corporation finance final exam

advertisement

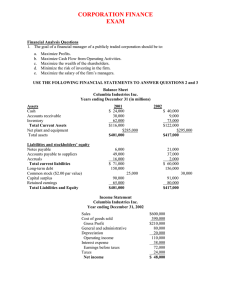

CORPORATION FINANCE FINAL EXAM NAME ________________________________________________________ STUDENT NUMBER ____________________________________________ DATE ___________________ INSTRUCTOR__________________________ READ THE FOLLOWING DIRECTIONS VERY CAREFULLY. FAILURE TO FOLLOW THESE DIRECTIONS WILL ALMOST CERTAINLY RESULT IN YOUR EXAM BEING MIS-GRADED WHICH WILL ADVERSELY AFFECT YOUR GRADE. IF THERE IS ANYTHING ABOUT THE DIRECTIONS THAT YOU DO NOT UNDERSTAND, ASK YOUR INSTRUCTOR IMMEDIATELY. 1. Fill in your name, student number, and the date of the exam for which you are registered 2. Read each question very carefully. Consider all of the answer items and then select the best correct answer - there is only one best answer per question. Circle the letter answer on the exam and record your answers on the Answer Sheet. NOTE WELL: ONLY THE ANSWER KEY WILL BE GRADED!!! 3. You may use a financial calculator. No notes, formula sheets, scratch paper (use back pages of exam if necessary), or stored formulae allowed. The exam consists of 25 questions each worth 4.0 points. Choose the BEST ANSWER for each question. Your score will be computed as: [100 - (number missed x 4.0)]. You will have 120 minutes to complete the exam. Do not leave any answers blank - an unanswered question will be graded as a wrong answer. Good Luck! DIRECTIONS: Circle the letter corresponding to the best answer for each multiple choice question and then transfer that letter answer to the attached ANSWER SHEET. Be sure to carefully record your answers to the ANSWER SHEET. Only the ANSWER SHEET will be graded. Financial Analysis Questions 1. The goal of a financial manager of a publicly traded corporation should be to: a. b. c. d. e. Maximize Profits. Maximize Cash Flow from Operating Activities. Maximize the wealth of the shareholders. Minimize the risk of investing in the firm. Maximize the salary of the firm’s managers. USE THE FOLLOWING FINANCIAL STATEMENTS TO ANSWER QUESTIONS 2 and 3 Balance Sheet Columbia Industries Inc. Years ending December 31 (in millions) Assets Cash Accounts receivable Inventory Total Current Assets Net plant and equipment Total assets 2001 $ 24,000 30,000 62,000 $116,000 $285,000 $401,000 Liabilities and stockholders’ equity Notes payable Accounts payable to suppliers Accruals Total current liabilities Long-term debt Common stock ($2.00 par value) Capital surplus Retained earnings Total Liabilities and Equity 6,000 49,000 16,000 $ 71,000 150,000 2002 $ 40,000 9,000 73,000 $122,000 $295,000 $417,000 21,000 37,000 2,000 $ 60,000 156,000 25,000 90,000 65,000 $401,000 30,000 91,000 80,000 $417,000 Income Statement Columbia Industries Inc. Year ending December 31, 2002 Sales Cost of goods sold Gross Profit General and administrative Depreciation Operating income Interest expense Earnings before taxes Taxes Net income $600,000 390,000 $210,000 80,000 20,000 110,000 38,000 72,000 24,000 $ 48,000 NOTE: You must use the financial statements on the prior page to answers questions 2 and 3 below 2. Net Cash Flows from Operating Activities for Columbia Industries Inc. is: a. b. c. d. e. $32,000 $52,000 $67,000 $84,000 None of the above is within $1,000 of the correct answer. 3. Columbia Industries Inc. expects sales to grow by 40% in 2003. The company plans to pay out $11,000 in dividends in 2002, and expects that the Net Profit Margin in 2003 will be 6%. Compute the Outside Funds Needed in 2003 to support this projected growth in sales. a. b. c. d. e. $111,800 $167,160 $107,760 $78,300 None of the above is with $1,000 of the correct answer. 4. Assume you are given the following for Stackelberg industries: Return on Assets (ROA) = 8% Debt Ratio = 60% The Return on Equity (ROE) for Stackelberg industries is: a. b. c. d. e. 20% 25% 80% 100% Insufficient information 5. If cash decreases by $1,000 during the year, total liabilities decrease by $5,000, and shareholders’ equity increases by $5,000, what is the change in non-cash assets for the year? a. b. c. d. e. A decrease of $5,000 An increase of $1,000 A decrease of $1,000 An increase of $5,000 The correct answer cannot be determined from the information given. Time Value of Money Questions: 6. Assume that all other factors are held constant and that the interest rate is greater than zero. Increasing the number of periods (i.e., n) will cause the present value of a lump sum to be received in the future to _________ and the present value of an annuity to _______. a. b. c. d. e. Increase; Increase Increase; Decrease Decrease; Decrease Decrease; Increase It depends on whether the annuity is an annuity due or an ordinary annuity 