Money and Banking - Holy Family University

advertisement

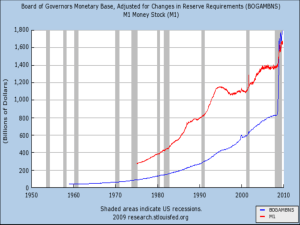

Chapter 16: Monetary Policy Tools 1. The Federal Funds Market and Reserves Central banks have three primary tools for influencing the money supply Discount loans Open market operations Reserve requirement Money supply 1. The Federal Funds Market and Reserves The reserve requirement works through the money multiplier, constraining multiple deposit expansion the larger it becomes. Central banks today rarely use it because most banks work around reserve requirements. 1. The Federal Funds Market and Reserves Discount loans influence the monetary base (MB = C + R). Discount loans depend on banks (or non-bank borrowers, where applicable) first borrowing, then repaying loans. The central bank does not have precise control over MB. 1. The Federal Funds Market and Reserves Open market operations influence the monetary base (MB = C + R). Open market operations (OMO) are generally preferred. The central bank can easily expand or contract MB to a precise level. Using OMO, central banks can also reverse mistakes quickly. 1. The Federal Funds Market and Reserves The Fed Funds Market: banks that need reserves can borrow them from banks that hold reserves they don’t need. Fed Funds Market Overnight bank borrowing Lower rates Higher rates Directly from Fed More Fed scrutiny 1. The Federal Funds Market and Reserves If Fed Funds rate < discount rate, banks borrow in Fed Funds Market If Fed Funds rate > discount rate, Arbitrage: Borrow at discount window/Lend in Fed Funds Market The discount rate sets an upper limit to ff* (the actual Fed Funds rate) because no bank would borrow reserves at a higher rate in the federal funds market than it could borrow directly from the Fed. 2. Open Market Operations and the Discount Window Open market activity decisions: Daily FRBNY researches: • • • • • • The level of reserves The Fed Funds target The actual market Fed Funds rate Expectations regarding float Treasury activities Treasury market conditions – primary dealers, specialized firms, and banks 2. Open Market Operations and the Discount Window Open market activity decisions: Each day, FRBNY determines buy or sell: • Outright – securities permanently join or leave Fed’s balance sheet • Repo (Repurchase agreement) – purchase with a guarantee that seller will repurchase • Reverse repo (matched sale-purchase transaction) – sell with guarantee that buyer will resell to Fed 2. Open Market Operations and the Discount Window Discount window is today primarily a backup facility used during crises when the federal funds market might not function effectively. As lender of last resort, the Fed has a responsibility to ensure that banks can obtain as much as they want to borrow provided they can post what in normal times would be considered good collateral security. 2. Open Market Operations and the Discount Window Discount window As lender of last resort, the Fed has a responsibility to ensure that banks can obtain as much as they want to borrow Provided they can maintain good collateral security To ensure that banks do not rely too heavily on the discount window: • discount rate is usually set a full percentage point above ff*, a “penalty” of 100 basis points 2. Open Market Operations and the Discount Window Discount window: Crisis of 2008 Federal Reserve invoked its emergency powers to create additional lending powers and programs, including: • Term Auction Facility (TAF), a “credit facility” that allows depository institutions to bid for short term funds at a rate established by auction • Primary Dealer Credit Facility (PDCF), which provides overnight loans to primary dealers at the discount rate • Term Securities Lending Facility (TSLF) also helps primary dealers by exchanging Treasuries for riskier collateral for 28-day periods • Asset-Backed Commercial Paper Money Market Mutual Liquidity Facility, which helps money market mutual funds to meet redemptions without having to sell their assets into distressed markets 2. Open Market Operations and the Discount Window Discount window: Crisis of 2008 Federal Reserve invoked its emergency powers to create additional lending powers and programs, including: • Commercial Paper Funding Facility (CPFF) allows the FRBNY, through a special purpose vehicle (SPV), to purchase commercial paper (short term bonds) issued by non-financial corporations • Money Market Investor Funding Facility (MMIFF) is another lending program designed to help the money markets (markets for short term bonds) return to normal 2. Open Market Operations and the Discount Window • The financial crisis also induced the Fed to engage in several rounds of “quantitative easing” or Large Scale Asset Purchases (LSAP) – Goals: 1. 2. increase the prices of (decrease the yields of) Treasury bonds and the other financial assets purchased influence the money supply directly. • Due to LSAP, the Fed’s balance sheet swelled from less than a trillion dollars in early 2008 to about 3 trillion in just a year http://www.federalreserve.gov/monetarypolicy/bst_ recenttrends.htm 2. Open Market Operations and the Discount Window The Discount window is also used to provide moderately shaky banks a longer-term source of credit at an even higher penalty rate .5 percentage (50 basis) points above the regular discount rate. 3. The Monetary Policy Tools of Other Central Banks Federal Reserve European Central Bank • Uses Open Market Operations (OMO) to manage overnight interbank rates • Uses outright purchases, repos, and reverse repos • Lends at marginal lending rates • Pays interest on reserves • Uses Open Market Operations (OMO) to manage overnight interbank rates • Uses outright purchases, repos, and reverse repos • Lends at marginal lending rates • Pays interest on reserves