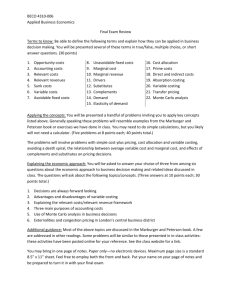

Managerial Accounting An Asian Perspective True / False Questions

advertisement

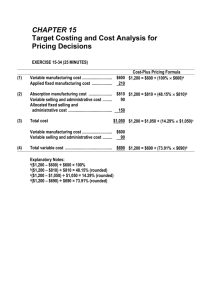

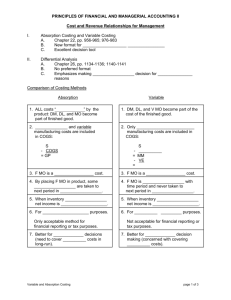

Managerial Accounting An Asian Perspective True / False Questions 1. The price elasticity of demand is used in the absorption costing approach to cost-plus pricing to determine the markup over cost. True False 2. If a product is price inelastic, then a small change in selling price will result in a substantial change in the volume of units sold. True False 3. Price elasticity measures the degree to which unit sales are affected by a change in price. True False 4. Demand for a product is said to be elastic if a change in price has a substantial effect on the number of units sold. True False 5. The demand for products that are sold in discount stores is generally more elastic than the demand for products sold in upscale boutiques. True False 6. All variable costs are included in the cost base used to set a selling price under the absorption approach to cost-plus pricing described in the text. True False 7. The markup over cost under the absorption costing approach would decrease if selling and administrative expenses increase, holding everything else constant. True False Multiple Choice Questions 8. Holding all other things constant, an increase in fixed production costs will affect: A. the selling price under the absorption costing approach to cost-plus pricing. B. the profit-maximizing price. C. both the selling price under the absorption costing approach to cost-plus pricing and the profit-maximizing price. D. neither the selling price under the absorption costing approach to cost-plus pricing nor the profit-maximizing price. 9. Holding all other things constant, an increase in fixed selling costs will affect: A. the markup under the absorption costing approach to cost-plus pricing. B. the markup used to compute the profit-maximizing price. C. both the markup under the absorption costing approach to cost-plus pricing and the markup used to compute profit-maximizing price. D. neither the markup under the absorption costing approach to cost-plus pricing nor the markup used to compute profit-maximizing price. 10. The optimal markup on variable cost: A. increases as unit sales become more sensitive to price. B. decreases as unit sales become more sensitive to price. C. is not affected by the price sensitivity of a product's sales volume. D. is equal to [ed/(1 + ed)] + 1, where ed is the price elasticity of demand. 11. Demand for a product is said to be elastic if a change in price has: A. no effect on the volume of units sold. B. substantial effect on the volume of units sold. C. little effect on the volume of units sold. D. little effect on the volume of units produced. 12. The more sensitive customers are to price, A. the smaller (in absolute value) is the price elasticity of demand. B. the more inelastic is the demand for a product. C. the larger (in absolute value) is the price elasticity of demand. D. the more likely price elasticity of demand will be greater than +1. 13. The optimal selling price for a product depends A. only on the variable cost per unit. B. only on the sensitivity of unit sales to changes in price. C. on the level of total fixed costs and the variable cost per unit. D. on the variable cost per unit and the sensitivity of unit sales to changes in price. 14. Holding all other things constant, if the unit sales increase, then the markup under absorption costing will: A. increase. B. decrease. C. remain the same. D. The effect cannot be determined. 15. Firestack Company's management believes that every 5% increase in the selling price of one of the company's products results in a 13% decrease in the product's total unit sales. The variable production cost of this product is $37.50 per unit and the variable selling and administrative cost is $4.30 per unit. The product's profit-maximizing price according to the formula in the text is closest to: A. $46.98 B. $49.32 C. $64.34 D. $65.13 16. Gorsche Company's management has found that every 3% increase in the selling price of one of the company's products leads to a 8% decrease in the product's total unit sales. The product's absorption costing unit product cost is $11.50. The variable production cost of the product is $6.20 per unit and the variable selling and administrative cost is $1.00 per unit. According to the formula in the text, the product's profit-maximizing price is closest to: A. $11.15 B. $11.91 C. $19.65 D. $17.82 17. Innes Company recently changed the selling price of one of its products. Data concerning sales for comparable periods before and after the price change are presented below. The product's variable cost is $23.20 per unit. According to the formula in the text, the product's profit-maximizing price is closest to: A. $44.10 B. $25.23 C. $40.95 D. $44.71 18. Epler Company's management believes that every 3% decrease in the selling price of one of the company's products leads to a 8% increase in the product's total unit sales. The product's price elasticity of demand as defined in the text is closest to: A. -1.29 B. -2.87 C. -3.83 D. -2.53 19. Harvey Company recently changed the selling price of one of its products. Data concerning sales for comparable periods before and after the price change are presented below. The product's price elasticity of demand as defined in the text is closest to: A. -1.98 B. -1.78 C. -2.40 D. -1.92 20. The following information is available on Product A: The company uses the absorption costing approach to cost-plus pricing described in the text. Based on these data, the total selling and administrative expenses each year would be: A. $240,000 B. $300,000 C. $140,000 D. $200,000 21. Kirby, Inc., manufactures a product with the following costs: The company uses the absorption costing approach to cost-plus pricing described in the text. The pricing calculations are based on budgeted production and sales of 19,000 units per year. The company has invested $580,000 in this product and expects a return on investment of 14%. The selling price based on the absorption costing approach would be closest to: A. $74.30 B. $56.11 C. $96.50 D. $78.57 22. Mahan, Inc., uses the absorption costing approach to cost-plus pricing described in the text to set prices for its products. Based on budgeted sales of 60,000 units next year, the unit product cost of a particular product is $56.20. The company's selling and administrative expenses for this product are budgeted to be $1,302,000 in total for the year. The company has invested $320,000 in this product and expects a return on investment of 8%. The selling price for this product based on the absorption costing approach would be