Dagres - Andrew Mitchel LLC

advertisement

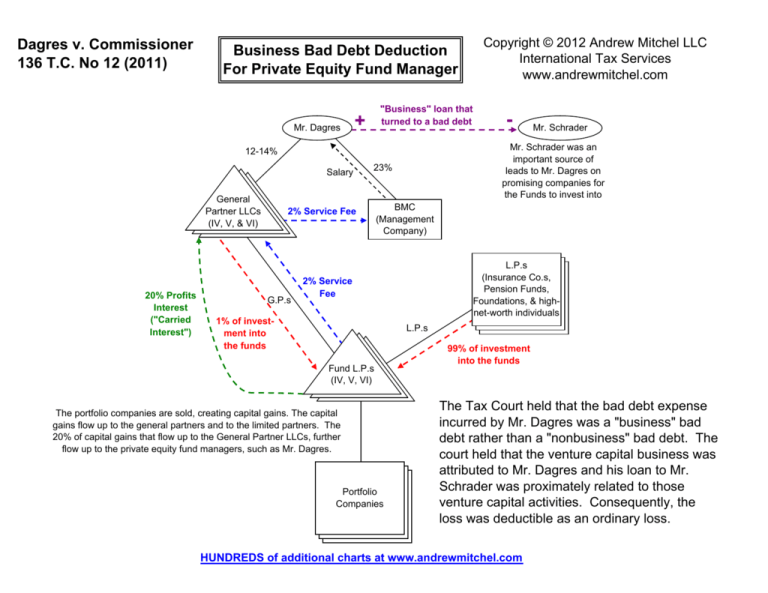

Dagres v. Commissioner 136 T.C. No 12 (2011) Business Bad Debt Deduction For Private Equity Fund Manager Mr. Dagres "Business" loan that turned to a bad debt + General Partner LLCs (IV, V, & VI) 20% Profits Interest ("Carried Interest") 23% 2% Service Fee G.P.s - Mr. Schrader Mr. Schrader was an important source of leads to Mr. Dagres on promising companies for the Funds to invest into 12-14% Salary Copyright © 2012 Andrew Mitchel LLC International Tax Services www.andrewmitchel.com BMC (Management Company) L.P.s (Insurance Co.s, Pension Funds, Foundations, & highnet-worth individuals 2% Service Fee 1% of investment into the funds L.P.s Fund L.P.s (IV, V, VI) The portfolio companies are sold, creating capital gains. The capital gains flow up to the general partners and to the limited partners. The 20% of capital gains that flow up to the General Partner LLCs, further flow up to the private equity fund managers, such as Mr. Dagres. Portfolio Companies 99% of investment into the funds The Tax Court held that the bad debt expense incurred by Mr. Dagres was a "business" bad debt rather than a "nonbusiness" bad debt. The court held that the venture capital business was attributed to Mr. Dagres and his loan to Mr. Schrader was proximately related to those venture capital activities. Consequently, the loss was deductible as an ordinary loss. HUNDREDS of additional charts at www.andrewmitchel.com