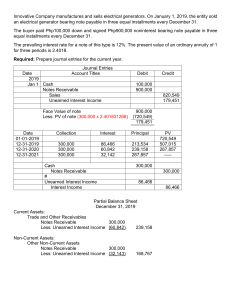

E2-12A

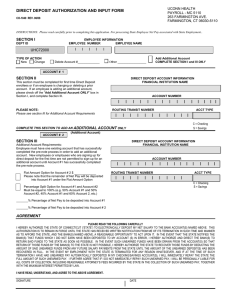

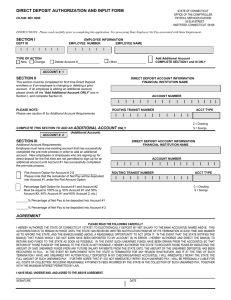

advertisement

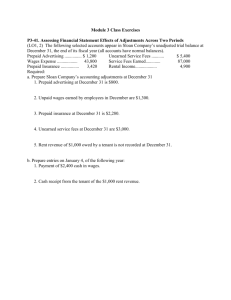

Acct 2210 Zeigler: E2-12A – pg 100 (Unearned Revenue and end of period adjusting entry) a. “Unearned Revenue” is a liability account (we have not earned anything initially) Ed Arnold Personal Financial Planning Horizontal Statements Model for 2013 Assets Event Cash 1. Advance Payment 120,000 2. Revenue Earned NA Totals 120,000 = Liabilities Unearned = Revenue = 120,000 = (80,000)* = 40,000 + Stk. Equity Retained + Earnings + NA + 80,000 + 80,000 Income Statement Rev. NA 80,000 80,000 Exp. NA NA -0- = = = = Net Income NA 80,000 80,000 Statement of Cash Flows 120,000 OA NA 120,000 Net Chg *$120,000 x 8/12 = $80,000 b. Revenue that will be recognized in 2014 is $40,000, the remainder of the unearned revenue. c. $-0-, no cash is received in 2014. All cash was received in 2013.