File - Stephen Kirst

advertisement

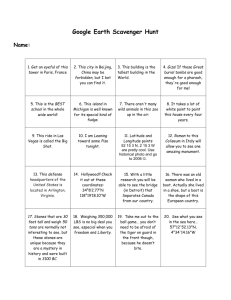

Table of Contents I. Business Description………………………………………………………………………4 A. Elevator Pitch…………………………………………………………………………….4 B. Product Description……………………………………………………………….….4 C. Location and Legal Form of Business………………………………….……..4 D. Organizational Strategy…………………………………………………………….4 II. Industry Analysis and Competitive Advantage………………………………5 A. Industry Overview and Ratio Analysis………………………………………5 B. Competitors and Market Shares…………………………………………….5-6 C. Sustainable Competitive Advantage…………………………………………6 III. Market Analysis and Pricing…………………………………………………………6 A. Target Market and Positioning………………………………………………6-7 B. Market Potential and Sales Forecasting…………………………………7 C. Pricing Strategy………………………………………………………………………7 IV. Resource Needs………………………………………………………………………….7 A. Physical and Technological Resources……………………………………7 B. Supply Chain Network……………………………………………………………7 C. Human Resources…………………………………………………………………..8 D. Start-up Capital………………………………………………………………………9 V. Operations Strategy……………………………………………………………………9 A. Production and Assembly Methods……………………………………….9 B. Capacity Management Plan……………………………………………………9 C. Quality Assurance Plan………………………………………………………….9-10 VI. Compensation Plan……………………………………………………………………10 VII. Financial Analysis………………………………………………………………………10 A. Financial Statements……………………………………………………………10 B. Financial Notes and Assumptions…………………………………………10 C. Financial Ratio Analysis of Business………………………………………10 VIII. Product Commercialization………………………………………………………11 A. Branding………………………………………………………………………………11 B. Sales and Promotions Plan……………………………………………………11-12 C. Inventory Management Plan………………………………………………..12 3 D. Distribution and Retail Location Plan……………………………………12 E. Post Production Quality Assurance Plan………………………………12-13 IX. Growth Strategy………………………………………………………………………13 A. Innovation and Market Growth……………………………………………13 B. Long-term Resource Needs………………………………………………….13 X. Company Valuation…………………………………………………………………13-14 A. Valuation Based on P/S Multiples or NPV…………………………….14 B. Valuation Assumptions………………………………………………………..14 C. Sensitivity Analysis of Valuation………………………………………….14 XI. Conclusion……………………………………………………………………………...14 XII. References………………………………………………………………………………15 XIII. Addendum……………………………………………………………..………………19 4 I. Business Description A. Elevator Pitch: Ask anyone who has ever walked in rain or snow; getting soaked down to your toes is never a pleasant experience. We intend to fix that problem by introducing a fashionable waterproof attachment that prevents any kind of precipitation from entering your shoes. Our product is distinctly unique and fills an existing gap in the market. By meeting our target market’s demand, we are able to create profits, which will be returned to investors. B. Product Description: The product is made up of polyurethane laminate material; a stretchy, waterproof, breathable fabric. It creates a barrier to prevent snow and rain from falling into one’s boots. The top of the product contains an elastic band that stretches around one’s leg, while the bottom is lined with a strip of silicone to adhere to the outside of one’s boot. The material wicks away moisture, keeping socks and the interior of shoes dry. The product will be available in a variety of colors and patterns to provide the wearer with both fashion and functionality. C. Location & Legal Form of Business: We are located in Olympia, Washington because of its close proximity to the city of Seattle as well as its lower prices of conducting business. Forbes listed Washington State as one of the top ten states for conducting business (Forbes, 2014). We have decided to incorporate in Olympia since the customer base in the Pacific Northwest better aligned with our company’s mission and core values. Our location is known for copious amounts of precipitation, which will lead to more sales opportunities in the Pacific Northwest. As a corporation, we are able to incorporate equity into our corporate structure and avoid possible liability. Incorporation also allows us to extend the life of the company beyond that of the founders. D. Organizational Strategy 1. Mission and Vision Statements Our mission is to provide our customers with fashionable products that serve a functional purpose, while emphasizing the importance of being an active member of the community. Our vision is to become a brand that people associate with fashion, function, and social responsibility. 2. Business Strategy: At Étanche, we are committed to providing our customers with a product they want while maintaining a close, active relationship with our immediate community. We plan to have a Total Quality Management operations system that closely monitors every aspect of the production process. This will reduce the amount of excess, unused product and will 5 streamline manufacturing to increase efficiency (Fleming, 2011). We will also ship our products in recyclable packaging.. This could incur short term costs, but through tax credits and a longterm reduction in fixed costs, the integration of these policies contribute significantly to our growth (Small Business Association 2014). We will also have a volunteer service in which our employees will periodically clean up Puget Sound in downtown Seattle. We believe this simple act will inspire others to pursue the prevention of environmental degradation, while improving the overall reputation of our brand. These strategies will provide Étanche with a responsible and ethical way to reach our desired growth and profitability. 