Financial Sector Review

advertisement

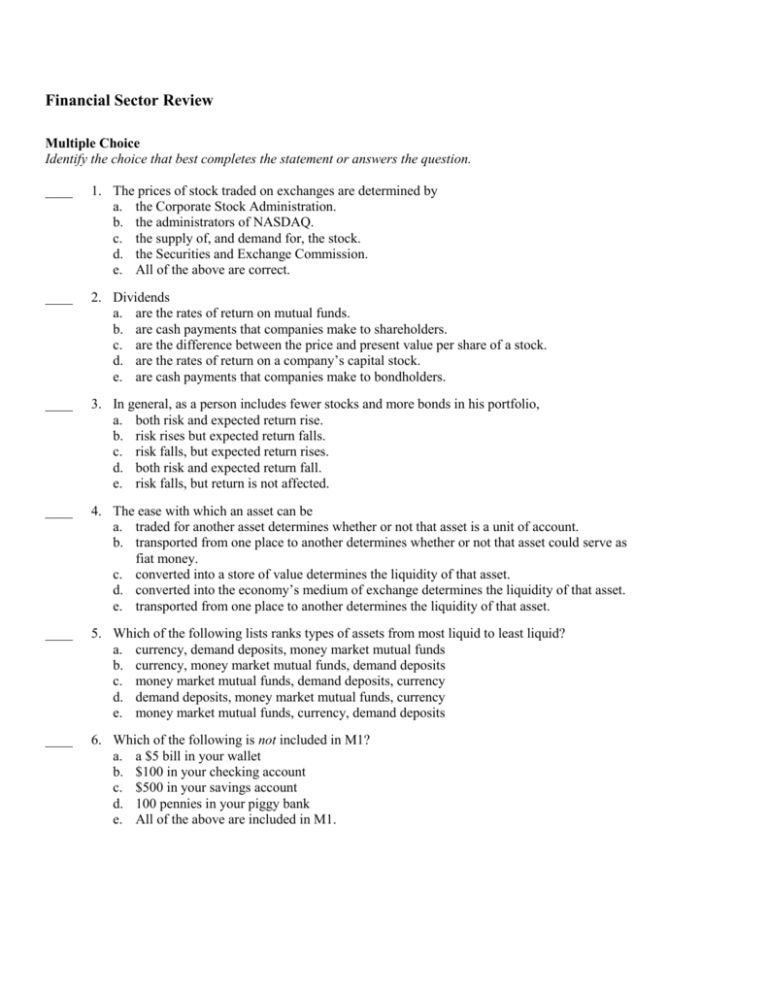

Financial Sector Review Multiple Choice Identify the choice that best completes the statement or answers the question. ____ 1. The prices of stock traded on exchanges are determined by a. the Corporate Stock Administration. b. the administrators of NASDAQ. c. the supply of, and demand for, the stock. d. the Securities and Exchange Commission. e. All of the above are correct. ____ 2. Dividends a. are the rates of return on mutual funds. b. are cash payments that companies make to shareholders. c. are the difference between the price and present value per share of a stock. d. are the rates of return on a company’s capital stock. e. are cash payments that companies make to bondholders. ____ 3. In general, as a person includes fewer stocks and more bonds in his portfolio, a. both risk and expected return rise. b. risk rises but expected return falls. c. risk falls, but expected return rises. d. both risk and expected return fall. e. risk falls, but return is not affected. ____ 4. The ease with which an asset can be a. traded for another asset determines whether or not that asset is a unit of account. b. transported from one place to another determines whether or not that asset could serve as fiat money. c. converted into a store of value determines the liquidity of that asset. d. converted into the economy’s medium of exchange determines the liquidity of that asset. e. transported from one place to another determines the liquidity of that asset. ____ 5. Which of the following lists ranks types of assets from most liquid to least liquid? a. currency, demand deposits, money market mutual funds b. currency, money market mutual funds, demand deposits c. money market mutual funds, demand deposits, currency d. demand deposits, money market mutual funds, currency e. money market mutual funds, currency, demand deposits ____ 6. Which of the following is not included in M1? a. a $5 bill in your wallet b. $100 in your checking account c. $500 in your savings account d. 100 pennies in your piggy bank e. All of the above are included in M1. ____ 7. Mia puts money into a piggy bank so she can spend it later. What function of money does this illustrate? a. store of value b. medium of exchange c. unit of account d. fiat money e. commodity money ____ 8. You receive money as payment for babysitting your neighbors' children. This best illustrates which function of money? a. medium of exchange b. unit of account c. store of value d. liquidity e. commodity money ____ 9. Liquidity refers to a. the ease with which an asset is converted to the medium of exchange. b. a measurement of the intrinsic value of commodity money. c. the suitability of an asset to serve as a store of value. d. how many times a dollar circulates in a given year. e. the ease with which an asset can be transported. ____ 10. Which of the following is not included in M1? a. currency b. demand deposits c. traveler’s checks d. credit cards e. coins ____ 11. If the Federal Open Market Committee decides to decrease the money supply, then the Federal Reserve a. creates dollars and uses them to purchase government bonds from the public. b. buys government bonds from its portfolio to the public. c. creates dollars and uses them to purchase various types of stocks and bonds from the public. d. buys various types of stocks and bonds from its portfolio to the public. e. destroys dollars by selling government bonds to the public. ____ 12. The agency responsible for regulating the money supply in the United States is a. the Comptroller of the Currency. b. the U.S. Treasury. c. the Federal Reserve. d. the U.S. Bank. e. the Secretary of the Treasury. ____ 13. Decisions by policymakers concerning the money supply constitute a. monetary policy. b. fiscal policy. c. banking policy. d. operations