Side Pockets - Katten Muchin Rosenman LLP

advertisement

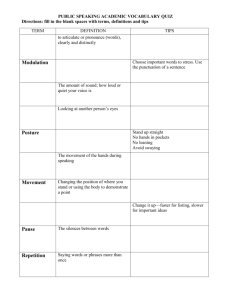

New Frontiers in Hedge Fund Due Diligence Due Diligence Concerns with Side Pockets March 19, 2007 Daniel F. Hunter Partner, Financial Services Group Katten Muchin Rosenman LLP 575 Madison Avenue New York, NY 10022 (212) 940-6783 daniel.hunter@kattenlaw.com Side Pockets - Definition • What is a side pocket? – “if such investments in the judgment of the General Partner are, either individually or as a whole, long-term, illiquid and/or without a readily ascertainable market value” – Historically, a means to protect investors from a bad investment and not charge fees, used infrequently – More recently, a means to separate a security from the fund for a variety of reasons, “parking” securities – Fund must be set up to permit side pockets 1 Side Pockets - Operation • How do side pockets operate onshore? – New class or series of interests – No LP approval required – Potential ERISA issues because of new class • How do side pockets operate offshore? – New class of shares – No Shareholder approval required – Again, potential ERISA issues – Can be viewed as a separate “sub-fund” • A Manager is effectively selling a relatively illiquid investment to a select group of investors with few checks or balances 2 Side Pockets – Operation (con’t) • How can an investor spot Side Pockets in an offering memorandum, the articles and the partnership or LLC agreement? • Can Side Pocket language be inserted after an investor invests? • Can Side Pockets be formed after an investor submits a redemption notice? 3 Some Causes of Side Pockets • Control position in a security – Board seat – Large investment – Activist funds and stake building • Exchange places controls on trading in a stock (common overseas) • Small or micro cap stock so sales in large volume would hurt price • Not a traded security, e.g., convertible debenture 4 Benefits of Side Pockets • Investor is not in the best position to make investment decisions on a particular security • Investor may not be able to hold a particular security for tax, regulatory or other reasons • Ultimate liquidation event may come at a higher price • Saves new investors from participating in what is already known to be a problem investment • Prevents having to price investment weekly or monthly • Can facilitate private equity allocations, hybridization of funds, and investments in “special situations” 5 Negatives of Side Pockets • Ability to redeem • Hiding assets – performance fee can now be taken on the remaining NAV (see SEC comment by R. Campos June 14, 2006) • Valuation Paradox: if a side pocket by definition cannot be valued how does the manager value it? • Bad decision making on illiquidity (investors often find rather high trading volumes in so-called illiquid securities) • Long wait for liquidity • Reporting of performance will be impacted by removal of Side Pockets from NAV 6 Fees and Side Pockets • Management Fees – Should a management fee be charged at all? – If it is charged and the manager uses “cost” is that fair? • Performance Fees – Typically accrued and charged on date of liquidation – Aligns incentives but by now the investor has been delayed in redemption time so why not a penalty? – Can a Side Pocket event trigger a performance fee? – How should loss carryforwards be adjusted? 7 New Investors into the Fund After Side Pockets Formed • What happens when new investors come into a fund that has issued side pocket securities to the investor? – Aren’t the new investors picking up the more liquid investments? – What are the old investor’s rights to the remaining cash? – What are the duties of the fund’s investment manager? – Can the investor force all new cash to redeem out its investment first? 8 Ways to Improve Side Pockets What to ask for when investing. • % Limits on Side Pockets – What is market (used to be 10% now see 30% or more) – But when is the limit calculated? – What if redemptions take place pushing the side pockets over the limit? – What remedy if the manager exceeds the limit? • Cause the fund to hire an independent valuation expert • Hire sub-advisor to determine liquidity • Opting out of Side Pockets via Side Letters – Fiduciary duty of fund’s investment manager – Side Pockets often sneak up on a manager 9 Listing Funds with Side Pockets • Irish Stock Exchange now permits Funds to list that permit Side Pockets – Additional limits see ISE rule May 2006 • Cayman too • Channel Islands too 10 Other Side Pocket Issues • How to handle income (e.g., coupon or dividends) on Side Pocket investments 11