Jefferies Healthcare Conference Presentation

advertisement

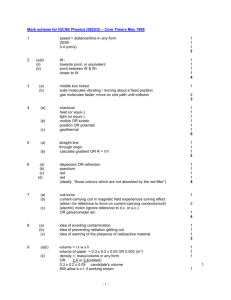

Jefferies Healthcare Conference Presentation 13th November 2012 Today’s presenters Chief Executive Officer John Beighton joined Mercury Pharma in May 2010 John has over 29 years of pharmaceutical industry experience Prior to joining Mercury, John spent 14 years at Teva Pharmaceuticals at various positions including as the Head of Teva UK and Vice President of Global Business Optimisation. Prior to joining Teva, John spent 14 years with the pharmaceutical sales and marketing department at SmithKline Beecham Guy Clark joined Mercury Pharma in August 2010 Guy has over 20 years of experience in the pharmaceutical industry Prior to joining Mercury Pharma, Guy had been President of Glenmark Europe for 3 years, and Director of Business Development for IVAX Europe for 5 years Guy also has a background in large pharma in sales, marketing and BD roles, having spent 9 years with GD Searle and Pharmacia Guy Clark Director, Strategic Business Development Today’s Presenters John Beighton Merger Plan Merger Background Cinven acquired Mercury Pharma in August of 2012 with the ambition of creating a significant panEuropean specialty pharmaceutical company focused on niche products, with an asset-light business model Cinven later announced the acquisition of Amdipharm, which specialises in marketing branded off-patent pharmaceutical products internationally. The transaction closed on October 31, 2012 Mercury now plans to merge with Amdipharm in a combined operation, run by group CEO John Beighton. The transaction creates an exciting enhanced business that: - Doubles the scale of the business with revenues of over £200m across 200+ molecules - Significantly expands the geographic foot print of the business in over 100 markets - Enhances a diversified business by decreasing reliance on any single product or manufacturer - Provides growth drivers through exploiting new opportunities across both business models - Creates cost synergies by combining infrastructure and leveraging Mercury’s bi-national cost structure 4 Mercury Pharma snapshot Company Overview Mercury Pharma is a specialty pharmaceutical company focused on sale of niche prescription off-patent products with limited competition from originators or generics manufacturers or license holders Operates in the retail and hospital segments with a direct sales presence in the UK, Ireland and the Netherlands with sales and marketing partnerships across 25 countries and distribution partners in 10 countries Flexible, asset-light business model focused on the sale of niche products with manufacturing outsourced to over 35 partners Core Processes centre of excellence in Mumbai, employs 2/3 rd of the company staff Mercury Pharma Growth Strategy 1. Driving volume growth of existing portfolio 2. Sustainable price increases in existing portfolio 3. Investment in product development to drive future new product launches 4. Profitable international expansion through insourcing sales and marketing in select territories (e.g. Netherlands) Standalone Pharmaceutical Trading Performance (£m) FYE - 31 December 120 Revenue EBITDA EBITDA Margin 100 60 40 20 67.8 58.5 50.1 29.8% 36.6% 18.3 2007A (1) 17.4 2008A (1) 36.2 47.7% 48.6% 44.9% 44.7% 37.0% 0 (1) 88.7 80.9 80 104.4 98.9 39.9 48.1 49.8 25.1 2009A (1) 2010PF Historical numbers based on FYE - March 31 5 2011PF LTM Sep-12 2012PF Amdipharm snapshot Company Overview Headquartered in Basildon (UK), Amdipharm is a specialty pharmaceutical company that acquires, markets and sells offpatent specialist pharmaceuticals Through eighteen significant acquisitions, Amdipharm offers more than 50 molecules which sell in over 80 countries and generated revenue of £107m (2012PF) Operates a highly flexible, asset-light business model with 26 third party manufacturers and 62 API suppliers to produce its portfolio of 632 finished SKUs Amdipharm is expected to show a decline in mature products, which is compensated with growth from drugs like Valoid ampules, soluble Prednisolone and Neomercazole, where the company has exclusive / semi-exclusive positions Founded in 2002 and acquired by Cinven in October 2012 Standalone Amdipharm