3. Triple Bottom-Line People- Étanche cares for its employees by providing health insurance, worker’s compensation, paid personal leave, and above average wages to employees. We cultivate a friendly and inclusive atmosphere through our leadership, our volunteer work, and even our workspace. Étanche works to positively affect everyone it interacts with. Planet- Maintaining a clean environment is the duty of everyone within the community, including businesses that reside and operate within it. As an organization, we not only reduce our carbon footprint by using energy saving light bulbs, but we also actively help to give back to the local community through our Puget Sound cleanup. Profit- As a company we provide a positive impact on the economic environment. We generate a flow of cash that is then spent on the local community. Every event that our company sponsors will have food, bands, and materials purchased from locally owned companies. Étanche strives to work harmoniously with the community in which it operates. II. Industry Analysis & Competitive Advantage A. Industry Overview and Ratio Analysis 1. Since our product is a complement to boots, our company is in the women’s footwear industry. We based many of our decisions, such as market shares, off of women’s footwear. We hope to share customers with brands such as Ugg, Steve Madden, and Ralph Lauren. 2. Figure 2 depicts the industry market shares. B. Competitors and Market Shares: Our company is operating in a monopolistically competitive environment. Our competitors include items such as boot cuffs, boot socks, and plastic boot covers. Boot cuffs are essentially the top part of tall socks that peek out from the top of women’s boots, and are solely worn for fashion purposes. Boot socks are merely tall socks that 6 provide a functional purpose. Lastly, plastic boot covers are plastic covers that go around the entire boot and serve only a functional purpose. The Boot Slip’s design differentiates us from the substitutes in the market. Figure 3 illustrates brands complementary to our product, from which we computed our market share. C. Sustainable Competitive Advantage: Our greatest competitive advantage is our brand name, which signifies functional fashion. Second, we have a competitive advantage in environmental efforts. Once a quarter, our employees will go to Seattle for a company wide cleanup of Puget Sound. Referring to the Five Forces table in Figure 4, our company faces the biggest threats from three of the five forces. Our most significant initial threat would be the availability of substitutes. Even though there are no companies currently making an identical product, it would be easy for someone to buy boot cuffs or socks instead. The functionality of our product will attract customers to buy our product over a substitute. Our second biggest threat is that of new entrants, which our unique product will counteract. Before new entrants arrive, we will build our brand name and a loyal customer base. Finally, there is a small threat of power of buyers due to the fact that our product is dependent upon the current fashion trends of our customers. As the trends change we may be forced to change the design of our product, such as colors, patterns, and size. III. Market Analysis and Pricing A. Target Market and Positioning: To determine our target market we researched individuals who would be interested in buying our product and who aligned with our company values. We believe in meeting customer needs while actively contributing to the community. Females aged 25-35 who live and work in urban areas best match the objectives of our company due their attitudes towards functional fashion and opinions on environmental sustainability. 85% of these individuals belong to an environmental organization, and will be attracted to our Puget Sound clean up and efforts to reduce negative externalities. (Experian, 2011). Additionally, 87% of this group shop online, with over 50% using the Internet as a means to purchase apparel and accessories, which is good since we will sell our product through Amazon.com (Experian 2011). Our research suggests that Étanche will be able to create a connection between this target market and our brand. We will position our product in their mind as one that satisfies both their physical and psychological needs, creating a long-lasting, profitable relationship. 7 Looking at Figure 5, our company plans to position the Boot Slip as a fashionable, multifunctional product. We are confident that our product is fashionable, since the design is similar to the popular boot cuff. While we have found a niche for a product that matches this current trend and serving a functional purpose, our competitors are sacrificing fashion for function or vice versa. B. Market Potential and Sales Forecasting: Market shares and sales forecasting is referred to in Figure 6. Our market share starts out at 1.5%. Companies in our industry currently account for between 1%-5% of the market shares (Euromonitor International, 2015). We plan to enter the market at 1.5% and increase to 3% at the end of year five. Our price starts at $20, marketing it as a brand-name product with a price to match it, and we will continue to sell at this price for the next five years. C. Pricing Strategy: Étanche will implement a penetration strategy in order to gain customers from our competitive substitutes. We are pricing ourselves in between the high end products and the cheaper products. Boot cuffs and similar items can cost anywhere between $10 and $50. It costs $4.95 in variable costs to make a pair Boot Slips, but we are charging $20 for each pair. See Figure 7 for breakeven analysis and comparative prices. IV. Resource Needs A. Physical and Technological Resources: The facility that is needed for our business to properly operate contains three designated areas. One section, the warehouse, is where we keep all of the equipment needed to produce the Boot Slip. There are desks and chairs equipped with sewing machines and paintbrushes in order for the employees to assemble the product. Up the stairs from the warehouse is the office space, where we conduct business. The third and final area in the facility is a holding area for the finished product. Our business will set up a website dedicated to informing potential customers about our product and the mission of the company. On our website there will be a link to our Amazon page which allows customers to purchase our products. Étanche will be using a build-to-stock inventory management model. There will be enough inputs in our facility to fulfill the next two weeks. 