134f9266-3f29-11e0-a0ac-f24e0f8686e0_Wixted

advertisement

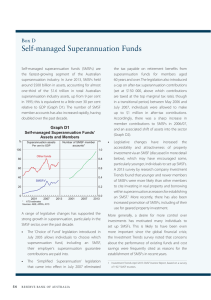

Latest SMSF Estate Planning Trends and Strategies Deborah Wixted Head of Technical Services, Colonial First State Disclaimer Adviser use only This presentation is given by a representative of Colonial First State Investments Limited AFS Licence 232468, ABN 98 002 348 352 (Colonial First State). Colonial First State Investments Limited ABN 98 002 348 352, AFS Licence 232468 (Colonial First State) is the issuer of interests in FirstChoice Personal Super, FirstChoice Wholesale Personal Super, FirstChoice Pension, FirstChoice Wholesale Pension and FirstChoice Employer Super from the Colonial First State FirstChoice Superannuation Trust ABN 26 458 298 557 and interests in the Rollover & Superannuation Fund and the Personal Pension Plan from the Colonial First State Rollover & Superannuation Fund ABN 88 854 638 840 and interests in the Colonial First State Pooled Superannuation Trust ABN 51 982 884 624. The presenter does not receive specific payments or commissions for any advice given in this presentation. The presenter, other employees and directors of Colonial First State receive salaries, bonuses and other benefits from it. Colonial First State receives fees for investments in its products. For further detail please read our Financial Services Guide (FSG) available at colonialfirststate.com.au or by contacting our Investor Service Centre on 13 13 36. The information is taken from sources which are believed to be accurate but Colonial First State accepts no liability of any kind to any person who relies on the information contained in the presentation. Colonial First State Investments Limited is not a tax agent. If anyone intends to rely on advice you give to satisfy liabilities or obligations or claim entitlements that arise, or could arise, under a taxation law – they should request advice from a registered tax agent. This presentation is for adviser training purposes only and must not be made available to any client. This presentation cannot be used or copied in whole or part without our express written consent. © Colonial First State Investments Limited 2011 Focus of estate planning Who will receive the SMSF death benefit? In what form – lump sum or pension – will the SMSF benefit be paid? Taxation Of the death benefit payment Of the fund assets required to make the payment Control and management of the SMSF Management of fund assets How does the SMSF death benefit interact with other assets and structures? A typical SMSF Two individual trustees / members Aged in their early 60s Like to include family members Want better tax planning – could include death benefits Approx. 60% of all SMSF assets in shares and cash Most likely source of asset concentration Trustee / member A Trustee / member B SMSF Australian shares Cash Trend: binding nominations SMSF Determination SMSFD 2008/3 clarified binding nominations not subject to provisions of SISR 6.17A manner of identifying benefit recipient and proportion of benefit they’ll receive non-lapsing Ensure governing rules permit this flexibility Donovan v Donovan Cooper Review and binding nominations “The SIS Act should be amended so that binding death nominations would be invalidated when certain ‘life events’ occur in respect of the member. The current systems used by States and Territories under which testamentary dispositions are invalidated could be used as guidance” “Subject to [this] recommendation being implemented, the SIS Act should be amended so that binding death benefit nominations only have to be reconfirmed every five years” No details on how non-lapsing binding nominations would be affected Trend: ‘superannuation will’ Binding nominations PLUS specific provisions in governing rules Leave specific super death benefits to specific beneficiaries Provide for executor to take deceased member’s place Pay out specific assets to specific beneficiaries Make conditional or contingent death benefit payments Important to engage other estate planning professions to ensure success Take care with understanding of the term ‘will’ Trend: death benefits to ‘non-traditional’ beneficiaries Interdependency relationship Exists where there’s a close personal relationship and – live together, one/each provides other financial support, OR either or both disabled or because temporarily living apart SCT March 2010 bulletin: ‘temporarily living apart’ requires parties to have lived together at some time Not necessary if separated due to physical, intellectual or psychiatric disability (eg. dementia)* Financial dependency Partial financial dependency sufficient (Noel v Cook) Financial dependence doesn’t equal financial “need” (Faull