Loan Practice

Loan Practice

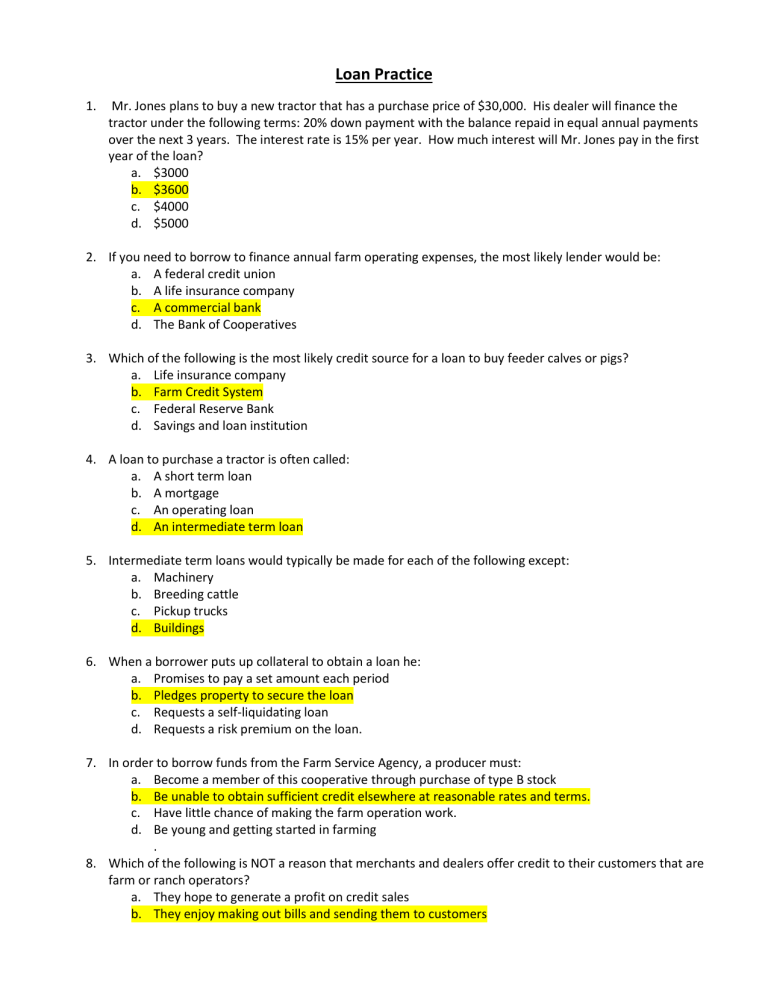

1.

Mr. Jones plans to buy a new tractor that has a purchase price of $30,000. His dealer will finance the tractor under the following terms: 20% down payment with the balance repaid in equal annual payments over the next 3 years. The interest rate is 15% per year. How much interest will Mr. Jones pay in the first year of the loan? a.

$3000 b.

$3600 c.

$4000 d.

$5000

2.

If you need to borrow to finance annual farm operating expenses, the most likely lender would be: a.

A federal credit union b.

A life insurance company c.

A commercial bank d.

The Bank of Cooperatives

3.

Which of the following is the most likely credit source for a loan to buy feeder calves or pigs? a.

Life insurance company b.

Farm Credit System c.

Federal Reserve Bank d.

Savings and loan institution

4.

A loan to purchase a tractor is often called: a.

A short term loan b.

A mortgage c.

An operating loan d.

An intermediate term loan

5.

Intermediate term loans would typically be made for each of the following except: a.

Machinery b.

Breeding cattle c.

Pickup trucks d.

Buildings

6.

When a borrower puts up collateral to obtain a loan he: a.

Promises to pay a set amount each period b.

Pledges property to secure the loan c.

Requests a self-liquidating loan d.

Requests a risk premium on the loan.

7.

In order to borrow funds from the Farm Service Agency, a producer must: a.

Become a member of this cooperative through purchase of type B stock b.

Be unable to obtain sufficient credit elsewhere at reasonable rates and terms. c.