6% of each month’s production will be kept in inventory to account for underestimated demand and incidents. B. Supply Chain Network: Our relationship with suppliers and consumers is in our Figure 8 SIPOC diagram. 8 C. Human Resources: Figure 9 displays our company’s organizational structure at the end of Year Two. The three most important employees to our company are our President, Human Resources Director, and our Warehouse Foreman. Our President will represent our company’s mission and vision. The President is the person who our employees will look to for the accepted norms and behaviors in the office. We intend to hire someone who has had at least five years of experience as a manager and who embodies the culture of our company, including our desire to give back to the community. At the end of three years with our company, our President will be allotted a bonus. Our Human Resources Director is the person who will be most involved in the hiring process of employees. They will be vital in ensuring that all of our workers are a good fit within our company. Similar to our President, we require that this employee first have at least five years of experience. At Étanche, our HR Director will also head up the volunteer aspect of our company, including organization of our Puget Sound cleanup days. Our Warehouse Foreman is in charge of confirming that the products we produce meet our quality standards. Their responsibilities include looking over factory workers, programming the embroidery machine, and cutting fabric and elastic for the next day’s work. In our office, we also have an Executive Assistant to directly assist the President. We have one Account Representative, whose responsibility is to create and maintain relationships with current and potential clients. Additionally, we employ an Accounting Coordinator and Accounting Clerk, a Customer Service Representative, and a Marketing Coordinator. All of our office employees will undergo periodic training for new technology developments, strategies, and enhancing leadership skills. In our warehouse, we employ six Sewing Machine Operators, one Embroidery worker who places our brand logo on each pair of Boot Slips, and one Painter who adds the strip of liquid grip. Lastly, we have three packaging and shipment workers. Warehouse workers will have updated training sessions based on new equipment. We want Étanche to be a friendly, close-knit environment. In addition to our volunteer trips, we strive to promote teamwork and camaraderie through company field days, an employee lounge, and an open office space. Every quarter, our warehouse will have a day in which the workers can team up to create and design their own product, whether it is a new Boot Slip or something new. We want our workers to feel appreciated and important, and this provides us with the opportunity to look for internal promotions. Our goal is to promote innovation at every level of our company. 9 D. Start-Up Capital: Our balance sheet is shown in Figure 10. Given our operating costs and liabilities, we have decided to fund our company primarily using debt capital to create our startup capital structure. We, the founders, have decided to keep a controlling interest in the company by investing a total of $50,000 from the liquidation of our personal assets. Approximately $500,000 will be acquired through bank loans and other forms of debt. By doing so, we are able to keep a controlling interest in our company while being able to properly finance it during its start-up phase.. We also expect an investment of approximately $50,000 from venture capitalists who will receive about 10% of our company’s total equity in return for their investment. In total, we will require $600,000 in order to successfully fund our company. V. Operations Strategy A. Production and Assembly Methods: Figure 11 maps out how the product will be assembled, produced, delivered, and distributed. All steps to the right of the dotted line are visible to the customer, which mostly take place in an online environment after the product has been assembled and packaged. Quality checkpoints as well as possible failure points are also listed in the figure. B. Capacity Management Plan: Our retail sales begin in 2016, with expected sales for that year being 120,456 units. Between our fabric cutter, high powered embroidery machine, six sewers, and our painter, we will be able to produce 478 pairs of Boot Slips per day for the first year, and increasing to 516 year two, 742 year three, 802 year four, and 1,299 in year five. We will add the necessary machinery and operators to meet the expected demand for each year. 6% of this output will be placed in finished goods inventory to account for the chance of underestimated demand and mistakes. There will be enough raw materials inventory in our facility for two weeks of production. C. Quality Assurance Plan: The first step in quality assurance starts in the warehouse. Our first priority is to ensure that the material received from our suppliers is waterproof. After our seamstresses have sewn together the Boot Slip, our Warehouse Foreman inspects the completed products to check for issues. We will test sample batches to ensure the final product is still waterproof by placing a Boot Slip around a mannequin leg wearing a rain boot, and then placing it under a shower for five minutes. If any water gets into the boot, it will be poured out and measured. If more than 30 milliliters is poured out, the machines would be checked to find and correct the problem. This assures customers as well as retailers that our product is of good quality. 