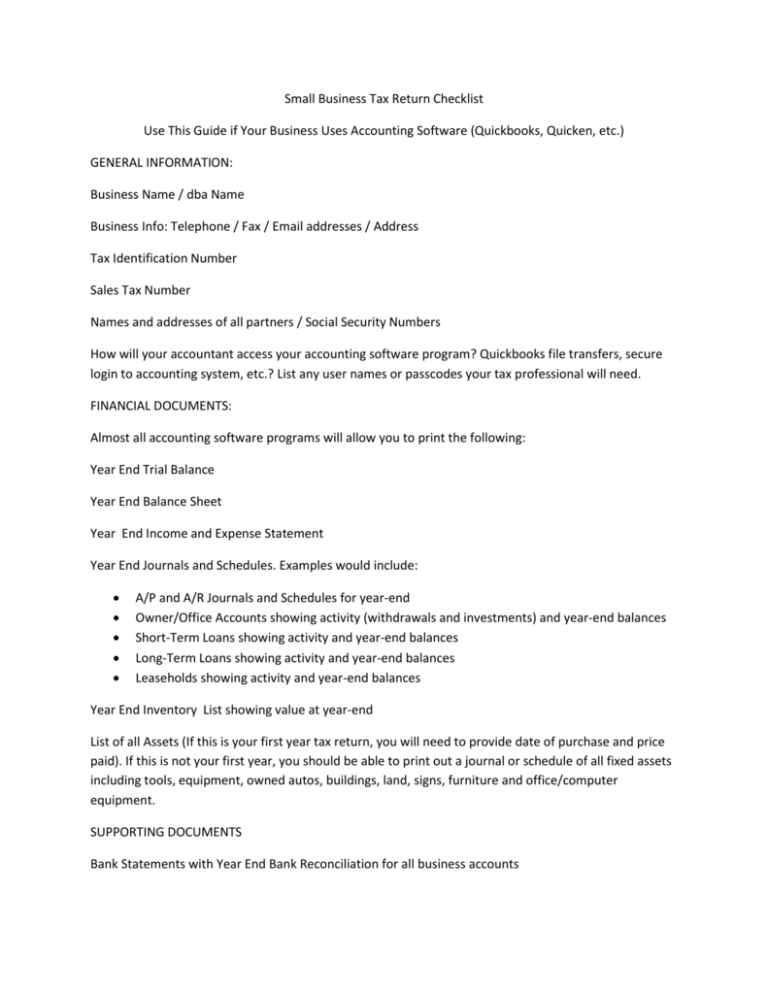

Small Business Tax Return Checklist Use This Guide if Your

advertisement

Small Business Tax Return Checklist Use This Guide if Your Business Uses Accounting Software (Quickbooks, Quicken, etc.) GENERAL INFORMATION: Business Name / dba Name Business Info: Telephone / Fax / Email addresses / Address Tax Identification Number Sales Tax Number Names and addresses of all partners / Social Security Numbers How will your accountant access your accounting software program? Quickbooks file transfers, secure login to accounting system, etc.? List any user names or passcodes your tax professional will need. FINANCIAL DOCUMENTS: Almost all accounting software programs will allow you to print the following: Year End Trial Balance Year End Balance Sheet Year End Income and Expense Statement Year End Journals and Schedules. Examples would include: A/P and A/R Journals and Schedules for year-end Owner/Office Accounts showing activity (withdrawals and investments) and year-end balances Short-Term Loans showing activity and year-end balances Long-Term Loans showing activity and year-end balances Leaseholds showing activity and year-end balances Year End Inventory List showing value at year-end List of all Assets (If this is your first year tax return, you will need to provide date of purchase and price paid). If this is not your first year, you should be able to print out a journal or schedule of all fixed assets including tools, equipment, owned autos, buildings, land, signs, furniture and office/computer equipment. SUPPORTING DOCUMENTS Bank Statements with Year End Bank Reconciliation for all business accounts Payroll backup: W-2 Wage Statements sent to all employees plus W-3 cover sheet 1099s sent to contract laborers Other 1099 (1099-INT for example, etc.) 941 Quarterly Reports State Wage Reports Payroll Ledgers and Journals State specific employee forms 940 FUTA form Any outstanding payroll or taxes due at year-end but not paid Asset purchases documentation – These would be copies of inventory purchased, autos, computers, printers, etc. Your accountant may need to keep a copy of these on file at their office. Health Insurance information – amounts paid by the company for owners and officers Life Insurance Information – amounts paid by the company for owners and officers Employee Retirement Plans – account information. You can get the details for these from your retirement plan company in a year-end format showing all company matched donations, types of plans, etc. Copies of all loans (short and long-term and leases) signed during the tax year Business credit card year end statements, activity for the year, interest paid, etc. Copies of your incorporation documents – Your tax professional will want copies of your articles of incorporation and bylaws to keep on file. NOTE: Depending on your tax professional, more information may be requested.