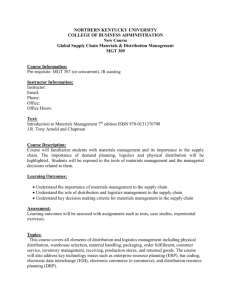

ETIG Knowledge Forum PPT

advertisement

The Rise of India in World Trade Chris Callen, Country Manager, DHL Express - Jan 28, 2004 Agenda India‘s International Trade Situation DHL Trade Confidence Index International Logistics Building “Brand India “ Becoming World Class in India India’s International Trade 2002/03 Exports – US $51.7 billion – Growth 18% • next only to that of China at 22% • second highest among world’s 30 leading exporters in world merchandise trade during the year 2002 Imports – Growth 17.03% Share of world trade – 0.8% Getting Ahead “If the present trend continues, we may reach our often stated goal of achieving 1% of world merchandise trade ahead of the year 2007…” Arun Jaitley Union Minister of Commerce & Industry 31 March, 2003 With the rupee rising against the dollar and the global slowdown in world trade over the past few months, is there cause for concern? GDP – Regional comparison JP 4,146 CN China India S. Korea Indonesia Thailand Pakistan Philippines Mexico Brazil 1,180 IN 485 KR 422 AU 357 TW 282 HK 162 ID 145 TH 115 MY 88 SG 86 PH 71 - 200 400 600 800 1,000 GDP (in USD Billion) 1,200 1,400 GDP growth, 1990-2001 10.0 5.9 5.7 3.8 3.8 3.7 3.3 3.1 2.8 India has recorded one of the highest growth rates in the 1990s Among the largest economies in the world, its GDP is close to US$ 500 billion Only China has had GDP growth higher than India Merchandise Exports vs GDP Thailand, Malaysia, Indonesia all export more than India ! JP 10% CN 23% IN 9% KR 36% AU 18% TW 44% HK ID 117% 39% TH 57% MY 101% 142% SG PH - 45% 200 400 600 800 (USD Billion) 1,000 1,200 1,400 GDP Exports India Rising -- Challenges WTO, Asean Free Trade Agreement (AFTA), Bilateral FTAs Ground Infrastructure Golden Quadrilateral Highway network New FTZs and enhanced transhipment facilities Liberalised air traffic rights Duty structures – among the world’s highest Air Express self-handling – elimination of monopolies in statutory service providers Agenda India‘s International Trade Situation DHL Trade Confidence Index International Logistics Building “Brand India “ Becoming World Class in India How do exporters view the situation? DHL Trade Confidence Index All India The DHL Trade Confidence Index (TCI) at an all-India level is 61 (Q2’Sep03), up from 58 (Q1- Jun03), driven by a very optimistic 72 points in general demand conditions. Factors contributing to this movement include optimistic demand conditions, better domestic conditions & optimism about the macro-economic state The factors where no significant change is seen include Attitude of US Customers, Impact of WTO, Exim Policy & Order Expectations The Exporter view on General Demand conditions, has become more optimistic, with almost 72% rating them as favourable as compared to 53% in the last quarter 100 90 80 70 60 50 40 30 72 53 Q1 36 11 20 10 0 7 Favourable Neutral 21 Q2 Less Favourable …DHL Trade Confidence Index Apparel Sector Confidence among Textile / Garment exporters is even higher: The DHL Apparel Trade Confidence Index has moved up to 63 (Q2 - Sep03), from 58 (Q1-Jun03) Factors contributing to this upward movement include optimistic Demand conditions, better Domestic conditions, optimism about macro-economic state & Policy context Factors that seem to have moved down on confidence include Attitude of US Customers & Impact of NTMs Optimism in Exporter view of the General Demand Conditions, shown here, has moved up to 80% from 60% in the previous quarter 100 90 80 70 60 80 60 50 40 30 20 Q1 7 10 0 5 Favourable Neutral 33 15 Q2 Less Favourable …DHL Trade Confidence Index Analysis So, the DHL Trade Confidence Index moved up by 5% in Q2-Sep03, despite the fact that month on month, export growth began to slacken. Dr Debroy’s view of the possible reasons for this apparently paradoxical finding include: - Time lag in perceptions reacting to objective reality - Better domestic conditions biasing the results - Exporters are unduly optimistic about seasonal demand conditions The upward movement in our Index can be ascribed more to better domestic economic conditions & this has negated the impact of certain negative developments internationally But there is no reason to despair… even if we get 8% growth in 2003-04 it will be respectable… and the target of 1% share of global trade appears fairly modest Agenda India‘s International Trade Situation DHL Trade Confidence Index International Logistics Building “Brand India “ Becoming World Class in India Emerging Trends Growing cross-border trade – More cross-border production to take advantage of lower costs/new markets – Greater liberalisation of trade policies & tariffs through WTO – Major shift by global companies to source, produce and distribute from