10 Our website has a page dedicated to assisting customers with any problems they encounter. Customers will be able to submit questions and comments on the website and will receive feedback within 1-2 business days. Customer feedback will be used to improve our products and meet our customers’ needs. As a company, we work hard to meet the eight dimensions of quality. We utilize Total Quality Management to hold ourselves to a higher standard (Fleming, 2011). We will do this by listening to customer feedback given through our website and keeping track of successes and failures. These strategies will make sure operations are constantly improving to meet the needs of our business-to-consumer and business-to-business customers. VI. Compensation Plan: At Étanche, we plan to hold a two-step interview process in order to find employees that best fit our company. First will be an interview with the HR director to ensure the interviewee has the expertise to perform their job and to get a feel for their personality. Those who make it through the first interview will then be asked back to a second step where they meet their potential coworkers. Then the company will hire the candidate who they feel will best fit the company culture. It is essential that the employees share the same values as the company to ensure a long lasting relationship. Étanche strongly believes in positively contributing to the community. This is why we want each employee to have some background in volunteer work and to agree to partake in our volunteer work. Figure 12 displays our staffing chart for Year One. Our company plans on compensating our employees with wages above the average salary for their job position in order to attract dedicated, productive workers. The employees are offered some benefits, but emphasis is placed on our high salaries. We provide five personal days, health insurance, and respective workers’ compensation insurance to all of our employees. Our office workers will also receive two weeks of paid personal leave. VII. Financial Analysis A. Financial Statements: The following figures depict our financial statements: Figure 13-FiveYear Pro-Forma Balance Sheet; Figure 14-Five-Year Pro-Forma Income Statement; Figure 15Five-Year Pro-Forma Statement of Cash Flows. B. Financial Notes and Assumptions: Figure 16 depicts our Financial Notes and Assumptions. C. Financial Ratios Analysis and Assumptions: Figure 17 depicts our 5-Year Financial Ratios. VIII. Product Commercialization 11 A. Branding: At Étanche, we establish our brand through our mission as an organization. Through our image we have developed an association of fashion without compromise, while effectively affirming a standard of quality within the industry and within the mind of our customer. We plan on cultivating this image by maintaining our promise to consistently provide a stylish, functional product that matches the preferences of our clientele. To supplement this image, we have developed and trademarked a logo that exudes the subtle sophistication of the brand and becomes the embodiment of what our company represents. We will place our logo on all of our products, symbolizing the prestige and quality the Étanche name commands, and allowing for immediate recognition by the consumer. The effective execution of these steps will lead to loyalty and will further cement the Étanche name in the fashion industry. B. Sales and Promotions Plan: For our first campaign, we plan to create a pop-up fashion show in downtown Seattle. We want to show potential consumers how the Boot Slip can be worn, emphasizing its fashion appeal. There will be a catwalk where models will display our colorful Boot Slips while wearing all black. They will be walking underneath artificial rain to show off the product’s functionality. Passersby are then welcome to walk on the catwalk sporting our Boot Slip and will be given a complimentary pair. A videographer will document the show, and we will post it on our website and YouTube for viral advertising. We will have signs displaying our hash tag #étanche for people to share their pictures, videos, and comments on social media sites. There will be a Twitter competition for best picture of a Boot Slip being worn, where the winner will receive a complimentary umbrella with our logo that matches the pair of Boot Slips. The Pop-Up Fashion Show will position our product as fashionable yet available to the average person. By including regular people in our fashion show, we are making the product more accessible while remaining stylish. This campaign will be on a flighting schedule. Our second campaign will coincide with two of our Puget Sound Cleanup Days. We will host a community event, where people in the Seattle area can come join us in our cleanup efforts, wearing Boot Slips while cleaning the Sound. Photos and videos will be taken to post on our website. After the cleanup portion, we will surprise our helpers with some fun, including a local band performance and food trucks. Volunteer t-shirts with our logo will be provided as well as some Boot Slip giveaways. Our hash tag for this event will be #ÉtancheOnTheSound. The Puget Sound Community Day will show consumers that we are a philanthropic company who cares about our community and our carbon footprint. During this campaign, we are also providing Boot Slips to our volunteers, highlighting the waterproof function of the product. Additionally, 12 we will purchase the following Google Ads keywords: boot slips, boot cuffs, boot socks, rain boots, rainwear, and Étanche. See Figure 18 for Promotions Budget. C. Inventory Management Plan: In order to accurately and effectively keep track of the component parts and finished goods, a perpetual inventory system will be used. The table shows how much and for how long inventory and safety stock will be held, relying on fast changing trends. The large majority of our finished goods will be sent directly to Amazon’s warehouse. The Boot Slips that are not sent to Amazon will be held in our inventory. D. Distribution and Retail Location Plan: In order to obtain a national reach for our product, we plan to sell exclusively through Amazon. This allows us to reach more of our target market, while alleviating some of the burden of shipping and distribution. Using an online channel also helps us gear our product towards Internet friendly target market we have chosen (Experian, 2011). Once we can present