Trading Performance (£m) FYE - 31 December 140 120 Revenue 106.2 Normalised EBITDA Normalised EBITDA margin 107.4 102.6 100 80 60 40.8% 40.2% 39.5% 42.0 43.8 41.2 40 20 0 2010PF 2011PF 6 2012F Mercury & Amdipharm combined Enhanced diversification Mercury & Amdipharm by product by country UK Rationale for combining Mercury Pharma and Amdipharm Enhanced position as a leading niche global pharmaceutical company Highly complementary businesses enhancing diversification Significant achievable cost synergies Provides platform for immediate further growth Doubling scale – 2012PF revenue increased from £104m to £212m (104% increase), 2012PF EBITDA increased from £50m to £94m (88% increase) 202 molecules (92% increase) split between 1,383 SKUs (259% increase) Non-UK sales increased from 24% to 44% No meaningful overlap in existing molecule or SKU portfolio UK reduced from 76% to 56% of total group revenue No individual molecule represents >11% of combined revenue; No individual CMO represents >10% of combined spend Both companies operate an asset-light business model Clearly identified cost synergies from eliminating overlapping headcount and infrastructure and consolidation of distribution and manufacturing and leveraging Indian operations Further synergies from reduced wholesaler rebates given increased scale and breadth of product offering Potential benefit could be £10-12m per annum Combined management team and infrastructure brings together Mercury Pharma’s UK and Amdipharm’s international expertise to create a best in class operations Identified and easily achievable value optimisation opportunities to be delivered through a combined business strategy; Amdipharm is an under exploited portfolio but is beginning to apply Mercury Pharma’s proven approach to drive growth 8 Strategy for combined business Robust strategy built upon key strengths and principles of both companies Apply best practices across both companies to drive value and growth Multiple levers to achieve growth Realise synergies to optimise combined organisation Not an operationally transformational acquisition, given asset light model – but easy wins given a similar focus on offpatent niche products: - Apply Mercury Pharma’s portfolio value optimisation skills to the Amdipharm UK portfolio - Utilise Mercury Pharma’s scalable, bi-national infrastructure for best-in-class skills at relatively low cost - Employ Mercury Pharma’s significant business development team to extend pipeline development across the group’s full range of products and markets - Leverage Amdipharm's strong international experience and network of partners to maximize potential of group portfolio - 14 countries have sales greater than £2m Significant volume / price optimization opportunities - Mercury Pharma management successfully applied this strategy to the Mercury portfolio over the last two years; Amdipharm started to apply this strategy but portfolio remains underexploited; opportunity to accelerate because Mercury management has a proven track record in executing Leveraging Mercury Pharma’s development team to develop pipeline across the Group Enhance opportunities to consolidate international operations into directly managed subsidiaries to drive further growth and enhance profitability (as done in Netherlands) Identified and verified immediate cost savings of at least £6m per annum Consolidation of overlapping headcount and infrastructure (leveraging existing Indian operations) and enhancing sales terms with wholesalers and distributors Further operational enhancements from optimising third-party manufacturing base Cautious and prudent approach will be adopted – Management team have significant experience of amalgamating acquisitions and successfully delivering synergies 9 Key Strategic Elements Key Strategic Elements Enhanced by merger 1 Highly diversified portfolio 2 The combined business has 202 molecules split between 1,383 SKUs Largest drug contributes no more than c.10% to group sales Sales presence in 125 countries, 3 direct and rest through distributors Strong barriers to entry due to relatively small size of individual product markets by country, combined with geographic and SKU diversity and requirement for separate marketing