Have little chance of making the farm operation work. d.

Be young and getting started in farming

.

8.

Which of the following is NOT a reason that merchants and dealers offer credit to their customers that are farm or ranch operators? a.

They hope to generate a profit on credit sales b.

They enjoy making out bills and sending them to customers

c.

They hope to improve the seasonal distribution of their sales d.

Provide a convenience to their customers

9.

In making loans to farmers and ranchers life insurance companies: a.

Provide a full range of loans including short term operating loans, intermediate loans and longterm real estate loans b.

Primarily make long term real estate loans c.

Do not currently have any money loaned to farmers or ranchers d.

None of the above.

10.

Which of the following loan terms may it be possible for the borrower to negotiate with the lender? a.

The amount of the loan b.

The interest rate c.

The amount of collateral to be pledged d.

All of the above

11.

Which of the following human characteristics of a prospective borrower are important to a lender? a.

Honesty b.

Moral character c.

Willingness to cooperate with the lender d.

All of the above

12.

What things does a lender try to learn about a prospective borrower from the credit bureau a.

Whether or not he keeps his machinery in good repair b.

His or her past repayment history and credit difficulties c.

Whether he has any financing statements filed in the county clerk’s office against any of his personal business property d.

What the borrowers net worth is

13.

Historically, individuals have held about 15% of the total outstanding farm debt. Which of the following are characteristics of loans made by individuals? a.

They are primarily short-term farm or ranch operating loans b.

They are primarily long-term loans to finance the purchase of real estate c.

The IRS will let the individual charge as low an interest rate as he wants without penalty d.

All of the above

14.

Which of the following factors may indicate to the lender that he has a problem loan? a.

If the collateral pledged for a loan disappears b.

If it is discovered that the borrower has provided fraudulent information on his balance sheet c.

If the borrower is several months delinquent on a scheduled loan payment d.

All of the above

15.

A security agreement reduces the risk of a loan for: a.

A borrower b.

The salesman c.

The lender d.

The Internal Revenue Service

16.

Which of the following statements correctly describes the first years payment on $9000 loan on which the principal is to be repaid in 3 equal installments with the interest charged at 10%? a.

Principal = $4500, Interest = $900

b.

Principal = $3500, Interest = $900 c.

Principal =$6000, Interest = $300 d.

Principal = $6000, Interest = $600

17.

A constant payment loan with payments consisting of principal and interest is called: a.

An amortized loan b.

A discounted loan c.

A capital loan d.

A complementary loan

18.

The Truth in Lending Act clearly specifies that: a.

Agricultural loans must be reported to the USDA b.

Discount method of computing interest is illegal c.

APR must be computed and displayed prominently d.

Agriculture liens must be recorded by the Secretary of State

19.

Under the remaining balance method of computing interest: a.

Interest is charge on the actual amount of money outstanding b.

Interest is calculated on the total amount of the loan and then subtracted from the principal balance c.

Interest is charged on the original loan amount and added to the principal balance d.

Interest is calculated and paid at the end of the loan repayment period.

20.

Under the add-on method for calculating interest: a.

Interest is charged on the actual amount of money outstanding b.

Interest is calculated on the total amount of the loan and then subtracted from the principal balance c.

Interest is charged on the original loan amount and added to the principal balance d.

Interest is calculated and paid that the end of the loan repayment period

21.

An equal total payment plan for repayment of a loan: a.

Must be used on an agricultural loan b.

Is always used on operating loans c.

Provides for equal amounts of principal payments d.

Provides for equal periodic repayments

22.

APR mean: a.

Annual Principal Rate b.

Annual Percentage Rate c.

Accrual Payment Rate d.

Aggies Provide Reality

23.

A revolving line of credit means: a.

An operating loan that may be borrowed, repaid, and then reborrower b.

An operating loan that may not be borrowed, repaid, and then reborrowed. c.

The borrower must repay the outstanding balance on each month d.

A strip of credit manufactured by Winchester

24.

