sales Milestone payments, etc Licensee pays a royalty to Licensor on all that income Up to 50% non pharma Pharma deals: 30% a good result 25% a poor/ fair result 20% a poor result 15% a very poor result . Licensor Licensee Sub-Licensee Benchmarking Royalty Rates Benchmarking Nobody wants to get 3% when the benchmark is 10% Nobody wants to put a deal at risk by demanding 8% when benchmark is 2% Need to know what is the right royalty rates Benchmarking or comparables Something is worth X because something else that is similar to it achieved X in the market place Challenge is whether it is truly comparable No two technologies are identical How similar / different are they ? The greater the similarities the greater the reliance on the comparable deal To benchmark need to source information about deals that concerns comparable IP Sources of information Databases Databases www.recap.com www.pharmaventures.com www.knowledgexpress.com www.royaltystat.com www.royaltysource.com Bioworld Today news archives on www.knowledgexpress.com Recap: best biotech source – contains most deal making information Pharmaventures – mostly press releases Royalty stat and royalty source – broad cross section of industries – compiled from EDGAR Knowledgexpress: Accesses pharmaventures and royaltysource Sources of information Professional Reports Professional reports Intellectual Property Research Associates issues reports on royalty rates for all industries, - fragmented information http://www.ipresearch.com/index.html US $995 US$250 US$1500 Sources of information Professional Associations Licensing Executives Society “Les Nouvelles” Journal www.lesi.org Members can search journal on line Wealth of opinions and observations about royalty rates for different types of industries Techno-L Discussion group Accessible at http://www.autm.net/index_ie.html Searchable archive of queries posted and replies with opinions and views onroyalty rates for different types of industries Sources of Information Press releases and web searches Press releases about deals in a particular industry or dealing with certain categories of products Sources of press releases Archived press releases on the web: http://www.prnewswire.com http://money.cnn.com/ http://www.businesswire.com http://www.prweb.com/ And Google Benchmarking Find comparable deals Ascertain their financial terms Ascertain the things about the deals that are Similar Different Assess the extent to which a deal can be a Comparable Assembles all the comparable deals and form conclusions The closer other deals are, the more reliable they are as benchmarks The further away they are, the less reliable they are