7. Congratulations! You have just won a small lottery. It will pay you either 5 annual payments of $15,000 each (with the first payment to be received two years from today), or a single lump sum to be received today. If you can invest at a 6% annual rate of interest, what is the least you should accept as the lump sum payout amount? a. b. c. d. e. $75,000.00 $66,976.58 $63,185.46 $59,608.92 $89,629.78 8. Which of the following accounts would pay you the highest effective annual rate? a. b. c. d. e. Stated annual rate of 6.05%, compounded annually Stated annual rate of 6.01%, compounded semi-annually Stated annual rate of 5.95%, compounded quarterly Stated annual rate of 5.90%, compounded monthly Stated annual rate of 5.85%, compounded daily (assuming 365 days a year) 9. You have financed the purchase of a used Mercedes with a $31,500 loan with a 5-year term, monthly payments, and an 8% stated annual rate. What is the amount of your monthly loan payment? a. b. c. d. e. $657.45 $583.33 $477.92 $638.71 $350.00 10. You have just invested $3,000 into an account that will earn a 9% annual interest rate. You want to have exactly $8,000 in the account at the end of 5 years. The account allows you to make one deposit at the end of the 3rd year. In order to have exactly $8,000 at the end of year 5, how much must you deposit at the end of the 3rd year? a. b. c. d. e. $2,848.35 $2,613.17 $2,397.40 $3,384.13 None of the above answers is within $50 of the correct amount 11. Terry just celebrated her 20th birthday and she has decided to quit drinking Diet Coke. Terry currently drinks 2 cans of Diet Coke per day at an average cost of $0.75 per can. To reward herself for quitting, Terry plans to invest all that she will save each day (i.e., $1.50) into a savings account that currently pays 6% p.a. Assuming her first deposit into the account is made tomorrow, and assuming that there are 365 days per year, how much money will be in Terry’s savings account on her 65 th birthday (i.e., 45 years or 16,425 days from today)? a. b. c. d. e. $27,629.13 $37,659.48 $49,906.76 $50,885.83 None of the above is within $1,000 of the correct answer. Stock and Bond Valuation Questions 12. A security that pays a constant dividend every year forever is known as: a. b. c. d. e. A zero-coupon bond Preferred stock Class A Common stock A Reverse Perpetual Mortgage obligation security A callable bond 13. A 10-year annual coupon bond was issued four years ago at par. Since then the bond’s yield to maturity (YTM) has decreased from 9% to 7%. Which of the following statements is true about the current market price of the bond? a. b. c. d. e. The bond is selling at a discount The bond is selling at par The bond is selling at a premium The bond is selling at book value Insufficient information 14. What should be the price of a $1,000 par value, 10% annual coupon rate (coupon interest paid semiannually) bond with 30 years remaining to maturity, assuming a discount rate of 9%? a. b. c. d. e. $1,101.88 $1,102.44 $1,103.19 $1,104.48 $1,105.72 15. You have just discovered a $1,000 par value corporate bond with a maturity of 10 years. The bond’s yield to maturity is 9% and the bond is currently selling for $743.29. What is the bond’s annual coupon rate (the bond pays coupon payments annually)? a. b. c. d. e. 5% 6% 7% 8% 9% 16. What is the yield to maturity of a $1,000 par value bond with a coupon rate of 10% (semi-annual coupon payments) that matures in 30 years assuming the bond is currently selling for $838.13? a. 6.0% b. 6.2% c. 10.0% d. 12.0% e. 12.4% 17. XYZ, Inc. just paid a dividend of $3 per share. The industry analysts predict that XYZ’s dividends will grow at a constant rate of 4% forever. If the stock is currently trading at $25 per share, what is the required rate of return on this stock? a. b. c. d. e. 8.48% 12.00% 12.48% 16.00% 16.48% 18. Unitongue Talk, Inc. just paid a $2.00 annual dividend. Investors believe that the dividends will grow at a rate of 20% per year for each of the next two years and 5% per year thereafter. Assuming a discount rate of 10%, what should the current price of the stock be? a. b. c. d. e. $60.50 $57.60 $54.55 $49.87 $43.56 Capital Budgeting Questions 19. Consider the following mutually exclusive projects with equal lives: Project A B C D Payback Period 3.2 years 2.7 years 4.1 years 5.6 years IRR 18% 22% 23% 16% PI 1.50 1.72 1.90 1.32 NPV $ 10,000 $ 37,000 $ 70,000 $150,000 Assuming that the appropriate discount rate is 12%, which project(s) would you choose? a. b. c. d. e. Project A Project B Project C Project D All of these projects should be accepted. 