Anti-Money Laundering Compliance Overview

advertisement

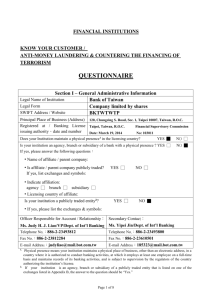

miller &chevalier Chartered Anti-Money Laundering Compliance Overview Michael L. Burton James G. Tillen Miller & Chevalier Chartered May 18, 2005 WHAT IS MONEY LAUNDERING? “Process by which one conceals the existence, illegal source, or illegal application of incomes, and disguises that income to make it appear legitimate” Money laundering represents between 2 and 5 percent of global gross domestic product ($800 billion to $2 trillion annually) 2 THE U.S. ANTI-MONEY LAUNDERING FRAMEWORK Money Laundering Control Act Bank Secrecy Act USA PATRIOT Act 3 MONEY LAUNDERING CONTROL ACT (“MLCA”) Transfers of money derived from specified (“predicate”) offenses Transactions with proceeds of specified offenses Similar to mail fraud and wire fraud 4 PREDICATE OFFENSES Literally hundreds of predicate offenses Traditional organized crime offenses: murder, arson, robbery, extortion, drug trafficking, RICO, etc. White collar crimes: fraud and other financial crimes Violations of international regulatory regimes: FCPA, export control violations, customs violations, foreign law (e.g., currency controls) (note: PATRIOT Act additions) 5 MLCA: PENALTIES Criminal penalties = imprisonment up to 20 years and/or fines totaling the greater of $500,000 or twice the value of the property involved in the transaction Civil penalties = greater of $10,000 or the value of the property involved in the transaction 6 BANK SECRECY ACT (“BSA”) Reporting and record-keeping obligations for “financial institutions” Pre-PATRIOT Act generally targeted only activities of banks PATRIOT Act expanded definition of “financial institutions” Suspicious transaction reporting requirements for certain financial institutions Cash reporting (>10K) for nonfinancial trades and business 7 BSA: PENALTIES Criminal penalties = up to 10 years imprisonment and/or $1 million fines Civil penalties = the greater of amount involved in transaction (not to exceed $100,000) or $25,000 $500 for negligent violations ($50,000 for pattern of negligence) up to $1 million in cases of international counter money laundering violations 8 BSA: FINANCIAL INSTITUTIONS Financial institutions (including PATRIOT Act additions) an insured bank (as defined in the Federal Deposit Insurance Act) a commercial bank or trust company a private banker an agency or branch of a foreign bank in the U.S. any credit union a thrift institution an SEC-registered broker/dealer a securities or commodities broker/dealer (including introducing brokers) 9 BSA: FINANCIAL INSTITUTIONS (cont’d) an investment banker or investment company a currency exchange an issuer, redeemer, or cashier of traveler’s checks, checks, money orders, or similar instruments an operator of a credit card system an insurance company a pawnbroker a loan or finance company a travel agency a licensed money-sender or others that engage in the business of transferring money 10 BSA FINANCIAL INSTITUTIONS (cont’d) a telegraph company a business engaged in vehicle sales a real estate broker a casino the U.S. Postal Service and other U.S. government agencies carrying out similar functions any futures commission merchant, commodity trading advisor, or commodity pool operator registered, or required to register under the Commodity Exchange Act (added by the PATRIOT Act) 11 BSA FINANCIAL INSTITUTIONS (cont’d) a dealer in precious metals, stones, or jewels others designated by regulation 12 RECENT U.S. ANTI-MONEY LAUNDERING DEVELOPMENTS: USA PATRIOT ACT Passed on October 26, 2001 Expanded BSA requirements to many more financial institutions Expanded predicate offenses to include violations of international regulatory regimes 13 PATRIOT ACT AMENDMENTS TO BSA Prohibits and regulates certain types of accounts relationships with financial institutions Expanded suspicious activity reporting requirements Expanded requirements for anti-money laundering compliance programs 14 PATRIOT ACT AMENDMENTS TO BSA (cont’d) Anti-money laundering (“AML”) compliance program – 4 required elements: Internal policies, procedures, and controls Designated compliance officer Ongoing training program for employees Independent audit function to test the program 15 PROPOSED AML COMPLIANCE PROGRAM FOR DEALERS On February 21, 2003, Treasury issued a notice of proposed rulemaking, which would require dealers in precious metals, stones, or jewels to implement an AML compliance program Sought public comment on rules No action by Treasury for past two years In March 2005, FinCEN issued its 2004 Annual Report; noted that it planned to finalize rules this year 16 PROPOSED AML COMPLIANCE PROGRAM FOR DEALERS (cont’d) Applies to “dealers”: person engaged in business of purchasing and selling jewels, precious metals, or precious stones who, during the prior year: Purchased more than $50,000 jewels, metals, or stones; or Received more than $50,000 in gross proceeds from transactions in jewels, metals, or stones 17 PROPOSED AML COMPLIANCE PROGRAM FOR DEALERS (cont’d) Exceptions to definition of dealer: Retailer, i.e., a person engaged in sales to the public other than a retailer who, during the prior year, purchases more than $50,000 in jewels, metals or stones from non dealers Persons who engage in transactions for purposes of fabricating finished goods that contain minor amounts of jewels, metals, or stones 18 PROPOSED AML COMPLIANCE PROGRAM FOR DEALERS (cont’d) Jewel includes organic substances that have marketrecognized gem level of quality, beauty, or rarity Precious metal: Gold, iridium, osmium, palladium, platinum, rhodium, ruthenium or silver, having a level of purity over 500 or more parts per thousand; and An alloy containing 500 or more parts per thousand, in the aggregate, of two or more metals listed above “Precious stone” includes inorganic substances that have a market-recognized gem level of quality, beauty, or rarity 19 PROPOSED AML COMPLIANCE PROGRAM FOR DEALERS (cont’d) Program requirements: Approved by Senior Management and in writing Incorporate policies that address the entity’s risk Incorporate policies to identify transactions that may involve use of the dealer to facilitate money laundering an terrorist financing Reflect BSA requirements (noted that only reporting of cash transactions currently apply to dealers) 20 KEYS TO MONEY LAUNDERING PREVENTION “Know-your-customer” (KYC) principles Customer and counterpart identification Customer and counterpart due diligence Screening against government lists (i.e., OFAC) Transactional alertness Screen transactions for red flags Payment restrictions Limit or prohibit cash transactions 21 KEYS TO MONEY LAUNDERING PREVENTION: RED FLAGS Purchases or sales that are unusual for customer or supplier Unusual payment methods, such as large cash transactions or payments from third parties Attempts by customer or supplier to maintain high degree of secrecy Purchases or sales that are not in conformity with standard industry practice 22 RED FLAGS (cont’d) Counterpart is reluctant to provide adequate identification information when making a purchase Counterpart provides inaccurate identification information Transactions that appear to be structured to evade reporting requirements (e.g., a series of transactions under $10,000) Counterpart presence in NCCT or country that is the subject of advisories issued by FinCEN 23 COMPLIANCE BASICS Make the commitment Identify the risks Develop compliance systems to manage risks Implement compliance processes Designate compliance “gatekeepers” Train personnel Monitor compliance – people, paper, process 24 CONTACT INFORMATION Michael L. Burton James G. Tillen Miller & Chevalier Chartered 202-626-5800 (main) mburton@milchev.com jtillen@milchev.com 25