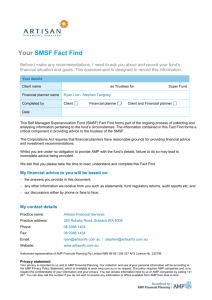

MasterKey Fundamentals 21 Nov Refresh

advertisement

SMSF’S FRIEND OR FOE? Slide title 1 What Do Accountants / Advisers Provide Clients??? Financial Independence = Building MY cashflow to replace employment cashflow to meet cost of living cashflow Slide title 2 2 WHAT DOES SMSF MEAN? • Stuffed • My • Super • Forever Slide title 3 What are we going to cover • • • • • • • • • • • Latest update on announced proposed changes to Super SPAA Survey Why has there been significant growth What are Trustees Accountable for What are the Administrative Responsibilities Pricing Models and Options What are the Pitfalls What are the Benefits WHO should use a SMSF WHO should NOT use a SMSF HOW do you promote SMSF’s inside your business Slide title 4 Proposed Changes - NOT LAW YET!!! • Tax Exempt Income Streams – 1/7/2014 Exemption on 1st $100,000.00 per person > $100,000.00 taxed at 15% - Threshold of $100,000.00 will be indexed to CPI and will increase in $10,000.00 increments • SOME TRANSITIONAL arrangements apply – Asset purchased BEFORE 4th April 2013 the new rules ONLY apply to Cap Gains that accrue after 1 JULY 204 • Asset purchased from 5th April 2013 to 30th June 2014 you can apply the new rules to the entire capital gain or only that part that accrues after 1 July 2014 • Withdrawals – STILL TAX FREE for those aged 60 and OVER Slide title 5 Proposed Changes – NOT LAW YET !!!!!! • Concessional Cont Caps Increased for over 50/60’s $35,000.00 ( Unindexed ) – For those Over 60+ from 1/7/2013 – From 1 July 2014 for those aged 50+ • Refund of Excess Concessional Cont’s – Can be withdrawn from 1/7/2013 Taxed at Marginal Tax Rates + Interest Charge = You will be taxed at the same as if the money was received as salary / wages and had made a Non-Concessional Cont • Super Income Streams to be “deemed” for Centrelink 1/1/2015 Grandfathering applies for those income streams held by pensioners before 1/1/2015 Slide title 6 SPAA Survey Results ( Source Rice Warner ) • • • • • • • • • • • 384 People Surveyed 81% Tertiary Qualified $1m+ = 50%+ $500k+ 63% < $200k 4% 25% expect $100k in Retirement 17% Require less than $50k PA 43% Trustees are NERVOUS about SMSF’s 42.7% Use a Financial Adviser 92% Use an Accountant 91% Use an Auditor Slide title 7 SPAA Survey • • • • • Key Benefits – CONTROL 87% - Happy with Performance 83% - Concerned with Super Changes 68% Concerned about a Major fall in Markets Not concerned about leaving benefits to Children Slide title 8 SPAA Survey Investments • • • • • Retirees lower exposure to Resi and Commercial Properties Little Annuities Held Most Respondants would like Govt Bonds ETF’s = 43%!!!!!!!!! Real Property Slide title 9 SPAA Survey ( Advice ) • • • • • • • • • • Younger Trustees seek more professional Advice Oldies = Internet / Media 52% Paid a Financial Adviser ( $500 - $2000 ) Strategic Advice -- 25% of plans cost more than $2000 Strategic and Investment Advice – 50% $2000+ < 44% Happy with advice < $500 76% Happy with Advice > $1000 - $2000 Link between Poor Advice and Poor Experience 40% Not Happy with Adviser CHALLENGE = Develop a VALUE PROPOSITION Slide title 10 SPAA Survey Advice Comments • • • • • • • • • • Adviser more interested in Product Flog Advice was too simple No Contact Major Firms Conflicted by APL Advice based on product sale Trustee felt they knew MORE 50% + intend to seek advice Happy Client would pay more (75% + would pay $1000 + ) High Financial Product Awareness NOT seeking simplified advice Slide title 11 SPAA Survey Income Requirements • • • • • $30000 – 1.9% $50000 + - 18.5% $60000 + - 10.5% $70000 + - 26.4% $100000 + 27.2% Slide title 12 Slide title 13 Trustee Responsibilities • Act Honestly in all fund matters • Same degree of care, skill and diligence as an ordinary person • Act in best interest of fund members • Retain Control over the fund Slide title • Keep Money / Assets separate from other monies and assets • Develop and Implement Investment Strategy • Provide access to certain information such as Financial Position of Fund 14 Administrative