policy. e. cyclical policy. ____ 14. Suppose that banks desire to hold no excess reserves, the reserve requirement is 5 percent, and a bank receives a new deposit of $1,000. This bank a. will increase its required reserves by $50. b. will initially see its total reserves increase by $1,000. c. will be able to make a new loan of $950. d. All of the above are correct. e. None of the above are correct. Table 29-5. Bank of Kopeka Assets Reserves Loans $2,000 18,000 Deposits Liabilities $20,000 ____ 15. Refer to Table 29-5. From the table it follows that Bank of Kopeka operates in a a. fractional-reserve banking system, since its reserves are less than its deposits. b. fractional-reserve banking system, since its reserves are less than its loans. c. 100-percent-reserve banking system, since its assets are equal to its liabilities. d. 100-percent-reserve banking system if the Fed’s reserve requirement is 10 percent; otherwise, it operates in a fractional-reserve banking system. e. 100-percent-reserve banking system since reserves plus loans equals deposits. ____ 16. Refer to Table 29-5. The Bank of Kopeka’s reserve ratio is a. 1 percent. b. 5 percent. c. 10 percent. d. 20 percent. e. 25 percent. ____ 17. Refer to Table 29-5. Assume there is a reserve requirement and the Bank of Kopeka is exactly in compliance with that requirement. Assume the same is true for all other banks. Lastly, assume people hold only deposits and no currency. What is the money multiplier? a. 2 b. 5 c. 10 d. 15 e. 20 ____ 18. Refer to Table 29-5. If the Fed’s reserve requirement is 9 percent, then what quantity of excess reserves does the Bank of Kopeka now hold? a. $200 b. $250 c. $400 d. $900 e. $1,000 ____ 19. Refer to Table 29-5. Assume the Fed’s reserve requirement is 9 percent and all banks besides the Bank of Kopeka are exactly in compliance with the 9 percent requirement. Further assume that people hold only deposits and no currency. Starting from the situation as depicted by the T-account, if the Bank of Kopeka decides to make new loans so as to end up with no excess reserves, then by how much does the money supply eventually increase? a. $555.00. b. $1,200.00. c. $1,777.78. d. $2,222.22. e. $3,333.33. ____ 20. Which tool of monetary policy does the Federal Reserve use most often? a. adjustments to long-term interest rates b. open-market operations c. changes in reserve requirements d. changes in the discount rate e. changes in the prime rate ____ 21. If the reserve ratio for all banks is 20 percent, then $100 of new reserves can generate a. $60 of new money in the economy. b. $250 of new money in the economy. c. $400 of new money in the economy. d. $500 of new money in the economy. e. $2,000 of new money in the economy. ____ 22. Which of the following is correct? When there is a reserve requirement, banks a. must hold exactly the required quantity of reserves. b. may hold more than, but not less than, the required quantity of reserves. c. may hold less than, but not more than, the required quantity of reserves. d. must seek the Fed’s permission whenever they wish to expand or contract their loans to customers. e. only member banks of the Federal Reserve must comply. ____ 23. To increase the money supply, the Fed can a. buy government bonds or increase the discount rate. b. buy government bonds or decrease the discount rate. c. sell government bonds or increase the discount rate. d. sell government bonds or decrease the discount rate. e. sell government bonds or increase the reserve requirement. ____ 24. If you deposit $100 of currency into a demand deposit at a bank, this action by itself a. does not change the money supply. b. increases the money supply by more than $100. c. increases the money supply by $100. d. decreases the money supply. e. has an indeterminate effect on the money supply. ____ 25. If the reserve