successful sales and brand loyalty to retailers, we will expand to retail stores such as Nordstrom. By selling through a national online retailer, we have an intensive strategy allowing us to reach a higher portion of our target market. The biggest challenge with this strategy is the fact that our competitors will be selling through the same channel. We plan to solve this by having our own informational website and by establishing a strong brand image. E. Post Production Quality Assurance Plan: Creating a fashionable, functional product and customer service are our top priorities at Étanche. We have implemented a hassle-free customer service plan in case of faulty products. The Boot Slip’s first stop after manufacturing and packaging is the Amazon distribution center. If our products arrive late, this would delay shipping to the customer. If this became habitual, Amazon would end our business relationship. Delivering damaged products to Amazon would affect our end-user, since Amazon is unlikely to detect a faulty product. To prevent this, we do many internal inspections before the product leaves the warehouse. 13 After the customer has received our product, a follow-up email will automatically be sent. This email will thank the customer for their purchase, and ask them what opinions they have formed about our product. If the customer received a deficient product, or wishes to return their Boot Slip for any reason, Amazon is responsible for their customer service. Their online returns center provides customers with help pages and details about how to contact us. If they want to return a product, Amazon directs the customer to our online Returns Center. Customers can also contact Étanche’s customer service via phone or e-mail and discuss their concerns. On top of getting a return or refund from Amazon, we would be happy to provide a small gift from the company to ensure our customers are as satisfied as possible. IX. Growth Strategy A. Innovation and Market Growth: After the first five years of business, Étanche will continue its expansion while staying true to its original mission. The consumer and our community are the most important factors in our business decisions. We plan to expand the existing water cleanup efforts across the country as our company grows. This will create more awareness for our brand and demonstrate that Étanche is an active member of the community. In five years, our products will be available for purchase on our own website as well as through retail stores around the United States. Étanche will brainstorm new designs and improvements for the Boot Slip in addition to other fashionable rainwear, such as our own line of umbrellas, boots, and jackets. We will hire designers to help develop new products. B. Long-term Resource Needs: The projected sales of the Boot Slip increase a substantial amount each year as demand for our product increases. New demand requires us to increase the number of employees and the amount of long-term assets needed each year. In order to meet projected demand we will need to purchase sewing machines for the following years: one machine in 2017, two in 2018, one in 2019, and six in 2020. The positions that will need additional hirings after the first year are the fabric cutter, the liquid grip painter, and the elastic cutter. One additional employee of each job will be needed in the last year to keep up with the projected sales for 2020. The last employee and long term asset that needs to be acquired after year one is the embroidering machine and the embroidering operator. Two machines and two operators will be added in 2020. The required resources to create the Boot Slip will not vary much over time. However, if the material does need to change, the process itself would stay the same. X. Company Valuation 14 A. Valuation Based on P/S Multiples of NPV: Figure 19 depicts our Valuation based on P/S Multiples of NPV. B. Valuation Assumptions: In constructing the net present value for Étanche, some assumptions were used to calculate the approximate valuation. Due to the beta of the fashion industry falling below 2, the NPV was calculated by discounting the cash flows for each year, determining the terminal value, and incorporating that into the discounted value for year 5. In the process, a growth rate of 3% was assumed due to the relative maturity of the fashion industry with a discount rate of 25%. From this the NPV, IRR, and MIRR was derived. C. Sensitivity Analysis of Valuation: Figure 20 depicts our Sensitivity Analysis of Valuation. XI. Conclusion: In an era of perpetual evolution within the fashion industry, achieving practicality and style while remaining sustainable and responsible are essential. At Étanche, our dynamic business structure has the capability to match these changing trends and exploit the gaps exposed in the current industry. Through the implementation of our marketing strategy, we effectively differentiate ourselves from the competition and successfully position our product as the seamless combination of style and function to the consumer. Also, by the incorporation of the Total Quality Management operations system, we carefully monitor each aspect of our manufacturing process to reduce wasted time and increase efficiency (Fleming, 2011). Furthermore, by the careful construction of our capital structure, we are able to derive profits from our business that far exceed investments. In addition to the strategies we have developed, we have established a community service objective that takes into consideration both people and planet. In today’s market, Étanche has successfully distinguished itself as a versatile organization that does not pursue any part of the triple bottom line at the expense of another. By investing in our company, you can be a part of a new era of design and comfort and become a part of a long, profitable relationship that inspires the customer to embrace life and nature in style. 