Adjusting Entries!

advertisement

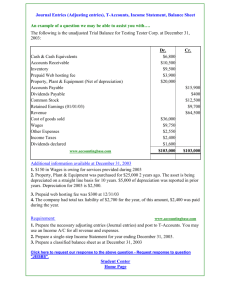

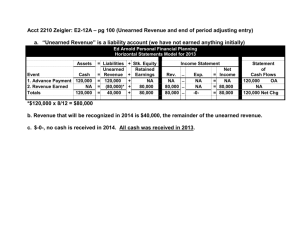

Chapter 8! The Accounting Cycle Work Sheet and Adjusting Process Unit 3 Test (cover chapter 6, 7 and 8, but we will cover only some portion of chapter 8) will be Tue Nov 18. DECA people will write the test on Wed lunch time. Adjusting Entries Typically only senior (or intermediate) accountants would make adjusting entries at the end of the fiscal period. They make entries for revenues and expenses which have been accruing but have not yet been recorded. Adjusting Entry: is a journal entry which assigns an amount of revenue and expense to the appropriate accounting period. Adjusting entries bring a balance sheet accout to its true value. Adjusting Entry There are many different types of adjusting entries accountants make at the end of the fiscal period: Prepaid Expense Prepaid Insurance Supplies adjustment Unearned Revenue Late-Arriving Purchase Invoice Prepaid Insurance Insurance premium is paid for assets (building, car etc) to protect (or insure) against fire, theft etc…. Journal Entry: Purchased auto insurance on July 1 for 1 year policy. Business paid $2400 on July 1. July 1 Prepaid Insurance 2400 Bank 2400 Adjustment on Dec 31, 2013 Insurance Expense 1200 Prepaid Insurance 1200 Prepaid Insurance T account Prepaid Insurance T account (J1) 2400 1200 (D31) 1200 (Ending Balance on Dec 31) Prepaid Expenses An expense is paid in advance to benefit more than one accounting period. Any current asset costs will be used up in the near future. Example: Prepaid Insurance, Licenses, Rent and Advertising Oct 1 you paid $5000 for radio ads which will go on for 5 months. Oct 1 Prepaid Advertising 5000 Bank 5000 Prepaid Expenses Dec 31, you will make an adjusting entry: Advertising Expense 3000 Prepaid Advertising (asset) 3000 Prepaid Advertising (asset) (O31) 5000 3000 (D31) 2000 (Ending balance D31) Adjusting Entry for Unearned Revenue Sometimes customer pays for service on December 15 for the service you will provide in January. Then Revenue Recognition says that accountant must make an adjusting entry because revenue is not earned yet. Adjusting Entry for Unearned Revenue For example, We to Me Care paid $1500 on December 29 2013 for accounting service which will be performed in January 2014. Dr. Cr. Dec 29 Bank 1500 Fees earned (Rev) 1500 Received fee for accounting service from We to Me Adjusting Entry for Unearned Revenue Dec 31 Fees earned 1500 Unearned Revenue (liab) 1500 Adjusting Entry for Unearned Revenue (We to Me) If I did not make the adjusting entry, then my revenue is too high for 2013 Income statement Net Income is overstated. This Unearned Revenue account is a liability to We to Me Care. T account for Unearned Revenue Fees earned (D31) 1500 1500 (D29) 0 (Ending Balance Dec 31) Classwork 1) 2) 3) Answer Review Questions – pg 275 #9, 10, 12, 16, 17, 18, 19, 20 and 21 Pg. 276 Ex #1 and 2(The rest you did not finish yesterday), Ex# 3 and #4,(P277 and P278)