ratio is 5 percent, then the money multiplier is a. 25. b. 20. c. 5 d. 2.5. e. 1.25. ____ 26. If R represents the reserve ratio for all banks in the economy, then the money multiplier is a. 1/(1-R). b. 1/R. c. 1/(1+R). d. (1+R)/R. e. R/1. ____ 27. If the Fed wanted to increase the money supply, it would make open market a. purchases or lower the discount rate. b. sales or lower the discount rate. c. purchases or raise the discount rate. d. sales or raise the discount rate. e. purchases or increase the reserve requirement. ____ 28. A decrease in the money supply might indicate that the Fed had a. purchased bonds in an attempt to increase the federal funds rate. b. purchased bonds in an attempt to reduce the federal funds rate. c. sold bonds in an attempt to increase the federal funds rate. d. sold bonds in an attempt to reduce the federal funds rate. e. sold bonds in an attempt to reduce the discount rate. ____ 29. If the nominal interest rate is 8 percent and expected inflation is 3.5 percent, then what is the real interest rate? a. 11.5 percent b. 7.5 percent c. 5.5 percent d. 4.5 percent e. 2.5 percent ____ 30. The supply of money is determined by a. the price level. b. the Treasury and Congressional Budget Office. c. the Federal Reserve System. d. the demand for money. e. the equilibrium interest rate. ____ 31. Money demand refers to a. the total quantity of financial assets that people want to hold. b. how much income people want to earn per year. c. how much wealth people want to hold in liquid form. d. how much currency the Federal Reserve decides to print. e. how much money banks demand from the Federal Reserve. ____ 32. Suppose the United States unexpectedly decided to pay off its debt by printing new money. Which of the following would happen? a. People who held money would feel poorer. b. Prices would rise. c. People who had lent money at a fixed interest rate would feel poorer. d. People who had borrowed money at a fixed interest rate would feel richer. e. All of the above are correct. ____ 33. In the graph of the money market, the money supply curve is a. vertical. It shifts rightward if the Fed buys bonds. b. vertical. It shifts rightward if the Fed sells bonds. c. horizontal. It shifts downward if the Fed sells bonds. d. upward sloping. It shifts rightward if the Fed sells bonds. e. upward sloping. It shifts rightward if the Fed buys bonds. ____ 34. Which of the following Fed actions would both increase the money supply? a. buy bonds and raise the reserve requirement b. buy bonds and lower the reserve requirement c. sell bonds and raise the reserve requirement d. sell bonds and lower the reserve requirement e. sell bonds and lower the discount rate ____ 35. When the Fed sells government bonds, the reserves of the banking system a. increase, so the money supply increases. b. increase, so the money supply decreases. c. increase, but the money supply remains the same. d. decrease, so the money supply decreases. e. decrease, so the money supply increases. Figure 34-2. On the left-hand graph, MS represents the supply of money and MD represents the demand for money; on the right-hand graph, AD represents aggregate demand. The usual quantities are measured along the axes of both graphs. . MS P2 r2 P1 r1 MD 2 AD MD 1 Y2 Y1 ____ 36. Refer to Figure 34-2. What is measured along the horizontal axis of the left-hand graph? a. nominal output b. real output c. the opportunity cost of holding money d. the quantity of money e. interest rate ____ 37. Refer to Figure 34-2. What does Y represent on the horizontal axis of the right-hand graph? a. the quantity of money b. the rate of inflation c. real output d. nominal output e. interest rate ____ 38. Refer to Figure 34-2. If the money-supply curve MS on the left-hand graph were to shift to the right, this would a. represent an expansionary action taken