Econ 104

advertisement

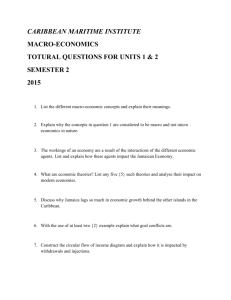

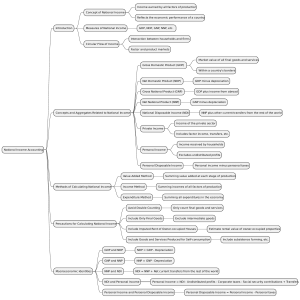

Econ 104 ANSWERS TO EXERCISES: CHAPTER 23 1. Below is a list of national income figures for a given year. All figures are in billions. Answer the following questions based on the figures given. Problem in National Income Accounting Gov’t tfr. Payments…………………………………………………..16 Gov’t purchases of goods and services………………………………69 Personal income taxes………………………………………………..38 Corporate income taxes………………………………………………28 Indirect business taxes………………………………………………..15 Social security contributions…………………………………………..8 Undistributed corporate profits……………………………………….19 Proprietors’ income…………………………………………………...25 Compensation to employees…………………………………………240 Personal consumption expenditures………………………………....267 Depreciation (cap. Consumption allowances)………………………...14 Rents…………………………………………………………………..10 Exports of the U.S…………………………………………………….14 Corporate profits……………………………………………………...70 Interest………………………………………………………………..12 Dividends……………………………………………………………..23 Imports of the U.S…………………………………………………….17 Net private domestic investment……………………………………...47 Net foreign Factor income……………………………………………...0 1 a. Calculate gross domestic product (GDP). GDP = C + Ig + G + Xn = 267 + (47 + 14) + 69 + (14 – 17) = 394 b. Calculate gross national product (GNP). GNP = GDP + Net foreign factor income = 394 + 0 = 394 c. Determine net national product (NNP). NNP = GNP – depreciation = 394 – 14 = 380 d. Determine national income (NI). NI = NNP – IBT = 380 – 15 = 365 e. Calculate personal income (PI). PI = NI – income earned but not received + transfer payments = 365 – 28 – 8 – 19 + 16 = 326 f. Calculate disposable personal income (DPI). DPI = PI – Personal taxes = 326 – 38 = 288 2 2. Which of the following transactions will be included in calculating this year’s GDP? Explain your answer in each case. a. Social Security payments received by a retired factory worker. No; Transfer Payment b. The services of a painter in painting her own home. No; Not marketed production c. The income of a dentist. Yes; payment for a service d. The money received by Smith when he sells a 1960 Chevrolet to Jones. No; included in year it was produced e. The monthly allowance that a college student receives from home. No; household transfer f. The rent received on a two-bedroom apartment. Yes; payment for a service g. An increase of 2 billion dollars in business inventories. Yes; increase in gross investment h. The purchase of 10 shares of General Motor’s stocks. No; exchange of assets 3 4