15 XII. References 1000 Light Bulbs. (2015, April 13). How many Lumens do I need? Retrieved from http://blog.1000bulbs.com/how-many-lumens-do-i-need/#.VO-D2_nF-So Alibaba. (2015) Paper Box Packaging. Retrieved from Alibaba http://www.alibaba.com/trade/search?fsb=y&IndexArea=product_en&CatId=&SearchT ext=paper+box+packaging Amazon. (2015) Janome HD1000 Heavy-Duty Sewing Machine with 14 Built-In Stitches. Retrieved from Amazon: http://www.amazon.com/gp/product/B001I1IZ2K/ref=as_li_ss_tl?ie=UTF8&camp=1789 &creative=390957&creativeASIN=B001I1IZ2K&linkCode=as2&tag=morldtechgoss-20 Amazon. (2012). Locations, Amazon in North America. Retrieved from Amazon: http://www.amazonfulfillmentcareers.com/amazon-fulfillment/locations/ Anderson, E. T., & Simester, D. (2013). Advertising in a Competitive Market: The Role of Product Standards, Customer Learning, and Switching Costs. Journal Of Marketing Research. Retrieved from http:/www.ebscohost.com Badenhausen, Kurt. (2014, November 12). The Best State For Business and Career. Retrieved from http://www.forbes.com/best-states-for-business/ BestBuy. (2015). Samsung 75” Class LED TV. Retrieved from http://www.bestbuy.com/site/samsung-75-class-74-1-2-diag--led-2160p-smart-3d-4kultra-hd-tv-black/5782163.p?id=1219159695751&skuId=5782163 BizFilings. (2015). Employers' Responsibility for FICA Payroll Taxes. Retrieved from Bizfilings: http://www.bizfilings.com/toolkit/sbg/tax-info/payroll-taxes/employers-responsibilityfica-payroll-taxes.aspx BizMiner. (2015). Industry financial profile: Boot Stores. Retrieved from BizMiner: http://www.bizminer.com/ Board of Governors of the Federal Reserve System. (2015, February 23). Selected Interest Rates (Weekly) - H.15. Retrieved from http://www.federalreserve.gov/releases/H15/current/ Bulbs. (2015). Energy Efficient Bulbs: Energy Saving Calculator. Retrieved from http://www.emeraldinsight.com/doi/pdfplus/10.1108/09590550410546197 16 Butterfly. (2014). Machines:Butterfly 1204B/T Independent Four (4) Head 12 Needle Commercial Embroidery Machine System. Retrieved from http://www.butterflyemb.com/4-head-butterfly-embroidery-machine-b-1204.php City Feet. (2015). 5506 6th Ave S. Retrieved from CityFeet: http://www.cityfeet.com/cont/ForLease/LN18840384/5506-6th-Avenue-S-Seattle-WA98108 Clifton, M. B. (2004). Target costing: market-driven product design. New York: Marcel Dekker. Costco. (2015). Office Furniture. Retrieved from Costco http://www.costco.com Delivery Express. (2015). Local Trucking. Retrieved from http://www.deliveryexpressinc.com/local_trucking.php# Department of Labor and Industries. (2014, November 24). Composite Base Rates by Risk Classification. Retrieved from http://www.lni.wa.gov/ClaimsIns/Files/Rates/2015RatesBusTypeClassCode.pdf Department of the Treasury Internal Revenue Service. (2015).Employer’s Tax Guide. Retrieved from http://www.irs.gov/pub/irs-pdf/p15.pdf Diaper Sewing Supplies. (2015). PUL Fabric by the Yard or Cut. Retrieved from www.com/pulfabric-by-the-yard-or-cut/ Digital Media Law Project. (2013). http://www.dmlp.org/ Eckor, Jason. (2013, November 13). Who Are You Wearing: Fashion’s 39 Most Popular Brands. Cornel Daily Sun. Retrieved from http://cornellsun.com/blog/2013/11/13/who-are-youwearing-fashions-39-most-popular-brands/ Edwards. Ian. (2007, May). Age-Based Internet Usage (MU303). Retrieved from http://ctfiles.glos.ac.uk/mwd/modules/co333/showcase/MU303_07_EdwardsISec.pdf Fleming, Dave (2011). Integrated Functional Systems Operations. Boston Burr Ridge, IL. Frick, E. (2013). Business matters: a freelancer's guide to business success in any economy: strategy, marketing, finance, operations. Laguna Hills, Calif.: XML Press, 2013. Geoselector. (2015). Retrieved from Geoselector: http://www.geoselector.com/default2.aspx Hull, B. (2011). Manufacturing best practices: optimizing productivity and product quality. Hoboken, N.J.: John Wiley & Sons. 17 IBIS world. (September 2014) IBISWorld Industry Report 31621: Shoe & Footwear Manufacturing. Retrieved from IBIS world: http://clients1.ibisworld.com/reports/us/industry/default.aspx?entid=369 Kerpen, D. (2013). Likeable business: why today's consumers demand more and how leaders can deliver. New York: McGraw-Hill. Kim, M., Suresh, N. C., & Kocabasoglu-Hillmer, C. (2013). An impact of manufacturing flexibility and technological dimensions of manufacturing strategy on improving supply chain responsiveness: Business environment perspective. International Journal Of Production Research. Retrieved from http://www.ebscohost.com Kubasek, Nancy. (2013). Dynamic Business Law: The Essentials. New York, New York: The McGraw Hill Companies. Lazboy. (2015). Dawson Sectional. Retrieved from http://www.la-z-boy.com/Product/74249096/ Loopnet. (2015). 873 Hinotes Ct. Retrieved from Loopnote http://www.loopnet.com/Listing/18521553/873-Hinotes-Ct-Lynden-WA/ Mosaic. (2011). Experian. Retrieved from Mosaic, Segments: http://guides.businessstrategies.co.uk/mosaicusa2011/html/visualisation.htm Northwestern University. (2010). Useful lives table. http://www.northwestern.edu/controller/accounting-services/equipmentinventory/useful-lives.html Overstock. (2015). Inspire Q Edmaire Rustic Baluster Weathered Pine Coffee Table. Retrieved from http://www.overstock.com/Home-Garden/INSPIRE-Q-Edmaire-Rustic-BalusterWeathered-Pine-CoffeeTable/9821281/product.html?refccid=H4KDMUPZC6YJ6ASFO6YJSKFG6E&searchidx=0 Payscale Human Capital. (2015). Salaries in Seattle. Retrieved from Payscale: http://www.payscale.com Rego, L. L., Morgan, N. A., & Fornell, C. (2013). Reexamining the Market Share--Customer Satisfaction Relationship. Journal Of Marketing. Retrieved from http://www.ebscohost.com Salary. (2015). International Business Machines Corporation. National Averages. Retrieved from http://www.salary.com/category/salary/ 18 Sew Sassy Fabrics. (2014, September 30). Natural Swimwear Elastics. Retrieved from http://www.sewsassy.com/LycraProducts/Accessories.html Sharma, S. (2014). Manufacturing operations management. New Delhi, India: Ane Books Pvt. Ltd. ; Boca Raton, FL : CRC, Taylor & Francis Group. Squarespace. (2015). Business Pricing. Retrieved from http://www.squarespace.com/pricing/ State Energy Conservation Office. (2015) Average Energy Use Costs Throughout the United States. Retrieved from http://www.seco.cpa.state.tx.us/TEP_Production/c/EPAEnergyStarSmallBusinessGuide. pdf U-Haul Moving. (2015). Large Moving Box. Retrieved February 26, 2015, from http://www.uhaul.com/MovingSupplies/Boxes/Standard-sized-moving-boxes/LargeMoving-Box?id=2753 U.S. Bureau of Labor and Statistics. (2013). Region of residence: Annual expenditures. Retrieved from http://www.bls.gov/cex/2013/combined/region.pdf U.S. Department of Labor. (2009 January). Employment and Training Administration. Retrieved from http://www.taxpolicycenter.org/taxfacts/Content/PDF/state_unemp_rate.pdf United States Plastic Corp. (2015). 