closest to: A. $108.57 B. $77.90 C. $78.33 D. $60.70 23. The following information is available on Browning Inc.'s Product A: The company uses the absorption costing approach to cost-plus pricing described in the text. Based on these data, the total selling and administrative expenses each year are: A. $720,000 B. $480,000 C. $640,000 D. $400,000 24. Cost data relating to the single product produced by the Jones Company are given below: The Jones Company uses the absorption costing approach to cost-plus pricing described in the text with a desired markup of 60%. If the company plans to produce and sell 20,000 units each year, the selling price per unit would be: A. $32.00 B. $41.60 C. $43.20 D. $36.00 25. Jabal Corporation makes a product with the following costs: The company uses the absorption costing approach to cost-plus pricing described in the text. The pricing calculations are based on budgeted production and sales of 28,000 units per year. The company has invested $560,000 in this product and expects a return on investment of 10%. The markup on absorption cost would be closest to: A. 46.0% B. 10.0% C. 141.1% D. 49.7% 26. Lagace Corporation uses the absorption costing approach to cost-plus pricing described in the text to set prices for its products. Based on budgeted sales of 20,000 units next year, the unit product cost of a particular product is $81.60. The company's selling and administrative expenses for this product are budgeted to be $354,000 in total for the year. The company has invested $260,000 in this product and expects a return on investment of 13%. The markup on absorption cost for this product would be closest to: A. 34.7% B. 23.8% C. 13.0% D. 21.7% 27. Straus Company, a manufacturer of electronic products, wants to introduce a new calculator. To compete effectively, the calculator could not be priced at more than $40. The company requires a 20% rate of return on investment on all new products. In order to produce and sell 30,000 calculators each year, the company would have to make an investment of $850,000. The target cost per calculator would be: A. $16.50 B. $23.50 C. $28.33 D. $34.33 28. The management of Jahns Corporation is considering introducing a new product–a compact barbecue. At a selling price of $59 per unit, management projects sales of 30,000 units. Launching the barbecue as a new product would require an investment of $500,000. The desired return on investment is 19%. The target cost per barbecue is closest to: A. $66.44 B. $59.00 C. $70.21 D. $55.83 29. Hostetter Corporation would like to use target costing for a new product it is considering introducing. At a selling price of $30 per unit, management projects sales of 30,000 units. The new product would require an investment of $200,000. The desired return on investment is 13%. The target cost per unit is closest to: A. $32.92 B. $30.00 C. $33.90 D. $29.13 30. A new product, an automated crepe maker, is being introduced at Boorman Corporation. At a selling price of $72 per unit, management projects sales of 20,000 units. Launching the crepe maker as a new product would require an investment of $700,000. The desired return on investment is 14%. The target cost per crepe maker is closest to: A. $72.00 B. $82.08 C. $76.49 D. $67.10 Reference A-1 Diehl Company makes a product with the following costs: The company uses the absorption costing approach to cost-plus pricing described in the text. The pricing calculations are based on budgeted production and sales of 52,000 units per year. The company has invested $420,000 in this product and expects a return on investment of 8%. Direct labor is a variable cost in this company. 31. The markup on absorption cost is closest to: A. 37.2% B. 8.0% C. 102.4% D. 38.4% 32. The selling price based on the absorption costing approach is closest to: A. $78.50 B. $54.10 C. $79.15 D. $108.62 33. If every 10% increase in price leads to an 11% decrease in quantity sold, the profitmaximizing price is closest to: A. $234.46 B. $214.69 C. $256.45 D. $78.50 Reference A-2 Altona Corporation's vice president in charge of marketing believes that every 3% increase in the selling price of one of the company's products would lead to a 5% decrease in the product's total unit sales. The product's absorption costing unit product cost is $13.50. The variable production cost is $7.80 per unit and the variable selling and administrative cost is $2.30 per unit. 34. The product's price elasticity of demand as defined in the text is closest to: A. -1.51 B. -1.33 C. -1.14 D. -1.74 35. The product's profit-maximizing price according to the formula in the text is closest to: A. $31.86 B. $23.84 C. $5.43 D. $18.41 Reference A-3 Boatsman Company's management believes that every 4% decrease in the selling price of one of the company's products would lead to a 7% increase in the product's total unit sales. The product's variable cost is $14.20 per unit. 36. The product's price elasticity of demand as defined in the text is closest to: A. -2.29 B. -2.24 C. -1.31 D. -1.66 37. The product's profit-maximizing price according to the formula in the text is closest to: A. $25.66 B. $25.21 C. $35.80 D. $60.44 Reference A-4 Coble Company recently changed the selling price of one of its products. Data concerning sales for comparable periods before and after the price change are presented below. The product's variable cost is $15.70 per unit. 38. The product's price elasticity of demand as defined in the text is closest to: A. -1.51 B. -1.23 C. -2.09 D. -1.47 39. The product's profit-maximizing price according to the formula in the text is closest to: A. $46.48 B. $30.12 C. $49.21 D. $84.37 Reference A-5 Eckhart Company uses the absorption costing approach to cost-plus pricing as described in the text to set prices for its products. Based on budgeted sales of 64,000 units next year, the unit product cost of a particular product is $13.60. The company's selling and administrative expenses for this product are budgeted to be $729,600 in total for the year. The company has invested $460,000 in this product and expects a return on investment of 11%. 40. The markup on absorption cost for this product would be closest to: A. 83.8% B. 11.0% C. 94.8% D. 89.6% 41. The selling price based on the absorption costing approach for this product would be closest to: A. $25.00 B. $25.79 C. $15.10 D. $47.41 Reference A-6 Raymond Company estimates that an investment of $800,000 would be necessary to produce and sell 40,000 units of Product S each year. Costs associated with the new product would be: The company requires a 20% return on the investment in all products. The company used the absorption costing approach to cost-plus pricing as described in the text. 42. The markup percentage needed on Product S in order to achieve the company's required return on investment would be: A. 29% B. 40% C. 50% D. 37% 43. The selling price based on the absorption costing approach would be: A. $48.38 B. $56.25 C. $52.50 D. $51.38 Reference A-7 The management of Matsuura Corporation would like to set the selling price on a new product using the absorption costing approach to cost-plus pricing. The company's accounting department has supplied the following estimates for the new product: Management plans to produce and sell 1,000 units of the new product annually. The new product would require an investment of $254,000 and has a required return on investment of 10%. 