Guide For Final Exam A430 F10

advertisement

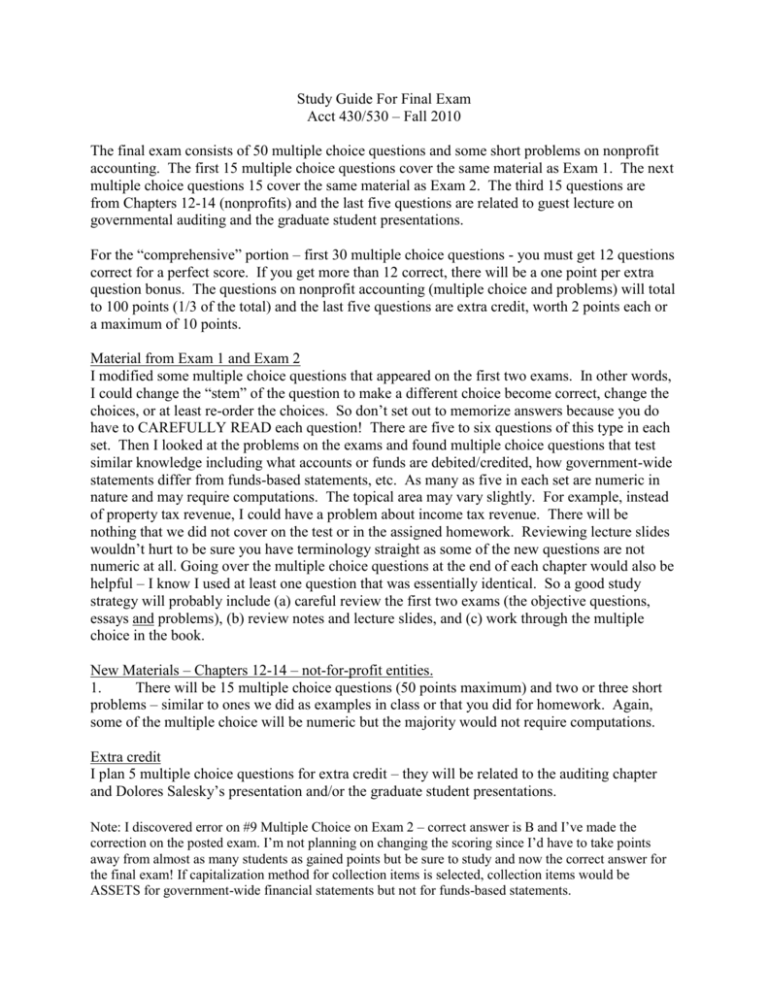

Study Guide For Final Exam Acct 430/530 – Fall 2010 The final exam consists of 50 multiple choice questions and some short problems on nonprofit accounting. The first 15 multiple choice questions cover the same material as Exam 1. The next multiple choice questions 15 cover the same material as Exam 2. The third 15 questions are from Chapters 12-14 (nonprofits) and the last five questions are related to guest lecture on governmental auditing and the graduate student presentations. For the “comprehensive” portion – first 30 multiple choice questions - you must get 12 questions correct for a perfect score. If you get more than 12 correct, there will be a one point per extra question bonus. The questions on nonprofit accounting (multiple choice and problems) will total to 100 points (1/3 of the total) and the last five questions are extra credit, worth 2 points each or a maximum of 10 points. Material from Exam 1 and Exam 2 I modified some multiple choice questions that appeared on the first two exams. In other words, I could change the “stem” of the question to make a different choice become correct, change the choices, or at least re-order the choices. So don’t set out to memorize answers because you do have to CAREFULLY READ each question! There are five to six questions of this type in each set. Then I looked at the problems on the exams and found multiple choice questions that test similar knowledge including what accounts or funds are debited/credited, how government-wide statements differ from funds-based statements, etc. As many as five in each set are numeric in nature and may require computations. The topical area may vary slightly. For example, instead of property tax revenue, I could have a problem about income tax revenue. There will be nothing that we did not cover on the test or in the assigned homework. Reviewing lecture slides wouldn’t hurt to be sure you have terminology straight as some of the new questions are not numeric at all. Going over the multiple choice questions at the end of each chapter would also be helpful – I know I used at least one question that was essentially identical. So a good study strategy will probably include (a) careful review the first two exams (the objective questions, essays and problems), (b) review notes and lecture slides, and (c) work through the multiple choice in the book. New Materials – Chapters 12-14 – not-for-profit entities. 1. There will be 15 multiple choice questions (50 points maximum) and two or three short problems – similar to ones we did as examples in class or that you did for homework. Again, some of the multiple choice will be numeric but the majority would not require computations. Extra credit I plan 5 multiple choice questions for extra credit – they will be related to the auditing chapter and Dolores Salesky’s presentation and/or the graduate student presentations. Note: I discovered error on #9 Multiple Choice on Exam 2 – correct answer is B and I’ve made the correction on the posted exam. I’m not planning on changing the scoring since I’d have to take points away from almost as many students as gained points but be sure to study and now the correct answer for the final exam! If capitalization method for collection items is selected, collection items would be ASSETS for government-wide financial statements but not for funds-based statements.