Extended Citations - James Ashley Morrison

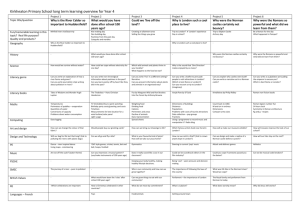

advertisement