emerging economies like India Greater need for dedicated air express freighters – Less reliance on under- floor space of passenger aircraft & dictated schedules – Enhanced schedules to meet shortened transit times Courier Air Express …Emerging Trends Challenge of Breaking the Time Barrier Further – Businesses demanding faster and more time-definite deliveries – Need shortest “Time- to- Market” – Shorter Product life cycle JIT processes and express transport key to supply chain logistics – Lower inventory holdings – Greater outsourcing of logistics services to integrators, 3PL/ 4PLs Air Express Logistics Solutions Agenda India‘s International Trade Situation DHL Trade Confidence Index International Logistics Building “Brand India “ Becoming World Class in India The Path Ahead Is India is at a point of inflection where it can take a significant share and role in world trade? “There is no better time to be an Indian in this world” Two things critical for India to go forward strongly : – Position India as a good place to do business in – Position India as a place for manufacturing excellence These two are not easy-wins since the task is not one of positioning alone – at least in many key sectors In marketing terms – India is not at the stage for aggressive ‘branding’ – but a stage for solid ‘product development’ But brand is very important – not at the country level but at the individual company level Branding What came first : Sony or Japan, LG or Korea ? Building world-class brands is the responsibility of each and every business – and the country has a smaller role in it The country responsibility is In making India an easy and good place to do business with ! (whether it is for Indian companies or MNCs) Infrastructure, labour reforms, primary education, borderless states, debilitating levels of corruption – all of them need to be managed with a far greater urgency. Individual companies will get enormous opportunities in the world market – as trade barriers topple around the world. Quotas in Apparel & textile Trade China’s growth has been spectacular in areas where quotas have recently been removed by USA (Source : US Intl. Trade Commission) For example : – Bras & foundation garments (Category 349/649) : 232 % – Knit Fabrics (Category : 222) : 21,976 % – Infant wear (Category : 239) : 826 % – Robes and dressing gowns (Category : 350 /650) : 540 % Clearly, as trade regimes liberalise worldwide, new opportunities will open up for businesses which have world class manufacturing excellence with vertically integrated skills! Don’t bother too much about ‘Brand India’, focus on building world class manufacturing excellence in our individual businesses – grow your own brand! Agenda India‘s International Trade Situation DHL Trade Confidence Index International Logistics Building “Brand India “ Becoming World Class in India Asia-Pacific Logistics Overview Characteristics Markets Mature Unique Hong Kong Singapore Japan Australia New Zealand Korea Taiwan China Developed Logistics High Competition High Service levels Lead time pressure Lower Growth Rapid Development Undeveloped domestic Increasing service levels High Growth Mid-Level Malaysia Thailand Indonesia Philippines India Developing sophistication Increasing competition Increasing service levels Varied Growth Developing Sub-Continent Vietnam Cambodia Laos Myanmar Etc Poorer infrastructure Lower competition Customs Ownership Issues High Growth Building a Strong Infrastructure Four Gateway Strategy – four state-of-the-art Express Handling Units for seamless self-handling of Air Express shipments at major airports – First 26,000 sq ft facility now operational in New Delhi; only dedicated facility of its kind in India – Similar facilities planned in Mumbai, Chennai and Bangalore 12 Spare Parts Centres across major cities Modern, technologically superior Service Centres 300-strong fleet of new vehicles, the largest of its kind in India, linked in real time to our data network. Globally integrated sophisticated IT infrastructure for real time supply chain management and tracking. 24-hour country-wide toll-free customer service call centre. Building a Strong Infrastructure Like you, many challenges we face are regulatory or bureaucratic – some we have overcome, some we are still battling, most of are unique to India: – On-board-courier – Gateways at Airports – 24-hour Customs in-premise – Indian Post Office (Amendment) Bill, 2002 Our investments are significant and we hope to provide the kind of logistics support which is truly world class. We’re getting there. We are leading the way – we have 70% of the international air express market in India, and over 20,000 exporters and importers in our customer base here ! Invest, excel, promote. THANK YOU