Ch06--National Income Accounting

advertisement

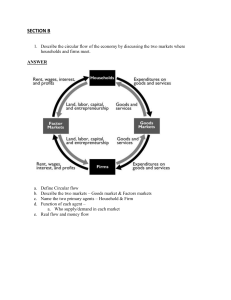

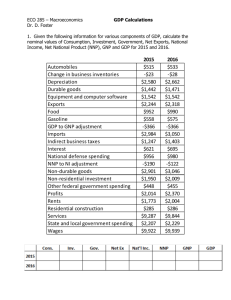

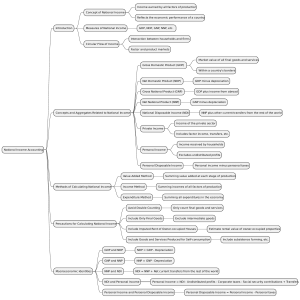

National Income and Product Accounting • Gross vs. Net • Domestic vs. National • Product vs. Income 1 National Income and Product Accounting • Gross vs. Net – Net of what??? • Net of depreciation • Gross Private Domestic Investment (I) includes all equipment, structures, and net additions to inventory produced in a year – But some capital stock depreciates in the process of producing this year’s output • Net National Product nets depreciation from Gross National Product – NNP reflects net investment 2 National Income and Product Accounting • Domestic vs. National • GDP refers to all final goods and services produced within a country’s borders • GNP refers to all final goods and services produced by the nationals of a country regardless of where they produce it. GNP = GDP + Net Factor Income From Abroad 3 National Income and Product Accounting • Product vs. Income • National Income (NI) includes the wages, interest, rents, and profits earned from producing the year’s Net National Product. – We don’t add income and product together … that would be double counting • NI = NNP – Indirect Business Taxes • Sales taxes are included in what we pay for things but go to the government. • They’re not part of anyone’s income 4 GDP “Output” • Gross Domestic Product (GDP): the market value of all final goods and services produced in a country during a year. Market Value: The worth of a thing is the price it will bring. Only Final Goods and Services Count GDP = C + I + G +X GDP excludes financial transactions and income transfers – these do not reflect production. GDP must be produced within our borders Net additions to inventory are current output so they are also included in GDP. 5 Income earned from production and GDP Payments for final goods and services: Wages and benefits paid to workers + Proprietors’ income + Rents + Interest + Corporate profits National Income Indirect business taxes NNP PLUS Capital consumption allowance GNP PLUS Minus Net factor income from abroad GDP6 GDP – GNP – NNP – NI – PI – DI 7 • Personal Income (PI) is national income – Plus net income received but not earned (e.g., interest on gov’t debt, transfer payments like social security) – Minus net income earned but not received (e.g., retained corporate earnings). • Disposable Personal Income (DI) is PI minus personal taxes. – We divide our disposable income (DI) between consumption expenditure (C) and saving (S) 8