Responsibilities • Keep Accurate and accessible accounts • Accounts must detail financial position and transactions ( 5 Years ) • Annual Operating Statement / Financial Statement ( 5 Years ) • Maintain Minutes ( 10 Years ) Slide title • Retain copies of all Annual returns (10 Yrs) • Retain copies of all reports to members (10 Yrs) • Report Cont’s made to ATO by specified dates each year 15 PRICING IN THE SMSF INDUSTRY • 50+ GROUPS PROVIDING OUTSOURCED ADMIN AND SETUP • AMP 1ST BIG MOVER IN THIS SPACE • ACCOUNTANTS NOW THE FOCUS OF INSTO’S • PREVIOUS INDUSTRY PRACTICE IS NON FIXED PRICE • VERY HARD FOR MARGIN TO BE CREATED IF WORK OUTSOURCED • IS THIS REALLY PROFITABLE FOR ACCOUNTANTS??? • WWW.THESMSFREVIEW.COM.AU Slide title 16 SMSF Industry Pricing Name Summary Set Up Annual Admin Absolute Super Set Up / Ongoing $770 $2475 ( 20 Sec’s ) Catalyst Flat Fee $825 / $1375 $1320 Yrly / $1980 Monthly Inc GST + Audit Cavendish Set Up / Ongoing $695 $1695 / $1995 + $455 Audit Extra for Pensions ( Platform ) Compli Set up / Ongoing $550 $1980 + $550 Audit ( Standard Fund) Contract Accounting Caters for LOW Transactions $560 / $1325 <50 = $900 50 – 100 = $1500 Slide title 17 SMSF Pricing Name Summary Discount Super Set Up / Ongoing FREE if you pay $250 Deposit for Admin Sliding Scale based on No. of members and Transactions DIXONS Set Up / Ongoing $990 1% of Fund up to $4990 Heffron Set Up / Ongoing $715 / $1430 $1980 / $3080 JUST Super Set Up / Ongoing $440 $1100 / $1650 Super Concepts Set Up / Ongoing $473 $1390 / $3960 1/4ly + Transactions Volume Slide title Set Up Admin 18 PRICING IN THE SMSF INDUSTRY • Pressure on Pricing is COMING!!!!!! • Expect Competition Consolidation to continue • Some clients get negative surprises around fees Slide title 19 Potential Pitfalls of SMSF’s for Clients • • • • • • • • Personal Use of Funds / Fund Assets Placing Business Assets into Super Estate Planning – Who will be Trustee after YOU die No Super Complaints Tribunal Onerous Penalties for non – compliance No Diversity High Costs for Small Balances Loss of focus of Trustees Slide title 20 PITFALLS OF SMSF’S FOR ACCT’S / ADVISERS • • • • • Clients providing up to date and accurate information Can be time consuming and do you really cover costs Leaves you open for COMPLAINTS if they get it wrong Grey area of Investment Advices Licensing Regime issues Slide title 21 Advantages of SMSF’s for Clients • • • • • • • • Means to hold broader range of Assets ( Business Assets ) Ability to buy and sell quickly Potential cut to costs Avoid Admin hassles of Large Funds Manage Tax Positions Buy Assets you cannot otherwise afford Flexible Estate Planning Transition from Accumulation to Pension Slide title 22 Advantages of SMSF’s for Acct’s / Advisers • • • • • Client Entanglement Increases Accounting Work is COMPLEX thus needs YOU Provides insights to all Clients Investments Helps Position YOU as pivotal to the client Growth AREA = Client Demand Slide title 23 WHO SHOULD USE A SMSF Slide title 24 Who should AVOID SMSF’s Slide title 25 Where are the Opportunities • • • • • • • • Insurance inside SMSF’s Replicate what approaches Industry Funds are taking Lifestyle Investment Approach Model Portfolio’s Create a free ASSESSEMENT on Appropriateness of SMSF’s Winding up of SMSF’s EDUCATING CLIENTS GROWING YOUR DATA BASE = INCREASED VALUE!!!!!!!!!!! Slide title 26 You do want to be differentiated Differentiated Commoditised • Value driven • Price and cost driven • Knowledge driven • Technology driven • Relationship based • Easily substituted • Low client mobility • High client mobility 3 ways to differentiate your business 1. 2. 3. Slide title Greater specialist knowledge / expertise effectively embedded into products and services being offered Closer and deeper client relationships Greater knowledge transfer, resulting in enhanced client decision-making and business capabilities 27 You get what you focus on • Vision • Planning Above the line ______________________________________ • Detail • Problem (focus on a problem not a problem focus) • Drama Slide title Below the line 28 28