Insurance II

advertisement

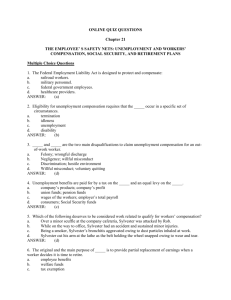

Attendance at the two dates you are assigned is mandatory Presentation date Evaluation date Attendance at the other eight (8) class dates will count as extra points toward your total points for EXAMS Class attendance grade will be based on a total of 52 class periods, not 60 as shown on Course Schedule Need video camera operator for each presentation date – double credit 2 pts/class 1 Construction Insurance Part 2 Construction Engineering 221 2 RPQ 1. Professional liability risk would more likely apply to a design-build contractor rather than a general contractor. A. True B. False 2. Worker’s Compensation pays only medical costs associated with an accident. A. True B. False 3. “Wrap-Up Insurance” is provided by the A. General Contractor B. Owner C. Architect D. Construction Manager 3 RPQ 1.Professional liability risk would more likely apply to a design-build contractor rather than a general contractor. A. True B. False The correct answer is A. True 4 RPQ 2. Worker’s Compensation pays only medical costs associated with an accident. A. True B. False The correct answer is B. False (also pay for lost wages) 5 RPQ 3. “Wrap-Up Insurance” is provided by the A. B. C. D. General Contractor Owner Architect Construction Manager The correct answer is B. Owner 6 Builder’s Risk Insurance Most widely used Project Property Insurance Not use by engineering contractors – why? Provides property coverage only Does not include liability coverage in any form Deduct cost of land prep and foundation – why? Premium mainly dependent on: Type of construction Availability of fire-fighting facilities 7 All-Risk Builder’s Risk Insurance Widely used on projects – covers all risks Covers: Project proper – building Temporary structures on jobsite Materials in transit, stored on site & not yet installed Very flexible coverage is available Exclusions and inclusions can be customized 8 Subrogation Clause Subrogation gives the insurance company the right to sue the offending party in the insured’s name for recovery of its loss This clause could defeat the entire purpose of the property insurance – Builder’s Risk Insurance policy The use of “Named Insureds” helps avoid the undesirable effects of subrogation 9 Named Insureds List of “Named Insureds” usually includes: Owner Architect and all other consultants General contractor Subrogation cannot usually be employed against parties named as in the “Named Insureds” list 10 Waiver of Subrogation Parties waive their rights to subrogation Many Owners and general contractors require subcontractors to include a “Waiver of Subrogation” clause as part of their insurance coverage 11 Professional Liability Insurance Professional liability insurance provides protection from: liability arising out of errors omissions or negligent acts of the insured in performing design and other professional services. Needed by design-build contractors to cover designers 12 Worker’s Compensation Insurance The Underlying Economic Principle The costs associated with an on-thejob injury or death of an employee, regardless of fault, is an expense of production and should be borne by the industry. 13 Worker’s Compensation Insurance Exclusions: Domestic servants, farm labor, casual employees, independent contractors, and workers in religious or charitable organizations In some states – business that employ less than a specific number of employees When injured worker accepts W.C. benefits – they forfeit the right to sue their employer Except in gross negligence by the employer 14 Worker’s Compensation Insurance Compensation Medical benefits shall be provided without limitation as to maximum total cost Wage compensation shall be paid for as long as the worker is disabled Include occupational disease (asbestos) Provides legal defense to the insured Some states allow self-insurance 15 Worker’s Compensation Insurance Manual Rate set by state rating bureaus Adjusted annually Vary by state and classification of work Higher premiums for higher risk work Roofing, Masonry, Carpentry, Painting, Structural Steel work How large an expense is workers compensation insurance? (up to a $1 per $1) Need for loss reduction programs 16 Worker’s Compensation Insurance Worker’s compensation insurance companies have become active participants in the field of construction safety and have established merit systems whereby contractors are rated according to their accident experience. A good safety record lowers workers compensation insurance SAFETY PAYS! 17 Employer’s Liability Insurance Coverage when an accident falls outside the coverage of workers compensation Company did not provide a safe work site as stipulated by state law – injured elects to sue Employee injured in another state in which the contractor is not covered Will pay legal costs incurred in contractor’s defense as well as any judgment (up to face amount of policy) 18 A few questions….. What are the three purposes of Umbrella Excess Liability Insurance? What is Wrap-Up Insurance? And why can it be important on large jobs? 19 Umbrella Excess Liability Insurance Liability claims may fall between the coverage carried under separate underlying liability policies Raises the policy limits of the contractor’s existing liability insurance Provides some coverage that are not covered by the underlying liability polices (self-insured for damage to other property outside the construction site - $25,000 deductible umbrella policy) 20 Wrap-Up Insurance All insurance is purchased by the Owner. No insurance cost from general contractors or subcontractors All claims are handled by central agency – quick claim service and centralized safety inspections May save owner money on very large projects DISADVANTAGE: No incentive for contractors to prevent claims – their insurance risk rating in not impacted 21 Unemployment Insurance Coverage required by federal and state law Weekly benefit payments to workers whose employment is terminated through no fault of their own The cost of the unemployment compensation system is paid for by employers through federal and state taxes. 22 Unemployment Insurance Questions How can an employee disqualify himself from unemployment benefits? Voluntarily quitting their last job without good cause Discharged for misconduct Being directly engaged in a strike or other labor dispute Failing to apply for or accept an offer of suitable work 23 Unemployment Insurance Questions How long can an employee draw unemployment? 26 weeks (paid by state) or 39 weeks (paid by state and federal) if unemployment reaches a certain level or More than 39 weeks (paid by federal government) in some areas if national unemployment rate is high 24 Certificate of Insurance Printed form executed by insurance company that a named insured has in force the insurance designated by the certificate ACCORD form is standard Proof of proper insurance coverage per contract Includes list of “Named Insureds” 25