Farmer Buzz owes the bank $2000 but the most that he can give the bank is $1100. If Buzz loans balance prior to payments was $5000 principal and $500 accrued interest, what is his principal after the payment? a.

$3900 principal and $500 interest

b.

$4000 principal and $400 interest c.

$4400 principal and $0 interest d.

$3500 principal and $0 interest

25.

Lenders may require a cash flow analysis to: a.

Determine the profitability of the farm operation b.

Collect data to complete the net worth statement c.

Determine the machinery investment per acre d.

Evaluate loan repayment potential

26.

The objective of determining repayment capacity of a farm or ranch business should be: a.

To determine return to land, labor, or management for the business b.

To determine how much debt the business can safely handle c.

To determine the rate of return to the farmers equity capital d.

To project the net worth of the business for the end of the year.

27.

At the beginning of last year, you had an outstanding loan for $90,000. The loan carries an interest rate of

12% annual percentage rate. You make one loan payment at the end of the year for $25,400. What is the outstanding balance at the beginning of this year? a.

$55,000 b.

$64,600 c.

$75,400 d.

$79,200

28.

It is profitable for a farmer to borrow money to expand his farm business when the borrowed money: a.

Can improve the level of production b.

Can be secured at a low interest rate c.

Returns more than the cost of borrowing money d.

Will increase the volume of business

29.

Accrued interest on a balance sheet refers to: a.

Interest forgiven by the lender b.

Interest that is past due c.

Interest on short term debt d.

Interest that has accumulated since the last loan payment

30.

A type of loan agreement in which the lender can require payment in full at any time is called: a.

An installment note b.

Mortgage c.

Revolving line of credit d.

Demand note

31.

Mr. Banks is considering purchasing a parcel of land. He decided to use the adjusted income capitalization approach to estimate the lands worth. He estimated the annual net income to the land to be $90,000 and his opportunity cost of capital is 12%. How much could he pay and realize a return equal to his opportunity cost of capital? a.

$7,500,00 b.

$750,000 c.

$75,000 d.

$10,800

32.

Farmer Mac owes the bank $2000, but the most that he can give the bank is $1500. If Macs loan balance prior to payment was $7000 principal and $700 accrued interest, what is his balance after the payment? a.

$5000 principal and $700 interest b.

$5500 principal and $700 interest c.

$5500 principal and $0 interest d.

$6200 principal and $0 interest

33.

The repayment of a loan and the interest due with a series of equal payments over a specified period of time? a.

Amortization b.

Capital budgeting c.

Investment analysis d.

Present value

34.

Which loan repayment schedule would cause you to pay the most interest? a.

Semi-annual b.

Monthly c.

Bi monthly d.

Annual

35.

When you shop for a loan, what should you shop for? a.

Rate b.

Term c.

Bankers personality d.

All of the above

36.

Sources of credit for farmers and ranchers are: a.

Commercial banks b.

Farm Credit Services c.

Farm Service Agencies d.

All of the above

37.

The present owner of the Farm Credit System is: a.

The federal government b.

Borrowers from the system c.

Commercial banks, in proportion to their contribution of funds d.

All of the above

38.

The type of loan that cannot be made by the Farm Service Agency is a: a.

Farm ownership loan b.

Homesite development loan c.

Grazing association loan d.

None of the above

39.

The Commodity Credit Corporation makes this type of loan to producers: a.

Nonrecourse loans b.

Stabilization loans c.

Long-term loans d.

All of the above

40.

From the perspective of economics, interest paid is

a.

No cost at all because there is no sacrifice involved b.

The opportunity cost of acquiring funds c.

A real cost only when it involves a written contract d.

Cannot be a real cost

41.

A series of periodic payments is called a(n) a.

Budget b.

Present value c.

Future value d.

Annuity

42.

The internal rate of return is the interest rate which would: a.

Make a net present value just equal to zero b.

Make net present value greater than zero c.

Make sure the investment would be financially feasible d.

Generate positive net cash flow from the investment

43.

An example of debt restructuring that would improve a farmers cash flow in the short run is: a.