v SCT) * Refer SCT D09-10\005 Taxation, insurance and SMSFs 1. Accumulation or pension interest? Accumulation Pension Proportions determined at time of payment Proportions determined on commencement $150,000 taxable $150,000 tax-free $150,000 taxable $150,000 taxfree 50% 50% 50% 50% $1,000,000 insurance proceeds received $1,000,000 insurance proceeds received $1,150,000 taxable $150,000 tax-free $650,000 taxable $650,000 tax-free 88.5% 11.5% 50% 50% Taxation, insurance and SMSFs 2. Untaxed element ATO ID 2010/76 clarifies that a lump sum death benefit will include an untaxed element where the benefit includes life insurance proceeds and a tax deduction has been claimed for: life insurance premiums or for a future benefit liability Not necessary to claim a deduction: In every income year, or In the year in which the death benefit is paid Consider taxation impact of any death benefits paid to nondependent beneficiaries Additional insurance cover may be needed Rollover any other super benefits with longer service periods Anti-detriment and SMSFs Anti-detriment benefits in SMSF may be funded out of a reserve Amount allocated out of reserve to increase death benefit Allocation will count to deceased member’s concessional cap Example Tom is age 55 with 20 years service $600,000 super balance, all taxable component, all nonpreserved Tom is the only member of his SMSF How can Tom maximise the death benefit paid to his surviving adult children? Anti-detriment and SMSFs Anti-detriment Re-contribution Account balance on death $600,000 Tax-free component $0 Taxable component $600,000 $600,000 $450,000 $150,000 Anti-detriment payment# $83,270 $20,817 Total death benefit Tax-free component Taxable component $683,270 $0 $683,270 $620,817 $450,000 $170,817 Tax on death benefit $112,739 $28,185 Excess contributions tax* $13,315 $0 Net benefit $592,632 $557,216 # Using formula in ATOID 2007/219 * Assumes 9% SG contributions on $100,000 salary, $50,000 concessional cap and 31.5% excess contributions tax Control and management of SMSFs Graph 1 – an older population of SMSFs means an increasing likelihood of the SMSF making a death benefit payment 40% all SMSFs 30% 20% 10% 0% <25 25-34 35-44 45-54 55-64 >64 Graph 2 - the death or mental incapacity of a trustee means some form of restructuring of the fund and its assets will be required. 100% 80% Corporate Individual 60% 40% 20% 0% All Graph 3 – the prevalence of mental incapacity through dementia in an ageing population. Without proper planning restructuring of an SMSF becomes difficult New 100% 80% 60% 40% 20% 0% 60 - 65 - 70 - 75 - 80 - 85 - 90 - 95+ 64 69 74 79 84 89 94 Management of fund assets 1. Preserve fund assets following death Avoids: Selling an asset when not desirable to do so Incurring unexpected valuation and transactions costs Triggering a capital gains event Possible strategies: Pay and income stream benefit supported by the asset Cash contribution by beneficiary plus ‘asset swap’ Non-member benefit life insurance policy plus ‘asset swap’ In-specie lump sum death benefit in whole or part Management of fund assets 2. Capital gains tax, exempt current pension income and the death of a member Tax exemption on income from assets supporting pensions may be extinguished on the death of the last member Requires liability to pay a pension death benefit to avoid CGT Refer: ATO ID 2004/688 National Tax Liaison Group Superannuation Sub-committee discussions ATO Priority Technical Issue and possible ruling Management of fund assets 2. Capital gains tax, exempt current pension income and the death of a member, continued Strategy: turnover fund assets Refresh cost base without undertaking ‘wash sales’ Strategy: offset taxable income from gain with deduction that arises by paying an anti-detriment payment Strategy: offset taxable income from gain by claiming a deduction for future benefit liability Eg. 55 year old with $420,000 balance and $600,000 death cover could result in a deduction of over $290,000 Management of fund assets 3. Limited recourse borrowing and estate planning Many commercial borrowing arrangements require fund assets to generate a threshold level of income Death of a fund member and need to pay a death benefit may require asset sales that lead to an inability to generate this income Strategy: SMSF trustees obtain non-member benefit life insurance cover over each member Provides funds to pay out SMSF’s loan Creates a fund reserve SMSF estate planning in context Good estate planning for SMSFs means understanding: It’s not only about super death benefits paid from the SMSF The interaction of the SMSF, its assets and other assets held by the member The provisions of the member’s will The future of the SMSF itself