authorisations by country Provides recurring revenues Portfolio comprises low-cost, off-patent products which are not the main focus of healthcare cost reduction initiatives UK is an attractive market owing to unrestricted pricing on unbranded products Current Mercury Pharma infrastructure in India can be leveraged for operations reducing headcount and generating synergies Largest CMO supplier is just c.10% of revenue for combined company, down from 21% for Mercury Pharma standalone Proven track record at executing multiple volume and price initiatives, tailored for each SKU Low-risk, low-cost pipeline already well progressed Synergies Limited and stable competitive dynamics around key products 3 Favourable position in UK regulatory framework 4 Bi-national, outsourced business model supporting strong, sustainable margins and cash generation 5 Multiple organic growth opportunities 11 1 Highly diversified portfolio 12 2 Complex manufacturing processes – 80% Regulatory approvals – – 70% Many of the products will have been on the market for many years and hence will have been approved under “easier” regulatory regimes Obtaining a new approval will often require qualifying under newer, tougher approval regimes 60% 50% rantoin 40% 30% Relatively limited sales potential 10% 0% 10% 20% 30% 40% United Kingdom Difficult to manufacture / API sourcing Financial unattractiveness (sales <£2m) Existing competition 13 50% 60% 70% 80% 90% Other Markets 0% % Belgium Portugal Netherlands This makes it harder for other suppliers to find it economically viable to enter the market £ Australia – Nearly all of these niche products have total global sales of less than £10m 20% Spain – Many of these niche products have total sales by presentation in any given country of less than £2m South Africa – Ireland 90% Italy Many of these products are old, with out-dated manufacturing processes, and were generally divested because they were difficult to make Sales (£m) 100% France Limited and stable competitive dynamics around key products 100% Favourable position in UK regulatory framework 3 UK is an attractive market for Mercury/Amdipharm UK pharmaceutical reimbursement less at risk from austerity policies Unlike many other areas of government expenditure, the DoH currently forecasts the NHS budget (£108.8bn) to continue to rise, at 2.5% CAGR through the year 2014-15 Pharmaceutical reimbursement contributed c.10% to the total NHS budget in 2012, so is not as material to overall healthcare spending as actual service provision, which is the primary focus of healthcare reform …driven by an effective regulatory policy encouraging the use of off-patent products The UK has one of the lowest per capita pharmaceutical spends in Europe… €600 Penetration of off-patent drugs in % (by volume) €400 €200 539 465 412 USA 373 358 345 338 315 289 249 DE SE ES IT GR NO UK €0 CH FR BE 14% 51% Japan 35% 68% Germany 7% 51% 25% 40% 9% …and the lowest average cost per prescription… France €0.5 €0.4 UK €0.3 €0.2 59% €0.4 €0.1 €0.3 €0.3 €0.3 €0.3 18% 0% 71% 25% Off-Patent Branded FR ES DE ROW 50% 13% 11% 75% €0.2 €0.0 IT 28% UK Source: IMS, EGA and Mercury Pharma management 14 Off-Patent Un-Branded On-Patent 100% Bi-national, outsourced business model supporting strong, sustainable margins and cash generation 4 Mercury Pharma’s scalable operating structure Head-to-head comparison 2011PF Revenue (£m) 89 FTEs Efficient structure combining UK headquarters with Indian centre of excellence 41 9 30 Number of employees 40 30 19 20 10 0 18 46 38 33 31 30 Commercial 40 16 26 Business Devt 7 2 Finance 23 13 Legal 2 0 Supply Chain 19 24 Med, Reg & Quality 53 43 HR / IT 29 7 Admin 14 4 Total FTEs 187 109 7 5 194 114 18 4 12 9 Commercial / Business Sales & Development Marketing 12 1 103 4 7 Global Regulatory / Finance / HR / IT / Facilities Operations Medical Affairs Legal / Admin Others Total employees High-quality employee base in India A balanced mix of qualified employees with varied academic backgrounds and strong understanding of regulatory, pricing and competitive aspects of the European pharmaceuticals industry India-based employees account for 65% of headcount but only 22% of employee cost Number of employees Employee costs India Senior