Lengthening the repayment period of a large loan from 3 years to 10 years b.

Increasing the interest rate on a line of operating credit c.

Consolidating several small loans into one larger one d.

Shortening the repayment period of a loan from 10 years to 3 years

44.

Outside equity to increase the total resources of a farming operation can be obtained by: a.

Long-term borrowing b.

Reinvesting net farm income c.

Securing funds from non-operator investors or limited partners d.

Inflation in asset values

45.

An amortized loan repayment plan with a balloon payment a.

Has all the principal due in one payment b.

Has each total payment larger than the previous one c.

Adjusts the interest rate after each payment d.

Has more principal due in the final payment than in others

46.

The Farm Credit System obtains loan funds from: a.

Selling bonds on the national money markets b.

Customers deposits c.

Guaranteeing commercial bank loans d.

The federal government

47.

When a borrower wants to establish credit with a new lender, the possibility of success will be improved if: a.

Existing loans and accounts payable are not revealed b.

Several years of accurate financial statement are provided, which show financial progress over time c.

The borrower will guarantee the loan alone rather than with a co-signer d.

The loan request is for a land purchase rather than for self-liquidating assets such as feeder livestock

48.

The main advantage of purchasing used machinery instead of new machinery is:

a.

Lower initial investment b.

Increased reliability c.

A longer expected useful life d.

Lower repair costs

49.

Major sources of farm credit include each of the following except: a.

Insurance companies b.

Farm Credit Services c.

Input suppliers d.

Federal credit unions

50.

On April 11, Karen borrowed $8000 to plant corn. On November 1, she repaid the $8000 along with $495 interest. What annual interest rate did she pay? a.

6.187% b.

9.281% c.

10.607% d.

12.375%

51.

Donna Farmer borrowed $100,000 from the First County Bank for five years on October 19, 2011. The terms of the loan require equal principal payments plus interest each October 19 th . If the interest rate is

10%, what would be the principal plus interest payment for October 19, 2012? a.

$20,000 b.

$28,000 c.

$30,000 d.

$33,000

52.

An $80,000 loan amortized at 9% interest for 10 years has annual payments of $12,465.61. How much total interest is paid over the loan? a.

$7200 b.

$44,656 c.

$72,000 d.

$124,656

53.

An $80,000 loan amortized at 9% interest for 10 years has annual payments of $12,465.61. If the 10 th and final payment includes $1029.27 of interest, what was the outstanding principal balance after the 9 th payment? a.

$9,102.93 b.

$11,219.04 c.

$11,463.24 d.

$13,494.87

54.

On March 1, a farmer borrowed $25,000 to buy seed and fertilizer. On December 1, the farmer repaid the

$25,000 along with $1828.13 interest. What is the annual interest rate of the loan? a.

7.31 b.

8.77 c.

9.75 d.

18.28

55.

A farmer has a $50,000 loan amortized at 9% interest for 15 years. The loans yearly annual payment is

$6203. How much of the first years payment is principal? a.

$1092

b.

$1703 c.

$2592 d.

$4500

56.

Your banker tells you that your loan will be amortized. This means: a.

You won’t be charged interest b.

You pay all the interest at the end of the loan c.

Interest is calculated on the original amount of the loan and added on d.

There will be more than one payment on the loan

57.

A rancher borrows $50,000 and pays it all back in 9 months along with $4125 interest due on the loan.

What was the interest rate on the loan? a.

8.25% b.

10.0% c.

11.0% d.

12.5%

58.

A feed dealer makes a credit charge of 1.5% monthly on all bills not paid by the 10 th of the month. The annual interest rate would be a.

6% b.

8% c.

12% d.

18%

59.

A line of credit loan to purchase fertilizer is: a.

An operating loan b.

A mortgage c.

A consumer loan d.

A long term loan

60.

Calculate the first year payments on a constant principal/decreasing payment loan for $240,000 over 20 years at 9% interest. a.

$12,450 b.

$22,350 c.

$33,600 d.

$36,200