Textbook - Louisiana Tech University

advertisement

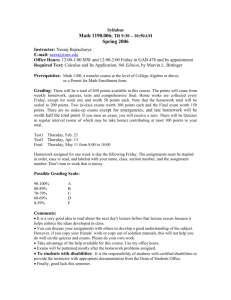

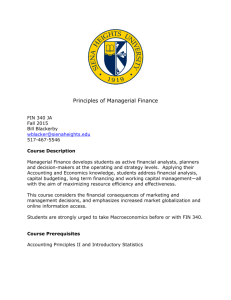

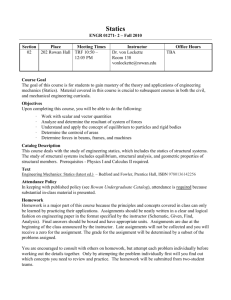

Course Syllabus Finance 485 International Finance Spring 2015, Louisiana Tech University Professor: Office: Office Hours: Office Phone: E-Mail: Qiming Wang, Ph.D, CFA COBB 211 9:00am-12:00pm, Tuesday, Thursday; 1:00-5:00pm, Friday or by appointment (318) 257-3863 qwang@latech.edu Class Time & Location: COBB101, TR, 12:00AM-1:50PM Textbook: Cheol Eun and Bruce Resnick, International Financial Management, 7th edition, McGraw-Hill/Irwin Recommended Reading: Wall Street Journal Course Description and Objectives: This course introduces students to issues and questions which concern financial management of international corporations. The course covers the international aspects of corporate finance, including the international monetary system, balance of payments, foreign exchange markets, international parity conditions, currency derivatives, foreign exchange exposure, world financial markets and global financing, foreign investment, and international capital budgeting. Course Prerequisites: FINC 318 Attendance: Students are expected to attend all class sessions. Attendance will be taken each class period as required by Board of Regents policy. Excessive absences will adversely affect your course grades. Disruptive behaviors, such as talking during lectures, eating or drinking, and using cell phones, etc… will not be tolerated during class meeting. When you miss a class, please ask a classmate (not the instructor) to debrief you and read related material first before talking to the instructor. You are responsible for all missed material. There will be also several assignments as attendance bonus given randomly in class throughout the quarter. Homework: It is essential in this course that you read assigned readings before each class sessions and complete homework assignments for each chapter before we start the next chapter. I will collect 5 homework assignments (5 points each and students are allowed to miss one homework assignment without affecting grades on homework) in class at the due date. No late homework will be accepted. Quizzes: There will be 4 online quizzes. Regardless of the reason for missing a quiz, there will absolutely be no make-up quiz because students are allowed to miss one online quiz without affecting their course grades. 1 Exams: Two exams will be held during class time. Exams are closed book. Part I of an exam will include only multiple choice problems drawn directly from lectures, homework assignments, and on-line quizzes. Part II of an exam will include numerical problems from homework assignments, in-class quizzes, and examples covered in class. Students will be allowed one “cheat sheet” – one side of standard letter size paper (8.5”x11”). There will be no make-up exams. Exams may be rescheduled under very limited circumstances specified by university policy. It is imperative that you notify me before the start of the exam in writing of your intent to miss an exam. This request must be approved by the instructor. Extra Credit: You will receive up to 40 bonus points if you do not miss any of the quizzes, homework assignments, and attendance bonuses. Appealing Process: You should notify me in writing – email is acceptable – of any problems with grading within one week after receiving a graded quiz or exam. I will not address previous quizzes and exams after the one week has passed. Grades and Grading Scale: Final overall course grades are calculated as follows: Activity Points 1. 4 on-online Quizzes 60 + 20 bonus 2. 5 homework (out of 13) 20 + 5 bonus 4. Exam 1 150 5. Exam 2 150 6. Attendance and participation 20 7. Attendance bonus 15 bonus TOTAL……………………………… 400 + 40 bonus With the build-in bonus, I will not curve quizzes and exams. The following scale reflects the minimum grade that you will earn based on your total points. A 360 – 400 points B 320 – 359 points C 280 – 319 points D 240 – 279 points F 0 – 239 points Students with Disabilities: Individuals who have any disability, either permanent or temporary, which might affect their ability to perform in this class, are encouraged to inform the instructor at the start of the semester. Adaptation of methods or testing may be made as required to provide for equitable participation. Campus Emergency Policies: All students should enroll in the Louisiana Tech Emergency Notification System and keep their contacts current on BOSS. In the event of an emergency closing the Tech campus, students are directed to the off-campus Louisiana Tech Moodle site for all course communication and for the continuation of course work. Information on class continuation will be available within these days of the closure. 2 Academic Policies: Students are expected to adhere to the Academic Honor Code established at Louisiana Tech University as discussed in the Louisiana Tech University Student Handbook. Students found guilty of committing acts of academic dishonesty will receive at least an “F” in the course and possible suspension from Louisiana Tech University. Examples of academic dishonesty include, but are not limited to: obtaining exams illegally, possession of exams from previous semesters that have not been released by the department, plagiarism, talking to others during an exam, using unauthorized “cheatsheets” on exams and looking at others’ exam papers. Tentative Course Schedule Thursday, March 12: Foundations of International Financial Management Chapter1, Globalization and the Multinational Firm Chapter 2, International Monetary System Chapter 3, Balance of Payments Quiz 1 ~ Chapter 1-3 Thursday, March 26: The Foreign Exchange Market, Exchange Rate Determination, and Currency Derivatives Chapter 5, The Market for Foreign Exchange Chapter 6, International Parity Relationships and Forecasting Foreign Exchange Rates Chapter 7, Futures and Options on Foreign Exchange Quiz 2 ~ Chapter 5-7 Thursday, April 09, Exam 1, Chapter 1-3, 5-7 Tuesday, April 14: Foreign Exchange Exposure and Management Chapter 8, Management of Transaction Exposure Chapter 9, Management of Economic Exposure Chapter 10, Management of Translation Exposure Quiz 3 ~ Chapter 8-10 Tuesday, April 28: World Financial Markets and Institutions Chapter 11, International Banking and Money Market Chapter 12, International Bond Market Chapter 13, International Equity Market Chapter 14, Interest Rate and Currency Swaps Quiz 4 ~ Chapter 11-14 Thursday, May 14, Exam 2, Chapter 8-10, 11-14 * Please note this is a tentative schedule and changes may be necessary as the quarter unfolds. Some of the above chapters will be covered in more details than others. 3