Midterm Practice Problems Solutions

advertisement

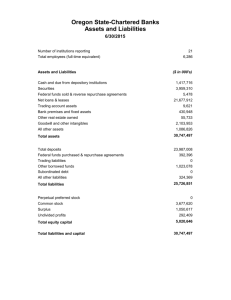

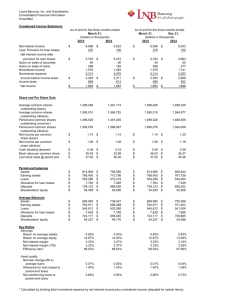

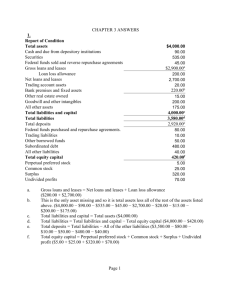

Midterm Practice Problems Solutions Chapter 4 4-2. Project Return: 17.01%. NPV= $507,465.18. Norfolk is likely to proceed with this project because the net present value is positive and the project expected return is greater than the 15% rate they need to earn. 4-3. E (R) = 10.4%, σ = 4.73% Thus the branch will slightly increase the bank's expected return but slightly decrease its overall risk. The bank should proceed with this project. 4-4. E (R) =10.80%, σ2 = .00244 and σ = .049395 or 4.94% The proposed project raises the savings banks expected return slightly and slightly decreases its overall risk. The bank should proceed with this project. 4-5. Lily location- E (R) = 12.15%, σ2 = .00242, and σ = .0492 or 4.92% Daisy location- E (R) =12.175%, σ2 = 0.00238, and σ = 0.04876 or 4.87% Based on the statistics and forecasts, the expected return of Daisy location is slightly higher and the risk is slightly lower compared to Lily location, and thus Daisy location should be used as a test case. 4-6. NPV=-$11,831.49. The net present value of this project is negative. First National Bank of Conway should not add the ATM machines to the Westside. Chapter 5 5-1. Report of Condition Total assets Cash and due from depository institutions Securities Federal funds sold and reverse repurchase agreements Gross loans and leases Loan loss allowance Net loans and leases Trading account assets Bank premises and fixed assets Other real estate owned Goodwill and other intangibles All other assets Total liabilities and capital Total liabilities Total deposits Federal funds purchased and repurchase agreements. Trading liabilities Other borrowed funds Subordinated debt All other liabilities Total equity capital Perpetual preferred stock Common stock Surplus Undivided profits a. b. c. d. e. f. $4,000.00 90.00 535.00 45.00 $2,900.00a 200.00 2,700.00 20.00 220.00b 15.00 200.00 175.00 4,000.00c 3,580.00d 2,920.00e 80.00 10.00 50.00 480.00 40.00 420.00f 5.00 25.00 320.00 70.00 Gross loans and leases = Net loans and leases + Loan loss allowance ($200.00 + $2,700.00) This is the only asset missing and so it is total assets less all of the rest of the assets listed above. ($4,000.00 − $90.00 − $535.00 − $45.00 − $2,700.00 − $20.00 − $15.00 − $200.00 − $175.00) Total liabilities and capital = Total assets ($4,000.00) Total liabilities = Total liabilities and capital − Total equity capital ($4,000.00 − $420.00) Total deposits = Total liabilities − All of the other liabilities ($3,580.00 − $80.00 − $10.00 − $50.00 − $480.00 − $40.00) Total equity capital = Perpetual preferred stock + Common stock + Surplus + Undivided profit ($5.00 + $25.00 + $320.00 + $70.00) 5-2. Report of Income Total interest income Total interest expense Net interest income Provision for loan and lease losses Total noninterest income Fiduciary activities Service charges on deposit accounts Trading account gains and fees Additional noninterest income Total noninterest expense Salaries and employee benefits Premises and equipment expense Additional noninterest expense Pretax net operating income Securities gains (losses) Applicable income taxes Income before extraordinary items Extraordinary gains—net Net income a. b. c. d. e. f. $200 140a 60 20b 100 20 25 25c 30 125 95d 10 20 15 5 3 17e 2 19f Total interest expense = Total interest income − Net interest income ($200 − $60) Provision for loan and lease losses = Net interest income + Total noninterest income − Total noninterest expense − Pretax net operating income (60 + $100 – $125 – $15) There are four areas of Total noninterest income and only one is missing and the total is given. ($100 − $20 − $25 − $30) There are three areas of Total noninterest expense and only one is missing and the total is given ($125 – $10 – $20) Income before extraordinary items = Pretax income + Security gains – Taxes ($15 + $5 – $3) Net income = Income before extraordinary items + Extraordinary gains—net ($17 + $2) 5-3. Net interest income Net noninterest income Pretax net operating income Net income after taxes Total operating revenues Total operating expenses Dividends paid to common stockholders a. b. c. $40a −15b 20c 16d 215e 195f 10g Total interest income − Total interest expense ($140 − $100) Total noninterest income − Total noninterest expense ($75 − $90) Net interest income + Net noninterest income − PLL ($40 – $15 − $5) d. e. f. g. Pretax net operating income − Taxes ($20 − $4) Interest income + Noninterest income ($140 + $75) Interest expenses + noninterest expenses + Provision for loan losses ($100 + $90 + $5) Net income after taxes − increases in bank’s undivided profits ($16 − $6) 5-4. Total assets Net loans Undivided profit Fed funds sold Depreciation Total deposits a. b. c. d. e. f. 5-5. a. b. c. 5-6. a. b. c. d. e. f. g. h. i. j. $405a $285b $7c $20d $5e $335f Total liabilities + Total equity capital ($30 + $375) Gross loans − Allowance for loan losses ($300 – $15) Total equity capital – Preferred stock – Common stock – Surplus ($30 – $15 – $5 – $3) This is the only asset missing so subtract all other assets from total assets Bank premises and equipment, gross – bank premises and equipment, net ($25 – $20) Total liabilities less nondeposit borrowings ($375 – $40) Net Loans = Gross Loans –ALL = $800 − $45 = $755 million Gross Loans = $800 million – ($10 million − $7 million) = $797 million ALL =$45 million – ($12 million− $2 million − $7 million) = $42 million (The amount of the loan that is bad) Net Loans = Gross Loans – ALL = $797 − $42 = $755 million Gross loans and ALL would not change as the bank would recover all the money invested earlier. This would be part of Additional noninterest expense and part of Total noninterest expense. This would be part of Salaries and Benefits and part of Total noninterest expenses. This would be part of Total interest expenses. This would be part of Provision for loans and losses to go into reserves for future bad debts. This would be part of Additional noninterest income and part of Total noninterest income. This would be part of Total interest income. This would be part of Service charges on Deposit accounts and then part of Total noninterest income. This would be part of Total interest income. This would be part of Premises and equipment expenses and part of Total noninterest expenses. This would be part of Security gains (losses). 5-7. Gross loans + $6,000 Total deposits + $6,000 b. Government securities + $1,000 Total deposits + $1,000 Bank premises & equipment, gross +$100,000 Common stock/surplus + $100,000 Gross Loans − $2,500 Total Deposits − $2,500 Cash and Due from Bank − $750,000 Gross Loans and Leases + 750,000 Cash and Due from Bank − $5,000,000 Federal Funds Sold +$5,000,000 Gross Loans −$1,000,000 ALL −$1,000,000 c. d. e. f. g. 5-8. Off-balance-sheet items for John Wayne Bank (in millions of $) Total unused commitments Standby letters of credit and foreign office guarantees (Amount conveyed to others) Commercial letters of credit Securities lent Derivatives (total) Notional amount of credit derivatives Interest rate contracts Foreign exchange rate contracts Contracts on other commodities and equities All other off - balance -sheet liabilities Total off-balance-sheet items Total assets (on-balance sheet) Off-balance-sheet assets ÷ on-balance-sheet assets a. b. $8,000 1,350 −50 60 2,200 100,000 22,000 54,000 22,800a 1,200 49 111,609b 12,000 9.30% Total derivatives − All other derivatives [100,000 – (22,000 + 54,000 + 1200)] The sum of all of the off-balance sheet items The Off-balance-sheet-assets of John Wayne Bank are in proportion with other banks of the same size. 5-9. Bluebird State Bank Report of Income (in millions of dollars) Total interest income Interest on loans Int earned on government bonds and notes Total $90 $9 $99 Total interest expense Interest paid on federal funds purchased Interest paid to customers time and Savings deposits Total $40 $45 Net interest income Provision for loan loss $54 $5 Total noninterest income Service charges paid by depositors Trust department fees Total Total noninterest expenses Employee wages, salaries and benefits Overhead expenses Total $5 $3 $3 $6 $13 $3 $16 Net noninterest income ($10) Pretax income Taxes paid (28%) Securities gains/(losses) $39 $11 ($7) Net income Less dividends Retained earnings from current income $21 $4 $17 5-10. The items which would normally appear on a bank's balance sheet are: Federal funds sold Credit card loans Vault cash Allowance for loan losses Commercial and Industrial Loans Repayments of credit card loans Common stock Federal funds purchased Deposits due to bank Leases of business equipment to customers Savings deposit Undivided profits Mortgage owed on the bank’s buildings Other real estate owned Additions to undivided profits The items which would normally appear on a bank’s income statement are: Interest received on credit card loans Depreciation on premises and equipment Interest paid on money market deposits Securities gains or losses Utility expense Provision for loan losses Service charges on deposits 5-11 Total interest income (TII) and Total interest expense (TIE): TII = 2 TIE and Net interest income = TII –TIE = $800 so: 2 TIE – TIE = $800 Hence, TIE = $800 and TII = 2 ($800) = $1,600 Total noninterest income (TNI) and Total noninterest expense (TNE): TNI = 0.75TNE and Net noninterest income = TNI – TNE = – $500 so: 0.75TNE – TNE = – $500 – 0.25 (TNE) = $500. Hence, TNE = $2,000 and TNI = 0.75 × ($2,000) = $1,500 Provision for loan losses (PLL): PLL = 0.03×Total interest income = 0.03 × ($1,600) = $48 Income taxes: Net income before taxes = Net interest income + Net noninterest income – PLL Net income before taxes = $800 – $500 – $48 = $252 Taxes = 0.3 × Net income before taxes = 0.3 × 252 = $75.60 Dividends paid to common stockholders: Net income after taxes = Net income before taxes − Taxes Net income after taxes = $252 − $75.60 = $176.4 Increase in undivided profit = Net income after taxes – Dividends Dividends = Net income after taxes – Increase in undivided profit Dividends= $176.4 − $200 = −$23.6 Therefore, no dividends are paid to the common stockholders.