1 Gallon Plasti Dip® - Black. Retrieved from http://www.usplastic.com/catalog/item.aspx?sku=38059&gclid=Cj0KEQiA6dGmBRC_3M i-x_XywKsBEiQA1lcFP2FRZ6xEexbBwfjHPYYZ6RmzcfBWP3qd-ODUYlfOd8YaApzb8P8HAQ USPTO. (January 17, 2015). USPTO Fee Schedule. Retrieved from United States Patent and Trademark Office: http://www.uspto.gov/learning-and-resources/fees-andpayment/uspto-fee-schedule U.S. Small Business Administration. (2014) Federal Tax Credits For Energy Efficiency. Retrieved from https://www.sba.gov/content/federal-tax-credits-energy-efficiency Young Ha Leslie Stoel. (2004). Internet apparel shopping behaviors: the influence of general innovativeness. Retrieved from Emerald Insight: http://www.emeraldinsight.com/doi/pdfplus/10.1108/09590550410546197 Yu-Lee, R. T. (2002). Essentials of capacity management. New York: Wiley. Zhao, X., & Xue, L. (2012). Competitive Target Advertising and Consumer Data Sharing. Journal Of Management Information Systems. Retrieved from http://www.ebscohost.com 19 XIII. Addendum Figure 1. Prototype Figure 2. Industry Ratios Figure 3. Industry Market Shares 20 Figure 4. Five Forces Figure 5. Perception Map 21 Figure 6. Sales Forecast Figure 7. Breakeven Analysis Fixed Costs Year 1 Year 2 Year 3 Year 4 Year 5 Advertising $203,958.00 $240,300.00 $346,032.00 $597,944.00 $968,669.00 Salaries $993,640.00 $993,640.00 $1,305,320.00 $1,335,560.00 $1,547,240.00 Rent/Mortgage $8,000.00 $8,000.00 $8,000.00 $8,000.00 $8,000.00 Utilities $10,000.00 $10,200.00 $10,600.00 $10,600.00 $20,000.00 License fees $1,110.00 $0.00 $0.00 $0.00 $0.00 Interest on debt $37,500.00 $31,043.00 $24,103.00 $16,642.00 $8,622.00 Overhead $569,135.00 $577,583.00 $594,479.00 $602,927.00 $695,855.00 Operational expense $2,000.00 $2,000.00 $2,000.00 $2,000.00 $2,000.00 Other overhead $2,000.00 $1,000.00 $1,000.00 $1,000.00 $1,000.00 Total Fixed Cost $1,827,343.00 $1,863,766.00 $2,291,534.00 $2,574,673.00 $3,251,386.00 Variable Costs Year 1 Year 2 Year 3 Year 4 Year 5 PUL Fabric $0.60 $0.60 $0.60 $0.60 $0.60 Elastic Interior $0.40 $0.40 $0.40 $0.40 $0.40 Liquid Grip $0.25 $0.25 $0.25 $0.25 $0.25 Thread $0.00 $0.01 $0.01 $0.01 $0.01 Packaging $0.80 $0.80 $0.80 $0.80 $0.80 Inbound transportation $0.25 $0.25 $0.25 $0.25 $0.25 Outbound transportation $0.15 $0.15 $0.15 $0.20 $0.20 Labor cost (wages) $2.50 $2.50 $2.50 $2.50 $2.50 22 Total Variable Cost $4.95 $4.96 $4.96 $5.01 $5.01 Price $20.00 $20.04 $20.04 $20.24 $20.24 Breakeven Point (quantity) 121,434.28 123,605.02 151,974.61 169,048.29 213,480.01 Breakeven Point ($) $2,428,442.67 $2,476,846.92 $3,045,328.08 $3,421,604.91 $4,320,920.87 Product Price Étanche's Boot slip $20.00 Hunter's Boot Sock $50.00 Pro Shoe Cover $19.75 J-Crew Boot Socks $28.99 Nike Socks $16.00 Figure 8. SIPOC Diagram Suppliers -allbrands.com for sewing machines -butterflyemb.com for embriodery -Diaper Sewing Supplies for PUL fabric -Sew Sassy Fabrics for elastic -United States Plastic Corporation for plastic grip -Squarespace.com -Dongguan Jin Yang Printing Co., LTD -United Postal Service -UHaul for packaging boxes Inputs -Polyurethane laminate fabric -Elastic bands -Plastic grip paint -Warehouse space -Office space -Factory employees -Office employees -Money from investors -Customer orders -Sewing machines -Shipping services -Package materials -Domain name -Webspace -Packing Boxes Process -Physical transformation -Exchange transformation Outputs -Assembled and packaged Boot Slips -Fashion brand/statement -Satisfied employees -Informative website -Environmental Philanthropy Customers B-B -Amazon B-C -Boot wearers -Preteen girls -Teenage girls -Women from rainy or snowy areas -Young professionals -College students -Women who seek out the latest fashions 23 Figure 9. Organizational Chart 24 Figure 10. Initial Funding Balance Sheet 25 Figure 11. Process Flow Chart Measures taken Possible Failures Q1 Q2 Q3 Q3 After receiving raw materials from suppliers, the materials are inspected to ensure that they are suitable to use in production. Besides checking for damaged materials, we will be testing to make sure fabric received is indeed waterproof. After each Slip is assembled, it will be inspected for durable seams, proper embroidery, and properly painted plastic grip, and water resistant. After passing the first two quality checks, we inspect the packaged product to make sure it is ready to be shipped to the customer. F1 F2 F3 F4 Receiving faulty fabric Technical malfunctions could arise with the use of an embroidery machine. We plan to counteract this by training our Warehouse foreman on the machine. This point in the process could be a failure if shipping is not on schedule. This point in the process could be a failure if shipping is not on schedule. 26 Figure 12. Staffing Chart 27 Figure 13. Five Year Pro-forma Balance Sheet 28 Figure 14. Five Year Pro-forma Income Statement 29 Figure 15. Five Year Pro-forma Statement of Cash Flows 30 Figure 16. Notes to Financial Statements 1a. Our product is made up of 3 different raw materials which are the Fabric, Liquid Grip, and Elastic Interior. The Fabric cost $0.60 per pair which is based on $9 per 3x5 feet of pull fabric (Diaper Sewing Supplies, 2015). 1b. Next is the Liquid Grip, this cost came from One Gallon Grip costs $66 with 128 ounces in a gallon. It’s half an ounce per pair, which comes out to $0.25 (United States Plastic Corporation, 2015). 