by the Federal Reserve. b. represent a contractionary action taken by the Federal Reserve. c. represent an expansionary action taken by the federal government. d. represent a contractionary action taken by the federal government. e. shift the AD curve to the left. ____ 39. In the short run, a decrease in the money supply causes interest rates to a. increase, and aggregate demand to shift right. b. increase, and aggregate demand to shift left. c. decrease, and aggregate demand to shift right. d. decrease, and aggregate demand to shift left. e. decrease, and aggregate supply to shift left. ____ 40. If the Fed conducts open-market purchases, the money a. supply increases and aggregate demand shifts right. b. supply increases and aggregate demand shifts left. c. supply decreases and aggregate demand shifts right. d. supply decreases and aggregate demand shifts left. e. demand increases and aggregate demand shifts right. ____ 41. The interest rate rises if a. either money demand or money supply shifts right. b. money demand shifts right or money supply shifts left. c. either money demand or money supply shifts left. d. money demand shifts left or money supply shifts right. e. both the money the money demand and the money supply shift right. Free Response 1. Country B is experiencing a serious problem with inflation. (This is the problem we started in class) (a) Using a correctly labeled graph for the money market, identify the current interest rate. (b) Now assume the central bank increases the reserve requirement for the country’s banks. On the graph you drew for (a), illustrate the effect of the change in the reserve requirement on the money supply and on the interest rate. (c) Explain the effect of this change in the money supply on each of the following: (i) Capital investment (ii) Aggregate demand (iii) Long-run economic growth (d) Assume that banks hold more excess reserves than are required by the Federal Reserve. Explain how the banks’ actions will affect each of the following: (i) The money supply (ii) The interest rate (iii) The inflation rate 2. Suppose the commercial banking system is initially "loaned up" and the required reserve ratio is 25%. The Federal Reserve Bank decides to purchase $100 million in government securities. a. What is the value of the nation’s money multiplier? b. If the Fed buys the bonds from commercial banks, by how much will banks’ actual and excess reserves change, and in what direction? c. By how much will the purchase potentially increase the nation’s money supply? d. Alternatively, suppose the Fed buys the bonds from the public, who then deposit the proceeds into their accounts in commercial banks. What is the initial impact of the sale on the nation’s money supply? e. By how much do commercial banks’ actual and required reserves change as a result of the sale to the public? f. By how much will the Fed purchase potentially increase the nation's money supply? 3. A simplified balance sheet for the local bank is shown below. The required reserve ratio is 20%. All figures are in thousands. Assets Liabilities and net worth Checkable Reserves $1200 deposits $5000 Securities 750 Stock shares 1000 Loans 3500 Property 550 a. How much is this bank required to hold in reserve? How much does the bank currently hold in excess reserves? b. Suppose the bank lends out the full amount of its excess reserves. Modify the balance sheet to reflect the creation of the loan. c. By how much has the money supply increased as a result of the loan? d. Suppose the borrower of the new loan writes a check for the amount of the loan to purchase new equipment for her business. The equipment seller then deposits the check in an out-oftown bank. Show the new balance sheet for this local bank once the check has cleared. e. Once the check has cleared, does the local bank have any excess reserves?