44. The absorption costing unit product cost is: A. $90 B. $97 C. $67 D. $69 45. To the nearest whole percent, the markup percentage on absorption cost is: A. 10% B. 8% C. 18% D. 36% 46. The unit target selling price using the absorption costing approach is closest to: A. $122 B. $132 C. $99 D. $97 Reference A-8 Hauber Corporation would like to use target costing for a new product it is considering introducing. At a selling price of $26 per unit, management projects sales of 60,000 units. The new product would require an investment of $300,000. The desired return on investment is 20%. 47. The desired profit according to the target costing calculations is: A. $312,000 B. $60,000 C. $1,560,000 D. $1,500,000 48. The target cost per unit is closest to: A. $26.00 B. $31.20 C. $30.00 D. $25.00 Reference A-9 The management of Fanton Corporation is considering introducing a new product–a compact lawn blower. At a selling price of $38 per unit, management projects sales of 60,000 units. The lawn blower would require an investment of $500,000. The desired return on investment is 18%. 49. The desired profit according to the target costing calculations is: A. $410,400 B. $2,190,000 C. $2,280,000 D. $90,000 50. The target cost per lawn blower is closest to: A. $38.00 B. $43.07 C. $44.84 D. $36.50 Essay Questions 51. Quare Company makes a product that has the following costs: The company uses the absorption costing approach to cost-plus pricing as described in the text. The pricing calculations are based on budgeted production and sales of 35,000 units per year. The company has invested $100,000 in this product and expects a return on investment of 11%. Required: a. Compute the markup on absorption cost. b. Compute the selling price of the product using the absorption costing approach. c. Assume that every 10% increase in price leads to a 14% decrease in quantity sold. Assuming no change in cost structure and that direct labor is a variable cost, compute the profit-maximizing price. 52. Nichnols Corporation's marketing manager believes that every 6% decrease in the selling price of one of the company's products would lead to a 18% increase in the product's total unit sales. The product's absorption costing unit product cost is $10.10. The variable production cost is $1.70 per unit and the variable selling and administrative cost is $1.60. Required: a. Compute the product's price elasticity of demand as defined in the text. b. Compute the product's profit-maximizing price according to the formula in the text. 53. Okino Company's management believes that every 8% increase in the selling price of one of the company's products would lead to a 17% decrease in the product's total unit sales. The variable cost per unit of this product is $44.60. Required: a. Compute the product's price elasticity of demand as defined in the text. b. Compute the product's profit-maximizing price according to the formula in the text. 54. Pasternack Corporation recently changed the selling price of one of its products. Data concerning sales for comparable periods before and after the price change are presented below. The product's variable cost is $23.10 per unit. Required: a. Compute the product's price elasticity of demand as defined in the text. b. Compute the product's profit-maximizing price according to the formula in the text. 55. Trevor Company is contemplating the introduction of a new product. The company has gathered the following information concerning the product: The company uses the absorption costing approach to cost-plus pricing as described in the text. Required: a. Compute the markup on absorption cost. b. Compute the selling price. c. If the price computed in "b" above is charged, and costs turn out as projected, can the company be assured that no loss will be sustained on the new product? Explain. 56. Roal Corporation manufactures a product that has the following costs: The company uses the absorption costing approach to cost-plus pricing as described in the text. The pricing calculations are based on budgeted production and sales of 37,000 units per year. The company has invested $220,000 in this product and expects a return on investment of 9%. Required: a. Compute the markup on absorption cost. b. Compute the selling price of the product using the absorption costing approach. 57. The management of Hettler Corporation would like to set the selling price on a new product using the absorption costing approach to cost-plus pricing. The company's accounting department has supplied the following estimates for the new product: Management plans to produce and sell 4,000 units of the new product annually. The new product would require an investment of $643,000 and has a required return on investment of 20%. Required: a. Determine the unit product cost for the new product. b. Determine the markup percentage on absorption cost for the new product. c. Determine the target selling price for the new product using the absorption costing approach. 58. Bourret Corporation is introducing a new product whose direct materials cost is $42 per unit, direct labor cost is $16 per unit, variable manufacturing overhead is $9 per unit, and variable selling and administrative expense is $3 per unit. The annual fixed manufacturing overhead associated with the product is $84,000 and its annual fixed selling and administrative expense is $16,000. Management plans to produce and sell 4,000 units of the new product annually. The new product would require an investment of $1,022,400 and has a required return on investment of 10%. Management would like to set the selling price on a new product using the absorption costing approach to cost-plus pricing. Required: a. Determine the unit product cost for the new product. b. Determine the markup percentage on absorption cost for the new product. c. Determine the target selling price for the new product using the absorption costing approach. 59. Turnhilm, Inc. is considering adding a small electric mower to its product line. Management believes that in order to be competitive, the mower cannot be priced above $139. The company requires a minimum return of 25% on its investments. Launching the new product would require an investment of $8,000,000. Sales are expected to be 40,000 units of the mower per year. Required: Compute the target cost of a mower. 