1c. The Elastic Interior cost came from $0.32 per yard divided by 3 (so it’s per foot). We then multiply that by two because we use two feet per pair, which comes out to $0.21 (Sew Sassy Fabrics, 2014). 2. It costs $0.80 per pair of Boot Slips because it costs $0.75 per each individual pair’s box and $1.35 for each big box that can fit 24 individual boxes (Alibaba, 2015). 3. Our Salary Expense comes from the combination of our Office Workers and our Factory Workers. Each Factory Worker makes $30,240 while the Foreman makes $50,000. The Office consists of 8 workers ranging from the President who makes $160,000 annually down to the Customer Service Manager who makes $55,000 annually (Payscale Human Capital, 2015). 4. The website costs $24/month. Since we’ll be running it for 12 months a year, the annual cost is $288 (Square Space, 2015). 5. In our first year we had to purchase multiple business licenses in order to become a corporation. We also had to purchase patents for the design on our product and trademark our logo (USPTO, 2015). 6. Our company decided to use 5% of annual revenue for our advertising. 7. We are shipping our products through Amazon who takes 15% of total revenue. We add this along with $480 to sell through the website (Amazon, 2012). 8. Our Equipment costs $20,000 for an embroidery machine and $300 or $5,900 for each sewing machine. Over the years we increased sewing machines in order to meet demand (Amazon, 2015) (Butterfly, 2014). 9. Our overhead consists of our rent, the foreman’s salary, manufacturing utilities, supplies for operating the manufacturing process, and safety costs (State Energy Conservation Office, 2015). 10. We’re shipping from Olympia, Washington to DuPont, Washington that is only a 16 minute drive. There is an Amazon distribution center in DuPont where all of our products will be shipped (Delivery Express, 2015). 11. The appliance expenses come from desks, chairs, computers, and computer programs that will be used in the office and factory (Cosco, 2015). 12. We intend to pay our executives a 3-year bonus of $701,483 and a 5-year bonus to the factory workers of $161,680. 13. At the end of our 5th year we decided to purchase our factory due to our financial capability and in order to save money opposed to paying rent every year (City Feet, 2015). 14. Our sales are based off of our potential target markets multiplied by the price of our product. 15. See cash budget. 16. We assume that 1/12 of the entire year’s sales will be leftover in finished goods for the following year. 17 The next two months of projected units demanded are kept as raw materials. 18. We have multiple costs associated with plant and equipment. a. Purchasing standard sewing machines at $300 per each unit for the first two years (2016-2017). b. Purchasing newer sewing machines at $5,900 per each unit for the final three years. (2018-2020) c. Purchasing embroidering machines at $20,000 per each unit. d. Rent is equal to $25,000 per month as per (http://www.cityfeet.com/) 19. Multiple costs associated with furniture and fittings. a. 8 Desks at $750 each. (http://www.costco.com/) b. 8 Chairs at $300 each. (http://www.costco.com/) c. 8 Computers at $400 each. (http://www.costco.com/) d. $400 for misc. products. 20. Multiple costs associated with office supplies. a. 2 Printers at $750 each. (http://www.costco.com/) b. 1 Fax Machine/Copier at $750 each. (http://www.costco.com/) c. $5,250 for maintenance and miscellaneous supplies. (http://www.costco.com/) 21. Employee Lounge a. 2 Dawson Section Couches at $4,395 each (www.la-z-boy.com) b. 1 Weathered Pine Coffee Table for $800 (Overstock.com) c. 1 65’ Sony LED Smart TV for $5,,000 (www.BestBuy.com) d. We spent $1,666 on miscellaneous goods 22. 2 Cars at $37347 each (http://www.carmax.com/) 23. For cost of patents and trademarks, we used USPTO and found a price $1,110. 24. Using Straight-Line-Depreciation and given a 10-year usable life span, we calculated out depreciation. th 31 25. To find packing and Amazon distribution, we took 15% of total revenue as Amazon’s portion and took the sum of total packing expenses per year. 26. Considering a 7-year payment period and a 7.5% interest rate. 27. Multiply our revenue by Washington state’s corporate interest rate of .00215% per year. 28. Considering the sum of leave and health benefits for each individual employee. a. Annualized by dividing yearly total by 12 (For total months per year) 29. Long-term bank loan less the current maturity for the current year. 30. Founders and venture capitalists will purchase 5021 and 2510 shares respectively valued at $25 par value. 31. Retained earnings as a running total of our net income over a 5-year span. 32. Amortization for Statement of Cash Flows was calculated by subtracting one years current maturity by the subsequent years current maturity. 33. Depreciation for Statement of Cash Flows was calculated by subtracting Accumulated Depreciation from its previous year of Accumulated Depreciation. 34. Change in Taxes Payable for the Statement of Cash Flows was calculated by subtracting one years taxes payable by the subsequent year. 35. We calculated the change in Wage Expense for the Statement of Cash Flows by subtracting one years wage expense by the subsequent year. 36. Change in Other Current Liabilities for the Statement of Cash Flows was calculated by the current liabilities of one year subtracted by the sum current liabilities of the next. 37. Change in Inventory for the Statement of Cash Flows was calculated by subtracting the inventory of one year by the inventory of the next. 38. Change in Investment in Fixed Assets for the Statement of Cash Flows was calculated by summing the fixed of one year and subtracting the summed fixed assets of the previous years. 39. Employee taxes calculated through (http://www.payscale.com/) Figure 17. Five-Year Financial Ratios 32 Figure 18. Promotions Budget Figure 19. Revenue Projections and Industry P/S & Pro forma Cash Flows and Weighted Average Cost of Capital 33 Figure 20. Sensitivity Analysis 34