MONEY MARKET AND CAPITAL MARKET

advertisement

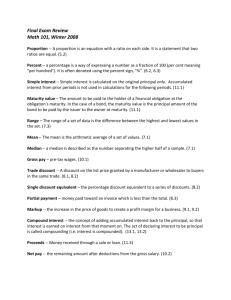

MONEY MARKET AND CAPITAL MARKET Money Market Money market is the market for lending and borrowing of short term funds. It deals with the financial assets having a maturity period less than 1 year. It deals with only those assets which can be converted into cash readily and with minimum transaction cost. Money Market Instruments Call money Market Treasury Bills Certificates of Deposit Commercial Papers Repo Instruments Call money Market Market for extremely short period loans1 day to 14 days. Loans are repayable at demand at the option of either the lender or the borrower. Commercial Papers Issuers: All Pvt sector companies, Public sector units and non banking companies. Investors: Individuals, Banks, Corporates, NRI’s Features: ◦ Instrument comprising promissory note with fixed maturity. ◦ Issued at a discount to face value basis but can also be issued in interest bearing form. ◦ No pledging of asset. ◦ Can be issued directly by the company or through banks Treasury Bills Issued to the public and other financial institutions for meeting the short term financial requirements of the central government. On the basis of periodicity, TB’s can be classified into ◦ 91 Days TB’s (issued at a fixed discount of 4%) ◦ 182 Days TB’s ◦ 364 Days TB’s (do not carry any fixed rate. The discount rate is quoted in the auction by the participants and accepted by the authorities) Certificates of Deposit Issuers: Commercial Banks, Financial Institutions. Subscribers: Individuals, Corporations, Trusts, associations and NRI’s Features: ◦ Freely negotiable ◦ Issued at discount to face value. ◦ Repayable at fixed date. Capital Market Primary Market Secondary Market Primary Market Also known as new issue market The services of Primary market are entirely taken up by banks, brokers and underwriters It deals with the new securities which are issued for the first time for the public subscription. It is also a Platform for expansion, diversification and modernization of existing units. Functions Origination Underwriter Distribution