60. Elio Corporation would like to use target costing for a new product that is under consideration. At a selling price of $84 per unit, management projects sales of 40,000 units. The new product would require an investment of $400,000. The desired return on investment is 11%. Required: Determine the target cost per unit for the new product. 61. The management of Mozdzierz, Inc., is considering a new product that would have a selling price of $83 per unit and projected sales of 90,000 units. The new product would require an investment of $200,000. The desired return on investment is 15%. Required: Determine the target cost per unit for the new product. 62. Management of Delaune Corporation is considering a new product, an outdoor speaker that would have a selling price of $45 per unit and projected sales of 70,000 units. Launching the new product would require an investment of $200,000. The desired return on investment is 12%. Required: Determine the target cost per unit for the outdoor speaker. True / False Questions 1. The price elasticity of demand is used in the absorption costing approach to cost-plus pricing to determine the markup over cost. FALSE 2. If a product is price inelastic, then a small change in selling price will result in a substantial change in the volume of units sold. FALSE 3. Price elasticity measures the degree to which unit sales are affected by a change in price. TRUE 4. Demand for a product is said to be elastic if a change in price has a substantial effect on the number of units sold. TRUE 5. The demand for products that are sold in discount stores is generally more elastic than the demand for products sold in upscale boutiques. TRUE 6. All variable costs are included in the cost base used to set a selling price under the absorption approach to cost-plus pricing described in the text. FALSE 7. The markup over cost under the absorption costing approach would decrease if selling and administrative expenses increase, holding everything else constant. FALSE Multiple Choice Questions 8. Holding all other things constant, an increase in fixed production costs will affect: A. the selling price under the absorption costing approach to cost-plus pricing. B. the profit-maximizing price. C. both the selling price under the absorption costing approach to cost-plus pricing and the profit-maximizing price. D. neither the selling price under the absorption costing approach to cost-plus pricing nor the profit-maximizing price. 9. Holding all other things constant, an increase in fixed selling costs will affect: A. the markup under the absorption costing approach to cost-plus pricing. B. the markup used to compute the profit-maximizing price. C. both the markup under the absorption costing approach to cost-plus pricing and the markup used to compute profit-maximizing price. D. neither the markup under the absorption costing approach to cost-plus pricing nor the markup used to compute profit-maximizing price. 10. The optimal markup on variable cost: A. increases as unit sales become more sensitive to price. B. decreases as unit sales become more sensitive to price. C. is not affected by the price sensitivity of a product's sales volume. D. is equal to [ed/(1 + ed)] + 1, where ed is the price elasticity of demand. 11. Demand for a product is said to be elastic if a change in price has: A. no effect on the volume of units sold. B. substantial effect on the volume of units sold. C. little effect on the volume of units sold. D. little effect on the volume of units produced. 12. The more sensitive customers are to price, A. the smaller (in absolute value) is the price elasticity of demand. B. the more inelastic is the demand for a product. C. the larger (in absolute value) is the price elasticity of demand. D. the more likely price elasticity of demand will be greater than +1. 13. The optimal selling price for a product depends A. only on the variable cost per unit. B. only on the sensitivity of unit sales to changes in price. C. on the level of total fixed costs and the variable cost per unit. D. on the variable cost per unit and the sensitivity of unit sales to changes in price. 14. Holding all other things constant, if the unit sales increase, then the markup under absorption costing will: A. increase. B. decrease. C. remain the same. D. The effect cannot be determined. 15. Firestack Company's management believes that every 5% increase in the selling price of one of the company's products results in a 13% decrease in the product's total unit sales. The variable production cost of this product is $37.50 per unit and the variable selling and administrative cost is $4.30 per unit. The product's profit-maximizing price according to the formula in the text is closest to: A. $46.98 B. $49.32 C. $64.34 D. $65.13 Price elasticity of demand = ln(1 + % change in quantity sold) ln(1 + % change in price) = ln(1 + -13%) ln(1 + 5%) = -2.8541 Profit maximizing markup on variable cost = -1 (1+ed) = -1 (1+ -2.8541) = 0.5393 Profit-maximizing price = (1+ Profit-maximizing markup on variable cost) x Variable cost per unit = (1 + 0.5393) x ($37.50 + $4.30) = (1.5393) x $41.80 = $64.34 (rounded) 16. Gorsche Company's management has found that every 3% increase in the selling price of one of the company's products leads to a 8% decrease in the product's total unit sales. The product's absorption costing unit product cost is $11.50. The variable production cost of the product is $6.20 per unit and the variable selling and administrative cost is $1.00 per unit. According to the formula in the text, the product's profit-maximizing price is closest to: A. $11.15 B. $11.91 C. $19.65 D. $17.82 Price elasticity of demand = ln(1 + % change in quantity sold) ln(1 + % change in price) = ln(1 + -8%) ln(1 + 3%) = -2.8201 Profit maximizing markup on variable cost = -1 (1+ed) = -1 (1+ -2.8201) = 0.5494 Profit-maximizing price = (1+ Profit-maximizing markup on variable cost) x Variable cost per unit = (1 + 0.5494) x ($6.20 + $1.00) = (1.5494) x $7.20 = $11.15 (rounded) 17. Innes Company recently changed the selling price of one of its products. Data concerning sales for comparable periods before and after the price change are presented below. The product's variable cost is $23.20 per unit. According to the formula in the text, the product's profit-maximizing price is closest to: A. $44.10 B. $25.23 C. $40.95 D. $44.71 Percent change in price = ($76.00 - $78.00) $78.00 = -2.5641% Percent change in total unit sales = (3,610 - 3,400) 3,400 = 6.1765 % Price elasticity of demand = ln(1 + % change in quantity sold) ln(1 + % change in price) = ln(1 + 6.1765%) ln(1 + -2.5641%) = -2.3074 Profit maximizing markup on variable cost = -1 (1 + ed) = -1 (1 + -2.3074) = 0.7649 Profit-maximizing price = (1+ Profit-maximizing markup on variable cost) x Variable cost per unit = (1 + 0.7649) x $23.20 = 1.7649 x $23.20 = $40.95 18. Epler Company's management believes that every 3% decrease in the selling price of one of the company's products leads to a 8% increase in the product's total unit sales. The product's price elasticity of demand as defined in the text is closest to: A. -1.29 B. -2.87 C. -3.83 D. -2.53 Price elasticity of demand = ln(1 + % change in quantity sold) ln(1 + % change in price) = ln(1 + 8%) ln(1 + -3%) = -2.53 19. Harvey Company recently changed the selling price of one of its products. Data concerning sales for comparable periods before and after the price change are presented below. The product's price elasticity of demand as defined in the text is closest to: A. -1.98 B. -1.78 C. -2.40 D. -1.92 Percent change in price = ($29.00 - $30.00) $30.00 = -3.3333% Percent change in total unit sales = (5,870 - 5,500) 5,500 = 6.7273 % Price elasticity of demand = ln(1 + % change in quantity sold) ln(1 + % change in price) = ln(1 + 6.7273%) ln(1 + -3.3333%) = -1.92 20. The following information is available on Product A: The company uses the absorption costing approach to cost-plus pricing described in the text. Based on these data, the total selling and administrative expenses each year would be: A. $240,000 B. $300,000 C. $140,000 D. $200,000 Markup percentage on absorption cost = [(Required ROI x Investment) + Selling and administrative expenses] [Unit product cost x Units sales] = [(15% x $400,000) + Selling and administrative expenses] [$50 x 10,000] = 60%* = [$60,000 + Selling and administrative expenses] $500,000 = 60% $60,000 + Selling and administrative expenses = $300,000 Selling and administrative expenses = $240,000 *60% = (Selling price per unit ($80) Unit product cost ($50)) - 1 21. Kirby, Inc., manufactures a product with the following costs: The company uses the absorption costing approach to cost-plus pricing described in the text. The pricing calculations are based on budgeted production and sales of 19,000 units per year. The company has invested $580,000 in this product and expects a return on investment of 14%. The selling price based on the absorption costing approach would be closest to: A. $74.30 B. $56.11 C. $96.50 D. $78.57 Unit Product Cost: Markup percentage on absorption cost = [(Required ROI x Investment) + Selling and administrative expenses] [Unit product cost x Units sales] = [(14% x $580,000) + ($3.70 x 19,000 + $191,900)] ($60.50 x 19,000) = [$81,200 + $262,200] $1,149,500 = 29.87% Selling price = $60.50 + (29.87% x $60.50) = $78.57 22. Mahan, Inc., uses the absorption costing approach to cost-plus pricing described in the text to set prices for its products. Based on budgeted sales of 60,000 units next year, the unit product cost of a particular product is $56.20. The company's selling and administrative expenses for this product are budgeted to be $1,302,000 in total for the year. The company has invested $320,000 in this product and expects a return on investment of 8%. The selling price for this product based on the absorption costing approach would be closest to: A. $108.57 B. $77.90 C. $78.33 D. $60.70 Markup percentage on absorption cost = [(Required ROI x Investment) + Selling and administrative expenses] [Unit product cost x Unit sales] = [(8% x $320,000) + $1,302,000] ($56.20 x 60,000) = [$25,600 + $1,302,000] $3,372,000 = 39.37% Selling price = $56.20 + (39.37% x $56.20) = $78.33 23. The following information is available on Browning Inc.'s Product A: The company uses the absorption costing approach to cost-plus pricing described in the text. Based on these data, the total selling and administrative expenses each year are: A. $720,000 B. $480,000 C. $640,000 D. $400,000 Markup percentage on absorption cost = [(Required ROI x Investment) + Selling and administrative expenses] [Unit product cost x Units sales] = [(16% x $500,000) + Selling and administrative expenses] [$60 x 20,000] = 60%* = [$80,000 + Selling and administrative expenses] $1,200,000 = 60% $80,000 + Selling and administrative expenses = $720,000 Selling and administrative expenses = $640,000 * (Selling price per unit ($96) Unit product cost ($60)) - 1 = 60% 24. Cost data relating to the single product produced by the Jones Company are given below: The Jones Company uses the absorption costing approach to cost-plus pricing described in the text with a desired markup of 60%. If the company plans to produce and sell 20,000 units each year, the selling price per unit would be: A. $32.00 B. $41.60 C. $43.20 D. $36.00 Unit Product Cost: Selling price = $26.00 + (60% x $26.00) = $41.60 25. Jabal Corporation makes a product with the following costs: The company uses the absorption costing approach to cost-plus pricing described in the text. The pricing calculations are based on budgeted production and sales of 28,000 units per year. The company has invested $560,000 in this product and expects a return on investment of 10%. The markup on absorption cost would be closest to: A. 46.0% B. 10.0% C. 141.1% D. 49.7% Unit Product Cost: Markup percentage on absorption cost = [(Required ROI x Investment) + Selling and administrative expenses] [Unit product cost x Units sales] = [(10% x $560,000) + ($4.80 x 28,000 + $551,600)] [$53.30 x 28,000] = ($56,000 + $686,000) $1,492,400 = 49.7% 26. Lagace Corporation uses the absorption costing approach to cost-plus pricing described in the text to set prices for its products. Based on budgeted sales of 20,000 units next year, the unit product cost of a particular product is $81.60. The company's selling and administrative expenses for this product are budgeted to be $354,000 in total for the year. The company has invested $260,000 in this product and expects a return on investment of 13%. The markup on absorption cost for this product would be closest to: A. 34.7% B. 23.8% C. 13.0% D. 21.7% Markup percentage on absorption cost = [(Required ROI x Investment) + Selling and administrative expenses] [Unit product cost x Units sales] = [(13% x $260,000) + $354,000] [$81.60 x 20,000] = ($33,800 + $354,000) $1,632,000 = 23.8% 27. Straus Company, a manufacturer of electronic products, wants to introduce a new calculator. To compete effectively, the calculator could not be priced at more than $40. The company requires a 20% rate of return on investment on all new products. In order to produce and sell 30,000 calculators each year, the company would have to make an investment of $850,000. The target cost per calculator would be: A. $16.50 B. $23.50 C. $28.33 D. $34.33 