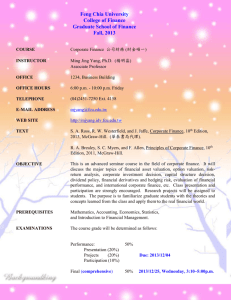

File - Kaitlyn Emerick

advertisement

Kaitlyn Emerick Keiarra Ragland Victoria Saber Agenda: Company Introduction Overview Analysis Analysis of Firm Riskiness Financial Statement Analysis Firm Valuation Future Recommendations Company Overview & Facts SWOT Analysis & Competitors S Presence across the energy value chain -Strategic acquisition of Atlas Energy -Wide geographic presence O Planned investments for future development Agreement to acquire Marcellus shale acreage Technological innovations W -Involvement in the environmental disaster in Ecuador -Strain on sales of refined products $41.06 $87.04 Market Cap 130.8B Market Cap $389.98 --- --- T CVX $117.25 CVX $117.25 Regulation of greenhouse gas emissions Market Cap 2227.78B Market Cap 2227.78B Civil unrest in Nigeria threatens crude oil production Commodity prices risks Health Environmental Safety Calculated Industry Beta Reuters Beta Yahoo Beta Group Calculation CAPM Computation Beta .90 as of 2/27/2013 .80 as of 2/27/2013 1.17 as of 2/27/2013 .77 as of 2/27/2013 3.22% Ratio Analysis: Liquidity Quick Ratio aka Acid Test 1.6 1.4 1.2 1 0.8 0.6 0.4 0.2 0 Quick Ratio aka Acid Test Current Ratio 1.8 1.6 1.4 1.2 1 0.8 0.6 0.4 0.2 0 Current Ratio Industry 2012 2011 2010 2009 Ratio Analysis: Asset Management Days Sales Outstanding Fixed Asset Turnover Ratio 45 40 35 30 25 Fixed Asset Turnover20 Ratio 15 10 5 0 70 60 50 40 30 20 10 0 Industry 2012 2011 2010 2009 2008 Industry Inventory Turnover Ratio 2012 2011 2010 2009 2008 Total Asset Turnover 1.6 45 40 35 30 25 20 15 10 5 0 Industry 2012 2011 1.4 1.2 1 2012 0.8 2010 2011 0.6 2009 2010 0.4 2008 0.2 0 Industry 2012 2011 2010 2009 2008 Industry 2009 2008 Ratio Analysis: Debt Management Times Interest Earned 250 Industry 200 2012 150 2011 2010 100 2009 50 2008 0 Industry 2012 2011 2010 2009 2008 Total Debt Ratio 7.00% 6.00% Industry 5.00% 2012 4.00% 2011 3.00% 2010 2.00% 2009 1.00% 2008 0.00% Industry 2012 2011 2010 2009 2008 Ratio Analysis: Profitability & Market Value Return on Equity Profit Margin Return on Total Assets 30.00% 25.00% 20.00% 15.00% 10.00% 5.00% 0.00% 30.00% 25.00% 20.00% 15.00% 10.00% 5.00% 0.00% 15.00% 10.00% 5.00% 0.00% Price/ Earnings Ratio Market/ Book Ratio 1.8 1.6 1.4 1.2 1 0.8 0.6 0.4 0.2 0 $16.00 $14.00 $12.00 $10.00 $8.00 $6.00 $4.00 $2.00 $0.00 2012 2011 2010 2009 2008 Industry 2012 2011 2010 2009 2008 Industry Firm Valuation: Discount Dividend Model (DDM) Do(1+g)/re-g = 3.69/3.22-2.56 For Chevron’s discount dividend model, re (calculated from CAPM) 3.22 constant growth = 2.56 Calculations = Stock Price $184.71 Currently trading: $117.22 UNDERVALUED Year Dividend % Change % Average of all years 2012 $3.51 .1359 13% 9.25% 2011 $3.09 .0880 8.80% 2010 $2.84 .0677 6.77% 2009 $2.66 .0514 5.14% 2008 $2.53 .1195 11.95% 2007 $2.26 Firm Valuation: WACC Cost of Equity 4.56% Cost of Debt 3.50% Debt to Value 41% Equity to Value 59% WACC 4.71% Terminal WACC Firm Valuation: Valuation using multiples (P/E ratio) Chevron's P/E Ratio Industry P/E Chevron's EPS Stock Price $12.2 $13.32 $162.50 Firm Valuation Revenue Growth Fiscal Year Total Revenues Revenue Growth Rate 2012 2011 241,909.00 253,706.00 -4.88% 5 year average -7.12% 2 year average 7.17% 19.23% Analysts predict -1.30% (yahoo finance) Our Prediction -1.30% Tax Rate Average 2010 2009 204,928.00 171,636.00 16.25% 2008 273,005.00 -59.06% 2012 2011 2010 2009 2008 43.16% 43.30% 40.37% 43.05% 44.19% 42.81% Firm Valuation: Free Cash Flow Model (FCFM) Firm Valuation: Stock Price Valuation Recommendations Begin Investing Continued Growth of Dividends Hold stock Increased Stock Price Value Currently Stable Potential Future Gains Well Established Company