20. Consider a project with an initial outflow at time 0 and positive cash flows in all subsequent years. As the discount rate is increased the _____________. a. b. c. d. e. IRR remains constant while the NPV increases. IRR decreases while the NPV remains constant. IRR increases while the NPV remains constant. IRR remains constant while the NPV decreases. IRR decreases while the NPV decreases. 21. Which of the following statements is most correct? a. b. c. d. e. Since depreciation is not a cash expense, it does not affect operating cash flows Corporations should include sunk costs when making investment decisions. Corporations should include opportunity costs when making investment decisions. All of the answers above are correct. Answers (a) and (c) are correct. 22. Milson Company is considering the purchase of MiHe Company at a price of $190,000. If Milson makes the acquisition, its after-tax net cash flows will increase by $30,000 per year and remain at this new level forever. If the appropriate cost of capital is 15 percent, should Milson buy MiHe? a. b. c. d. e. Yes, because the NPV = $30,000 Yes, because the NPV = $200,000 Yes, because the NPV = $10,000 No, because NPV < 0. There is not enough information given to answer this question. USE THE FOLLOWING INFORMATION TO ANSWER QUESTIONS 23 THROUGH 25 Philburn Files manufactures a variety of saws and tools for the commercial building industry. The company is considering the construction of a new facility to update its manufacturing process. The company's CFO has collected the following information about the proposed new facility project. (Note: You may or may not need to use all of this information, use only the information that is relevant.) The project has an anticipated economic life of 10 years. The new facility will be constructed on a piece of land that Philburn currently owns. The land has a current market value of $5 million. If Philburn does not use the land for this project, the land will instead be sold. Last year Philburn spend $500,000 to grade the land and to put in sewer and water lines. The company has capitalized these costs and is recording them on their income statement at $100,000 per year over the next 5 years. Construction of the new production facility will require an immediate outlay (at t=0) of $15 million. The production facility will be depreciated on a straight-line basis over 10 years to a $5 million salvage value. Philburn plans to sell the production facility to a competitor at the end of the 10year period for $5 million. If the company accepts the project, the land will be sold with the production facility in 10 years for its current book value, which is $2 million. If the company goes ahead with the proposed project, it will require an immediate increase in inventory of $1,800,000, but will also result in an immediate increase of $800,000 in accounts payable. Each of these positions will be reversed at the completion of the project (that is, any change in net working capital that occurs at the beginning of the project will be recovered at the end of the project). The new facility is expected to reduce annual operating expenses, excluding management salaries, by $8 million per year for each of the next 10 years. No change in annual revenue is expected. The accounting department plans to allocate the annual salaries of 5 managers to this new facility, however, only 2 new managers will actually be hired by the company. Each of these managers will earn $200,000 per year for the next 10 years. The company's interest expense each year will be $300,000. The company's cost of capital (i.e., the required rate of return on this project) is 12 percent. The company's tax rate is 40 percent. Record your final numerical answer to each of the following questions on the answer sheet. Show your work on the back of the answer sheet for possible partial credit. 23. What is the initial investment for the project? 24. What is the fourth year expected incremental operating cash flow? 25. What is the 10th year incremental non-operating cash flow? Corporation Finance Answer Key to Final Exam 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. 24. 25. C B A A B D D B D A E B C C A D E C D D C C $21m $4.96M $8M Details of solution for #23: Construction of new facility Land Opportunity cost Change in net working capital Initial Investment ($15M) ($ 5M) ($ 1M) ($21M) Details of solution for #24: NCF = (Incremental revenue – Incremental Cost – Incremental Depreciation)(1-T) + Incremental Depreciation. NCF = (0 - -8M - .4M – 1M)(.6) + 1M = 4.96M Notes: Depreciation = (15M – 5M)/10 = 1M The incremental part of management salaries = .4M (2 managers at 200,000/yr) Details of solution for #25: Sell new facility Sell Land Recover net working capital 10th Year non-operating cash flow $5M $2M $1M $8M