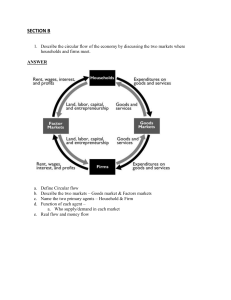

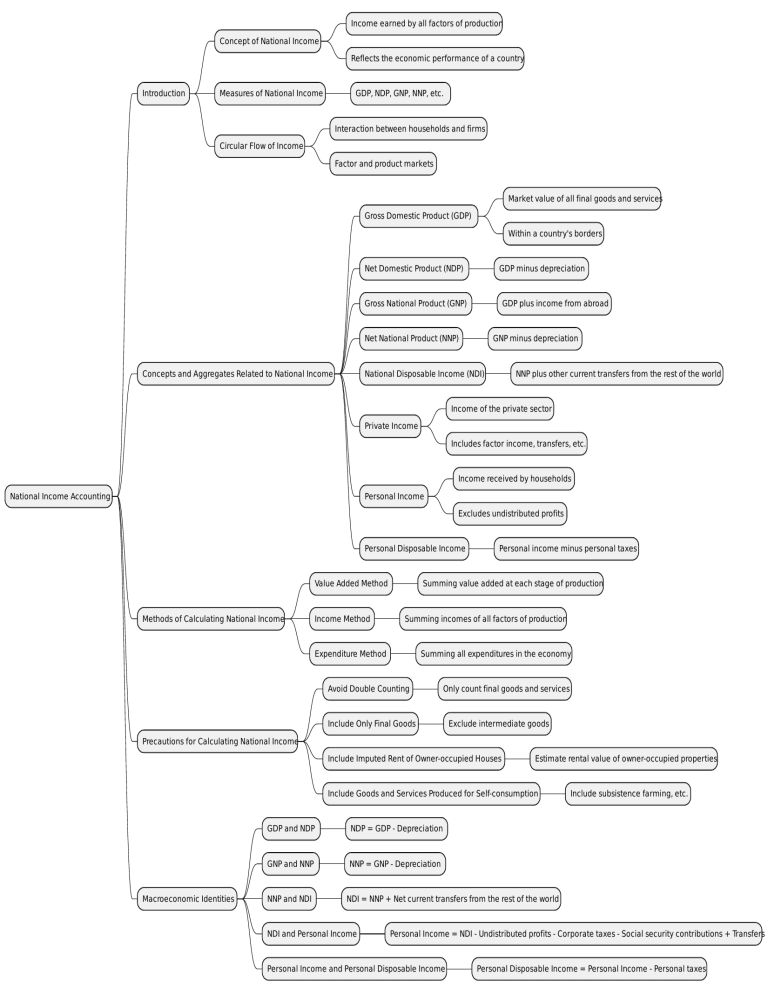

Income earned by all factors of production Concept of National Income Reflects the economic performance of a country Introduction Measures of National Income GDP, NDP, GNP, NNP, etc. Interaction between households and firms Circular Flow of Income Factor and product markets Market value of all final goods and services Gross Domestic Product (GDP) Within a country's borders Net Domestic Product (NDP) GDP minus depreciation Gross National Product (GNP) GDP plus income from abroad Net National Product (NNP) Concepts and Aggregates Related to National Income GNP minus depreciation National Disposable Income (NDI) NNP plus other current transfers from the rest of the world Income of the private sector Private Income Includes factor income, transfers, etc. Income received by households National Income Accounting Personal Income Excludes undistributed profits Personal Disposable Income Value Added Method Methods of Calculating National Income Income Method Personal income minus personal taxes Summing value added at each stage of production Summing incomes of all factors of production Expenditure Method Summing all expenditures in the economy Avoid Double Counting Only count final goods and services Include Only Final Goods Exclude intermediate goods Precautions for Calculating National Income Include Imputed Rent of Owner-occupied Houses Estimate rental value of owner-occupied properties Include Goods and Services Produced for Self-consumption Macroeconomic Identities GDP and NDP NDP = GDP - Depreciation GNP and NNP NNP = GNP - Depreciation NNP and NDI NDI = NNP + Net current transfers from the rest of the world NDI and Personal Income Include subsistence farming, etc. Personal Income = NDI - Undistributed profits - Corporate taxes - Social security contributions + Transfers Personal Income and Personal Disposable Income Personal Disposable Income = Personal Income - Personal taxes