28. The management of Jahns Corporation is considering introducing a new product–a compact barbecue. At a selling price of $59 per unit, management projects sales of 30,000 units. Launching the barbecue as a new product would require an investment of $500,000. The desired return on investment is 19%. The target cost per barbecue is closest to: A. $66.44 B. $59.00 C. $70.21 D. $55.83 29. Hostetter Corporation would like to use target costing for a new product it is considering introducing. At a selling price of $30 per unit, management projects sales of 30,000 units. The new product would require an investment of $200,000. The desired return on investment is 13%. The target cost per unit is closest to: A. $32.92 B. $30.00 C. $33.90 D. $29.13 30. A new product, an automated crepe maker, is being introduced at Boorman Corporation. At a selling price of $72 per unit, management projects sales of 20,000 units. Launching the crepe maker as a new product would require an investment of $700,000. The desired return on investment is 14%. The target cost per crepe maker is closest to: A. $72.00 B. $82.08 C. $76.49 D. $67.10 Reference A-1 Diehl Company makes a product with the following costs: The company uses the absorption costing approach to cost-plus pricing described in the text. The pricing calculations are based on budgeted production and sales of 52,000 units per year. The company has invested $420,000 in this product and expects a return on investment of 8%. Direct labor is a variable cost in this company. 31. The markup on absorption cost is closest to: A. 37.2% B. 8.0% C. 102.4% D. 38.4% Unit Product Cost: Markup percentage on absorption cost = [(Required ROI x Investment) + Selling and administrative expenses] [Unit product cost x Units sales] = [(8% x $420,000) + ($3.60 x 52,000 + $920,400)] [$57.20 x 52,000] = ($33,600 + $1,107,600) $2,974,400 = 38.4% 32. The selling price based on the absorption costing approach is closest to: A. $78.50 B. $54.10 C. $79.15 D. $108.62 Unit Product Cost: Markup percentage on absorption cost = [(Required ROI x Investment) + Selling and administrative expenses] [Unit product cost x Units sales] = [(8% x $420,000) + ($3.60 x 52,000 + $920,400)] [$57.20 x 52,000] = ($33,600 + $1,107,600) $2,974,400 = 38.4% Selling price = $57.20 + (38.4% x $57.20) = $79.16 33. If every 10% increase in price leads to an 11% decrease in quantity sold, the profitmaximizing price is closest to: A. $234.46 B. $214.69 C. $256.45 D. $78.50 Price elasticity of demand = ln(1 + %change in quantity sold) ln(1 + %change in price) = ln(1 + -11%) ln(1 + 10%) = -1.22268 Variable cost per unit = $18.80 + $16.20 + $4.10 +$3.60 = $42.70 Profit maximizing markup on variable cost = -1 (1+ed) = -1 (1 + -1.22268) = 4.4907 Profit-maximizing price = (1+ Profit-maximizing markup on variable cost) x Variable cost per unit = (1+4.4907) x $42.70 = (5.4907) x $42.70 = $234.46 Reference A-2 Altona Corporation's vice president in charge of marketing believes that every 3% increase in the selling price of one of the company's products would lead to a 5% decrease in the product's total unit sales. The product's absorption costing unit product cost is $13.50. The variable production cost is $7.80 per unit and the variable selling and administrative cost is $2.30 per unit. 34. The product's price elasticity of demand as defined in the text is closest to: A. -1.51 B. -1.33 C. -1.14 D. -1.74 Price elasticity of demand = ln(1 + % change in quantity sold) = ln(1 + -5%) ln(1 + 3%) = -1.74 ln(1 + % change in price) 35. The product's profit-maximizing price according to the formula in the text is closest to: A. $31.86 B. $23.84 C. $5.43 D. $18.41 Price elasticity of demand = ln(1 + % change in quantity sold) ln(1 + % change in price) = ln(1 + -5%) ln(1 + 3%) = -1.73561 Variable cost per unit = $7.80 + $2.30 = $10.10 Profit maximizing markup on variable cost = -1 (1 + ed) = -1 (1 + -1.735) = 1.36 Profit-maximizing price = (1+ Profit-maximizing markup on variable cost) x Variable cost per unit = (1 + 1.36) x $36.70 = (2.36) x $10.10 = $23.84 Reference A-3 Boatsman Company's management believes that every 4% decrease in the selling price of one of the company's products would lead to a 7% increase in the product's total unit sales. The product's variable cost is $14.20 per unit. 36. The product's price elasticity of demand as defined in the text is closest to: A. -2.29 B. -2.24 C. -1.31 D. -1.66 Price elasticity of demand = ln(1 + % change in quantity sold) ln(1 + % change in price) = ln(1 + 7%) ln(1 + -4%) = -1.66 37. The product's profit-maximizing price according to the formula in the text is closest to: A. $25.66 B. $25.21 C. $35.80 D. $60.44 Price elasticity of demand = ln(1 + % change in quantity sold) ln(1 + % change in price) = ln(1 + 7%) ln(1 + -4%) = -1.657 Profit maximizing markup on variable cost = -1 (1 + ed) = -1 (1 + -1.657) = 1.52 Profit-maximizing price = (1+ Profit-maximizing markup on variable cost) x Variable cost per unit = (1 + 1.52) x $14.20 = (2.52) x $14.20 = $35.78 Reference A-4 Coble Company recently changed the selling price of one of its products. Data concerning sales for comparable periods before and after the price change are presented below. The product's variable cost is $15.70 per unit. 38. The product's price elasticity of demand as defined in the text is closest to: A. -1.51 B. -1.23 C. -2.09 D. -1.47 Percent change in price = ($27.00 - $30.00) $30.00 = -10% Percent change in total unit sales = (1,620 - 1,300) 1,300 = 24.62 % Price elasticity of demand = ln(1 + % change in quantity sold) ln(1 + % change in price) = ln(1 + 24.62%) ln(1 + -10%) = -2.09 39. The product's profit-maximizing price according to the formula in the text is closest to: A. $46.48 B. $30.12 C. $49.21 D. $84.37 Percent change in price = ($27.00 - $30.00) $30.00 = -10% Percent change in total unit sales = (1,620 - 1,300) 1,300 = 24.62% Price elasticity of demand = ln(1 + % change in quantity sold) ln(1 + % change in price) = ln(1 + 24.62%) ln(1 + -10%) = -2.09 Profit maximizing markup on variable cost = -1 (1 + ed) = -1 (1 + -2.09) = 0.92 Profit-maximizing price = (1+ Profit-maximizing markup on variable cost) x Variable cost per unit = (1 + 0.92) x $15.70 = 1.92 x $15.70 = $30.14 Reference A-5 Eckhart Company uses the absorption costing approach to cost-plus pricing as described in the text to set prices for its products. Based on budgeted sales of 64,000 units next year, the unit product cost of a particular product is $13.60. The company's selling and administrative expenses for this product are budgeted to be $729,600 in total for the year. The company has invested $460,000 in this product and expects a return on investment of 11%. 