Management India Total FTEs Mercury Pharma infrastructure is designed to be scalable and is built for growth Significant overlap providing substantial scope for synergies Note: Global Operations includes Quality, Supply Chain Management, Procurement and Project Management 15 4 Bi-national, outsourced business model supporting strong, sustainable margins and cash generation Long and closely managed strategic relationships with well established blue-chip CMOs with some approaching 15 years Combined company has decreased overall reliance on any single CMO Top 10 CMOs by net spend (1) CMO Mercury Pharma Standalone % of spend Rank Amdipharm Amdipharm Standalone % of spend 1 18% 7.0 10.4% 9 2% 6.7 9.9% - 2 13% 5.3 7.9% - 3 11% 4.3 6.4% - 4 8% 3.3 4.9% - 5 8% 3.0 4.5% Rank Mercury - 1 21% % of Total Spend (2) 2 10% - 2.8 4.2% 3 9% - 2.7 3.9% 4 9% - 2.6 3.8% 5 9% - 2.4 3.6% 52.6 14.8 67.4 59.3% 40.7% 100% Subtotal Other Total (1) (2) Spend (£m) (1) Figures refer to 2011PF for Amdipharm and Mercury Pharma Figures based on CY2011 for Amdipharm and FYE March 2012 for Mercury Pharma 16 5 Multiple organic growth opportunities Volume Price Mercury/ Amdipharm Best practice synergies Low risk, executable pipeline International consolidation Multiple levers to drive growth with different strategies for different products and geographies 17 5 Multiple organic growth opportunities: Low risk pipeline Low risk executable initiatives Solid track record of delivering FY13 full-year budget of £4.2m New Company Revenue (£m) £3.0 Launch of existing molecules in new markets £2.5 £2.2 95% above YTD budget Superior execution of Mercury Pharma management strategy £2.0 £1.5 £1.1 £1.0 £0.5 New strength version of existing molecules £0.0 (2) FY13 YTD Budget PIPELINE SUCCESS CONTINUES: – New formulations of existing molecules New molecules (1) (2) Figures based on CY2011 for Amdipharma and FYE March 2012 for Mercury Pharma Figures are YTD Sep-12 (April to September) 18 8 product launches YTD – on track vs plan KEY NEW LAUNCHES: – Eltroxin Oral Solution launched in May 2012 – on time – Alfacalcidol capsules launched in May 2012 – on time – Teromeg (Omega 3) capsules launched in October 2012 – on time PRIOR YEAR GROWTH DRIVERS: – Codipar capsules (new formulation of existing product) – Co-codamol Effervescent (new formulation of existing product) FUTURE PIPELINE: – C. 11% of 2015 revenue comes from low risk executable pipeline initiatives(1) FY13 YTD Achieved 9 new deals signed YTD, against YTD target of 7 5 Multiple organic growth opportunities: International consolidation There is significant potential upside from undertaking incremental investment in recruiting sales managers across selected international markets. Case study – establishing direct sales in the Netherlands Potential front-end strategy in international markets A natural progression of the Company’s international business as it gains scale is to establish a direct sales presence in selected markets A direct presence would allow the Company to: – Capture a greater portion of the pharmaceutical value chain – Implement a ‘push’ strategy for its products to drive higher sales – Better identify opportunities for its products already being sold in the UK – Identify local product / company acquisitions In FY2012, Mercury Pharma management moved from a distributor model to a direct sales model in the Netherlands (see case study on right hand side) Management believes there is significant upside potential in replicating the Dutch model across other ‘mature’ generics markets (with no / limited generics detailing) requiring only small sales offices to significantly drive sales Potential markets for front-ending could include: In FY2012, Mercury Pharma recruited a sales manager in the Netherlands and subsequently revised its contract with its partner from a sales and marketing function to a distribution function The table below shows management’s best estimate of the impact of the new business model in the Netherlands Sales (£m) 12.3 5.1 YE 2011 YE 2013 Revenue (£m) 1.6 2.9 Gross margin 83.0% 79.6% - 0.1 1.0 2.1 65.2% 70.5% 3.6 Cost of sales employees (£m) 9.6 4.2 3.6 9.3 3.9 3.0 6.2 3.7 2.3 Illustrative operating profit (£m) Operating margin 5.4 3.6 1.7 19