Do you agree that the cost benefit rule conflicts with our traditional

advertisement

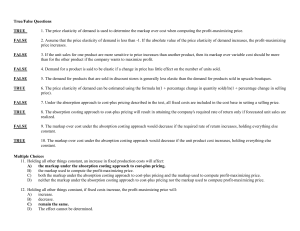

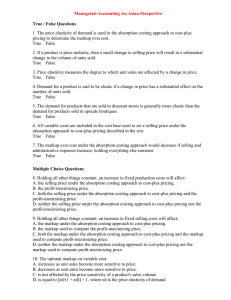

Do you agree that the cost benefit rule conflicts with our traditional principles of “never give up” and “go for it”? 1. Yes 2. No 50% 1 50% 2 Do all companies such as RealNetworks, Inc. use cost-benefit analysis for decisionmaking? 1. Yes 2. No 50% 1 50% 2 Do you think that the cost-benefit approach to help in selecting alternatives is a complex process? 1. Yes 2. No 50% 1 50% 2 Do you think that computers and software can help in performing cost-benefit and differential analysis for decision-making? 1. Yes 2. No 50% 1 50% 2 Do companies like RealNetworks, Inc. ever choose the wrong alternative using costbenefit analysis and differential analysis? 1. Yes 2. No 50% 1 50% 2 Differential cost is the amount of increase or decrease that is expected from a course of action as compared with an alternative. 1. True 2. False 50% 1 50% 2 When using differential analysis to lower selling prices for special short-run decisions, the minimum short-run price is set high enough to cover all variable costs. 1. True 2. False 50% 1 50% 2 An opportunity cost appears as a part of historical accounting data. 1. True 2. False 50% 1 50% 2 In a demand-based method, if there is a high demand for the product, then the price may be set low. 1. True 2. False 50% 1 50% 2 Managers using the cost-plus methods price the product in order to achieve a target profit. 1. True 2. False 50% 1 50% 2 When managers add to the cost of a product it is called a net gain. 1. True 2. False 50% 1 50% 2 A production bottleneck occurs at the point in the process where the demand for the company’s product exceeds the ability to produce the product. 1. True 2. False 50% 1 50% 2 Costs that have been incurred in the past and are not relevant to the decision are called 25% 1. 2. 3. 4. 25% 25% 25% fixed costs variable costs sunk costs committed costs 1 2 3 4 The analysis that focuses on the effect of alternative courses of action on the relevant revenues and costs is called 25% 25% 25% 25% 1. variance analysis 2. income statement analysis 3. performance analysis 4. differential analysis 1 2 3 4 Differential analysis can be used to analyze which of the following alternatives? 1. Leasing or selling equipment 2. Discontinuing an unprofitable segment 3. Manufacturing or purchasing a needed part 4. All of these choices 25% 1 25% 2 25% 3 25% 4 The amount of income that is foregone from an alternative use of an asset, such as cash, is called a(n) 25% 1. 2. 3. 4. 25% 25% 25% opportunity cost sunk cost fixed cost contribution margin 1 2 3 4 Which of the following is not a cost concept used in applying the cost-plus approach? 25% 1. 2. 3. 4. 25% 25% 25% Total cost Sunk cost Product cost Variable cost 1 2 3 4 Using the total cost concept, all the cost of manufacturing a product 1. 2. 3. 4. less the selling and administrative expenses gives the cost amount to which the markup is deducted plus the selling and administrative expenses are included in the cost amount to which the markup is deducted plus the selling and administrative expenses are included in the cost amount to which the markup is added less the selling and administrative expenses gives the cost amount to which the markup is added 25% 1 25% 2 25% 3 25% 4 The formula for the markup percentage under the product cost concept is 1. 2. 3. 4. desired profit divided by total costs desired profit plus total selling and administrative expenses divided by total manufacturing costs desired profit plus total fixed costs divided by total variable costs desired profit less total selling and administrative expenses divided by total manufacturing costs 25% 1 25% 2 25% 3 25% 4 Which of the following is not a cost-plus method? 25% 25% 25% 25% 1. Total cost concept 2. Product cost concept 3. Variable cost concept 4. Demand-based method 1 2 3 4 A method that combines market-based pricing with a cost-reduction emphasis is 25% 25% 25% 25% 1. target costing 2. activity-based costing 3. variable costing 4. product costing 1 2 3 4 The theory of constraints (TOC) is a manufacturing strategy that focuses on 1. 2. 3. 4. reducing variable costs for products reducing the influence of bottlenecks on a process maximizing operating efficiency in the manufacturing process earning the maximum net income for a company 25% 1 25% 2 25% 3 25% 4