40. The markup on absorption cost for this product would be closest to: A. 83.8% B. 11.0% C. 94.8% D. 89.6% Markup percentage on absorption cost = [(Required ROI x Investment) + Selling and administrative expenses] Units sales] = [(11% x $460,000) + $729,600] [$13.60 x 64,000] = ($50,600 + $729,600) $870,400 = 89.6% [Unit product cost x 41. The selling price based on the absorption costing approach for this product would be closest to: A. $25.00 B. $25.79 C. $15.10 D. $47.41 Markup percentage on absorption cost = [(Required ROI x Investment) + Selling and administrative expenses] x Units sales] = [(11% x $460,000) + $729,600] [$13.60 x 64,000] = ($50,600 + $729,600) $870,400 = 89.6% Selling price = $13.60 + (89.6% x $13.60) = $25.79 [Unit product cost Reference A-6 Raymond Company estimates that an investment of $800,000 would be necessary to produce and sell 40,000 units of Product S each year. Costs associated with the new product would be: The company requires a 20% return on the investment in all products. The company used the absorption costing approach to cost-plus pricing as described in the text. 42. The markup percentage needed on Product S in order to achieve the company's required return on investment would be: A. 29% B. 40% C. 50% D. 37% Markup percentage on absorption cost = [(Required ROI x Investment) + Selling and administrative expenses] [Unit product cost x Units sales] = [(20% x $800,000) + ($5.00 x 40,000 + $240,000)] [$37.50* x 40,000] = ($160,000 + $440,000) $1,500,000 = 40% *$37.50 = Variable product cost per unit ($30.00) + Fixed product cost per unit ($300,000 40,000) 43. The selling price based on the absorption costing approach would be: A. $48.38 B. $56.25 C. $52.50 D. $51.38 Markup percentage on absorption cost = [(Required ROI x Investment) + Selling and administrative expenses] [Unit product cost x Units sales] = [(20% x $800,000) + ($5.00 x 40,000 + $240,000)] [$37.50* x 40,000] = ($160,000 + $440,000) $1,500,000 = 40% *$37.50 = Variable product cost per unit ($30.00) + Fixed product cost per unit ($300,000 40,000) Selling price = $37.50 + (40% x $37.50) = $52.50 Reference A-7 The management of Matsuura Corporation would like to set the selling price on a new product using the absorption costing approach to cost-plus pricing. The company's accounting department has supplied the following estimates for the new product: Management plans to produce and sell 1,000 units of the new product annually. The new product would require an investment of $254,000 and has a required return on investment of 10%. 44. The absorption costing unit product cost is: A. $90 B. $97 C. $67 D. $69 Unit Product Cost: 45. To the nearest whole percent, the markup percentage on absorption cost is: A. 10% B. 8% C. 18% D. 36% Markup percentage on absorption cost = [(Required ROI x Investment) + Selling and administrative expenses] Unit sales] = [(10% x $254,000) + ($2.00 x 1,000 + $5,000)] [$90 x 1,000] = [$25,400 + $7,000] $90,000 = 36% [Unit product cost x 46. The unit target selling price using the absorption costing approach is closest to: A. $122 B. $132 C. $99 D. $97 Unit Product Cost: Markup percentage on absorption cost = [(Required ROI x Investment) + Selling and administrative expenses] Unit sales] = [(10% x $254,000) + ($2.00 x 1,000 + $5,000)] [$90 x 1,000] = [$25,400 + $7,000] $90,000 = 36% Selling price = $90.00 + (36% x $90.00) = $122.40 [Unit product cost x Reference A-8 Hauber Corporation would like to use target costing for a new product it is considering introducing. At a selling price of $26 per unit, management projects sales of 60,000 units. The new product would require an investment of $300,000. The desired return on investment is 20%. 47. The desired profit according to the target costing calculations is: A. $312,000 B. $60,000 C. $1,560,000 D. $1,500,000 Desired profit = Desired return on investment x Investment = 20% x $300,000 = $60,000 48. The target cost per unit is closest to: A. $26.00 B. $31.20 C. $30.00 D. $25.00 Reference A-9 The management of Fanton Corporation is considering introducing a new product–a compact lawn blower. At a selling price of $38 per unit, management projects sales of 60,000 units. The lawn blower would require an investment of $500,000. The desired return on investment is 18%. 49. The desired profit according to the target costing calculations is: A. $410,400 B. $2,190,000 C. $2,280,000 D. $90,000 Desired profit = Desired return on investment x Investment = 18% x $500,000 = $90,000 50. The target cost per lawn blower is closest to: A. $38.00 B. $43.07 C. $44.84 D. $36.50 Essay Questions 51. Quare Company makes a product that has the following costs: The company uses the absorption costing approach to cost-plus pricing as described in the text. The pricing calculations are based on budgeted production and sales of 35,000 units per year. The company has invested $100,000 in this product and expects a return on investment of 11%. Required: a. Compute the markup on absorption cost. b. Compute the selling price of the product using the absorption costing approach. c. Assume that every 10% increase in price leads to a 14% decrease in quantity sold. Assuming no change in cost structure and that direct labor is a variable cost, compute the profit-maximizing price. Ans: Markup percentage on absorption cost = [(11% x $100,000) + ($2.20 x 35,000 + $738,500)] (35,000 x $56.00) = [($11,000) + ($815,500)] $1,960,000 = 42.17% b. Target selling price = $56.00 + 42.17% x $56.00 = $79.61 c. Price elasticity of demand = ln(1+%change in quantity sold)/ln(1+%change in price) = ln(1 + -14%)/ln(1 + 10%) = -1.58 Profit-maximizing markup on variable cost = -1/(1+ed) = -1/(1+(-1.58)) = 1.72 Profit-maximizing price = (1+Profit-maximizing markup on variable cost) x Variable cost per unit = (1+1.72) x $40.40 = (2.72) x $40.40 = $109.76 52. Nichnols Corporation's marketing manager believes that every 6% decrease in the selling price of one of the company's products would lead to a 18% increase in the product's total unit sales. The product's absorption costing unit product cost is $10.10. The variable production cost is $1.70 per unit and the variable selling and administrative cost is $1.60. Required: a. Compute the product's price elasticity of demand as defined in the text. b. Compute the product's profit-maximizing price according to the formula in the text. Ans: a. Price elasticity of demand = ln(1+%change in quantity sold)/ln(1+%change in price) = ln(1 + 18%)/ln(1 + -6%) = -2.67 b. Profit-maximizing markup on variable cost = -1/(1+ed) = -1/(1+(-2.67)) = 0.60 Profit-maximizing price = (1 + Profit-maximizing markup on variable cost) x Variable cost per unit = (1+0.60)*($1.60 +$1.70) = (1.60) x $3.30 = $5.27 53. Okino Company's management believes that every 8% increase in the selling price of one of the company's products would lead to a 17% decrease in the product's total unit sales. The variable cost per unit of this product is $44.60. Required: a. Compute the product's price elasticity of demand as defined in the text. b. Compute the product's profit-maximizing price according to the formula in the text. Ans: a. Price elasticity of demand = ln(1+%change in quantity sold)/ln(1+%change in price) = ln(1 + -17%)/ln(1 + 8%) = -2.42 b. Profit-maximizing markup on variable cost = -1/(1+ed) = -1/(1+(-2.42)) = 0.70 Profit-maximizing price = (1 + Profit-maximizing markup on variable cost) x Variable cost per unit = (1+0.70) x $44.60 = (1.70) x $44.60 = $75.98 54. Pasternack Corporation recently changed the selling price of one of its products. Data concerning sales for comparable periods before and after the price change are presented below. The product's variable cost is $23.10 per unit. Required: a. Compute the product's price elasticity of demand as defined in the text. b. Compute the product's profit-maximizing price according to the formula in the text. Ans: a. % change in quantity = 17.59% % change in price = -9.62% Price elasticity of demand = = ln(1+%change in quantity sold)/ln(1+%change in price) = ln(1 + 17.59%)/ln(1 + -9.62%) = -1.60 b. Profit-maximizing markup on variable cost = -1/(1+ed) = -1/(1+(-1.60)) = 1.66 Profit-maximizing price = (1 + Profit-maximizing markup on variable cost) x Variable cost per unit = (1+1.66) x $23.10 = (2.66) x $23.10 = $61.44 55. Trevor Company is contemplating the introduction of a new product. The company has gathered the following information concerning the product: The company uses the absorption costing approach to cost-plus pricing as described in the text. Required: a. Compute the markup on absorption cost. b. Compute the selling price. c. If the price computed in "b" above is charged, and costs turn out as projected, can the company be assured that no loss will be sustained on the new product? Explain. Ans: a. Markup percentage on absorption cost = [(Required ROI x Investment) + Selling and administrative expenses] [Unit product cost x Unit sales] = [(15% x $200,000) + $90,000] [$25 x 12,000] = $120,000 $300,000 = 40% c. No, sales volume may be less than the 12,000 units projected annually, resulting in inadequate contribution margin to cover fixed costs, and a consequent loss for the company on the product. 56. Roal Corporation manufactures a product that has the following costs: The company uses the absorption costing approach to cost-plus pricing as described in the text. The pricing calculations are based on budgeted production and sales of 37,000 units per year. The company has invested $220,000 in this product and expects a return on investment of 9%. Required: a. Compute the markup on absorption cost. b. Compute the selling price of the product using the absorption costing approach. Ans: Markup percentage on absorption cost = [(9% x $220,000) + ($2.30 x 37,000 + $699,300)] (37,000 x $60.20) = [($19,800) + ($784,400)] $2,227,400 = 36.10% b. Target selling price = $60.20 + 36.10% x $60.20 = $81.94 57. The management of Hettler Corporation would like to set the selling price on a new product using the absorption costing approach to cost-plus pricing. The company's accounting department has supplied the following estimates for the new product: Management plans to produce and sell 4,000 units of the new product annually. The new product would require an investment of $643,000 and has a required return on investment of 20%. Required: a. Determine the unit product cost for the new product. b. Determine the markup percentage on absorption cost for the new product. c. Determine the target selling price for the new product using the absorption costing approach. Ans: a. The unit product cost is: b. Markup percentage on absorption cost = [(Required ROI x Investment) + Selling and administrative expenses] [Unit product cost x Units sales] = [(20% x $643,000) + ($3.00 x 4,000 + $16,000)] [$87 x 4,000] = 45% c. The target selling price is determined as follows: 58. Bourret Corporation is introducing a new product whose direct materials cost is $42 per unit, direct labor cost is $16 per unit, variable manufacturing overhead is $9 per unit, and variable selling and administrative expense is $3 per unit. The annual fixed manufacturing overhead associated with the product is $84,000 and its annual fixed selling and administrative expense is $16,000. Management plans to produce and sell 4,000 units of the new product annually. The new product would require an investment of $1,022,400 and has a required return on investment of 10%. Management would like to set the selling price on a new product using the absorption costing approach to cost-plus pricing. Required: a. Determine the unit product cost for the new product. b. Determine the markup percentage on absorption cost for the new product. c. Determine the target selling price for the new product using the absorption costing approach. Ans: a. The unit product cost is: b. Markup percentage on absorption cost = [(Required ROI x Investment) + Selling and administrative expenses] [Unit product cost x Units sales] = [(10% x $1,022,400) + ($3.00 x 4,000 + $16,000)] [$88 x 4,000] = 37% c. The target selling price is determined as follows: 59. Turnhilm, Inc. is considering adding a small electric mower to its product line. Management believes that in order to be competitive, the mower cannot be priced above $139. The company requires a minimum return of 25% on its investments. Launching the new product would require an investment of $8,000,000. Sales are expected to be 40,000 units of the mower per year. Required: Compute the target cost of a mower. Ans: Target cost per unit = $3,560,000 40,000 units = $89 per unit 60. Elio Corporation would like to use target costing for a new product that is under consideration. At a selling price of $84 per unit, management projects sales of 40,000 units. The new product would require an investment of $400,000. The desired return on investment is 11%. Required: Determine the target cost per unit for the new product. Ans: 61. The management of Mozdzierz, Inc., is considering a new product that would have a selling price of $83 per unit and projected sales of 90,000 units. The new product would require an investment of $200,000. The desired return on investment is 15%. Required: Determine the target cost per unit for the new product. Ans: 62. Management of Delaune Corporation is considering a new product, an outdoor speaker that would have a selling price of $45 per unit and projected sales of 70,000 units. Launching the new product would require an investment of $200,000. The desired return on investment is 12%. Required: Determine the target cost per unit for the outdoor speaker. Ans: